Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

As the US Department of Commerce’s 232 investigations represent the latest tariff threat, medtech companies are getting creative.

Donald Trump has a longstanding fixation with tariffs. Once calling them the "greatest thing ever", the US President believes tariffs are a mechanism to regulate trade and retaliate against foreign nations.

As 2025 unfolds, the Trump Administration has homed in on Section 232 investigations - a US government review to determine if imports threaten national security.

Citing national security as the reason behind the probes, the US Department of Commerce's latest 232 probe is centred on personal protective equipment (PPE), medical consumables, and medical equipment, including medical devices. The investigation has sparked fresh concern across the medical device industry, while motivating players in the space to utilise customs planning protocols to mitigate their probable impact – tariffs.

Meanwhile, Trump's view is that tariffs are making the US "rich as hell". While they may benefit the current administration, with US Treasury Secretary Scott Bessent claiming that annual tariff revenue could reach $300bn in 2025, experts agree that tariffs have a deleterious economic impact on companies reliant on importation. It is important to note that tariff costs are borne by importers, not foreign governments, contrary to Trump's belief.

The Advanced Medical Technology Association (AdvaMed) has urged the Trump Administration to consider how lower tariffs combined with supportive policies will promote increased medtech manufacturing and job growth in the US. With similar concerns, MedTech Europe has highlighted that measures that may result from the 232 investigation could adversely impact patient access to fundamental medical technologies.

Trump imposed tariffs under the International Emergency Economic Powers Act (IEEPA) in February 2025, with sweeping tariff measures taking effect from 2 April. Most critical for the medical device industry, tariffs on China imports are currently set at 55%. However, posting to his Truth Social platform on 10 October, Trump has since threatened to impose additional 100% tariffs on China imports by 1 November.

IEEPA is most commonly used to impose economic sanctions on foreign entities for violations such as human rights abuses. While tariffs remain in place, two US federal courts have ruled against the statute's use to impose them, with the Supreme Court set to hear these cases on 5 November.

The upcoming Supreme Court hearing is likely what the Trump administration is preparing for, according to Damon Pike, principal & technical practice leader at consultancy BDO.

"If the IEEPA tariffs are struck down in the Supreme Court, they've got to have another source of revenue to replace it with," says Pike.

The key challenge tariffs bring for the medical device industry are that the industry is heavily reliant on China's manufacturing capabilities.

For manufacturing in the medical device space, David Navazio, CEO of US wound care company Gentell notes that there is a "whole regulatory approach", meaning that disentanglement from using China as a manufacturing hub is not an easy thing to accomplish.

Navazio says: "Any such undertaking is going to take at least five years, and the current administration is not going to last five years.

"I think companies are saying, you know what, we're going to bring this manufacturing here, and just assume that another administration will have a better understanding of how tariffs will affect the US economy."

Gentell's executive vice president, Kevin Quilty, also highlights that shifting manufacturing to the US is not a straightforward process in terms of regulation.

"For example, we make a dressing. It has a 510(k) approval in the US, and if we decide to change the raw material in that dressing, we have to then reapply," says Quilty.

"We can't just change the raw materials from one supplier to another. It can take an extensive amount of time and effort, and then you have to take your product off the market while you're changing it."

Trump's aggressive stance on tariffs is causing concern among C-suite executives, and strategies to deal with the challenges are beginning to unfold.

"Even CEOs and company presidents are taking charge and saying, we need to have a strategy; we can't just rely on whatever the administration is doing," says Pike.

The current situation features challenges related to tariff classification sourcing, supply chain, and country of origin issues all rolled into one.

"The other issue is transfer pricing, and especially so in the medical device industry, because participants are often global conglomerates that are related parties," says Pike.

Regarding income tax, companies ideally want a high inventory basis so they can get a bigger deduction from whatever they owe in taxes, but their inventory basis essentially their customs values, meaning that with a higher customs value, they are required to pay more in duties.

"This is resulting in this constant tension between income tax and customs that has to be balanced, because this otherwise results in a whipsaw effect, where you get one benefit with customs or the IRS and vice versa, and it doesn't help with the other agency," Pike explains.

Another factor coming into focus due to Trump's tariffs is the first sale rule that's available in the US for customs planning.

In a typical scenario, Pike explains that were a contract manufacturer to make something for a big medical device conglomerate in the UK, and resell it to their US distributor, normally, the price that the US distributor pays to the UK, which is the highest value, would normally be the basis for determining the customs duty.

