Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Trump-brokered ceasefire in Gaza is hanging by a thread, as local officials say that nearly 100 Palestinians have been killed and some 230 wounded overall since the ceasefire's start on October 10.

The Trump-brokered ceasefire in Gaza is hanging by a thread, as local officials say that nearly 100 Palestinians have been killed and some 230 wounded overall since the ceasefire's start on October 10.

Israel on Sunday launched dozens of new airstrikes in response to what it called Hamas's "blatant violation" of the deal, but which the militant group denied. Gaza sources said at least 44 were killed as a result of those Sunday strikes.

Israel's military (IDF) had said "terrorists fired an anti-tank missile and gunfire" toward its troops in Rafah, killing two soldiers - but this was met with a statement by Hamas saying it was "unaware" of any such fighting.

But the Palestinian side is charging Israel of violations while warning that these strikes could "push the situation toward a total collapse".

But by Sunday night the IDF said it "had begun renewed enforcement of the ceasefire" but followed by asserting it would "respond firmly to any violation of it."

"The military later said it resumed enforcing the ceasefire, and the official confirmed that aid deliveries would resume Monday," France24 writes. "The official spoke on condition of anonymity because he’s not authorised to discuss the issue with the media."

President Trump has sought to downplay the weekend flare-up in hostilities. He told reporters that the ceasefire is still in placed, but that Hamas had been "rambunctious and they've been doing some shooting." He stipulated it could be "some rebels within" the armed group. "Either way it's gonna be handled properly. Toughly but properly," he added.

Special envoy Steve Witkoff and Trump's son-in-law Jared Kushner have returned to Israel, as part of efforts to ensure the fragile ceasefire continues, and after Israel temporarily prevented aid from reaching the Strip, but then reopened at least one border crossing on Monday morning.

Kushner told CBS over the weekend, "The biggest message that we’ve tried to convey to the Israeli leadership now is that now that the war is over, if you want to integrate Israel with the broader Middle East, you have to find a way to help the Palestinian people thrive and do better."

Israeli media is also reporting Vice President JD Vance is also to visit Israel on Tuesday, with Tel Aviv's Ben Gurion International Airport being the first to note it's been ordered to make preparations.

Meanwhile, Al Jazeera highlights yet another pressing issue facing Palestinians - toxic health risks piling up in cities and streets. "Public services were suspended during the war, and waste piled up. Municipal officials say piles of filthy rubbish need to be cleared from Gaza’s streets," the outlet reports. "The mounds of rubbish are posing a severe health risk."

