Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Cambodia and Thailand agreed to an "immediate and unconditional ceasefire" from midnight (1700 GMT) on Monday, in a bid to halt their deadliest conflict in more than a decade after five days of fierce fighting that has displaced more than 300,000 people.

Cambodia and Thailand agreed to an "immediate and unconditional ceasefire" from midnight (1700 GMT) on Monday, in a bid to halt their deadliest conflict in more than a decade after five days of fierce fighting that has displaced more than 300,000 people.

After days of efforts by Malaysia, chair of the ASEAN regional bloc, the United States and China to bring both sides to the table, the two countries' leaders agreed to end hostilities, resume direct communications and create a mechanism to implement the truce. At least 36 people have been killed in the fighting, mostly civilians.

Following more than two hours of talks at his official residence in Putrajaya, Malaysian Prime Minister Anwar Ibrahim, flanked by Thai and Cambodian leaders, said he was ready to deploy a team to observe and ensure implementation.

"This is a vital first step towards de-escalation and the restoration of peace and security," he told a press conference.

"All parties shared a commitment to peace."

The Southeast Asian neighbours have wrangled for decades over border territory and have been on a conflict footing since the killing of a Cambodian soldier in a skirmish late in May, which led to a troop buildup on both sides. A full-blown diplomatic crisis brought Thailand's fragile coalition government to the brink of collapse.

They accuse each other of starting the fighting last week, both quickly deploying heavy artillery at multiple points along their 800-km (500-mile) land border. Thailand flew air raids with an F-16 fighter jet.

U.S. President Donald Trump called both leaders at the weekend, warning he would not conclude trade deals with them unless they ended the fighting. Both sides are facing a steep import tariff of 36% on their goods in the U.S., their top export market.

Cambodian Prime Minister Hun Manet thanked his acting Thai counterpart Phumtham Wechayachai for what he said was a positive role and said he deeply appreciated Trump's "decisive mediation" and China's constructive participation.

"We agreed that the fighting will stop immediately," he said, expressing confidence that both sides could rebuild trust and confidence.

"The solutions proposed by Prime Minister Anwar will set the conditions for moving forward with bilateral discussions, returning to normalcy, and forming the foundation for future de-escalation."

Responding to the ceasefire, White House spokeswoman Karoline Leavitt said Trump "made this happen".

"Give him the Nobel Peace Prize!" Leavitt posted on X.

Tensions boiled over last week after Thailand recalled its ambassador to Phnom Penh and expelled Cambodia's envoy, in response to a second Thai soldier losing a limb to a landmine that Bangkok alleged Cambodian troops had recently laid.

Cambodia has strongly denied the charge, as well as Thai accusations that it has fired at civilian targets including schools and hospitals.

Hun Manet last week accused Thailand of "unprovoked and premeditated military aggression".

This map shows the locations where military clashes have occurred along the disputed border between Thailand and Cambodia.

Thai leader Phumtham, who had expressed doubts about Cambodia's sincerity, said Bangkok had agreed to a ceasefire that would be "carried out successfully in good faith by both sides".

"Today's outcome reflects Thailand's desire for peaceful resolution by continuing to protect our sovereignty and the life of our people," he said, thanking Trump and Malaysia.

The fighting has scarred border communities on both sides.

In Thailand's Sisaket province, a house lay reduced to splintered wood and twisted beams after being struck by artillery fire from Cambodia. The roof had caved in, windows hung by the frame and power lines drooped over the structure.

Amid the din of occasional artillery fire, homes and shops remained shut and a four-lane road was deserted except for a few cars and military vehicles.

Dozens of displaced residents lined up quietly for their evening meal at an evacuation centre about 40 km away from the frontlines.

A few children played with dogs, others swept the dusty floor.

Fifty-four-year-old Nong Ngarmsri just wanted to go back to her village.

"I want to go to my children who stayed back," she said. "I want them to cease firing so that I can go home."