"But if you meet certain rules for arm's length pricing, you can use the factory invoice price, whether it's an unrelated contract manufacturer, that first sale can qualify, as long as the merchandise is shipped directly from the factory to the US," Pike says.

Pike explains that to utilise this mechanism, related parties have begun creating new middlemen structures, separating out the valuative determinants such as intellectual property since it represents a huge part of the value of what's being imported.

"Companies are creating these middlemen companies to hold all of that intellectual property, and then the manufacturing entity is just selling whatever the cost of manufacture is for the physical production of the medical device, then marking it up a small amount to sell to the middleman, and then the middleman, which has all the intellectual property, they then they sell to the US customer, typically a distributor.

"They still get all the margin on the second sale, but then it becomes exempt from customs duties if they can use the original factory invoice price."

Beyond manufacturing concerns related to tariffs for the medtech industry, the probes add to complications emanating from the ongoing US-China trade war, with China recently announcing additional global export controls on 12 rare earth metals, some of which are key to the production of medical devices such as MRI scanners and laser devices used for corneal surgery.

Congress used to issue a miscellaneous tariff bill that could alleviate the tariff threats being faced by the device industry, should the 232 investigations result in tariffs.

Pike explains: "Every two years, like clockwork, Congress used to pass a miscellaneous tariff bill, and they would put in a provision that would temporarily suspend the duty on products where importers could not buy them from any other place but outside the US, like rare minerals."

"However, this process stopped when Biden took office in 2020, and there has not been a miscellaneous tariff trade bill since."

Pike says that Congress could also move to temporarily suspend the Chapter 99 duties under the Harmonized Tariff Schedule (HTSUS) that everybody has to pay under the trade remedy tariffs.

"Congress could easily decide to suspend the duties under these statutes because the importer has to purchase it from outside the US, like critical minerals. Congress could fix this in a heartbeat, but no such action has yet been taken. And it's reasonable to ask, where's Congress?"

Pike's prevailing view is that we may be in for a "long ride on the tariff train", yet he hopes the Trump administration will "wake up" eventually and provide tariff exemptions for the medical device industry.

"Tariffs have a huge impact. Healthcare equipment constitutes necessary goods, and Section 232 tariffs shouldn't even apply to anything healthcare related," concludes Navazio.

"But this is all reversible. It's all fixable. We've seen it in the past when we went from Carter to Reagan; almost overnight, with Reagan being a president, the economy completely changed."

"Trump's tariffs: any road to relief?" was originally created and published by Medical Device Network, a GlobalData owned brand.

The information on this site has been included in good faith for general informational purposes only. It is not intended to amount to advice on which you should rely, and we give no representation, warranty or guarantee, whether express or implied as to its accuracy or completeness. You must obtain professional or specialist advice before taking, or refraining from, any action on the basis of the content on our site.

The DE 40 stock index has partially rebounded from its recent losses, but the overall trend remains bearish. The DE 40 forecast for today is negative.

