Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

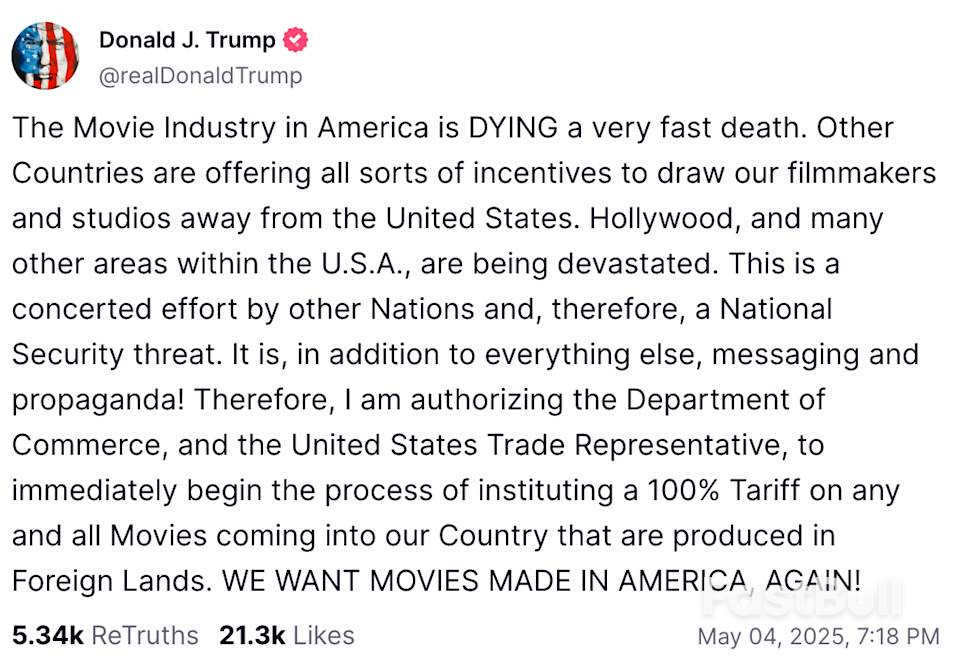

U.S. Treasury Secretary Scott Bessent on Monday said President Donald Trump's tariff, tax-cut and deregulation agenda would work together to drive long-term investment to the U.S. economy, adding that U.S. financial markets were "anti-fragile" and would weather any short-term turbulence.

Bessent, in prepared remarks to the Milken Institute Global Conference in Los Angeles, delivered a full-throated defense of Trump's tariffs but emphasized the Republican tax bill working its way through Congress, saying it would make many parts of the president's first-term tax cuts permanent, including a deduction for small businesses.

"The primary components of the Trump economic agenda - trade, tax cuts, and deregulation - are not standalone policies. They are interlocking parts of an engine designed to drive long-term investment in the American economy," Bessent said.

Bessent said that Trump's tariff blitz since taking office for a second time on January 20 was engineered to encourage companies like those attending the conference to invest in the U.S., build factories and make products in the U.S.

This effort would be rewarded with tax and deregulation benefits, Bessent said. Trump's tax legislation would provide tax credits and deductions for research and innovation into high-tech operations, restore 100% expensing for equipment while expanding this benefit to new factory construction to accelerate investment, he added.

"The result of the president's economic plan will be more. More jobs, more homes, more growth, more factories, more critical manufacturing plants, more semiconductors, more energy, more opportunity, more defense, more economic security, more innovation," Bessent said.

