Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Africa Trade Balance (Nov)

South Africa Trade Balance (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

South Korea Trade Balance Prelim (Dec)

South Korea Trade Balance Prelim (Dec)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Dec)

South Korea IHS Markit Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Dec)

Indonesia IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Dec)

India HSBC Manufacturing PMI Final (Dec)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Dec)

U.K. Nationwide House Price Index MoM (Dec)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Dec)

U.K. Nationwide House Price Index YoY (Dec)A:--

F: --

P: --

Turkey Manufacturing PMI (Dec)

Turkey Manufacturing PMI (Dec)A:--

F: --

P: --

Italy Manufacturing PMI (SA) (Dec)

Italy Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Dec)

Euro Zone Manufacturing PMI Final (Dec)A:--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Nov)

Euro Zone M3 Money Supply (SA) (Nov)A:--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Nov)

Euro Zone 3-Month M3 Money Supply YoY (Nov)A:--

F: --

P: --

Euro Zone Private Sector Credit YoY (Nov)

Euro Zone Private Sector Credit YoY (Nov)A:--

F: --

P: --

Euro Zone M3 Money Supply YoY (Nov)

Euro Zone M3 Money Supply YoY (Nov)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Dec)

U.K. Manufacturing PMI Final (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Dec)

Brazil IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

Canada Manufacturing PMI (SA) (Dec)

Canada Manufacturing PMI (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Dec)

U.S. IHS Markit Manufacturing PMI Final (Dec)A:--

F: --

P: --

Mexico Manufacturing PMI (Dec)

Mexico Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Japan Manufacturing PMI Final (Dec)

Japan Manufacturing PMI Final (Dec)--

F: --

P: --

China, Mainland Caixin Composite PMI (Dec)

China, Mainland Caixin Composite PMI (Dec)--

F: --

P: --

China, Mainland Caixin Services PMI (Dec)

China, Mainland Caixin Services PMI (Dec)--

F: --

P: --

Indonesia Trade Balance (Nov)

Indonesia Trade Balance (Nov)--

F: --

P: --

Indonesia Core Inflation YoY (Dec)

Indonesia Core Inflation YoY (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Dec)

Indonesia Inflation Rate YoY (Dec)--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Dec)

Saudi Arabia IHS Markit Composite PMI (Dec)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Dec)--

F: --

P: --

Turkey CPI YoY (Dec)

Turkey CPI YoY (Dec)--

F: --

P: --

Turkey PPI YoY (Dec)

Turkey PPI YoY (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Nov)

U.K. Mortgage Approvals (Nov)--

F: --

P: --

U.K. M4 Money Supply MoM (Nov)

U.K. M4 Money Supply MoM (Nov)--

F: --

P: --

U.K. Mortgage Lending (Nov)

U.K. Mortgage Lending (Nov)--

F: --

P: --

U.K. M4 Money Supply (SA) (Nov)

U.K. M4 Money Supply (SA) (Nov)--

F: --

P: --

U.K. M4 Money Supply YoY (Nov)

U.K. M4 Money Supply YoY (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. ISM Inventories Index (Dec)

U.S. ISM Inventories Index (Dec)--

F: --

P: --

U.S. ISM Output Index (Dec)

U.S. ISM Output Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing PMI (Dec)

U.S. ISM Manufacturing PMI (Dec)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Dec)

U.S. ISM Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Dec)

U.S. ISM Manufacturing New Orders Index (Dec)--

F: --

P: --

Japan Monetary Base YoY (SA) (Dec)

Japan Monetary Base YoY (SA) (Dec)--

F: --

P: --

Japan Foreign Exchange Reserves (Dec)

Japan Foreign Exchange Reserves (Dec)--

F: --

P: --

U.K. BRC Shop Price Index YoY (Dec)

U.K. BRC Shop Price Index YoY (Dec)--

F: --

P: --

Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

India HSBC Services PMI Final (Dec)

India HSBC Services PMI Final (Dec)--

F: --

P: --

India IHS Markit Composite PMI (Dec)

India IHS Markit Composite PMI (Dec)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Dec)

South Africa IHS Markit Composite PMI (SA) (Dec)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The Treasury market in 2025 had its best year since 2020 as US trade policy shifts curtailed economic activity and the Federal Reserve cut interest rates in response to weakening labor-market conditions.

