Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Trump on Friday had given Hamas a deadline of Sunday evening to release all the remaining Israeli hostages, both living and dead (estimated to be 48 total), or else they will be "hunted down, and killed".

President Trump on Friday had given Hamas a deadline of Sunday evening to release all the remaining Israeli hostages, both living and dead (estimated to be 48 total), or else they will be "hunted down, and killed".

"They will be given one last chance," he had posted on Truth Social. "THIS DEAL ALSO SPARES THE LIVES OF ALL REMAINING HAMAS FIGHTERS!" That is, if they agree to fully disarm based on the White House's 20-point peace plan.

So far, Hamas is said it is willing the release the captives, but indicated it wants to enter negotiations on other points, which is presumably happening through mediators. But Trump has demanded the Palestinian militant group act quickly.

On Sunday Trump told CNN that Hamas faces "complete obliteration" if it doesn't comply to disarming and if it attempts to cling to power in Gaza.

And more, via Israeli media and CNN:

Asked about those who say Hamas effectively rejected Trump’s proposal by refusing to accept disarmament and setting conditions for a hostage release, Trump writes, "We will find out. Only time will tell!!!"

The terror group has said repeatedly it does not want to remain, itself, the government of Gaza, but it has not assented to its total disarmament and has demanded to play some role in a future Palestinian state.

Trump also responds "yes" when asked if Prime Minister Benjamin Netanyahu is on board with doing whatever is needed to make peace a reality.

Palestinians sources say that little has changed on the ground, after the Israeli government ordered a pause to the ground offensive. Aerial bombardments are still going strong, also according to Al Jazeera.

Interestingly, Axios is reporting ongoing deep tensions behind the scenes between Trump and Netanyahu over the Gaza peace plan.

The publication said that Trump over the weekend called his Israeli counterpart to discuss the 'good news' of Hamas saying it would cooperate with the peace deal. Axios writes that Trump expressed frustration that Bibi received this unenthusiastically:

Hamas' response has been characterized as a "yes, but..." - despite Trump having previously said that there's very little room open for negotiations at this late point.

"In private consultations Friday, Netanyahu stressed that he viewed Hamas' response as a rejection of Trump's plan," Axios says further "He said he wanted to coordinate with the U.S. on its response to avoid a narrative that Hamas had answered positively, an Israeli official told Axios."

It's long been known that the two leaders appearing closer than ever in appearances together (after all, Netanyahu has been to the White House some four times already during Trump's term), they somewhat frequently have clashed running years back.

Gold prices soared to a record high in early Asian trade on Monday amid a sharp weakening in the yen and as bets on lower U.S. interest rates remained squarely in play.

Bullion was also supported by persistent concerns over a U.S. government shutdown, which remained in place as lawmakers marked little progress towards a spending bill.

Spot gold jumped as much as 0.8% to a record high of $3,920.31 an ounce, while gold futures for December rose 0.8% to a peak of $3,944.45/oz.

Gains in gold came amid heightened volatility in foreign exchange markets, especially after the Japanese yen weakened sharply in morning trade. The yen slid after conservative politician Sanae Takaichi was elected as the leader of Japan’s ruling Liberal Democratic Party, setting her up to become the next prime minister.

The yen’s USD/JPY pair, which gauges the amount of yen required to purchase one dollar, jumped 1.4% to 149.58 yen.

Takaichi is viewed as fiscally dovish, and is expected to oppose any further monetary tightening by the Bank of Japan. This notion battered the yen and Japanese bond markets.

In the U.S., markets were increasingly convinced the Federal Reserve will cut interest rates again in October. Traders were seen pricing in an over 99% chance for a 25 basis point cut later in October, CME Fedwatch showed.

The dollar was nursing losses on this notion, while Treasury yields also retreated.

An ongoing U.S. government shutdown also kept demand for gold largely in play, even as risk-driven markets in the country largely brushed off concerns over the impact of a shutdown.

There’s a battle underway to win the energy export market between the world’s two largest economies: The US wants the world to buy its fossil fuels, while China wants to sell the world its clean energy technologies.

The country’s exports of electric vehicles, solar panels, batteries and other carbon-cutting technology has been climbing for years. Exports hit a record in August, with US$20 billion in products shipped globally, according to a new report from the think tank Ember.“China reached a record value in cleantech exports even as technology prices have fallen sharply,” said Euan Graham, a data analyst for Ember.The US, which has positioned itself as a major fossil fuel exporter, sold US$80 billion in oil and gas abroad through July, the last month with data available. China exported US$120 billion in green technology over the same period.

