Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

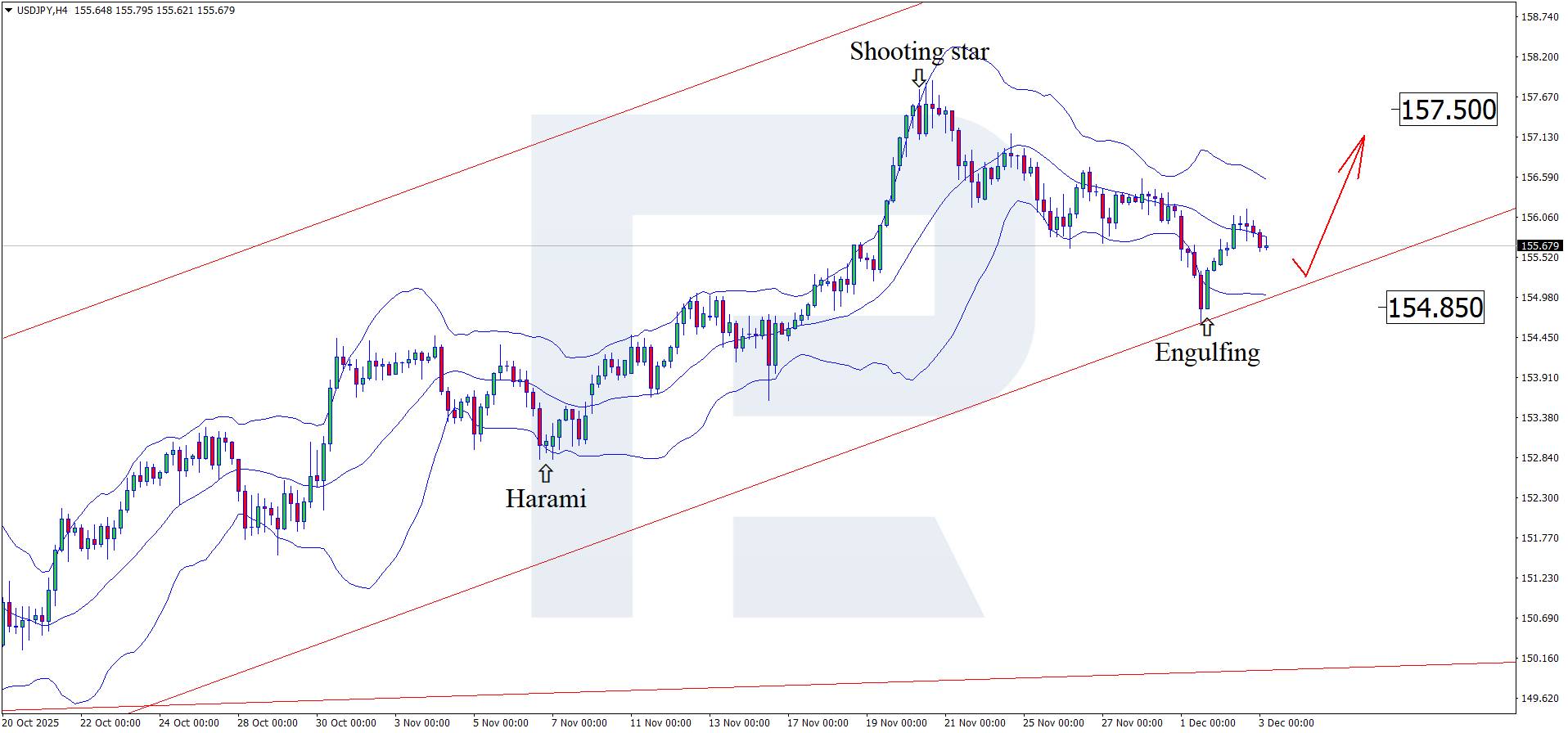

Positive US fundamental data may trigger a rally in USDJPY towards 157.50.

Positive US fundamental data may trigger a rally in USDJPY towards 157.50.

The forecast for 3 December 2025 considers that the USDJPY pair continues its correction, trading near 155.80.

Japan's services PMI covers multiple industries, including transport and communications, financial intermediation, business and household services, information technologies, hospitality, and food services.

The USDJPY forecast for today appears moderately optimistic for the Japanese yen, with the PMI up to 53.2 from 53.1 previously. At the moment, the PMI is above the 50.0 threshold, which may add support to the yen.

The US services PMI is also expected to rise to 55.0 from the previous 54.8. In this case, the increase in momentum may be slightly stronger, but it is still only a forecast. The actual figure may differ significantly, adding either support or pressure to the USD.

According to the forecast for 3 December 2025, ADP nonfarm employment change in the US may fall to 7 thousand, but this is only a projection. Last month, the number of employed grew more strongly than expected. The USDJPY forecast for today takes into account that a stronger-than-expected reading could support the US dollar and push the USDJPY rate higher towards 157.50.

On the H4 chart, the USDJPY pair has formed an Engulfing reversal pattern near the upper Bollinger Band and is currently trading around 155.80. At this stage, it may continue an upward wave following the pattern's signal, with a potential upside target at 157.50.

At the same time, the USDJPY forecast also considers an alternative scenario, where the price corrects towards 154.85 before rising.

Stronger US economic indicators may support the USD. The USDJPY technical analysis suggests a rise towards 157.50 after a correction.