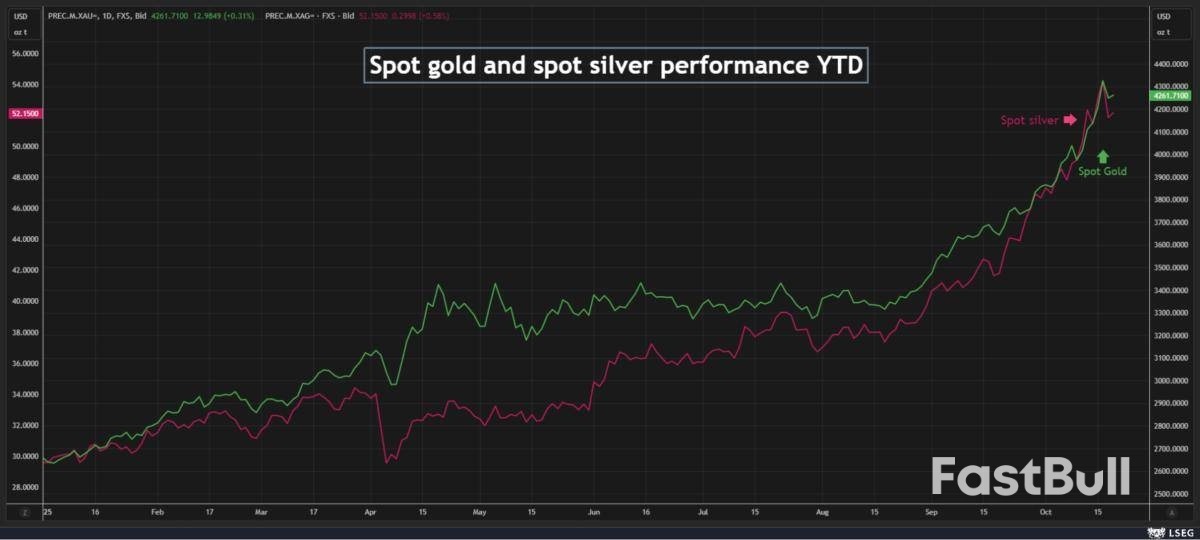

Gold prices inched higher on Monday after a record rally, supported by expectations of more U.S. rate cuts and safe-haven demand linked to the government shutdown in Washington, while investors awaited cues from upcoming U.S.-China trade talks.

Spot goldwas up 0.3% at $4,2562.84 per ounce, as of 1139 GMT. U.S. gold futuresfor December delivery climbed 1.6% to $4,280.40 per ounce.

Spot silverrose 0.3% to $51.98, recovering slightly after falling 4.4% on Friday after hitting a record high of $54.47 earlier that day.

"We're holding well above $4,000 in gold and $50 in silver, and as long as we do that I do not expect any major amount of long liquidation coming into the market," said Ole Hansen, head of commodity strategy at Saxo Bank, adding that gold is still very bullish.

The U.S. government shutdown is still adding some underlying support while the upcoming U.S.-China meeting will be a major focus, Hansen added.

U.S. PresidentDonald Trumpsaid on Friday that his proposed 100% tariff on goods from China would not be sustainable, adding that he would meet with Chinese President Xi Jinping in two weeks.

Gold, which has hit multiple record highs this year - most recently on Friday when it reached $4,378.69 - gained more traction last week after the U.S. threatened steep tariff hikes over China's rare-earth export controls. But it fell more than 1.8% on Friday following Trump's remarks.

The U.S. CPI data, which was delayed due to the ongoing U.S. government shutdown, will be released on Friday, days before the Fed's October 28–29 policy meeting. It is expected to show that core inflation held at 3.1% in September.

TheU.S. Federal Reserveis widely expected to cut interest rates by a quarter percentage point again.

Meanwhile, China's economic growth slowed to its weakest pace in a year in the third quarter.

"The weakness in the Chinese property market remains a key source of support for the gold market," Hansen said.

Elsewhere, platinumfell 0.8% to $1,596.95 per ounce and palladiumdropped nearly 2% to $1,445.24 per ounce.

Insurance IPO activity in 2025 has shown stark regional contrasts. While the U.S. has seen a surge in activity as tech-driven insurers capture investors' attention, activity in the UK and Europe has been subdued amid liquidity shortages and valuation hurdles.In the U.S., Neptune Insurance's $3.1 billion debut, Slide Insurance's $2.6 billion listing and HCI Group's Exzeo Group, which is targeting a valuation of up to $2 billion in its U.S. IPO, are among examples that have shown heightened investor appetite for profitable business in the insurance space.

Cristiano Dalla Bona, co-head of U.S. equity capital markets at Mergermarket, said this latest wave of U.S. insurance IPOs is differentiated by "the breadth of business models coming to market, with a focus on insurtech offerings".Dalla Bona highlighted that while some insurance platforms carry significant underwriting exposure, others – particularly MGA and broker-driven businesses – are asset-light.He noted: "The broker model is especially attractive because it doesn't require holding underwriting risk, operates with light capital intensity and remains a deeply fragmented sector, offering ample opportunities for growth through consolidation."

The U.S. market benefits from a deep, insurance-savvy investor base in New York, a regulatory environment supportive of public offerings and a valuation premium that has grown in the aftermath of the COVID-19 pandemic.