The Treasury market in 2025 had its best year since 2020 as US trade policy shifts curtailed economic activity and the Federal Reserve cut interest rates in response to weakening labor-market conditions.

At the same time, Treasury yields remained confined to ranges in place roughly since the end of the Fed's historic 2022-2023 tightening cycle. The 10-year, for example, ranged from 3.86% to 4.81%, its narrowest band since 2021.

Yield declines were biggest for short maturities, and the 30-year increased slightly, amid expectations at year-end that the Fed was likely to cut rates further in 2026.

During the year, in which US President Donald Trump took office in January, the Treasury market drew support from economic uncertainty created by the turbulent roll-out of tariffs, broadly mounting expectations for Fed rate cuts, and a record six-week government shutdown that curbed growth.

Meanwhile, yields faced upward pressure from the dire long-term fiscal outlook, predictions that tariffs would cause inflation, and indications of accommodative financial conditions including record highs for US stock-market benchmarks and robust corporate bond issuance.

The Trump administration's drive to change the leadership of the Fed in pursuit of lower interest rates drove short-term Treasury yields lower and long-term ones higher, reflecting concern about unwarranted rate cuts keeping upward pressure on inflation.

For 2026, most Wall Street interest-rate strategists expect stable-to-higher Treasury yields as the Fed's rate-cutting cycle comes to an end.

Global central banks are now trading gold at a rate never seen before in history, as illegal exports strip billions from national revenues and weaken foreign exchange reserves, according to reporting by the Financial Times.

The problem comes mainly from Madagascar, an island where central bank governor Aivo Andrianarivelo said produces up to 20 tonnes of gold each year, worth literally $2.8 billion at current prices, yet almost none of it appears in official trade records.

Aivo said criminal groups involved in the gold trade operate with aircraft, helicopters, and advanced transport systems that allow metal to leave the country undetected. "The criminal gangs, they have aircraft, helicopters, very sophisticated means of transportation," he said. "Our strategy is to reduce the gold trafficking business in Madagascar."

As Cryptopolitan extensively reported throughout 2025, gold rallied by more than 60 percent and crossed $4,300 per troy ounce, becoming one of the top 5 most-traded assets globally. In countries where mining happens outside formal systems, authorities link the trade to environmental destruction, polluted rivers, human trafficking, and funding for armed groups.

Madagascar now joins a growing list of countries where central banks and finance ministries are running domestic buying programs to get back control of the market. According to Aico, they're trying to pull small-scale miners into regulated markets by offering official purchase channels instead of leaving them dependent on smugglers.

Countries including Ecuador, the Philippines, and Ghana are expanding similar schemes. David Tait, chief executive of the World Gold Council, said artisanal and small-scale miners produce up to 1,000 tonnes each year, with large volumes entering illegal trade. "It's anybody's guess how much gold goes to bad actors, but even if you take a guess at 50 percent, it is an enormous amount of money," David said.

Rising prices also increase criminal income and environmental damage. "It could be apocalyptic, it really could, a law of unintended consequences of a rally to $10,000," David said.

In Ghana, the government launched a centralized buying body called GoldBod in 2025 as mercury use and water pollution from mining turned into a political crisis. Officials say more than 60 percent of the country's waterways are now contaminated due to mining tied to gold.

In Ecuador, where drug gangs have shifted into mining for cash, the government is expanding a buying program launched in 2016. A new buying station is set to open in Zamora in January. Diego Patricio Tapia Encalada, head of investments and international settlements at the Central Bank of Ecuador, said fast payments attract miners. "The price is important because then we incentivise the miner not to go to other channels," Diego said, adding that payments are made within 48 hours.

