Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

President Donald Trump urged the Federal Reserve (Fed) to cut interest rates by a full percentage point, intensifying his pressure campaign against Chair Jerome Powell.

President Donald Trump urged the Federal Reserve (Fed) to cut interest rates by a full percentage point, intensifying his pressure campaign against Chair Jerome Powell.

“‘Too Late’ at the Fed is a disaster!” Trump posted Friday on social media, using a derisive nickname for Powell. “Despite him, our Country is doing great. Go for a full point, Rocket Fuel!”

While the size of Trump’s rate-cut demand — a full percentage point — was unusual, his call for the central bank to lower rates is not new. The president, who first nominated Powell to the job in 2017, has regularly complained that the Fed chief has been too reluctant to cut borrowing costs. Trump pushed Powell to lower rates in a White House meeting last month.

Fed officials are scheduled to meet June 17-18 in Washington and are widely expected to leave their benchmark rate unchanged, as they have done all year. Many policymakers have said they want to wait for more clarity over how Trump’s policies on trade, immigration and taxation will affect the economy before they alter rates.

It would be highly unusual for the Fed to lower its benchmark rate by a full percentage point at one meeting outside of a severe economic downturn or financial crisis. Officials last cut rates by a full point in March 2020, when the US economy was cratering as the Covid-19 pandemic prompted widespread shutdowns and layoffs, triggering a deep recession.

The Fed targets 2% inflation over time, and adjusts interest rates with the goal of maintaining both stable prices and maximum employment — the two responsibilities assigned to it by Congress. Lowering rates too quickly could stoke inflationary pressures, while holding them at high levels for too long could restrain the economy more than desired.

Trump posted his call after new data showed US job growth moderated in May, but was still better than expected, and the unemployment rate held at a low 4.2%. In a separate statement, the White House touted the “BOOMING economy”, including job gains, increasing wages and tame inflation.

Fed policymakers in recent weeks have described the labor market as on stable footing, which they’ve said provides further cause for them to keep borrowing costs steady for now — especially with inflation still above their target.

Trump, in a subsequent message, accused Powell of “costing our Country a fortune” by keeping rates at their current level, saying they have increased borrowing costs for the federal government that “should be MUCH LOWER!!!”

“If ‘Too Late’ at the Fed would CUT, we would greatly reduce interest rates, long and short, on debt that is coming due. Biden went mostly short term. There is virtually no inflation (anymore), but if it should come back, RAISE ‘RATE’ TO COUNTER. Very Simple!!!” he posted.

US borrowing costs have swelled in recent years as the Fed lifted interest rates to combat historically high inflation. The average interest rate on US Treasuries outstanding is currently around 3.36%, well above levels the government enjoyed before the Fed started ramping up rates.

Last fiscal year, the government’s interest costs on debt were the equivalent of 3.06% as a share of gross domestic product, the highest ratio since 1996.

Trump and congressional Republicans have vowed to rein in government spending and lower deficits, but the tax bill they are advancing would likely do the opposite, according to several estimates.

The nonpartisan Congressional Budget Office said Thursday that added interest costs from the bill would come to US$551 billion (RM2.33 trillion) over a decade. CBO estimates didn’t account for other potential effects, such as any boost to growth. The agency separately has estimated interest costs would shrink if high tariffs stay in place, reducing borrowing needs.

China has issued temporary export licenses to rare-earth suppliers for the top three U.S. automakers, according to a report from Reuters, citing two sources familiar with the situation. The move comes as supply chain disruptions begin to emerge due to Beijing’s restrictions on the export of these materials.

The licenses, valid for a period of six months, have been granted to suppliers of General Motors (NYSE:GM), Ford, and Jeep-maker Stellantis (NYSE:STLA). However, the specifics about the quantity or items included in the approval remain unclear, as the sources chose to remain anonymous due to the information not being public.