By contrast, IPO activity across Europe and London remains subdued in 2025.The London Stock Exchange saw only nine new listings in the first half of this year, none of which were in the insurance space.Market uncertainty, geopolitical tensions and macroeconomic challenges have dampened investor appetite and delayed many IPO plans. Some hoped-for European insurance IPO activity failed to materialise.Inigo, once considered a strong IPO candidate, opted for acquisition rather than going public. Similarly, Centerbridge Partners-led Canopius withdrew its IPO plans earlier this year.

Aspen Insurance, closely linked to the London market, chose to list in New York instead, seeking higher valuations and more favorable conditions in the U.S. market, and has since agreed to be acquired by Sompo in a $3.5 billion deal pending regulatory approvals.Despite these headwinds, analysts remain cautiously optimistic about a likely rebound in activity in Europe in the months to come, fuelled by regulatory reforms and renewed M&A activity. Nevertheless, the environment remains risk-averse and focused on profitability and resilience.

Erickson Davis, head of European equities, KBW, said: “In general, across sector, EU and UK IPO activity has been subdued versus US activity levels.” He pointed to liquidity differentials: “Liquidity profiles of listing venues is a major factor in this, particularly in insurance where there is often an international business mix or distribution profile to the company which enables more flexibility in an IPO listing decision.”This dynamic is evident in insurer valuations. More liquid U.S.-listed stocks which have offered a way to play a hard market have been easier investments for global fund managers than less liquid UK or EU alternatives. Davis added: "We find the relative valuation multiples on several UK and EU-listed insurers too cheap to ignore, particularly as capital return dynamics play out.”

The post-pandemic era has also shifted valuation premiums. “It’s also noteworthy that in the post-COVID era, a valuation premium for U.S.-listed insurers has emerged. This is most pronounced in the reinsurance space when looking at Bermudians vs Lloyd’s stocks,” Davis said.London’s challenges are heightened by Brexit-related market access issues and macroeconomic headwinds, according to Lukas Muehlbauer, research associate and Europe director, IPOx.

“(The) UK’s new listing rules to simplify requirements and attract more companies are a step in the right direction,” Muehlbauer, said. He added that “sizeable European IPO candidates have opted for sales rather than listings”.U.S. mortgage insurer Radian's $1.7 billion acquisition of UK-based Inigo is one such example, which “removed another potential IPO candidate from an already thin roster of prospective London floats”, according to Muehlbauer.

Against that backdrop, Allianz CEO Oliver Bäte acknowledged the pull of deeper U.S. markets. “For Europe's largest insurer, it would currently be a rational decision to move to the New York Stock Exchange,” he said at the Bundesbank's Financial Center Conference in Frankfurt in September.A 2024 report by former European Central Bank president Mario Draghi on European competitiveness shed light on these structural challenges, emphasizing that “capital markets in Europe remain fragmented”.

This fragmentation leads to “higher compliance costs and inefficiencies,” which weigh heavily on companies seeking to list in Europe, the report stated.Draghi and Bäte’s observations underscore the tough structural situation for European insurers, who face weaker liquidity and limited capital market support compared to their U.S. peers.Elaborating on the scope of dual listings, Fitch senior director Gerald Glombicki said: "There’s not many companies that do that because it’s pretty expensive and there’s a lot of regulatory burdens to it, and some who do, don't get the benefit of being dual listed.”

Meanwhile, IPOx’s Muehlbauer highlighted the limitations in crossing markets. “Some European insurers may look at a U.S. dual listing to reach a larger pool of investors, yet they may also have to factor in higher underwriting fees on average and greater litigation exposure in the U.S., so it isn’t an automatic choice," he said.

Amid a backdrop of slowing growth and rising trade tensions, China’s leaders gathered in Beijing to sketch out policies for the next five years. Problem is, it’s hard enough to navigate the next five days right now as US President Donald Trump ratchets up the tariff pressure.