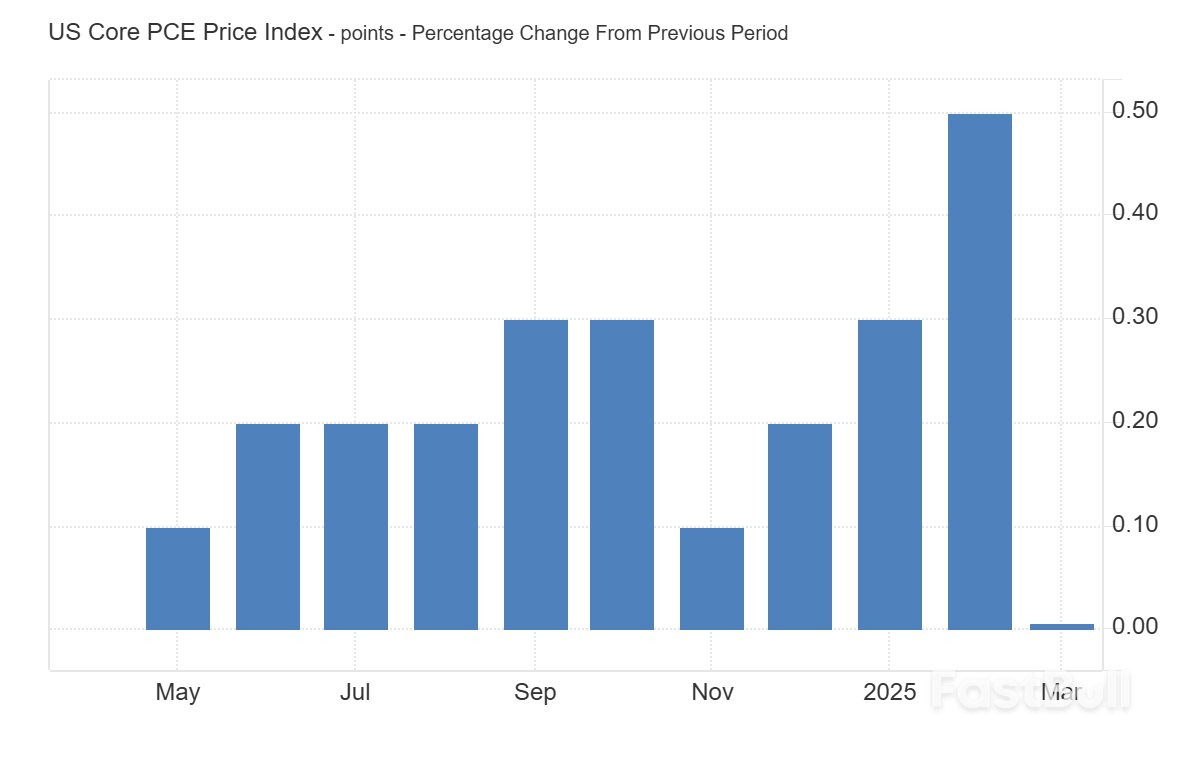

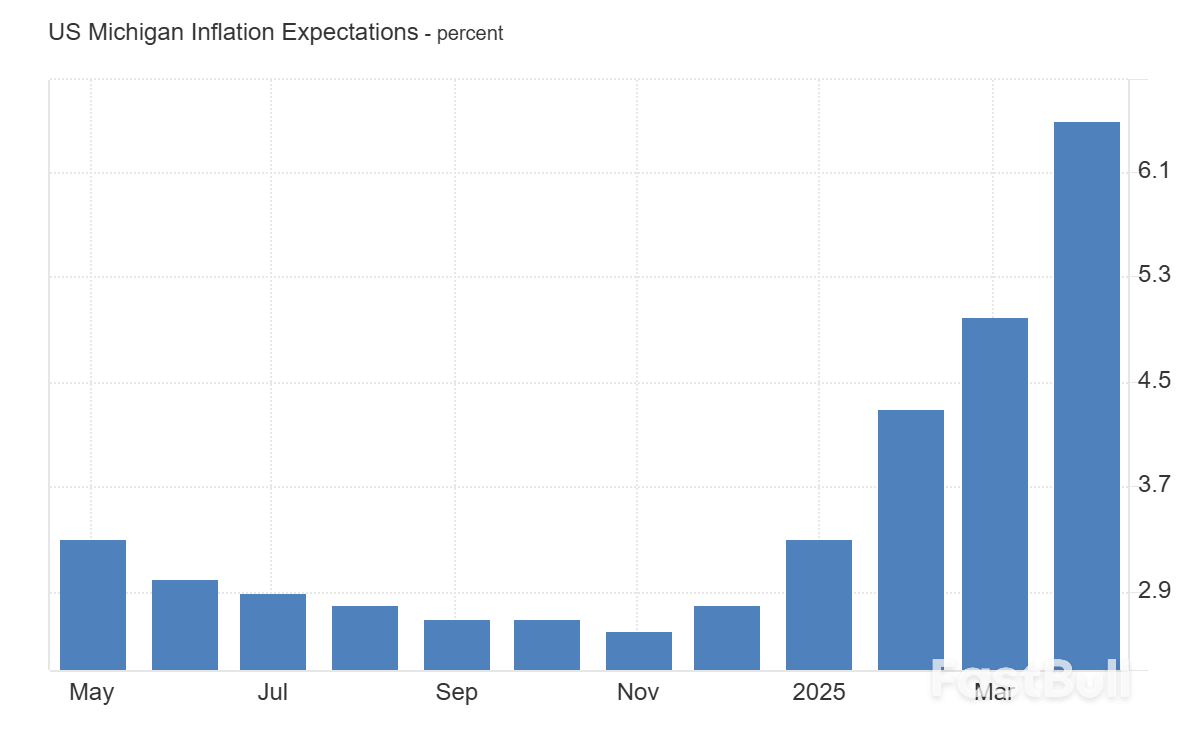

In a subsequent interview with CNBC television, Bessent said that he believed these policies could push U.S. growth close to 3% by this time next year, which would help to bring down U.S. budget deficits to their long-term average share of economic output.

