Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

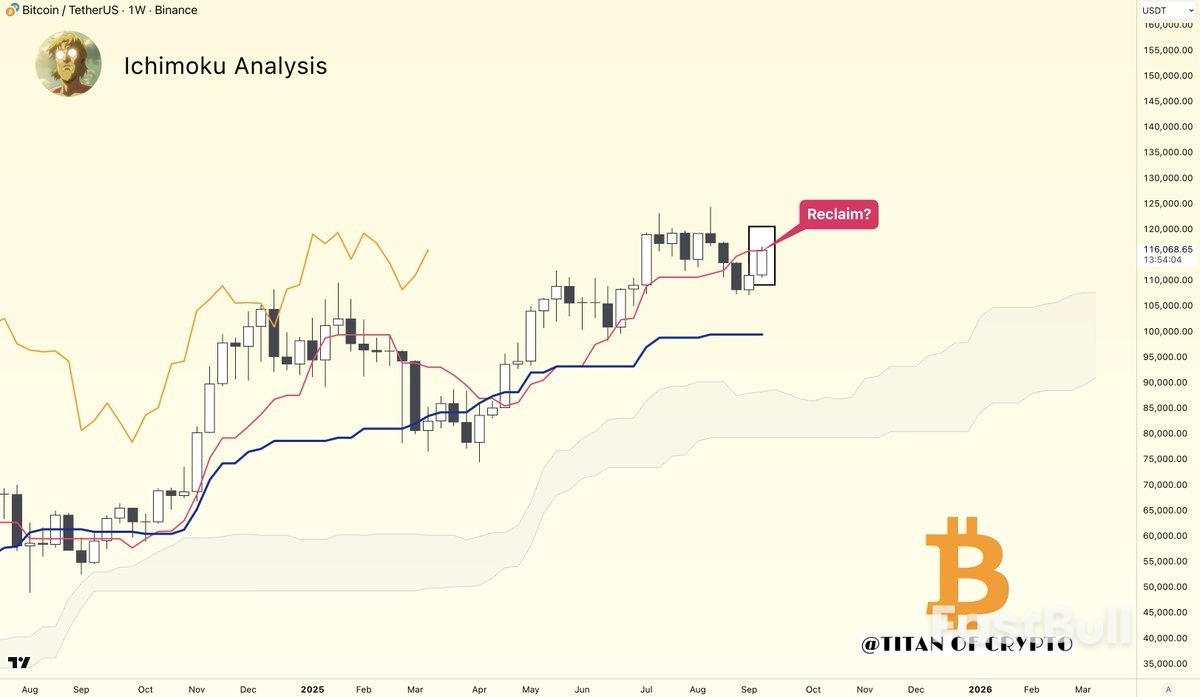

Bitcoin braced for further gains toward $120,000 after finishing the week in the green above $115,000, new price analysis concluded.

BTC/USD weekly chart. Source: Titan of Crypto

BTC/USD weekly chart. Source: Titan of Crypto

A less open global economy threatens to upend President Trump’s plan to kickstart his plan for US energy dominance.

President Trump and his administration have been ardent proponents of US “energy dominance,” or at least as it applies to the production and exports of fossil fuels. However, some of the administration’s other policies have been having deleterious impacts on that goal.

American energy companies thrive in an open and unfettered economic environment — one in which business decisions are made for economically rational reasons, not politicized ones. We have made some great strides in that direction with the lifting of the market-distorting ban on US crude oil exports at the end of 2015 and President Trump’s decision to grant blanket permission for exports of liquefied natural gas (LNG), lifting President Biden’s moratorium on new approvals.

But broadly speaking, the Trump administration has moved toward a less open global economic system, introducing tariffs on friends and foes alike. While he has exempted most oil and gas imports from US tariffs to prevent a price impact on US consumers, it is not at all clear that other countries will refrain from retaliating in ways that undermine US energy commodity exports.

One of the impacts that has already taken place is the scrambling of global LNG trade flows. With the US-China trade war beginning in February, China imposed a punitive 125 percent tariff on US LNG imports. Since those contracts do not have destination clauses, that caused the Chinese recipients to swap out those volumes in exchange for volumes from other suppliers, leading to somewhat less efficient shipping routes.

The signing of the memorandum of understanding for additional volumes of piped gas from Russia via the proposed Power of Siberia 2 pipeline also could represent a big loss for US LNG exports. It may or may not ultimately come to fruition, but if it does, it would move a large tranche of Chinese gas demand growth away from the global LNG market, which is dominated by the US and Qatar, and hand it to Russia.

In a period of heightened tensions with the United States, China sees the piped gas option as beneficial due to not increasing dependency on imports that come by sea or are sourced from the United States. The other major source of demand growth for LNG is India, whose rate of economic growth has accelerated in the last decade past that of a maturing China. But the United States has stoked new trade tensions with India, imposing punitive tariffs because of India’s continuing purchases of Russian oil. It is not yet clear whether this will last over the medium to long term or impact the potential growth of US LNG exports.

