Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Peak-tariff pain in U.S. services may be easing, but Jefferies is not ready to call time on services inflation because the underlying wage and labor backdrop still points to sticky price pressures rather than a clean disinflation story.

Peak-tariff pain in U.S. services may be easing, but Jefferies is not ready to call time on services inflation because the underlying wage and labor backdrop still points to sticky price pressures rather than a clean disinflation story.

The November ISM Services PMI rose to 52.6 from 52.4, hitting the highest reading since February, but the prices paid component of the index, an inflationary gauge, stole the show after falling to 65.4 from 70.0.

The fall in prices paid, points to "evidence that tariff pressure has probably peaked, though overall inflation pressure in the service sector remains significant," Jefferies economists Thomas Simons and Michael Bacolas said in a recent in note.

The call on 'peak tariffs' in services comes at time when there Are plenty of reasons to be optimistic by growth in the sector picking up pace.

"Tariffs are causing headaches in many industries, and pressuring prices for both goods and services, but the data suggest that this pressure has probably peaked," the economists said, pointing to lower uncertainty in early 2026, fiscal tailwinds, the government shutdown "in the rearview," and modestly lower interest rates as reasons to be "optimistic about a return to a solid trajectory of growth."

Still, the service sector is not out of the inflation woods as tariffs pressure were not only catalyst stoking inflation headwinds.

The threat of faster wage growth pushing inflation higher had been upstaged by tariff pressure, but now with the latter likely in the rearview, the tight labor market is likely to dominate attention.

Once the tariff impulse fades, "price pressure in services will fall back to wage pressure and the availability of labor," Jefferies said, pointing to weaker supply of labor as a concern.

While the rising unemployment rate suggests that the earlier labor scarcity that "was broadly pushing up prices for services" is easing, underlying wage and labor-supply dynamics mean services inflation will not drop quickly.

"Limited immigration flows and long-term demographic trends suggest that labor force growth is going to remain subdued in the months and years ahead," Jefferies said.

Korea's yearly exports are expected to hit a record high in 2025 on the back of strong performance by key export items, such as semiconductors, automobiles and ships, the industry ministry said Thursday.

From January to November, outbound shipments reached an all-time high of $640.2 billion for the period, compared with a previous record of $628.7 billion posted in 2022, the Ministry of Trade, Industry and Resources said.

According to the ministry, annual exports for 2025 are poised to surpass the $700 billion mark for the first time. The data was released on the occasion of the country's 62nd Trade Day.

The ministry said major export items, including semiconductors, automobiles, ships and bio-health products, led the country's exports this year, along with the robust performance by food and beauty products amid the soaring global popularity of Korean culture.

This year, Seoul also diversified its export markets, expanding shipments to the Association of Southeast Asian Nations (ASEAN), the European Union and other regions, beyond its previous concentration on the United States and China, the ministry added.

Exports by small and medium-sized enterprises (SMEs) also hit a record $87.1 billion in the first 11 months of this year.

"This year's achievements are the result of our industrial competitiveness combined with our strong will to export, and they embody the resilience and strength of our economy," Industry Minister Kim Jung-kwan said.

"Moving forward, we will build on this record-breaking performance to open new paths for Korea's trade through industrial innovation and K-culture," he added, vowing efforts to spread the positive momentum to SMEs and local communities.

In the ceremony marking the 62nd anniversary of Trade Day, major chipmaker SK hynix received the highest award given to companies that export more than $35 billion.

Logistics firm Hyundai Glovis also received an award for achieving an accumulated $6 billion worth of exports, and shipbuilder HD Hyundai an award for an accumulated $4 billion worth of exports, according to the ministry.

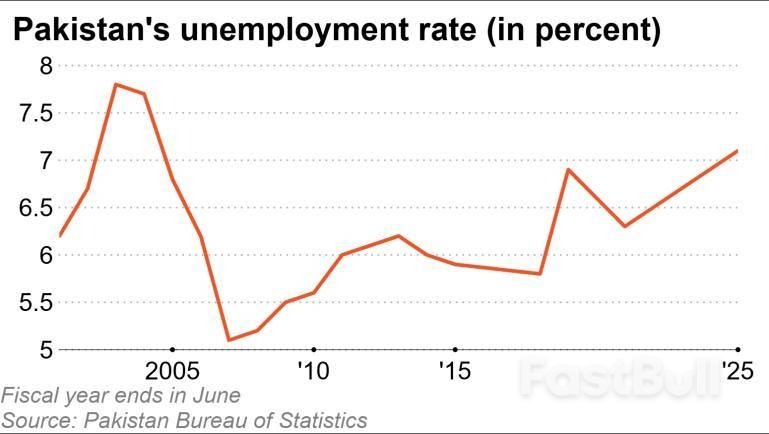

Pakistan is facing the prospect of more job losses as U.S. President Donald Trump's tariff measures threaten to cut exports to the the world's largest economy, experts warn, as a new labor survey shows the South Asian country's unemployment rate hitting its highest level in two decades, leaving key export sectors exposed to further layoffs.