Speaking from Air Force One on Sunday, Trump listed rare earths, fentanyl and soybeans as the US’s top issues with China just before the two sides return to the negotiating table and as a fragile trade truce nears expiration. Days earlier, the US leader threatened a 100% tariff on Chinese shipments after Beijing vowed to exert broad controls on the minerals.

While President Xi Jinping and his officials have become accustomed to dealing with Trump’s threats, shrugging off the first trade war and keeping the export engines humming through the second take so far, the tariff uncertainty can only complicate their planning.

Chang Shu, Eric Zhu and David Qu of Bloomberg Economics expect a more balanced approach among growth, equity, and security, reflecting a deeper understanding of how these goals reinforce each other.

“This trinity of priorities could mark a shift from the growth-at-all-costs model in the older plans and the heavier emphasis on equity and security in the past two,” they wrote. As for trade, Beijing “will likely signal a shift from a long-held mercantilist approach to a more two-way opening with diversified global engagement.”

But that’s not to say growth — which came in at the weakest pace in a year during the third quarter — will no longer be a priority.

Standard Chartered’s China economists Shuang Ding and Hunter Chan say recent deliberations in policy circles indicate that average growth of 4.7-4.8% is desired for 2026-30, to pave way for a doubling of 2020 GDP by 2035.

To pull that off, Beijing will aim to boost productivity amid an aging population and technology restrictions from the West, they say. Specific policy proposals over the period could center around:

The authorities may see the next five years as a good window to promote the use of Renminbi in international trade and investment, they said.

Macquarie’s China economist Larry Hu expects a three-prong approach will underpin policy in the next five years:

“To achieve the growth target, Beijing will have no choice but to boost domestic demand,” Hu said. “For investors, it's the single most important thing to watch, although the timing is less determined by the 5-Year Plan made in Beijing, and more by policies made in Washington.”

After being delayed by the US government shutdown, the Bureau of Labor Statistics will release of the September consumer price index on Friday. The data, originally slated for Oct. 15, will give Federal Reserve officials a critical piece of information on inflation ahead of their policy meeting the following week.

Elsewhere, inflation data from Japan to the UK, purchasing manager indexes from major economies, and the first summary of a meeting by Swiss central bank officials will be among the highlights.