DE 40 forecast: key trading points

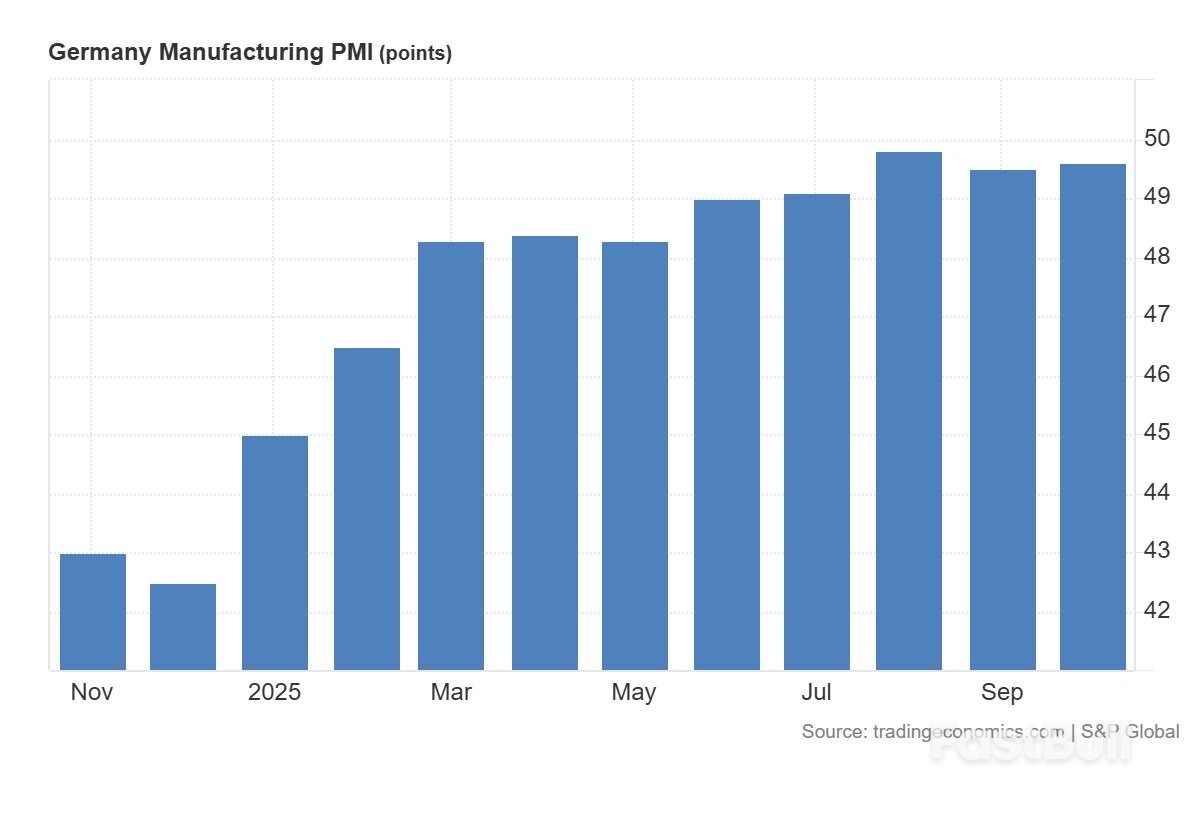

Germany's manufacturing PMI for October came in at 49.6 points, slightly above both the consensus forecast of 49.5 and the previous reading of 49.5. The figure indicates that the industrial sector remains in contraction, but with signs of gradual stabilisation near the neutral threshold. For the equity market, this is a moderately positive signal in terms of expectations: the slower pace of decline in manufacturing supports the valuation of future cash flows in cyclical sectors, reduces the risk of margin erosion from underutilised capacity, and may help narrow discounts on industrial assets. However, since the indicator remains below 50, it continues to reflect weakness in domestic and external demand, limiting the upside potential and making it dependent on confirmation of improvement in subsequent data releases.

For the DE 40 index, the likely response is neutral to positive. Key beneficiaries include automakers, industrial equipment manufacturers, and chemical producers, which may gain support from expectations of stabilising output levels, especially if German bond yields remain flat and the euro strengthens. If yields stay contained, valuation multiples for long-duration and export-oriented companies could expand slightly due to a reduced recession-risk premium.

For the DE 40 index, the key resistance level is located near 24,470.0, while the support around 24,160.0 has been broken. The downward movement persists, and it remains difficult to assess its duration. The next potential downside target lies near 23,385.0.

The DE 40 price forecast considers the following scenarios:

The PMI reading below 50 will continue to limit revaluation potential: the market is likely to remain selective, favouring issuers with strong operational efficiency, diversified export portfolios, and solid order backlogs, while companies dependent on domestic capital demand may underperform. The next downside target for the DE 40 index could be at 23,385.0.

The Philippine central bank may cut its key interest rate again in December and further next year, as the economic fallout from a corruption scandal may linger through the end of 2026, an official said."I would expect another 25 basis points cut" at the next meeting in December, Bangko Sentral ng Pilipinas Monetary Board member Benjamin Diokno said in an interview with Bloomberg Television's Avril Hong on Monday.Further rate cuts are possible "maybe sometime next year," as policymakers assess economic growth and employment data, with inflation under control, according to Diokno.

The BSP reduced its benchmark interest rate by a quarter point this month as a corruption scandal in the government's flood-control projects threaten the country's economic outlook. Its next rate-setting meeting is scheduled for Dec. 11.Diokno, who once helmed the central bank as well as the finance and budget departments, said the economy may "slow down a bit" due to the corruption controversy and trade uncertainties. He said 2026 will be "a transition period" as President Ferdinand Marcos Jr. fixes the problem.In July, Marcos exposed corruption in flood-control projects worth billions of pesos. Many of the projects were either substandard or nonexistent, leading to investigations that have implicated key public works officials and several lawmakers, who have denied wrongdoing. The allegations fueled a broad exit by foreign investors in the stock market.