For Madagascar, higher prices increase pressure to control a sector long beyond state reach. "One of the objectives is to make gold benefit Madagascar, and to legitimise the business," Aivo said. "That is the main goal, to make it more transparent." The central bank plans to raise reserves from one tonne to four tonnes, a target unchanged after a new government took power in October.

The bank buys output from artisanal miners and ships it overseas for refining. The metal can then be sold for foreign currency or added to reserves. The potential impact is large. Despite widespread production, gold does not appear among Madagascar's top recorded exports, which include vanilla, cloves, clothing, and nickel.

Not all programs succeed. Marc Ummel, head of raw materials at SwissAid, said weak traceability has caused failures. "Most of them do not have good due diligence mechanisms," Marc said, pointing to cases in Sudan and Ethiopia, where central banks bought illegally mined supply from the Tigray region.

There are working models. In Mongolia, a buying program running for over 30 years helped eliminate mercury use because stations test for contamination. Enkhjin Atarbaatar, director general of financial markets at the Bank of Mongolia, said artisanal mining was widespread in the 1990s, but most production now comes from small or mid-sized firms. Selling gold remains a key source of foreign currency.

As prices stay high, regulation grows harder. Diane Culillas, chief executive of Swiss Better Gold, said all output reaches markets regardless of legality. "The gold always finds its way to market," she said. New tracing tools may help. Ecuador is testing isotope scanners to identify ore origins. "If you do this now, in 10 years there'll be only tiny amounts of gold going in the bad guys' directions," David said.

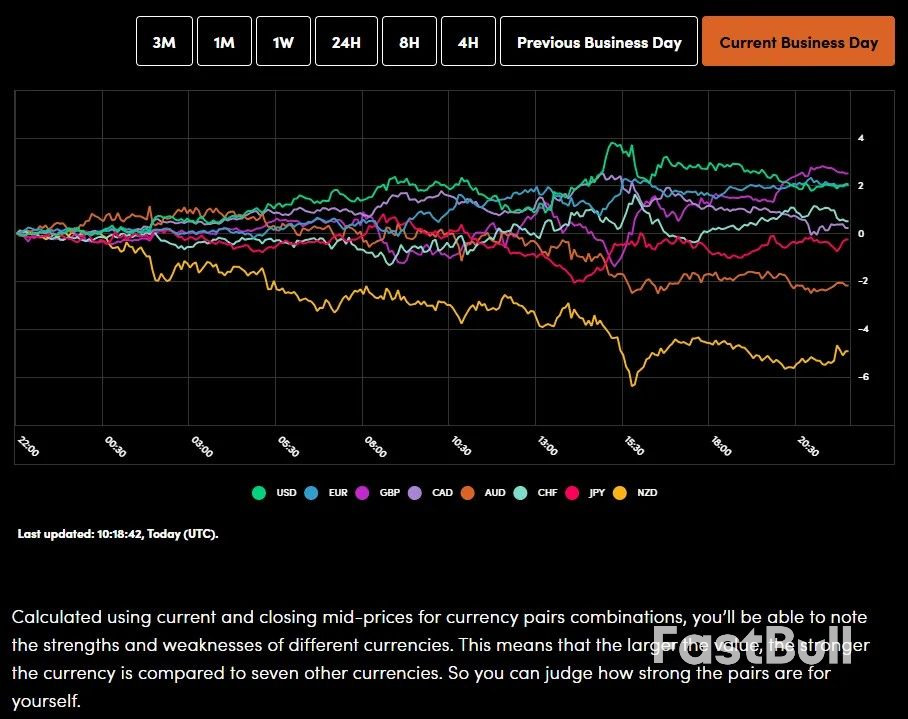

The US dollar made a positive start to 2026 on Friday after struggling against most currencies last year, while the yen inched back towards a 10-month low as traders awaited US economic data to predict interest rate moves this year.

A narrowing interest rate difference between the US and other economies cast a shadow over markets last year, resulting in sharp gains against the dollar for most major currencies, with the exception of the Japanese yen.