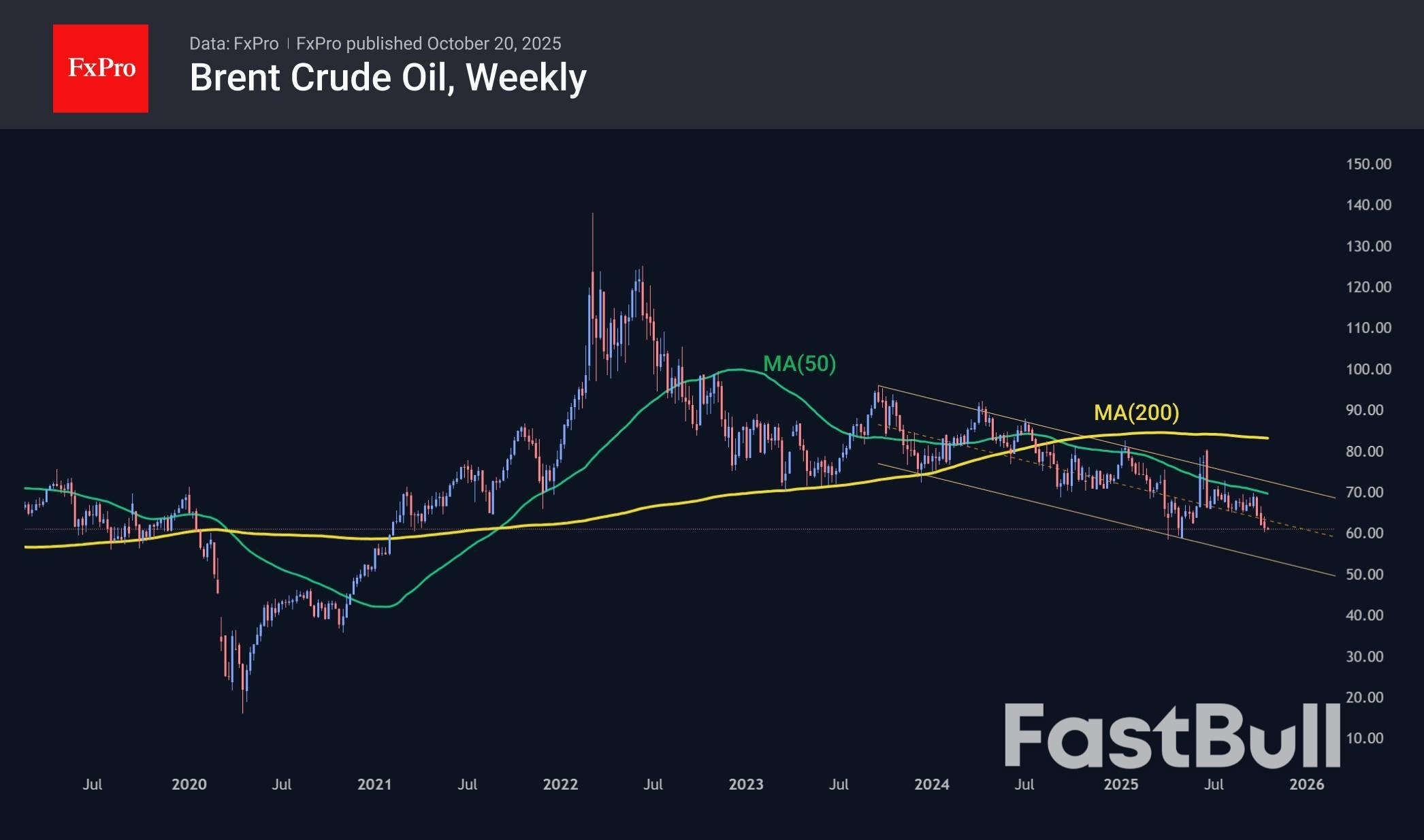

Crude oil prices fell 0.7% on Monday after three consecutive weeks of decline. Global production is growing while global economic growth is slowing, putting pressure on prices. In addition, the risk premium on signing the gas agreement and intensifying efforts to resolve the Ukrainian conflict has begun to decline. At the same time, oil prices are far from oversold, leaving room for further decline in the coming months.