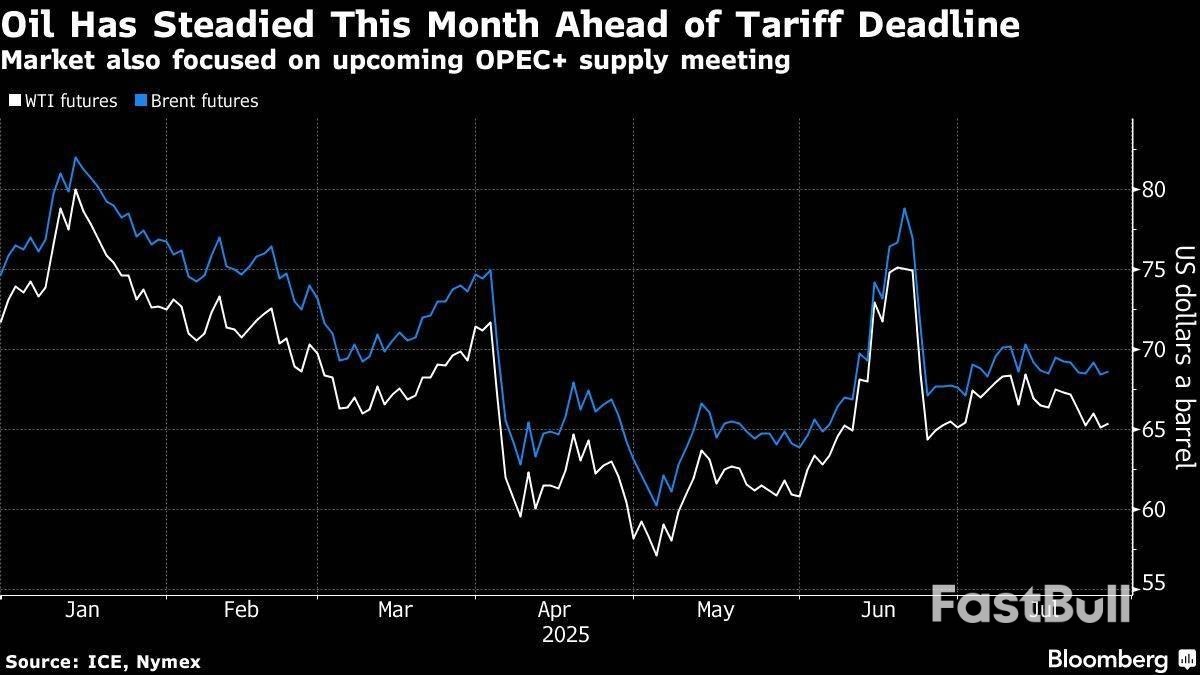

Oil rose after President Donald Trump said he would reduce the deadline for Russia to agree to a truce in Ukraine, compounding earlier gains from a US-European Union trade deal.

Brent was near $70 a barrel after closing 1.1% lower on Friday. Trump said the EU had agreed to buy $750 billion in American energy products, although he and European Commission President Ursula von der Leyen appeared to differ on some key details of the agreement.

Later on Monday, Trump also said he would reduce a 50-day deadline he gave to Vladimir Putin to achieve a ceasefire in the war in Ukraine. He said he was disappointed the Russian president hadn’t already agreed to a truce. Trump previously threatened Moscow with 100% “secondary tariffs” unless the conflict halts within 50 days.

Trump’s trade policies and threats of retaliation from targeted countries for months have raised concerns about the outlook for energy demand should global economic growth slow, while a decision by OPEC+ to rapidly increase output has put the market on track for oversupply later this year.

An OPEC+ committee will convene later on Monday to assess the oil market ahead of a meeting on Sunday to decide on production policy for September. Traders and analysts expect the group to hike its quota again.

US and Chinese officials are scheduled to meet on Monday for trade talks, and the South China Morning Post reported that the two countries are expected to extend their tariff truce, according to people it didn’t identify.

What is the South Korea Stablecoin Bill All About?