That’s a continuation of a trend. The US hit a record in oil exports in 2024, according to the Energy Information Administration. Yet China’s clean technology exports were US$30 billion higher.Dollars only tell part of the story. The price of solar panels is falling, which means that China is exporting more of them per dollar earned. August’s solar export revenue was nowhere near the high set in March 2023. But the 46,000 megawatts of power capacity shipped abroad set a record.

Crucially, China’s exports in emerging markets are growing rapidly. This year, more than half of China’s electric car exports have come from outside the Organization for Economic Cooperation and Development, a rich-country club.The US, under President Donald Trump’s first term and then former President Joe Biden, pushed for higher oil and gas production. As a result, the country rapidly increased oil and gas exports. Trump is trying to drive production even higher in his second term by loosening regulations while also kneecapping the green technology sector.

It’s worth noting that China is a big importer of oil and gas, and it’s so energy hungry that it deploys most of the clean tech it manufactures. This quarter, China will sell more electric cars domestically than all cars sold in the US, regardless of fuel type. The US, on the other hand, can meet all its fossil fuel needs.Still, both countries have excess capacity in their areas of strength, which helps them generate billions of dollars in export revenue each year. The US may boost fossil fuel exports further and start to earn more revenue than China does from low-carbon goods that keep getting cheaper. However, China’s clout among other countries will likely grow because the volume of its clean tech exports will keep increasing.

From the point of view of countries importing American or Chinese energy goods and technologies, the division could not be starker: “Clean energy exports is hardware, which once a country has bought it, will generate electricity for a decade or two to come,” said Greg Jackson, the chief executive officer of Octopus Energy, the UK’s largest energy retailer. “Whereas with gas, the day you buy it, you use it, it's gone forever.”

Every few months, a consignment of car parts rolls off a production line in an industrial town on China’s mighty Yangtze river. The engines and chassis are sent to a different factory to be half-assembled into what is known as “knocked down” form, before being loaded into containers and shipped to their final destination — Iran.But these half-built cars are not paid for in cash. Instead, they are exchanged for containers of Iranian copper and zinc to feed China’s vast metals industry.The cars-for-metals trade, described to Bloomberg News by four people with knowledge of the situation, offers a rare insight into how an unprecedented wave of western sanctions has fragmented the global trading system and spurred a renaissance in the age-old art of barter.

The barter trade revolves around a clutch of companies from Anhui province in China’s industrial heartland – among them Chery Automobile, the carmaker which last month raised $1.2 billion in an initial public offering in Hong Kong, and Tongling Nonferrous Metals Group Holdings, a leading metals company.Now the biggest exporter of Chinese cars to the world and the 11th-largest passenger vehicle company globally, Chery’s car parts form a key link in a complex web of trade where vehicles have been bartered for metals and even cashew nuts in order to sidestep payment headaches created by an ever-proliferating wave of US sanctions.

There’s no suggestion that Chery, Tongling, or any of the other companies named in this story are in breach of sanctions.

The automaker doesn’t actually barter directly with Iran, instead selling parts and technology to a different company in Anhui province, which assembles them into semi-knocked down vehicles which are sent to Iran, said the people, who asked not to be identified discussing private information. And US and European sanctions on Iran apply specifically to individuals and companies from those countries and anyone using their currencies, meaning that Chinese companies can continue to do business there without breaking any sanctions as long as they trade in rials or yuan. Under Chinese law, trade with Iran remains legal.Representatives from both Chery and Tongling didn't respond to multiple requests for comment for this story.

Since its founding three decades ago, Chery has become a success story for Beijing’s foreign trade policy under the Belt and Road Initiative, doing business everywhere from Iran and Cuba to Russia, where since 2022 Chery has vied with Philip Morris for the title of the largest foreign company by revenues. And it has made its home province of Anhui into China’s number one producer of cars in the first half of 2025, fulfilling a goal to transform its hometown of Wuhu into “China’s Detroit.”In its IPO prospectus, the company says that it had stopped doing business in both Iran and Cuba by the end of 2024, and pledged to scale down its business in Russia to “negligible” levels by 2027. It said its legal adviser Hogan Lovells had assessed that its activities in countries subject to sanctions “did not represent a primary sanctioned activity or a violation of the US primary sanctions and the secondary sanctions risk is relatively limited.”