Pakistan's Labor Force Survey 2024-25 released last week shows that the national jobless rate stood at 7.1% -- the highest reading since 2003-2004 when it was at 7.7%. Pakistan's fiscal year starts in July.

The survey shows that the country's total labor force was 83.1 million people, of which 5.9 million were unemployed. Of the jobless, more than three-quarters are educated, including nearly 1 million degree holders.

The survey defines an unemployed person as someone aged 10 or above who has no work and is actively looking for a job.

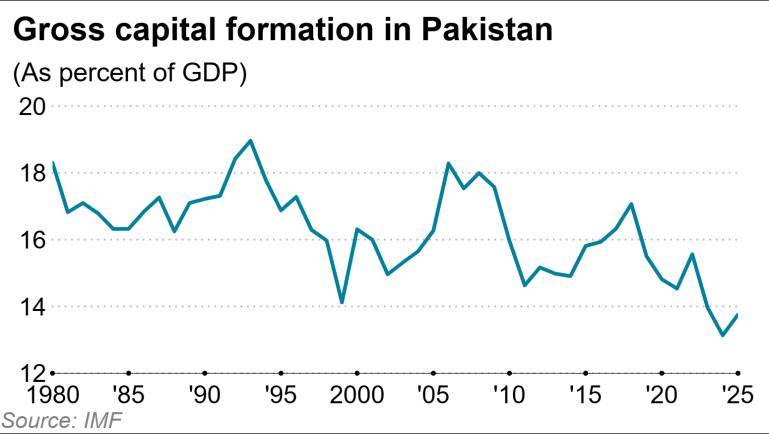

Naafey Sardar, an assistant professor of economics at U.S.-based St. Olaf College, said that the core reason for the increase in unemployment is a persistent decline in investment, which limits the economy's ability to create productive jobs.

"Pakistan's investment-to-GDP ratio has fallen steadily over the past two decades; now hovering around 14%, down from roughly 18% in the early 2000s," he told Nikkei Asia.

Tahir Naeem Malik, a professor at the National University of Modern Languages in Islamabad, stated that the primary issue is that manufacturing in Pakistan is now almost non-existent.

"Manufacturing has dropped drastically over the past two to three decades in Pakistan. The cost of doing business is very high, and political instability makes it worse," he told Nikkei.

Against the backdrop of a weakening job market, Pakistan's exports to the U.S. are expected to fall significantly due to Trump's tariffs. A recent report by the SAARC Chamber of Commerce & Industry, a South Asian regional trade body, states that the tariffs have increased prices of Pakistani textiles and apparel products in the U.S., potentially triggering a decline in export volumes of up to 30%.

Pakistan exports around $5.5 billion worth of goods to the U.S., accounting for up to 18% of its total exports. In August, Trump announced plans to impose 19% tariffs on Pakistan, almost doubling the previous 10%.

With its army chief Asim Munir and Prime Minister Shehbaz Sharif having met Trump over the past couple of months, Pakistan has improved diplomatic ties with Washington. Even so, the tariffs are adding pressure on its economy.

"Pakistan can face around $1.14 billion in potential export loss due to tariffs," Mutaher Khan, co-founder of Data Darbar, a market intelligence provider, told Nikkei based on his estimates.

Experts fear that a decline in exports to the U.S. will cause a significant increase in Pakistani unemployment.

"If we assume that demand falls by 30% and that this translates proportionally into jobs, then we are looking at a potential impact of around 600,000 jobs," Khan told Nikkei.

Stacked shipping containers are seen in the port area in Karachi on July 31. © Reuters

Stacked shipping containers are seen in the port area in Karachi on July 31. © ReutersSt. Olaf College's Sardar said that the tariffs would reduce demand for Pakistan's key export products, particularly textiles and apparel. "These sectors are highly labor-intensive, and even a moderate fall in orders typically results in immediate production cuts and layoffs," he told Nikkei.

Niaz Murtaza, an Islamabad-based independent economist, said that unless Pakistan is able to diversify into other markets, tariffs could have a huge impact on jobs. "Pakistan currently employs 8-10 million people directly and indirectly in its exports sector," he told Nikkei, adding, "A fall in its exports could reduce jobs in the [export] sectors by at least half a million."