Worries about the US fiscal deficit, a global trade war and concern about Federal Reserve independence took a toll on the greenback, and those issues are likely to linger into 2026.

Markets in Japan and China were closed on Friday, making for light trading volume and little movement.

"Market liquidity should improve next week alongside a fuller data slate," said Jens Naervig Pedersen, FX strategist at Danske Bank.

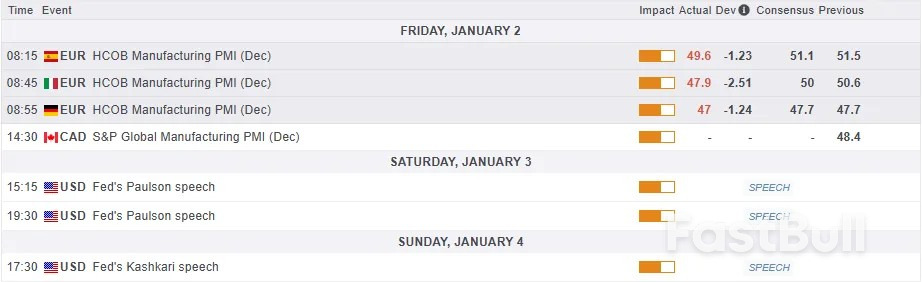

The euro was down 0.2% at US$1.1725 on the first trading day of the year, as eurozone manufacturing activity fell in December to its weakest in nine months, a survey showed. The currency surged 13.5% last year, its biggest annual rise since 2017.

Sterling last bought US$1.3439 following a 7.7% increase in 2025, also its biggest yearly jump since 2017.

The dollar index, which measures the US currency against six other units, was up 0.2% on Friday at 98.44 after registering a 9.4% decline in 2025, its biggest drop in eight years.

Economic data including US payrolls and jobless figures are due next week, providing clues on the health of the labour market and where the Fed's policy rate may end up this year.

Much of the focus at the start of the year will be on whom US President Donald Trump chooses to be the next Fed chair as the term of current head Jerome Powell ends in May.

Trump flagged that he would make his Fed chair pick this month, with White House economic adviser Kevin Hassett the current favourite on betting site Polymarket.

Investors are bracing for Trump's pick to be more dovish and cut rates, as the president has repeatedly criticised Powell and the Fed for not lowering borrowing costs more swiftly or deeply.

Traders are fully pricing in two cuts this year compared to one projected by a currently divided Fed board.

"We expect that concerns around central bank independence will extend into 2026, and see the upcoming change in Fed leadership as one of several reasons why risks around our Fed funds rate forecast skew dovish," Goldman strategists said.

The yen was at 156.90 per US dollar after rising less than 1% against the greenback in 2025. It remained close to a 10-month low of 157.90 touched in November that drew policymaker attention and raised the prospect of intervention.

The Bank of Japan hiked interest rates twice last year but that did little to improve yen performance as the cautious pace frustrated investors, with speculators reversing significant long yen positions held in April.

There has also been growing investor unease about fiscal expansion under Prime Minister Sanae Takaichi, though she has sought to ease some of that concern.

Traders are pricing the next BOJ rate hike as being toward the end of 2026. Min Joo Kang, senior economist at ING, expects the most likely timing to be October.

"A further fiscal push could backfire on the economy, but the current government is expected to maintain its expansionary policy stance, posing a significant risk to the economy in 2026," Kang said in a client note.

The Australian and New Zealand dollars started the new year on the front foot. The Aussie was 0.3% higher at US$0.6691 after a nearly 8% rise in 2025, its strongest yearly performance since 2020.

The kiwi snapped its three-year losing streak with a nearly 3% gain last year. On Friday, it firmed a touch to US$0.5770.

Germany's economy has endured a terrible 2025. Chancellor Friedrich Merz's government has set the course for further decline in the coming year.