China’s decision to limit exports of a wide array of rare earths and related magnets since April has complicated supply chains crucial to automakers, aerospace manufacturers, semiconductor companies, and military contractors globally. China’s control over the critical mineral industry, which is essential for the green energy transition, is seen as a significant leverage point for Beijing in its trade conflict with U.S. President Donald Trump.

The U.S. Federal Reserve should cut interest rates by a full percentage point, President Donald Trump said on Friday as he reiterated his view that Fed Chair Jerome Powell has been too slow to lower borrowing costs.

"Europe has had 10 rate cuts, we have had none. Despite (Powell), our Country is doing great. Go for a full point," Trump wrote in a social media post. Central banks typically limit rate moves to quarter point changes.

Trump said the Fed could always raise rates again if cuts led to inflation.

The president has repeatedly berated Powell for not cutting rates as he desires. The two men met face-to-face for the first time last week, with Trump telling Powell he was making a "mistake" by not lowering rates.

The Fed in May left the policy rate in the 4.25%-4.50% range, where it has been since December, and policymakers have since signaled they may leave it there for another few months as they wait for more clarity on Trump's tariff policy.

The Canadian labour market basically tread water again in May, adding only 8.8k net new positions (+0.0% month/month). The details were slightly better, with the private sector up 61k positions (+0.4% m/m), and solid gains in full-time jobs (58k). However, these were mostly offset by losses in part-time jobs (-49k).

The unemployment rate rose for the third consecutive month to 7.0%, the highest rate since September 2016 (apart from the pandemic). The labour force grew by 0.2% m/m. Growth in the labour supply has slowed in recent months, but employment growth has slowed further.

The job market is even tougher for students. The unemployment rate for returning students (aged 15-24) was 20.1% — the highest since the 2009 recession (excluding the pandemic).

The impact of tariffs shows up in the industry pattern and regional unemployment pattern. The manufacturing sector was down (-12.2k), as was transportation and warehousing (-15.5k). Manufacturing has lost jobs for four months now, totaling 55k. That said, the wholesale and retail trade sector recouped some (+43k) of the 55k jobs lost through march and April. The highest unemployment rates across CMAs were in Windsor (10.8%), Oshawa (9.1%) (three-month moving averages), which have both seen significant increases since January.

Wage growth was steady in May. Average hourly wages rose 3.4% versus a year ago, matching April’s pace. Lastly, total hours worked were flat.

Canada’s labour market continued to soften in May. The unemployment rate continued to rise, and the impact of U.S. tariffs is clearly evident in industry and regional patterns. Wage gains were steady in May but have cooled from a roughly 5% pace a year ago.

On Wednesday, the Bank of Canada opted to wait and see how tariffs would impact the Canadian economy, while also weighing recent hotter than expected inflation readings. May’s jobs report puts another mark in the economic weakness tally. We think this will ultimately lead to further rate cuts from the Bank of Canada.