"We will probably be able to recover from this mess by the end of next year. And 2027 and 2028, we'll be back on track.", Diokno said.The Philippine peso last week fell to its lowest level against the dollar since February. It was little changed at 58.635 at 11:05 a.m. in Manila on Monday. The benchmark stock index was down 1.3%.Diokno said the central bank will only intervene in the foreign exchange market if the peso's weakness affects the BSP's inflation target range of 2% to 4%. "The BSP does not target a specific rate," he said.

Economists expect the Bank of Canada to make a second consecutive policy rate cut this week due to a slowing economy and high joblessness.

Canada's economy contracted in the second quarter by 1.6% as U.S. tariffs on Canadian imports of steel, autos and lumber eroded demand and slashed employment levels.On Thursday, U.S. President Donald Trump suspended all trade talks with Canada.

Early estimates indicate the Canadian economy might barely avoid contracting again in the third quarter.A recent business and consumer survey by the BoC showed that while companies do not expect tariff-related impacts to exacerbate, they anticipate continued sluggish demand, weak order books and low hiring.

In his September monetary policy statement, Governor Tiff Macklem said the bank would be ready to cut rates again if risks to the economy rise and inflation stays under control.

Most economists and analysts expect a rate cut due to high unemployment and slack growth in the economy.

"The output gap is sizeable with mounting evidence of labor market softness," said David Doyle, managing director and head of economics at Macquarie Group, adding that he expects a 0.25% cut.

Overseas interest rate swap markets are pricing in an 82% probability of a 25-basis-point rate cut by the BoC on October 29.

This would bring the rates down to 2.25%, or the lower end of the so-called neutral range where the economy is neither stimulating nor restricting growth.

The majority in a Reuters poll of economists forecast a 25-basis-point rate cut this week, with over 60% predicting the rate to be 2.25% at the end of next year. That would mean a long pause after the October 29 cut.

The BoC has a single mandate: to keep inflation anchored at around the midpoint of its 1% to 3% target range. However, the consumer price index in September rose more than expected to 2.3% and core-inflation measures, which exclude volatility, continue to stay above 3%.

That has prompted some economists to argue the central bank should hold rates steady.

The core inflation is not where the bank wants it to be and the economy has not fallen off a cliff, said Pedro Antunes, chief economist at Conference Board of Canada. He proposes a rate hold will help the bank retain some future firepower.

The BoC will announce its monetary policy decision on October 29 at 9:45 a.m. ET (1345 GMT). It will also release the quarterly Monetary Policy Report, including forecasts for the economy and inflation.

XRP price prediction 2026 has become a focal topic for crypto investors analyzing Ripple’s next growth cycle. Following years of legal progress and expanding institutional use, 2026 may mark a turning point for XRP. This analysis examines market data, technical signals, and expert forecasts to outline Ripple’s potential price trajectory next year.

Understanding Ripple’s past performance is key to any realistic projection for 2026. Since 2020, XRP’s trajectory has reflected the effects of both market cycles and Ripple’s legal battle with the SEC. Analysts tracking xrp price prediction after lawsuit trends observed that once regulatory clarity improved, market confidence and trading volume steadily recovered.

The table below outlines XRP’s price evolution and major catalysts that shaped investor sentiment, forming the foundation for xrp price prediction 2026 and broader crypto market expectations.

| Year | Average Price (USD) | Market Cap (Billion) | Key Event / Catalyst |

|---|---|---|---|

| 2020 | $0.25 | $11 | SEC lawsuit filed against Ripple Labs |

| 2021 | $1.05 | $48 | Crypto bull run; XRP relisted on select exchanges |

| 2023 | $0.47 | $24 | Partial court victory boosted xrp 2025 price prediction confidence |

| 2024 | $0.85 | $45 | Ripple’s cross-border expansion; stable market recovery |

| 2025 (Est.) | $2.5 – $5.0 | $100+ | Global remittance adoption and improving liquidity outlook |

According to ripple xrp price prediction chris larsen and independent analysis firms like xrp price prediction claver and xrp price prediction barric, the 2020–2025 cycle marked a period of stabilization, where XRP rebuilt institutional trust. This historical base supports both short-term and mid-term scenarios, including xrp price prediction 2025 chat gpt simulations and evolving forecasts for 2026.

As the market transitions into 2026, analysts expect stronger institutional involvement and improved infrastructure for on-chain liquidity. Based on data from xrp price prediction 2026 models, Ripple’s token could enter a new accumulation phase driven by global payment adoption and integration with central bank digital currencies (CBDCs).