Still, it was notable that the banks leading Chery’s IPO were all Chinese; the company had picked JPMorgan Chase & Co. to be part of the deal, but the US bank dropped out before signing a formal mandate. JPMorgan had concerns about Chery’s disclosures, including of its business dealings with sanctioned countries, according to three people familiar with the matter, who asked not to be identified discussing private deliberations.

The Chinese Foreign Ministry's Spokesperson's Office said it wasn’t aware of the trade, but “as a principle, China has always firmly opposed illegal unilateral sanctions. Normal cooperation between countries and Iran within the framework of international law is reasonable, just, and legal, and should be respected and protected.\

Chery first entered the Iranian market in 2004, setting up a company with a local partner. The local venture, called Modiran Vehicle Manufacturing, or MVM, went on to become the most popular foreign car brand in the country.

It was a time of rapid expansion for Chery. The company had been established only a few years earlier, in 1997, when the Wuhu government brought in a young engineer called Yin Tongyue to build a local car manufacturer. The textile industry, the mainstay of the city’s economy, had fallen on hard times and so the local government needed to find a new driver of growth.A farmer’s son who had grown up in Anhui province, Yin bought an assembly plant in Spain and an engine plant in Britain, and moved both to Wuhu, producing his first car in 1999.

The export market soon became Chery’s biggest strength. The company began selling its cars abroad in 2001, long before most Chinese car brands, when a Syrian car dealer visiting China had spotted a Chery car on the street, and persuaded Yin to let him import a handful of the vehicles, according to an interview Yin gave in 2018.

Ever since, producing low-cost cars and selling them all over the world has been a big part of Chery's strategy — its most popular model is priced at the equivalent of just $7,000. In recent years, even as rival Chinese carmakers have made big strides in electric vehicle technology and ramped up their own exports, Chery has maintained its position as the largest exporter of Chinese-branded passenger vehicles thanks to its fleet of cheap, gasoline-fueled cars that are more affordable than offerings from rivals like BYD Co. Last year, 40% of its sales were outside China. The group reported total annual revenue of 270 billion yuan ($38 billion) for 2024.

For many years, Iran was Chery’s most important international market. By 2016, the country accounted for more than half of its international sales, according to a local bond prospectus. “I am proud to see Chery cars everywhere in Iran,” said Yin in an interview that year as he accompanied President Xi Jinping on a state visit to Iran – the only Chinese automotive executive to do so. “Chinese cars are like our high-speed railway system: it is value-added and of good quality, it can represent China and should be marketed overseas.”

The barter trade with Iran began about six or seven years ago, according to the people familiar with the trades. The shift coincided with a sharp escalation of US sanctions against Iran in Donald Trump’s first term as president. Those sanctions — the result of Trump’s decision to abandon a 2015 nuclear accord — drastically reduced Iran’s access to the global financial system, and so made it more difficult for Iranian companies to pay for imported goods.

Chery’s local bond prospectuses offer a glimpse of the scale of the potential problem. In March 2017, Chery’s Iranian affiliate MVM owed the Chinese company 2.2 billion yuan ($325 million) – its single largest such exposure.Under Chinese laws and regulations, trade with Iran remained legal and Chinese diplomats repeatedly stated that Beijing would maintain its economic cooperation with Iran notwithstanding the US sanctions.

Nonetheless, the tougher restrictions created numerous headaches. In practice, large Chinese state-owned enterprises – especially those with extensive overseas networks in finance and other sectors – became extremely conservative and largely avoided any direct business dealings with Iranian entities. As a result, trade between China and Iran started to be carried out through multiple layers of shell companies.

And so the cars-for-metals barter trade began — with two other companies from Anhui province playing key roles.

One of them was Tongling Nonferrous Metals Group Holdings, one of China’s largest metals companies. It’s based in the city of Tongling – just 90 kilometers from Wuhu in Anhui province – the site of the first copper industry in modern China, where construction of a mine and smelter began right after the People’s Republic was formed in 1949.Now Tongling stepped into a key role in the barter trade – helping China to access to Iran’s rich metal ores in an increasingly competitive marketplace.