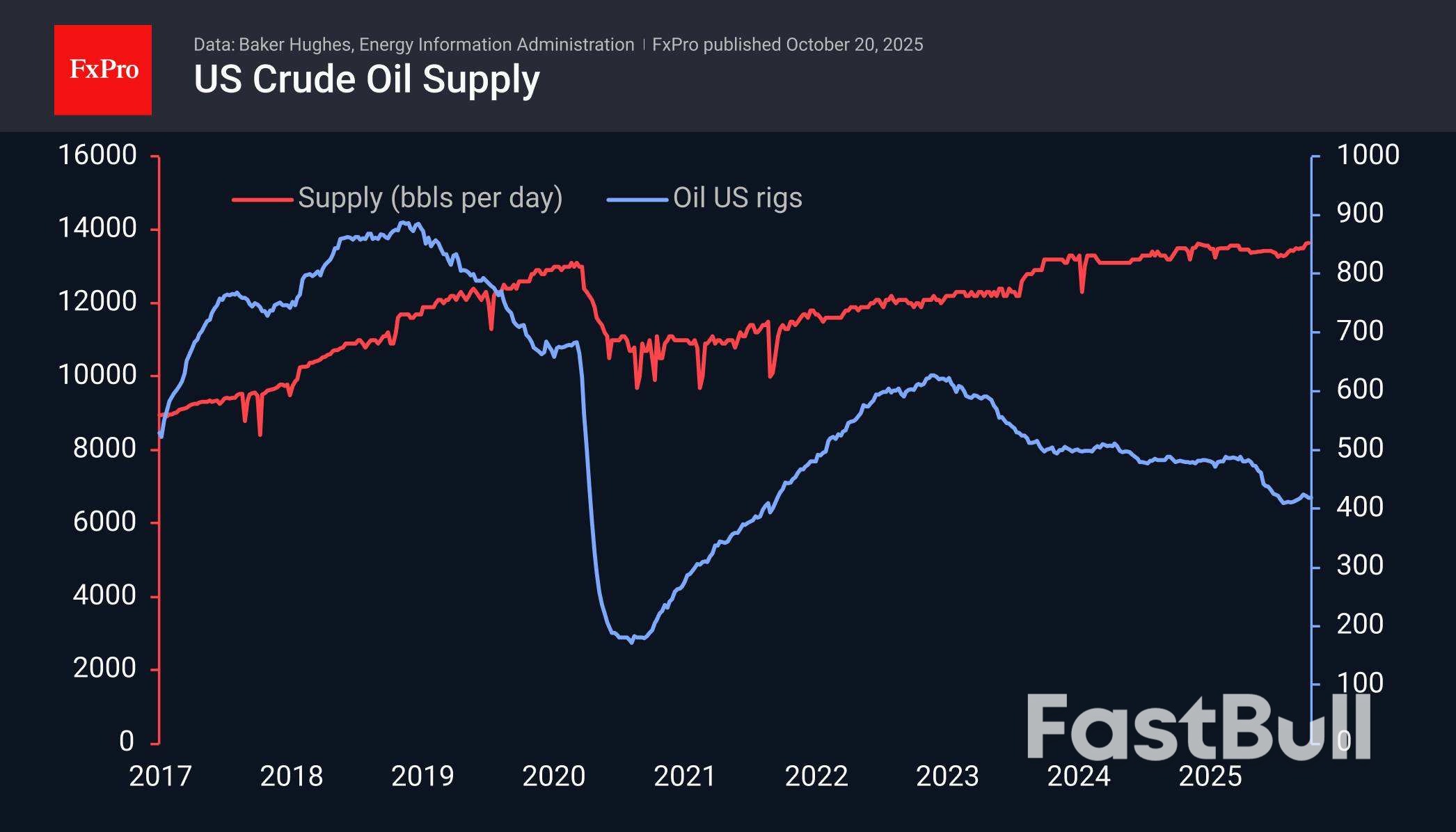

Baker Hughes reported on Friday that 418 oil rigs are operating in the US, the same as a week earlier, undermining the recovery trend seen since August. However, America is increasing production efficiency, extracting more oil from each well.

Bloomberg noted that there are now nearly 1.2 billion barrels of oil at sea, a record since the peak in 2020, when US production was at historic highs and Saudi Arabia and Russia were fighting for market share, boasting of their potential.

The current situation strongly resonates with what happened more than five years ago. The latest weekly data showed a record high in daily production in the US, with supplies of 13.64 million barrels per day.