If German politicians' salaries were linked to private sector growth, lawmakers would likely have to take out loans in the deeply recessive year of 2025 and compensate citizens for parliamentary inaction and ideological foolishness.

Although the term diät derives from the Latin dieta, loosely meaning "compensation," in the context of Germany's collapsing industry it more accurately reflects the German meaning: deserved frugality and material austerity. Economically, Germany is now facing the end of the illusion of prosperity, which follows the catastrophic policies of the government.

After eight months under Chancellor Merz, the record is not just meager—it is pitiful. Assuming a 50% state quota and calculating real GDP growth of 0.2% with net new debt over 4%, the net result for 2025 is a roughly 3.8% contraction of the private sector compared to the previous year.

What is scarcely known in Berlin—likely a form of economic esoterica not taught in party seminars or union courses—is that only the private sector produces the goods and services people actually consume. It is no surprise that heavy regulation and crushing taxes—Germany is surpassed only by Belgium in the OECD in fiscal extraction—strangle private enterprise.

Investment fell roughly 6.5% below long-term averages—a quantum leap in the wrong direction, deeply impacting labor markets, public budgets, and social security. While Finance Minister Lars Klingbeil attempts to mask deficits and exemptions as mere cosmetic fixes, municipalities face a €35 billion shortfall this year.

At the lowest levels of the state, in cities and towns, the bill for decades of political mismanagement is now arriving first.

The trigger is collapsing business tax revenue, a direct result of a record number of corporate bankruptcies: 24,000 companies will have exited the market in 2025.

The labor market's seeming stability is misleading. Hundreds of thousands of new public sector jobs and age-related retirements obscure the collapse of the real economy in official statistics. Merz executed the debt brake with the outgoing Bundestag in April, catapulting Germany into a debt spiral with a €500 billion special fund—a clear indication that policymakers knowingly ran the economy into a wall.

Neither the green "art economy" nor the heavily subsidized military sector will adequately fill freed industrial capacity. Core sectors such as chemicals operate at just 70% capacity, 10% below break-even—a stark signal that the creeping productivity erosion and economic depression since 2018 will worsen, regardless of state credit funneled into centrally planned subsidies.

Berlin has fully submitted to Brussels' dreadful climate-socialist doctrine and now faces the challenge of hiding its ideological failure. Merz and his team continue the known media-political strategy: as with migration, a continuous camouflage is maintained.

When it comes to deceiving the public, party headquarters show remarkable creativity, leaving no lie too bold. A deportation flight may be staged for optics, while borders remain wide open, family reunification is promoted, and German passports are handed out freely. The aim is to cultivate new voter bases and apply a "divide et impera" strategy to erode cultural and traditional societal cohesion.

Time is bought and the course maintained—just as in climate policy. Pseudo-reforms, such as the ostensible end to the combustion engine phase-out, serve only to give the struggling auto industry an illusion of technological openness while creating a new bureaucratic monster, ultimately fulfilling Brussels' objective: halting German automotive production.

From the Eurocrats' perspective, the results are impressive if the goal was deindustrialization. Around 300,000 industrial jobs were cut in the last five years. And when a nation loses its industrial core, much of its value creation disappears with it.

In 2025, German production hovered about 20% below the 2018 peak. An economic and social catastrophe looms, whose consequences seem intellectually incomprehensible to functionaries and eco-centric elites with regard to social cohesion.

If 2025 was already catastrophic, the coming year will likely be a collision with reality for many Germans. Social contributions and taxes must rise sharply to sustain social security amid migration and demographic pressures.

Merz's government continues the legacy of Angela Merkel and Olaf Scholz: a Brussels-bound green central planner in the guise of the Ludwig-Erhard party, a political scarecrow devoted solely to consolidating power in Brussels.

The German people, particularly the shrinking class of economic achievers in the middle market, will face an accelerated decline after a dreadful 2025—one the government's media games can no longer conceal.

Merz's illustrious "Made for Germany" entrepreneur café was a media fake; "Made in Germany" increasingly belongs to the past. The bitter truth: Germany is done

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up