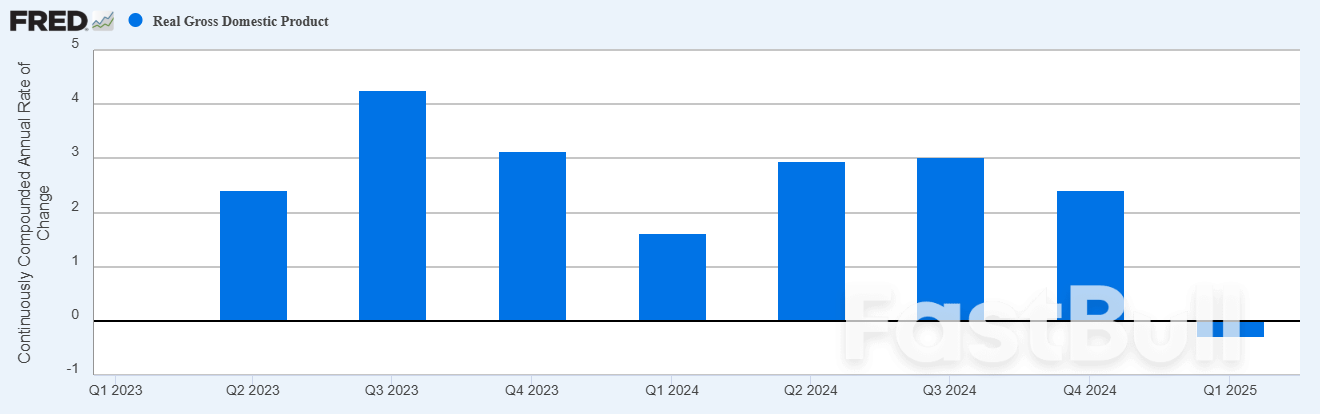

The U.S. economy contracted for the first time in three years in the first quarter amid a flood of imports to beat Trump's tariffs, and the International Monetary Fund has forecast that U.S. GDP will grow only 1.8% in 2025.

He said the "smart way" to cut deficits was to reduce them by about $300 billion per year, noting that is equivalent to about 1 percentage point of the nearly $30 trillion U.S. economy.

"We're talking about bringing the deficit down by about 100 basis points every year for four years, (to) get us back to the long-term average of 3.5%," he said, referring to percentages of GDP. "And then a big cure for the deficit is upward growth shock."

He told the Milken conference that if deficit reduction can remove credit risk from U.S. Treasury debt, then interest rates "will naturally come down."

The Treasury chief said U.S. financial markets were well equipped to weather any short-term turbulence, citing their rebound from challenges over the past century, including the Great Depression, two World Wars, the September 11, 2001, attacks, the 2008-2009 global financial crisis, the COVID-19 pandemic and the subsequent surge in inflation.

"Each time the American economy gets knocked down, it gets back up again. And it gets back up even stronger than it was before," Bessent said. "U.S. markets are anti-fragile. Indeed, the entirety of our economic history can be distilled in just five words: 'Up and to the right.'"

The largest U.S. lender, along with its peers has been ramping up its use of AI. Goldman Sachs is rolling out a generative AI assistant to its bankers, traders and asset managers, while Morgan Stanley developed a chatbot for its financial advisers with OpenAI.

JPMorgan's AI tools have supercharged the speed at which its bankers could provide research and investment advice to wealthy clients last month at a time when the U.S. tariff announcements erased trillions of dollars from the stock market.

"In the last few weeks, there have been several fluctuations in the market which are not in normal bite sizes, making it very complicated to think about all your clients and all the things required to do," Mary Erdoes said. The "powerful" AI tools helped advisors to quickly handle client requests by pulling data on their trading patterns and anticipating queries, she said.

In the days surrounding U.S. President Donald Trump's tariff announcement last month, U.S. stock markets set a new record for single-day trading volume, and posted some of the sharpest intraday swings of the past 50 years.

The volatility prompted individual investors to call their bankers seeking advice, Erdoes told Reuters.

"When you have a tool that pre-populates all the data and the movement in real time, while also remembering clients' old investment preferences and helps in tailoring a plan for them quickly, it also allows advisors to do much more," she added.

JPMorgan's so-called Coach AI tool used by private client advisers is quicker at locating content and research to drive conversations with clients.

"Our advisors are finding the right information up to 95% faster--which means they spend less time searching and more time engaging in meaningful conversations with clients," said Mike Urciuoli, chief information officer at JPMorgan asset and wealth management.

"It's a great example of how of AI isn't replacing human touch, it's enhancing it," Urciuoli added.

The app will help advisers expand their client rosters by 50% in the next three-to-five years by enabling them to take on more clients, with AI handling some of the other research-related work.

JPMorgan Asset & Wealth Management also saw a 20% year-over-year increase in gross sales between 2023-2024, with Gen AI-driven tools which has helped teams focus more effectively on high-impact client work, it said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up