While extreme projections such as xrp price prediction 10000 token remain unrealistic, a sustained rise in transaction volume, remittance demand, and on-chain utility could validate a long-term uptrend. Many institutions now consider XRP’s steady progress as part of their price prediction for xrp portfolios when evaluating digital payment assets heading into 2026.

Combining AI data, market cycles, and human analysis, xrp 2026 price prediction studies converge on a common range of $5–$15, reflecting cautious optimism rather than speculative hype. Ripple’s expanding partnerships and the aftermath of its legal clarity continue to influence every institutional forecast across xrp price prediction claver and xrp price prediction barric research platforms.

The year 2026 could prove decisive for Ripple and its native token, XRP. As global financial systems evolve, several factors may either drive or limit price appreciation. Analysts studying xrp price prediction 2026 emphasize how regulation, adoption, and technology interplay to shape investor confidence.

Overall, Ripple’s 2026 trajectory depends on a balanced mix of innovation and compliance. Strong fundamentals, combined with institutional utility, remain critical to realizing sustainable growth envisioned in many professional price prediction for xrp studies.

Technical indicators for XRP suggest an emerging recovery phase. Traders analyzing xrp 2026 price prediction data focus on long-term chart structures that show consolidations near key support levels, hinting at possible accumulation before a major move.

| Indicator | Current Reading | Interpretation |

|---|---|---|

| RSI (14D) | 59.8 | Neutral to bullish zone; supports mid-term uptrend in xrp price prediction january 2026 scenarios. |

| MACD | Positive crossover | Momentum indicates steady accumulation consistent with xrp price prediction 2026 forecasts. |

| 50-Day MA | Above 200-Day MA | Golden cross formation; often signals bullish continuation according to ripple xrp price prediction chris larsen technical models. |

| Volume Trend | Rising (Q4 2025–Q1 2026) | Institutional accumulation phase similar to xrp price prediction claver trend analysis. |

Market analysts caution that despite encouraging signals, volatility remains high. Comparing previous xrp 2025 price prediction outcomes with current 2026 data reveals cyclical behavior, suggesting that gradual appreciation may continue into mid-2026. Still, traders should remain alert for consolidation or pullback phases, as seen in xrp price prediction barric research reports.

From an algorithmic standpoint, 2026 xrp price prediction models using AI-based backtesting suggest potential gains of 30–60% year-over-year if Bitcoin maintains macro support. However, technical patterns indicate that breaking above $1.20 remains crucial for sustained upside momentum across most professional forecasts.

As Ripple enters a new growth cycle, 2026 presents both potential breakthroughs and notable challenges for XRP investors. Analysts studying xrp price prediction 2026 emphasize that the balance between innovation, adoption, and regulation will determine whether Ripple’s native token can sustain its momentum.

Ultimately, Ripple’s 2026 success depends on disciplined execution, favorable regulation, and technological scalability. If these factors align, many analysts believe that XRP could outperform broader crypto benchmarks—confirming the cautious optimism seen in most 2026 xrp price prediction studies.

Long-term forecasts from institutional and AI-based analyses vary widely. Most projections, including those from xrp price prediction 2026 and xrp 2025 price prediction studies, estimate XRP trading between $20 and $70 by 2030. Growth largely depends on regulatory adoption and Ripple’s expansion into global banking networks.

While some bullish analysts envision this scenario, it remains ambitious. AI forecasts like xrp price prediction january 2026 and reports by xrp price prediction claver place more realistic 2026 targets between $5 and $15. A $50 valuation could be possible only if Ripple achieves massive institutional and CBDC integration worldwide.

XRP and Bitcoin serve fundamentally different purposes—Bitcoin as a decentralized store of value, and Ripple as a utility-focused payments network. Analysts such as ripple xrp price prediction chris larsen note that XRP’s potential lies in remittance technology rather than speculation. Still, xrp price prediction 2025 chat gpt and xrp price prediction barric analyses suggest that Ripple’s regulatory advantage may help it capture a growing share of institutional capital by 2026.

The outlook for xrp price prediction 2026 reflects cautious optimism. While extreme forecasts like $10000 remain unrealistic, most experts expect steady growth as Ripple expands global adoption and secures regulatory clarity. With increasing institutional use and technical stability, XRP’s 2026 performance could mark the beginning of a stronger long-term recovery cycle.