The deal envisaged the sale of up to 90,000 cars a year, one of the people said. Chery would supply parts and technology to third company based in Anhui province, in the city of Anqing, which would then ship them to Iran, usually in “semi-knocked down” form. Once they arrived in Iran, the vehicles would be assembled locally and sold under the MVM brand. In return, an equivalent value of Iranian metals — mostly in the forms of unprocessed ores and concentrates — would be delivered to China, where Tongling's commercial team would broker its distribution to other Chinese companies.Chery and Tongling are two of Anhui province’s largest companies, and both have significant state ownership: Tongling’s parent company is wholly owned by the Anhui provincial government, while Chery’s largest shareholder is the Wuhu city government. An email to Anhui's state-owned assets regulator wasn't answered.

The quantities and types of metals sold under the deal have varied over the years. Parcels of Iranian metals including copper and zinc sometimes appear for sale on the Chinese market in connection with the barter deal, according to several of the people, who asked not to be identified discussing private information. And it is not just metals: separate people familiar with the matter said some Iranian agricultural products, including cashew nuts, had at points in recent years also been delivered to China in exchange for vehicles.

The amounts involved in the cars-for-metals barter are relatively small, equivalent to hundreds of millions of dollars according to Bloomberg calculations, compared with China's total exports to Iran of about $9 billion last year. Still, they highlight the resurgence of barter trade that has been spurred by successive waves of western sanctions.

In the 1980s and 1990s, barter trade was relatively common, as the political divides of the Iron Curtain and the collapse of the Soviet Union meant hard currency was often inaccessible or simply non-existent. Commodity traders bartered Cuban cigars for milk powder and Uzbek cotton for corn.

Barter trade fell out of use in the past three decades, as the dollar dominated global trade flows thanks to the scale of the US banking system and the dominance of dollar-denominated contracts for pricing commodities. While that’s still largely the case, the proliferation of sanctions in recent years has begun to spur an increase in the use of different currencies and even barter for commodities from Russia, Venezuela, Iran and elsewhere.Sri Lanka has traded tea for Iranian oil, for example, while more recently Beijing sent $2 million of auto parts to Iran in exchange for pistachios. Barter trade with Russia has also been increasingly common since 2022, when a plethora of Western sanctions have placed the economy under severe strain. The country’s economy ministry even issued a guide to barter trade last year.

For Chery, the trade flow involving Iran — as well as others with other countries under sanctions — has caused headaches as it prepared in recent months to sell its shares to the public for the first time.

In its prospectus, it said that Iran and Cuba had each generated no more than 0.5% of its revenues in the previous three years. Russia had accounted for as much as 25.5% of its total revenue in 2023, but it had already begun to wind down its business with the sale of certain local assets and distribution channels in April.Still, there were no western banks leading Chery’s IPO, in part due to concerns over its disclosures about its work in sanctioned countries including Iran, according to several of the people. The same issue put off some potential investors, the people said.In the end, Chery sold a stake of 5% in the IPO. The largest single investor, taking around one in every seven shares on offer, was a Chinese state-owned investment vehicle.

Key Points:

Bitcoin open interest has reached a historical peak of $90.717 billion, driven by major inputs from CME and Binance, signaling increase in liquidity as of October 2025.This milestone indicates heightened institutional and retail engagement, potential increased market volatility, and reflects growing confidence in Bitcoin derivatives. Increased CME activity highlights regulatory-backed trading appeal.

This rise in open interest highlights an evolving marketplace. Increased liquidity and potential volatility are noted, driven by expanded participation from regulated funds, asset managers, and significant crypto exchanges. The figures presented suggest a burgeoning confidence in Bitcoin futures, potentially affecting spot market prices due to heightened trading activity.

Industry experts, such as Binance CEO Richard Teng, have noted that a high open interest showcases maturity in the BTC market, although no immediate public reactions have come from key institutional figures like CME CEO Terry Duffy or Binance CEO Richard Teng. "We see the rise of derivatives as a clear sign of the maturing markets, reflecting increased interest and participation in the ecosystem." This milestone reflects broader investor interest in digital assets.

Industry experts, such as Binance CEO Richard Teng, have noted that a high open interest showcases maturity in the BTC market, although no immediate public reactions have come from key institutional figures like CME CEO Terry Duffy or Binance CEO Richard Teng. "We see the rise of derivatives as a clear sign of the maturing markets, reflecting increased interest and participation in the ecosystem." This milestone reflects broader investor interest in digital assets.