At its core, the upcoming South Korea stablecoin bill, spearheaded by DPK lawmaker Ahn Do-geol, aims to establish a clear regulatory pathway for stablecoins pegged to the Korean Won. Unlike previous, broader digital asset proposals, Ahn’s bill is specifically designed to address the unique characteristics and challenges of value-stable digital assets. It’s a targeted approach, focusing on:

While DPK lawmaker Min Byeong-dug introduced a broader basic digital asset act last month that touched upon stablecoins, Ahn’s proposal, set for July 28, is poised to be the first dedicated and comprehensive piece of legislation. Furthermore, there’s anticipation that Kim Eun-hye of the opposition People Power Party (PPP) will also introduce a similar bill, highlighting a bipartisan recognition of the urgent need for stablecoin regulation.

The introduction of a dedicated South Korea stablecoin bill is more than just another piece of legislation; it’s a transformative step for several reasons:

1. Enhancing Consumer Protection: The primary driver behind this regulation is likely the protection of investors and users. By mandating transparent reserves and robust oversight, the bill aims to prevent scenarios akin to the Terra-Luna collapse, where a lack of regulation led to significant financial losses. This will foster greater trust in stablecoins and the broader digital asset ecosystem.

2. Fostering Financial Stability: Stablecoins, by their nature, aim to bridge the gap between volatile cryptocurrencies and traditional fiat currencies. Unregulated stablecoins, however, can pose systemic risks if their reserves are not properly managed. This bill seeks to integrate stablecoins safely into the financial system, mitigating potential risks to national financial stability.

3. Promoting Innovation with Clarity: While regulation might sometimes be perceived as a hindrance, a clear regulatory framework can actually spur innovation. By providing legal certainty, businesses and developers will have a clearer understanding of the rules, encouraging them to build new services and applications utilizing Korean Won-pegged stablecoins without fear of sudden regulatory shifts.

4. Boosting Global Competitiveness: As nations worldwide grapple with crypto regulation, South Korea’s proactive stance with a dedicated South Korea stablecoin bill positions it as a leader in responsible digital asset adoption. This could attract foreign investment and foster a vibrant domestic blockchain industry, enhancing the country’s competitiveness in the global digital economy.

The legislative landscape for digital assets in South Korea is dynamic, with several key figures championing different approaches:

The interplay between these lawmakers and their respective proposals highlights a concerted effort within South Korea’s political arena to address the burgeoning digital asset market with careful consideration.

Every significant regulatory move comes with its own set of challenges and opportunities. The proposed South Korea stablecoin bill is no exception:

Challenges:

Opportunities:

South Korea’s move is part of a broader global trend towards stablecoin regulation. Here’s how it stacks up against other major jurisdictions:

| Jurisdiction | Regulatory Approach to Stablecoins | Key Highlights |

|---|---|---|

| South Korea | Targeted, comprehensive bill for Won-pegged stablecoins. | Focus on issuance, circulation, and oversight. Aim to protect consumers and foster financial stability. |

| United States | Fragmented, ongoing discussions. | Various proposals (e.g., Lummis-Gillibrand bill, Treasury reports). SEC and CFTC vie for oversight. Emphasis on reserve requirements and systemic risk. |

| European Union | MiCA (Markets in Crypto-Assets) regulation. | Comprehensive framework covering all crypto assets, including stablecoins. Strict rules for e-money tokens (EMT) and asset-referenced tokens (ART), focusing on reserves, governance, and consumer protection. |

| United Kingdom | Integrating stablecoins into existing financial regulations. | Consultations to bring stablecoins under the Electronic Money Regulations and Payment Systems Regulations. Focus on systemic stablecoins. |

While different jurisdictions have varying speeds and approaches, the common thread is a recognition of stablecoins’ potential and the necessity for robust regulation to manage associated risks. South Korea’s specific focus on Won-pegged stablecoins highlights a national interest in controlling the digital representation of its own currency.

The journey for the South Korea stablecoin bill is just beginning. Once proposed, it will undergo a rigorous legislative process, including committee reviews, public hearings, and votes in the National Assembly. This process allows for amendments and ensures that various stakeholders’ perspectives are considered.

For individuals and businesses involved in the South Korean crypto space, staying informed will be paramount. Monitoring the legislative developments, understanding the implications of the proposed regulations, and preparing for compliance will be crucial. This bill has the potential to reshape how stablecoins are perceived and utilized in one of Asia’s most technologically advanced nations.