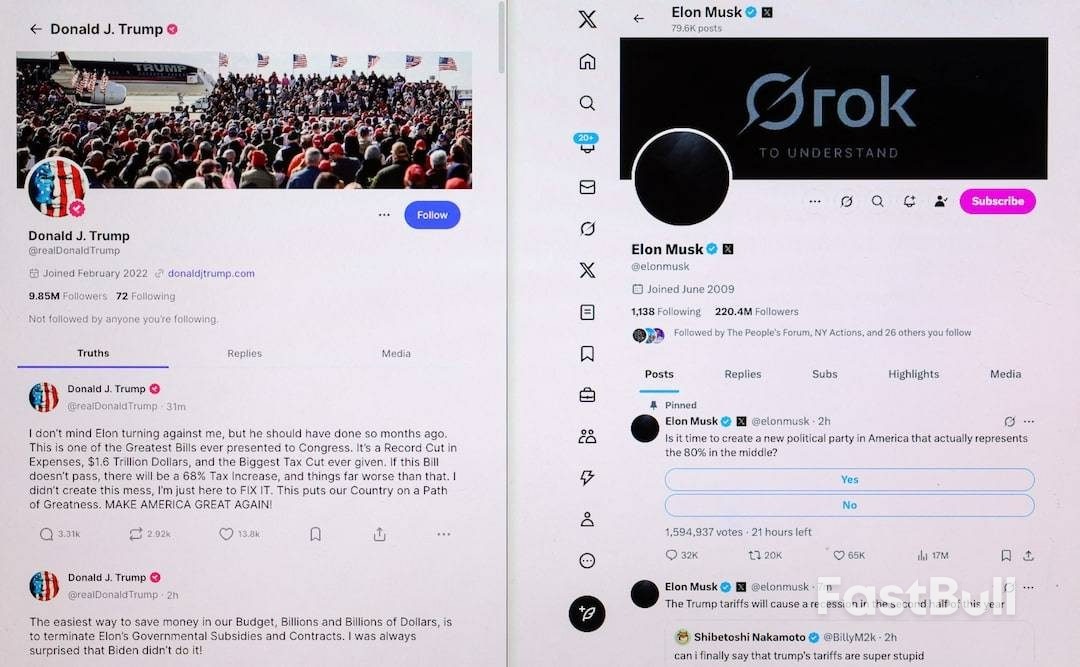

U.S. President Donald Trump is not interested in talking with his former ally Elon Musk, amid a bitter feud over the president's sweeping tax-cut bill, a White House official said on Friday, adding that no phone call between the two men is planned for the day.

A separate White House official had said earlier that Trump and Musk were going to talk to each other on Friday.

Trump, the world's most powerful leader, and Musk, the world's richest man, launched an extraordinary day of hostilities on Thursday - largely over social media - marking a stark end to a close alliance.

In pre-market trading on Friday, shares in Musk's Tesla (TSLA.O), opens new tab rose as much as 5% after the early news that the two men were scheduled to speak.

Tesla had closed down 14% on Thursday, losing about $150 billion in market value in the largest single-day decline in value in the electric vehicle maker's history.

Musk bankrolled a large part of Trump's presidential campaign and was then brought to the White House to head up a controversial effort to downsize the federal workforce and slash spending.

The falling-out had begun brewing days ago when Musk, who left his role as head of the Department of Government Efficiency a week ago, denounced Trump's tax-cut and spending bill. The feud is complicating efforts to pass the bill, which is the president's main demand of the Republican-controlled Congress.

Musk has denounced the package, which contains most of Trump's domestic priorities, as a "disgusting abomination" that would add too much to the nation's $36.2 trillion in debt.

The package narrowly passed the House of Representatives last month and is now before the Senate, where Republicans say they will make further changes. Nonpartisan analysts say it would add $2.4 trillion in debt over 10 years.

House Speaker Mike Johnson said he has been in touch with Musk.

"I don't argue with him about how to build rockets and I wish he wouldn't argue with me about how to craft legislation and pass it," he said on CNBC.

Trump initially stayed quiet while Musk campaigned to torpedo the bill, but broke his silence on Thursday, telling reporters he was "very disappointed" in Musk.

"Look, Elon and I had a great relationship. I don't know if we will anymore," he said.

The pair then traded barbs on their social media platforms: Trump's Truth Social and Musk's X.

"Without me, Trump would have lost the election," wrote Musk, who spent nearly $300 million backing Trump and other Republicans in last year's election.

Musk also asserted that Trump's signature import tariffs would push the U.S. into a recession and responded "Yes" to a post on X saying Trump should be impeached. That would be highly unlikely given Trump's Republicans hold majorities in both chambers of Congress.

Trump, for his part, suggested he would terminate government contracts with Musk's businesses, which include rocket company SpaceX and its satellite unit Starlink.

Musk, whose space business plays a critical role in the U.S. government's space program, responded that he would begin decommissioning SpaceX's Dragon spacecraft, which is the only U.S. spacecraft capable of sending astronauts to the International Space Station. He backed off the threat later in the day.