Did you know? Previous highs in Bitcoin futures often coincided with shifts in policy, such as the 2024 Bitcoin ETF announcements, adding to market momentum and price fluctuations.

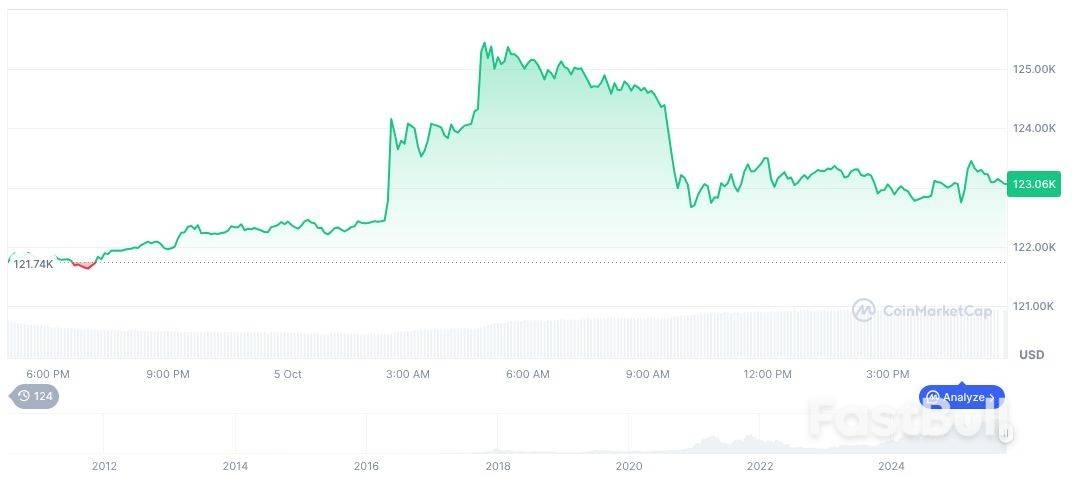

Bitcoin (BTC), now trading at $124,000.69, commands a market cap of approximately $2.47 trillion, dominating 58.45% of the crypto space according to CoinMarketCap. Its 24-hour trading witnessed nearly $73.60 billion, jumping 99.01%. BTC surged 14.56% over 90 days, indicating robust interest.

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:24 UTC on October 6, 2025. Source: CoinMarketCap

Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 00:24 UTC on October 6, 2025. Source: CoinMarketCapOil gained after OPEC+ agreed to raise production by a modest amount, staving off traders’ fears of a super-sized increase.

Brent rose above $65 a barrel, while West Texas Intermediate was near $61. At a meeting on Sunday, the Organization of the Petroleum Exporting Countries and partners including Russia backed a 137,000-barrel-a-day increment, well below some of the possible figures reported before the decision.

The move “is clearly on the light side of expectations,” said Chris Weston, head of research at Pepperstone Group, who attributed the price gain to traders — who’d readied for a larger hike — adjusting tactical positions. The OPEC+ increase “will do no favors to the notion of an oversupplied market in 2026, and as such the upside in this rally should be capped,” he said.

Crude has declined this year — including an 8% drop last week — on concern that worldwide supplies are set to top demand. The International Energy Agency has forecast a record annual surplus for 2026, and many Wall Street banks have predicted lower prices in the coming months as balances weaken.

The group’s latest decision came despite an earlier difference of position between co-leaders Saudi and Russia. Ahead of the session, which lasted just nine minutes, Moscow had favored an adjustment that would help to defend prices, according to two people. Still, Riyadh — more mindful of market share — indicated it supported a larger addition, one of the people said.

OPEC+ has been progressively unwinding supply restraints this year in a bid to reclaim market share from drillers outside the alliance. The group initially agreed to bring back a 2.2-million-barrel-a-day tranche of halted output in stages, and then followed up by tackling another layer of curbed production. Still, actual increases in output have lagged behind headline figures.

“Balances have shifted decisively into surplus after a period of tightness that began in mid-2024 through 2025,” said Susan Bell, an analyst at Rystad Energy AS. “Supply is only moving in one direction, and with demand weakening, the remainder of 2025 will be a one-two punch for crude prices.”

Trading in early stages of the session was busier than usual, with about 2,000 lots each of Brent and WTI traded across the curve in the first five minutes.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up