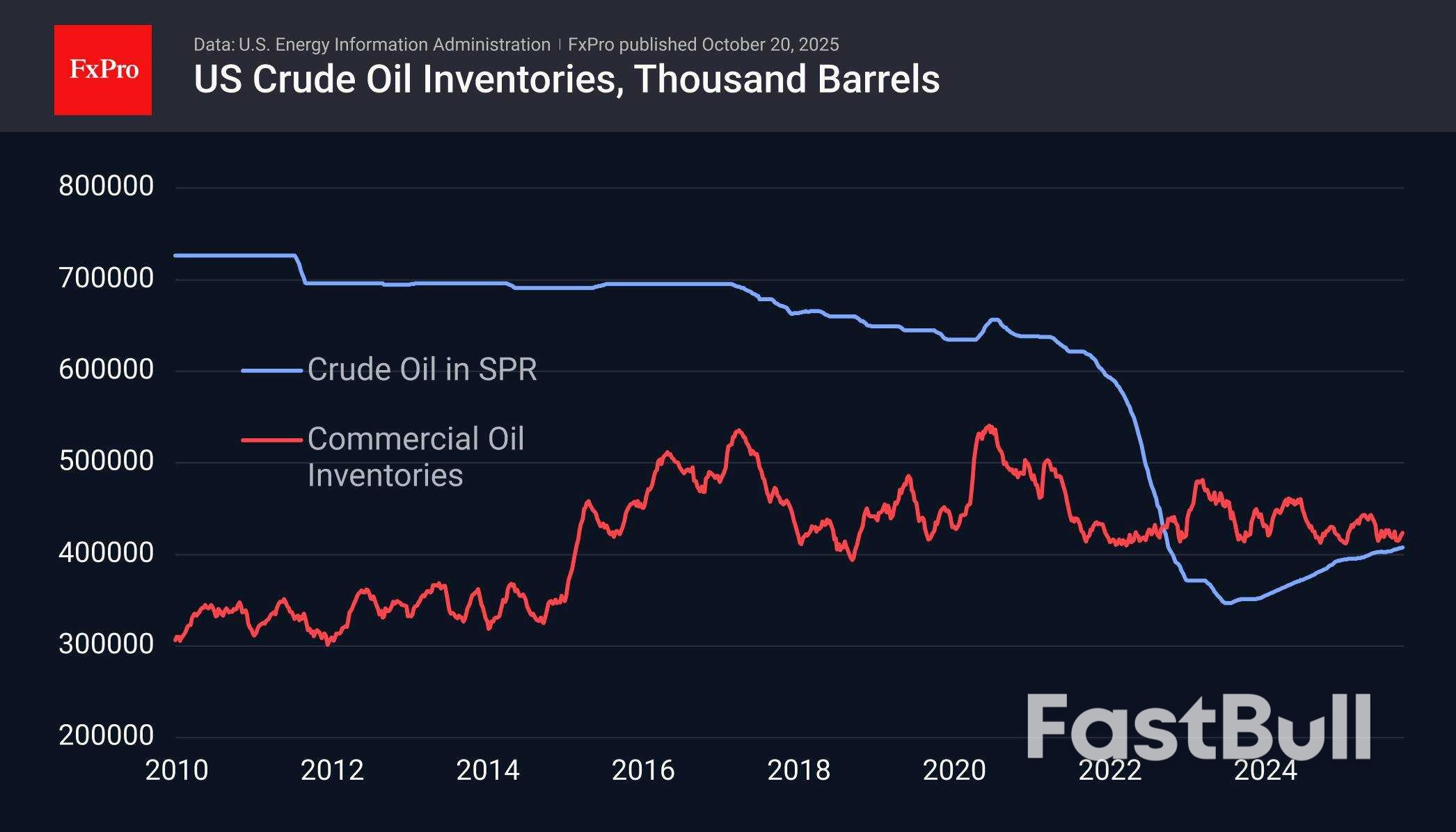

Inventory figures are a stabilising factor. Commercial inventories in the US are at the lower end of the range for the last decade, but they were about the same in January 2020, and six months later, this figure set a new record. However, without a collapse in consumption, such rapid growth should not be expected. The US government may also move to more actively rebuild the strategic petroleum reserve sold off in 2022.

The price of oil has been in a downward channel for just over three years, and at the end of September, it accelerated its decline as it approached the 50-week moving average and the upper limit of the range. The lower limit of this range is now close to $53 per barrel of Brent, with a decline towards the end of the year closer to $50.50 against the current $61.00.

The main scenario for oil is a decline towards $50 in the next 2-4 months. At the same time, the potential for an increase in US inventories is a potential stabilising factor. We assume that the situation with inventories is roughly similar worldwide, excluding the abundance of oil at sea.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up