In a sign of a possible detente, Musk subsequently wrote: "You're not wrong" in response to billionaire investor Bill Ackman saying Trump and Musk should make peace.

A prolonged feud between the pair could make it harder for Republicans to keep control of Congress in next year's midterm elections if Musk withholds financial support or other major Silicon Valley business leaders distance themselves from Trump.

Musk had already said he planned to curtail his political spending, and on Tuesday he called for firing "all politicians who betrayed the American people" next year.

His involvement with the Trump administration has provoked widespread protests at Tesla sites, driving down sales while investors fretted that Musk's attention was too divided.

Additional reporting by Susan Heavey and Jarrett RenshawWriting by Andy SullivanEditing by Scott Malone and Frances Kerry

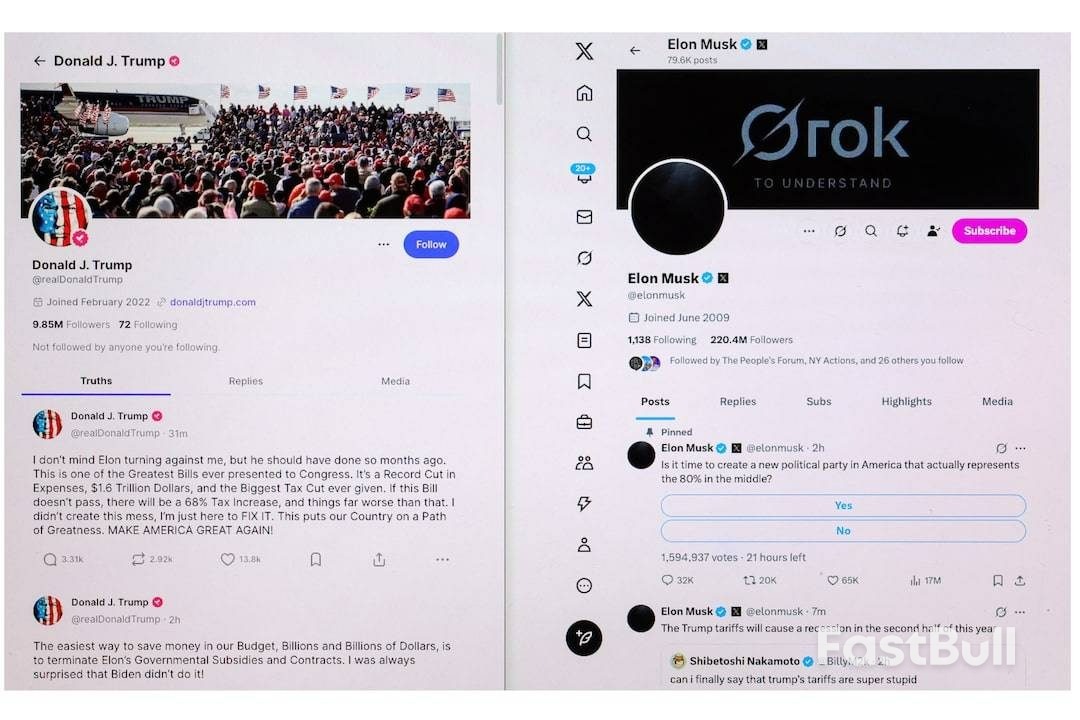

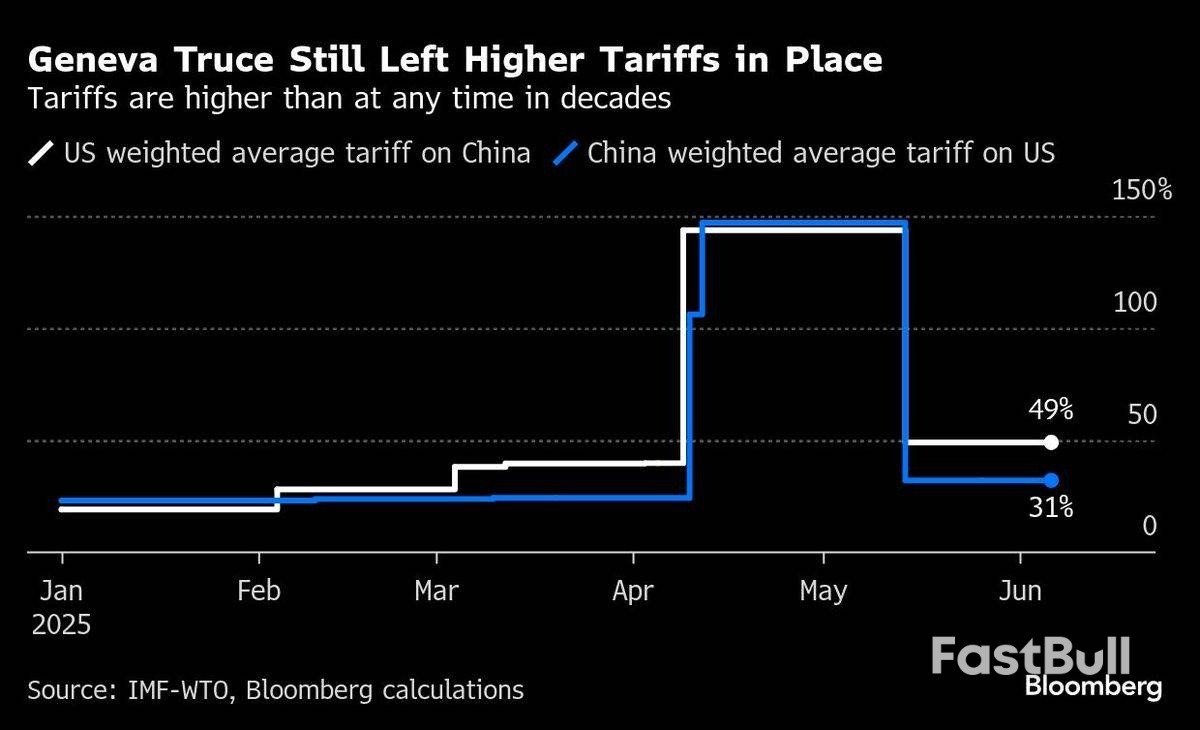

In the early hours of Wednesday, Donald Trump declared that Xi Jinping was “VERY TOUGH, AND EXTREMELY HARD TO MAKE A DEAL WITH!!!” Some 36 hours later, the US leader said he got what he wanted: A commitment to restore the flow of rare earth magnets.

It’s less clear what Xi got in return, apart from putting a lid on further punitive US measures. One of the few clear takeaways appeared to be an assurance for the US to welcome Chinese students, a major issue in China but also not one that would explain why Xi got on the phone after making Trump wait for months.

By taking the call now, Xi appears to be betting that a reset in ties will lead to tangible wins in the weeks and months ahead, including tariff reductions, an easing of export controls and a generally more civil tone. The biggest sign of that was another round of talks that will now include US Commerce Secretary Howard Lutnick, who is in charge of curbs on the sale of advanced technology to China.

Whether Xi will get any of that, however, now hinges on a famously erratic Trump administration in which views toward China differ drastically.

“This call provides tactical de-escalation for US-China relations,” said Sun Chenghao, a fellow at the Center for International Security and Strategy at Tsinghua University in Beijing.

“However, China’s core demands — equal sanction relief, reciprocal enforcement mechanisms, and an end to tech containment — remain critical for sustainable agreements,” he added. “Without substantive US adjustments in follow-up talks and policies, the consensus may not translate into long-term stability.”

Investors were sceptical that relations between the world’s biggest economies were finally on track, with China’s CSI 300 Index little changed on Friday. While the two leaders spoke just days before Trump’s inauguration, Xi had kept his US counterpart waiting for a phone call ever since as tensions rapidly escalated, with tariffs climbing well beyond 100% before the two sides agreed to lower them in Geneva last month.