The impending proposal of South Korea’s first comprehensive South Korea stablecoin bill marks a significant milestone in the global journey towards responsible digital asset integration. By focusing on the issuance, circulation, and oversight of Korean Won-pegged stablecoins, lawmakers aim to establish a framework that protects consumers, enhances financial stability, and fosters innovation within a clear regulatory environment. This pioneering legislative effort positions South Korea as a key player in shaping the future of digital finance, offering a beacon of clarity in an often-unpredictable market. As the world watches, South Korea’s commitment to thoughtful regulation could very well set a new standard for how nations embrace the transformative potential of stablecoins.

Q1: What exactly is a stablecoin?

A stablecoin is a type of cryptocurrency designed to maintain a stable value, usually pegged to a fiat currency like the US Dollar or Korean Won, or to a commodity like gold. This stability is typically achieved by holding an equivalent amount of reserves in traditional assets.

Q2: Why is South Korea focusing on regulating stablecoins now?

South Korea is focusing on stablecoin regulation to enhance consumer protection, prevent financial instability, and provide legal clarity for businesses. Recent events in the crypto market have highlighted the risks associated with unregulated stablecoins, prompting a proactive legislative response.

Q3: How does Ahn Do-geol’s stablecoin bill differ from Min Byeong-dug’s broader digital asset act?

Min Byeong-dug’s act is a more general framework for all digital assets, including some references to stablecoins. Ahn Do-geol’s bill, however, is specifically and comprehensively dedicated to the issuance, circulation, and oversight of Korean Won-pegged stablecoins, making it the first of its kind in South Korea.

Q4: How will this South Korea stablecoin bill impact cryptocurrency users and businesses in South Korea?

For users, the bill is expected to increase trust and safety when dealing with Won-pegged stablecoins due to enhanced consumer protection and transparent reserve requirements. For businesses, it will provide regulatory clarity, potentially leading to increased institutional adoption and the development of new, compliant stablecoin-based services.

Q5: Will this bill affect global stablecoin projects like USDT or USDC in South Korea?

While Ahn Do-geol’s bill primarily focuses on Korean Won-pegged stablecoins, it sets a precedent for how South Korea views and regulates stable assets. It may influence future regulations concerning foreign-pegged stablecoins or prompt their issuers to seek local compliance to operate within South Korea.

Ethereum (ETH) has been trading at a significant price point, with the digital asset now nearing a key resistance level of $4000. This mark has drawn attention due to its potential to shape the next movement in the market.

According to Crypto Patel, Ethereum's recent price rally has sparked optimism among investors, especially those who purchased the asset when its value was below $1500. As ETH continues its upward trajectory, traders are focused on the $4000 level, which has been acting as a multi-month resistance.

Ethereum breakout | Source: X

Ethereum breakout | Source: XEthereum breaks through this level, and there are expectations that it could head towards its previous all-time high (ATH) of $6000 or more. A sustained breakout above this resistance could signal continued strength in the asset's price. If rejected at this level, some experts anticipate a decline, potentially pulling ETH back below the $3500-$3200 range.

Crypto analyst ZAYK Charts notes that if Ethereum manages to break above $4,000, it could open the door for a potential surge toward the $6,000 mark, a significant increase from its current price.

A successful breakout could indicate continued strength and set the stage for further price growth in the coming months. However, it could also establish the $4000 level as a new support zone, further reinforcing the bullish sentiment surrounding Ethereum.

Ethereum Bullish | Source: X

Ethereum Bullish | Source: XBoth short-term traders and long-term investors closely watch this price action. Many are considering the potential for Ethereum to move higher if the resistance at $4000 is cleared.

At the time of writing, ETH is priced at approximately $3,890, reflecting a 3.10% increase in the last 24 hours. Ethereum remains active in terms of trading volume, with over $34 billion in transactions reported within the past 24 hours.

Despite this significant trading activity, market observers remain cautious as Ethereum faces its next critical decision point. Should the asset manage to surpass this level, a strong bullish trend may continue.

Conversely, a rejection could lead to a consolidation phase or a downward adjustment in price. Traders are advised to monitor this crucial level closely.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up