On oil, there are also impacts of this policy that severely distort trade patterns. The United States had become a major supplier of crude oil to China, but punitive tariffs in retaliation for Trump’s measures in February have cut Chinese imports of US crude to near-zero over the summer months. Those volumes are going elsewhere, but if much of the world ends up imposing tariffs on US energy commodities, this could become a much larger problem.

The Trump administration has exempted energy commodities from most US import tariffs, but given the United States’ comparative advantages in energy and the availability of alternate sources, that sector will likely be targeted. Apart from the United States, most other countries are not raising tariff barriers against their other trading partners, which could eventually put US oil and gas exports at a competitive disadvantage.

Ironically, one other major impact of Trump’s trade wars is that they have shifted Canada’s focus from the United States. Where it has previously had only a modest capacity to move oil from its major production centers in Alberta to the West Coast, the Canadian government is now scrambling to add new capacity to get it out to destinations other than the United States. Much of that will eventually go to China.

Another example of a negative impact on the US energy sector is the development cost increases in both upstream and midstream segments. Oil and gas development and transportation use large quantities of steel pipes, the overwhelming majority of which are imported. Japan has a US market share of over two-thirds for this. Other steel equipment is sourced from Asia, Europe, and Mexico. Estimates of the overall impact on production costs have been about two percent to five percent, depending on the exact circumstances. Again, with most other producers in the world not having these costs imposed, they gain an advantage over US producers, who will have lower market share and reduced profitability.

US refined product exports — largely to Latin American countries that lack self-sufficiency in refining capacity — also could be impacted. The US exports over $100 billion in refined products annually. The global refining sector is a generally thin-margin business and is likely to undergo another period of consolidation in the coming years. If petroleum product importers impose tariffs to offset US tariffs on other industries, that will put serious pressure on the continued viability of some of those US refineries, giving the advantage to non-tariffed foreign competitors.

Each of the issues here may be of modest significance to the US economy individually, but as a whole, they combine to seriously undercut the notion of US “energy dominance.” The American industry would be a lot better off if we could return to the now-quaint notion of “free markets.”

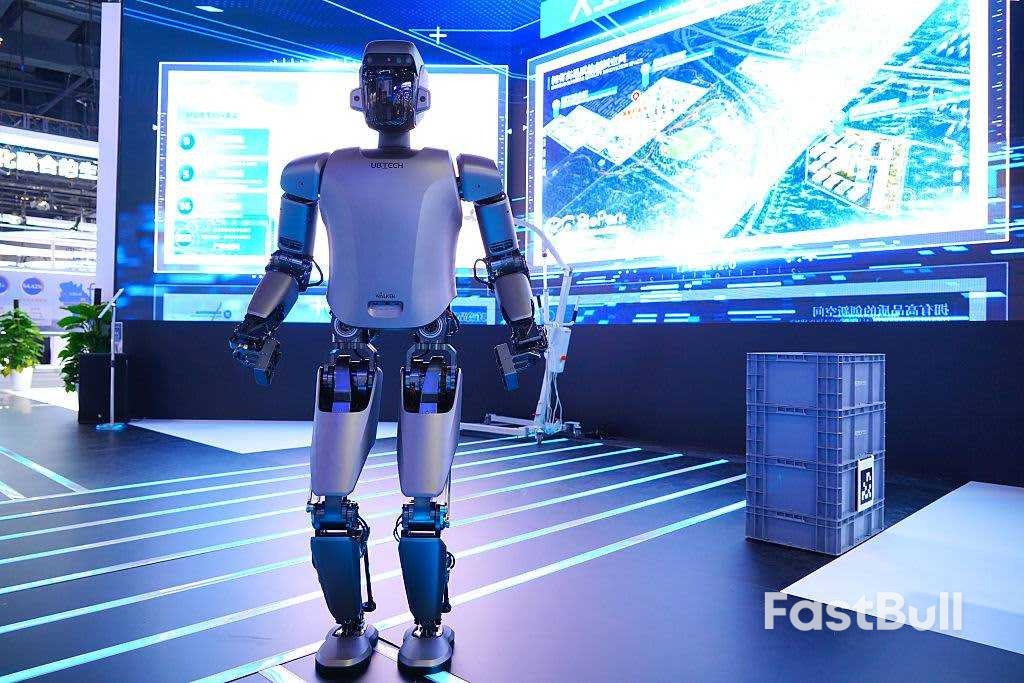

Humanoid robots, which have made significant technological advances this year, may be at the precipice of a ChatGPT-like spike in investment and popularity — or at least, that's what many in the industry believe.So-called humanoid robots are artificial intelligence-powered machines designed to resemble humans in appearance and movement, with expected use cases across the industrial and service sectors.Makers of these robots have been working on the technology in the background for years. Now, they say they're ready to unleash the technology into the world."There is a consensus in our industry that the ChatGPT moment for humanoid robots has arrived," Xiong Youjun, general manager at the Beijing Innovation Center for Humanoid Robotics, said during a panel in Singapore on Thursday, alongside other professionals from China's robotics industry.