In recent days, Trump had looked like the more desperate of the two, seen by his repeated requests for a call capped off by his social media post at 2.17am on Wednesday. The call next day finally ended the longest post-inauguration silence between American and Chinese leaders in more than 20 years.

“We’re in very good shape with China and the trade deal,” Trump told reporters on Thursday after the 90-minute conversation. “I would say we have a deal, and we’re going to just make sure that everybody understands what the deal is,” he added.

The big immediate problem for the US was a lack of rare earth magnets essential for American electric vehicles and defence systems. After the Geneva meeting, the US side believed it had secured the flow of these materials, only to be disappointed when China kept its export licensing system in place, saying that exporters to the US still needed to apply just like everyone else.

China, in turn, felt betrayed by a fresh wave of US restrictions on AI chips from Huawei Technologies Co, software for designing chips, plane engines and visas for upwards of 280,000 Chinese students.

“Both sides felt that the agreement in Geneva was being violated,” said Gerard DiPippo, associate director at the RAND China Research Center. From the White House’s perspective, he said, “China committed to send the magnets.”

Although Xi flexed his muscles with the rare earths restrictions, he also has reasons to come to the table. China’s economy is expected to slow sharply in the second quarter and come under pressure into the second half of the year, according to Morgan Stanley economists led by Robin Xing.

“Now the China pendulum is swinging back from ‘political principle’ of standing firm against the US to ‘pragmatism’ in support of a still fragile economy,” said Han Lin, China country director at The Asia Group. “In other words, Beijing wants to de-escalate, and as long as there is a face-saving path for Xi to do so, now is better than never.”

Xi can point to several things that indicate more is coming. The addition of Lutnick in upcoming trade talks, led in Geneva by Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer, signals Trump may be willing to consider reversing some of the technology curbs that threaten to hobble China’s long-term growth ambitions.

Xi’s statement after the call also made clear he expects the US to “remove the negative measures taken against China”, which could include warnings against the use of Huawei's Ascend chips and restriction on the sale of chip design software to China.

The two leaders also exchanged invitations to visit each other’s country, events that will build momentum toward stabilising the relationship with agreements on thorny issues spanning trade, export controls and people-to-people exchanges. Trump said their wives would also come along, adding to the positive optics.

It’s significant that Trump agreed to visit China first, according to Bert Hofman, professor at the East Asian Institute at the National University Singapore and former World Bank country director for China.

“Xi probably realised that a call would be in the Chinese interest given the eagerness of Mr Trump to have one,” he said. “This will accelerate talks and hopefully extend the truce beyond August,” he added, as the tariff reductions agreed in Geneva will expire in early September.

But some analysts advised against being overly optimistic, pointing out the lack of details on key trade matters.

“There doesn’t seem to be a deeper agreement that would prevent either side from taking additional negative actions, even as talks proceed,” said Kurt Tong, a former US consul general in Hong Kong and a partner at The Asia Group.

That fragility is compounded by Trump’s transactional approach to foreign policy and ties with China in particular. In January 2020, when Trump signed a Phase-One trade deal with Beijing, he said the relationship between the countries was “the best it’s ever been” before it quickly unraveled following the spread of Covid-19 around the globe.

“It would be unwise to bet that Trump has a vision for further negotiations that he won’t abandon suddenly later on,” said Graham Webster, who leads the DigiChina project at Stanford University.

Another area where Xi could see an early win is on the issue of fentanyl. Any deal to cooperate in blocking the flow of the drug to the US could immediately bring down American tariffs on Chinese imports by 20 percentage points.

While the call helped to stem the negative trajectory of the relationship, the next two weeks will be crucial to confirm whether the truce will last, according to Wu Xinbo, a professor at Fudan University in Shanghai. He said China expects to see more progress on tariffs and US tech curbs.

“The call in itself is not a reward,” Wu said. “What’s important is what will come out of the call.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up