How to Buy Amazon Stock is a common question among investors eager to join one of the world’s most valuable companies. With Amazon’s expanding presence in cloud computing, AI, and e-commerce, understanding how to purchase its shares wisely in 2025 can help beginners build long-term wealth through strategic investing and platform selection.

For investors exploring how to buy amazon stock or other leading tech shares, Amazon remains a benchmark for long-term value. Its diverse revenue sources — from e-commerce and cloud computing to artificial intelligence and advertising — position it as one of the most resilient companies heading into 2025.

Over the past three years, Amazon’s performance has reflected both post-pandemic normalization and new growth cycles. Investors tracking how to buy stock in amazon can see how its stock rebounded as cost efficiency and AWS profits improved.

| Year | Average Price (USD) | Revenue (Billion USD) | Key Catalyst |

|---|---|---|---|

| 2023 | $125 | $554 | Cost optimization and AWS rebound |

| 2024 | $155 | $610 | AI integration and ad revenue growth |

| 2025 (Projected) | $180–$220 | $670+ | Cloud expansion and logistics automation |

Most analysts agree that Amazon remains a strong long-term play. For beginners learning how to buy amazon stock for beginners, Amazon offers stability through consistent cash flow, dominant market share, and high reinvestment in innovation. Still, short-term volatility may persist as interest rates and AI competition evolve.

| Metric | 2023 | 2024 | 2025 (Est.) |

|---|---|---|---|

| P/E Ratio | 60x | 48x | 42x |

| EPS Growth | +30% | +45% | +25% |

| Free Cash Flow | $36B | $45B | $52B+ |

Before investing, beginners should understand the practical steps involved in opening a brokerage account and meeting the basic requirements. Learning how to buy amazon stocks responsibly begins with preparation.

Once you’ve gathered your information, you’ll need to choose a reliable platform. The table below compares popular brokers frequently used by those researching how to buy stocks from amazon or other blue-chip companies.

| Broker | Minimum Deposit | Commission | Why Choose |

|---|---|---|---|

| Robinhood | $0 | Commission-free | Easy-to-use mobile app; ideal for beginners. |

| Fidelity | $0 | $0 per trade | Trusted brand with strong research tools. |

| E*TRADE | $0 | $0 per stock trade | Comprehensive education and robust charting. |

Once you’ve selected your broker, the process to invest is straightforward. Here’s a quick guide on how to buy amazon stock effectively and safely.

For anyone wondering how to buy stocks on amazon or expand into big-tech portfolios, combining direct stock ownership with ETF exposure is often the smartest move for balanced growth.

Choosing the right platform is just as important as knowing how to buy amazon stock. In 2025, investors can access Amazon shares through several trusted brokers and trading apps, each catering to different experience levels—from beginners to advanced traders.

| Platform | Minimum Deposit | Trading Fees | Best For |

|---|---|---|---|

| Robinhood | $0 | Commission-Free | Beginners learning how to buy amazon stock for the first time. |

| Fidelity | $0 | $0 per trade | Long-term investors researching how to buy stocks from amazon securely. |

| E*TRADE | $0 | $0 commission | Active traders who want detailed analytics when deciding how to buy stock in amazon. |

| Charles Schwab | $0 | $0 per online trade | Investors managing diverse portfolios beyond how to buy amazon stocks. |

Most platforms also allow fractional investing—meaning you can purchase less than one share, making it easier for new investors searching how to buy amazon stock for beginners to get started without large capital requirements.

You cannot currently buy shares directly from Amazon; the company does not offer a direct stock purchase plan (DSPP). Instead, investors need to use a registered brokerage account. Popular platforms like Fidelity and Robinhood are beginner-friendly options for those exploring how to buy stocks on amazon through public exchanges.

Yes. Many brokers support fractional share investing, allowing you to buy a portion of a stock with as little as $1. This feature is ideal for users searching how to buy amazon stock for beginners or anyone starting small. Simply enter the dollar amount you wish to invest—such as $100—and your broker will execute a fractional order for Amazon (AMZN).

A $10,000 investment in Amazon’s IPO at $18 per share (adjusted for stock splits) would be worth over $15 million today, proving the power of long-term investing. While past performance doesn’t guarantee future results, understanding how to buy amazon stock early and holding through market cycles remains one of the most effective strategies for wealth building.

Learning How to Buy Amazon Stock is the first step toward owning a piece of one of the world’s most innovative companies. With easy online access, fractional investing, and trusted brokers, beginners can confidently start building wealth through Amazon in 2025—balancing long-term vision with smart, consistent investing habits.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up