"This year has been defined as the first year of mass production of humanoid robots," Xiong, chief technology officer and executive director of robotics firm UBTech, said in Mandarin translated by CNBC. He added that there had been rapid progress in both the mechanical bodies and the AI-powered "brains."The original "ChatGPT moment" occurred in late 2022, when OpenAI released its groundbreaking generative AI chatbot to the public, leading to mass adoption of large language models and widespread recognition of their potential.

Robotics players hoping to recreate that impact include Tesla's Optimus. Meanwhile, a growing number of humanoid robot start-ups are emerging in China, with companies like Unitree, Galbot, Agibot and UBtech Robotics bringing products to market.While humanoid robots are yet to reach a fraction of the adoption seen with generative AI, many experts do expect the technology to have a transformative impact on the global economy in a matter of years.Meanwhile, robots have begun to appear everywhere, from factories to technology conferences and sporting events.

Tesla CEO Elon Musk has said he expects the company to produce 5,000 of its Optimus robots this year, with the technology expected to eventually make up the majority of the EV maker's business.Meanwhile, humanoid robot firms in China say their products are already being used in factories and for commercial services.Speaking on Thursday, Zhao Yuli, chief strategy officer at Galbot, said the start-up had already deployed almost 1,000 robots across different businesses.

Other companies, such as UBTech Robotics and Galbot, have also installed robots in local factories, according to local media reports.According to Zhao, these deployments have come alongside a surge of investor interest and government support in the sector, as well as the maturation of both robotics and generative AI technology.Industry experts noted that this maturation in technology has been on display at a number of conferences and events this year, such as China's World Humanoid Robotics Game, which sees robots compete in practical scenarios.

Galbot won a gold medal in the Robot Skills event after placing first in a pharmaceutical sorting challenge.Improvements in Chinese humanoid robots' motion control have also been on display in recent months at sporting events such as marathons and boxing matches.Guo Yandong, founder and CEO of AI² Robotics, added that improvements in generative AI have also enabled robots to learn on the job rather than rely solely on preset commands, a shift that could expand the uses of humanoids across sectors.

Despite the hype from humanoid robotics companies, however, many experts resist the idea that mass public adoption will occur anytime soon."Humanoids won't arrive all at once in a ChatGPT moment, but slowly enter more and more positions as their capabilities increase," said Reyk Knuhtsen, analyst at SemiAnalysis, an independent research and analysis company specializing in semiconductors and AI. He added that their first uses will be in low-stakes, failure-tolerant tasks.That's not to mention long manufacturing timelines and high costs, which will also slow adoption compared to generative AI, he added.

Even UBTech's Xiong conceded that some hurdles remain for the sector, such as ethical considerations, laws and regulations that need to be addressed.Still, analyst Knuhtsen expects investment in the space to continue as long as the autonomy of the robots continues to improve."The market opportunity for humanoids is enormous, contingent on how well the AI performs ... If the technology works, it has the chance to transform many labor processes around the world," he said.Merrill Lynch analysts recently estimated in a research note that global humanoid robot shipments will reach 18,000 units in 2025 from 2,500 units last year. It also predicts a global robot "population" of 3 billion by 2060.

India’s exports rose for a second month in August after President Donald Trump’s 50% tariffs took effect, as businesses front-loaded shipments.

The trade deficit narrowed to US$26.49 billion (RM111.39 billion) last month from an eight-month high of US$27.35 billion in July, data released by the Ministry of Commerce and Industry showed Monday. Economists in a Bloomberg survey had predicted a US$24.8 billion deficit for August.

Imports fell 10.1% in August to US$61.59 billion from a year earlier, while exports rose 6.7% to US$35.1 billion.

This is the first trade data since the US slapped a 25% tariff on Indian goods on Aug 7, doubling it 20 days later to punish New Delhi for buying Russian oil. The levies are among the highest in the world and threaten to make Indian exports, especially labour-intensive goods, uncompetitive against regional rivals like Vietnam and Bangladesh.

Businesses advanced their orders before the US tariffs came into effect, with outbound shipments to the US — India’s top export market — reaching US$40.39 billion between April and August, up from US$34.21 billion a year earlier, the data showed.

India-US relations showed some signs of improvement last week as Trump and Prime Minister Narendra Modi pledged to resume trade talks. A trade team from the US will be in New Delhi Monday night, India’s chief negotiator Rajesh Agarwal told reporters at a briefing.

New Delhi is also trying to help exporters expand in newer markets and is pursuing a free trade pact with the European Union with heightened urgency, with the next round of talks set for Oct 6-10.

Commerce Secretary Sunil Barthwal told reporters Monday that India is working to reduce its dependence on certain geographies to limit the impact of supply chain disruptions. The government has also identified about 100 products where India can boost its domestic manufacturing in order to cut reliance on imports, he added.

The data also showed that gold imports rose to US$5.4 billion last month, compared to US$3.9 billion in July, while crude oil imports stood at US$13.2 billion in August, down from US$15.5 billion the previous month.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up