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair's movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

France's dominant services sector expanded slightly more than first estimated in November, hitting a 15-month high as new business gained momentum in the euro zone's second-biggest economy, a survey showed on Wednesday.

The HCOB France final purchasing managers index (PMI) for the services sector, compiled by S&P Global, stood at 51.4 - up from 48.0 in October - marking the first time the figure has topped the 50 threshold separating growth from contraction since August 2024.

November's flash services PMI was at 50.8.

The composite PMI, which includes both manufacturing and services, also entered positive territory, climbing to 50.4 in November from 47.7 in October and versus a flash estimate of 49.9.

However, manufacturing output continued to decline, widening the gap between the two sectors.

"Finally, some positive news. For the first time in over a year, output in France's private sector has increased. However, manufacturing remains a drag on overall performance, posting its steepest fall in nine months," said Jonas Feldhusen, junior economist at Hamburg Commercial Bank.

While the services sector's rebound is encouraging, Feldhusen cautioned that it remains to be seen whether this is the start of a sustained recovery or a temporary uptick.

Business expectations improved but remained cautious, with firms hopeful for a more stable policy environment to boost household consumption and business investment.

And, despite this positive development, the survey highlighted ongoing challenges.

Employment in the services sector fell slightly, reversing a robust hiring trend from the previous three months. Competitive pressures also limited companies' ability to raise prices, with output prices remaining largely unchanged despite rising input costs.

The Japanese-inspired core bond selloff eased yesterday. An unconvincing attempt to eke out a few more bps during European dealings was more or less killed off in the US session. Net daily changes for US Treasury yields eventually varied between -2.1 bps to +0.9 bps in technical trading. The German curve shifted similarly by shedding 1.4 bps at the front.

Even UK yields swapped earlier gains for minor declines across the curve. We wouldn't call it a day on the underlying forces though. Japanese yields this morning are again headed north with new highs for the (ultra) long maturities including the 30-year ahead of a closely watched auction tomorrow. News in any case was scarce yesterday and that seemed to suffice for riskier assets to recover some ground.

European and US equities inched 0.3-0.6% higher and crypto markets rebounded in a daily perspective after the violent selloff in recent weeks. The likes of Bitcoin extend gains to almost 94k, the strongest level since mid-November. The meeting between US envoy Witkoff and Russian president Putin and his entourage was called constructive by the Kremlin but no compromise was reached yet.

Sticking to event risks, French politics reared its head again with local newspaper Le Figaro reporting that Horizons won't back premier Lecornu's social security budget bill in the upcoming vote December 9. Being part of the coalition government, Horizons' lack of support is a reminder of how fragile and perhaps deceiving the current French calm is. OATs underperformed compared to European peers.

The euro ignores the matter for now. After an uninspiring session yesterday, EUR/USD is gently trending north this morning towards first resistance around 1.165-1.167 (short term highs). The trade-weighted dollar index depreciates back to the 99 area. The economic agenda has things in store that could spice up the session today. ECB president Lagarde appears before parliament. The ADP job report and services ISM are to further shape Fed expectations for December.

A rate cut is priced for 95% now. At this stage it would take blow-out numbers to flip the balance again by December 10. The next Fed chair meanwhile is becoming ever more certain. Hassett emerges as the frontrunner and favours a growth-supporting policy – perhaps the most compared to the other contestants. President Trump will officially announce Powell's successor early 2026.

Barring renewed risk aversion for whatever reason (France, public finances, equity valuation … ) we'd expect the dollar to remain on the backfoot. Were EUR/USD to take out the recent highs, the 1.1728 October top – 1.1747 61.2% recovery on the Sep-Nov decline emerges as the next reference. EUR/GBP's three-day win streak ran into resistance around 0.88. We hold our negative bias for sterling though and assume EUR/GBP's fundamental level to be 0.90+.

Australian GDP growth slowed from an upwardly revised 0.7% Q/Q in in Q2 to 0.4% in Q3 (vs +0.7% consensus), the average quarterly growth pace since the end of the COVID-19 pandemic. Annual growth ticked up from 2% to 2.1%. Details showed final consumption rising by 0.6% Q/Q with both household (+0.5%) and government (+0.8%) spending contributing to growth. The household saving ratio rose from 6% in Q2 to 6.4% in Q3 with gross disposable income (+1.7%) rising faster than nominal household spending (+1.4%).

Total gross fixed capital formation rose a strong 3% Q/Q mainly due to a rebound in public investments (+3% Q/Q after -3.5% Q/Q in Q2). Net trade detracted 0.1 ppt from GDP growth, with imports up 1.5%, and exports up 1%. Today's numbers strengthen market belief that the next move by the Reserve Bank of Australia will a rate hike next year. AUD/USD builds on its recent comeback, eyeing first resistance around 0.66. The Aussie yield curve bear flattens this morning with yields rising by 5.8 bps (2-yr) to 3.2 bps (30-yr).

The EU agreed to gradually prohibit Russian LNG gas import by the end of 2026, one year faster than originally planned. Russia is still the second-largest LNG-provider (15% of total) to Europe after the US. The deadline now matches with the ban of seaborne deliveries which is already part of EU sanctions against Russia.

The EU's RePowerEU plan also targets halting to pipeline gas imports under long-term deals by the end of Q3 2027. The commission also plans to put forward a legislative proposal on phasing out Russian oil imports no later than the end of 2027.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up