It is feared the tariff hit will land hard on Pakistan's ailing economy, with Murtaza predicting that the fall in exports and subsequent job losses "will reduce consumption and, hence, again growth in investments and job creation, starting a vicious cycle."

Malik suggests that Pakistan should diversify its economy and reduce reliance on textile exports to the U.S.

"Pakistan is still relying on the traditional players, like the U.S., to keep the economy running, and even small restrictions from them affect everything," he said.

The Kremlin said on Wednesday that Putin accepted some U.S. proposals aimed at ending the war in Ukraine and was prepared to keep working to find a compromise.

U.S. special envoy Steve Witkoff and Trump adviser and son-in-law Jared Kushner spent hours at the Kremlin, departing in the early hours of Wednesday morning with no specific breakthrough on ending the war.

Trump, speaking to reporters in the Oval Office, said Witkoff and Kushner briefed him about the talks via telephone and told him their impression from Putin was that "he would like to make a deal." What happens now, however, is unclear, Trump said.

"What comes out of that meeting I can't tell you because it does take two to tango," Trump said, without elaborating. He added: "We have something pretty well worked out (with Ukraine)".

A White House official said Witkoff and Kushner would meet with Ukrainian officials in Miami on Thursday.

Kremlin spokesman Dmitry Peskov, asked if it would be correct to say that Putin had rejected the U.S. proposals, disagreed.

"A direct exchange of views took place yesterday for the first time," Peskov said. "Some things were accepted, some things were marked as unacceptable. This is a normal working process of finding a compromise."

A Kremlin aide said after the meeting that "compromises have not yet been found."

Ukraine President Volodymyr Zelenskiy said in his nightly video address that his team is preparing for meetings in the United States and that the dialogue with Trump's representatives will continue.

"Only by taking Ukraine's interests into account is a dignified peace possible," he said.

The negotiations have intensified at a difficult juncture for Kyiv, which has been losing ground to Russia on its eastern front while facing its biggest corruption scandal of the war.

Zelenskiy's chief of staff, who had led the Ukrainian delegation at peace talks, resigned on Friday after anti-corruption investigators searched his home. Two cabinet ministers have been fired and a former business partner of Zelenskiy has been named as a suspect in the crackdown.

Peskov said Russia was grateful to Trump for his efforts but the Kremlin would not be giving a running commentary on discussions with the United States, as publicity was unlikely to be constructive.

"Work is currently being carried out at a working expert level," Peskov said. "It is at the expert level that certain results should be achieved that will then become the basis for contacts at the highest level."

A leaked set of 28 U.S. draft peace proposals emerged in November, alarming Ukrainian and European officials who said they bowed to Moscow's main demands.

European powers then came up with a counter-proposal, and at talks in Geneva, the U.S. and Ukraine said they had created an updated and refined peace framework to end the war.

Putin on Tuesday said European powers were trying to sink the peace talks by proposing ideas which were absolutely unacceptable to Russia.

Putin's foreign policy aide, Yuri Ushakov, told reporters after the Witkoff talks that Moscow had previously received a 27-point set of proposals and then four additional documents which were discussed with Witkoff.

Putin last week said that the U.S. and Ukraine had divided up the initial proposals into four components. The exact contents have not been disclosed.

Great British Energy, a state-owned energy company, unveiled a five-year strategic plan on Thursday aimed at accelerating the country's transition to renewable power to help meet its climate targets.

Britain is seeking to largely decarbonise its power sector by 2030, a goal that it says will help drive down energy costs and that will also require a huge increase in renewable capacity.

GBE was launched last year to invest in and co-develop clean power projects. The government has pledged a total of 8.3 billion pounds ($11.04 billion) over the current Parliament.

Under the strategic plan, GBE said it would deliver some 15 gigawatts of clean energy generation and storage capacity by 2030, enough to power around 10 million homes, by using its own investments and partnerships to help mobilise 15 billion pounds of private finance.

The company will focus on three priority areas: local community energy, onshore energy development, and offshore wind expansion, and will operate as both developer and equity investor, with returns from the publicly owned assets reinvested into new capacity.

"GBE will build a portfolio which is generating income by 2030 and be on a pathway to company-wide profitability," the strategic plan said.

The initiative is expected to directly support over 10,000 jobs, including in regions that are historically reliant on oil and gas, while backing more than 1,000 local community energy projects, GBE said.

($1 = 0.7519 pounds)

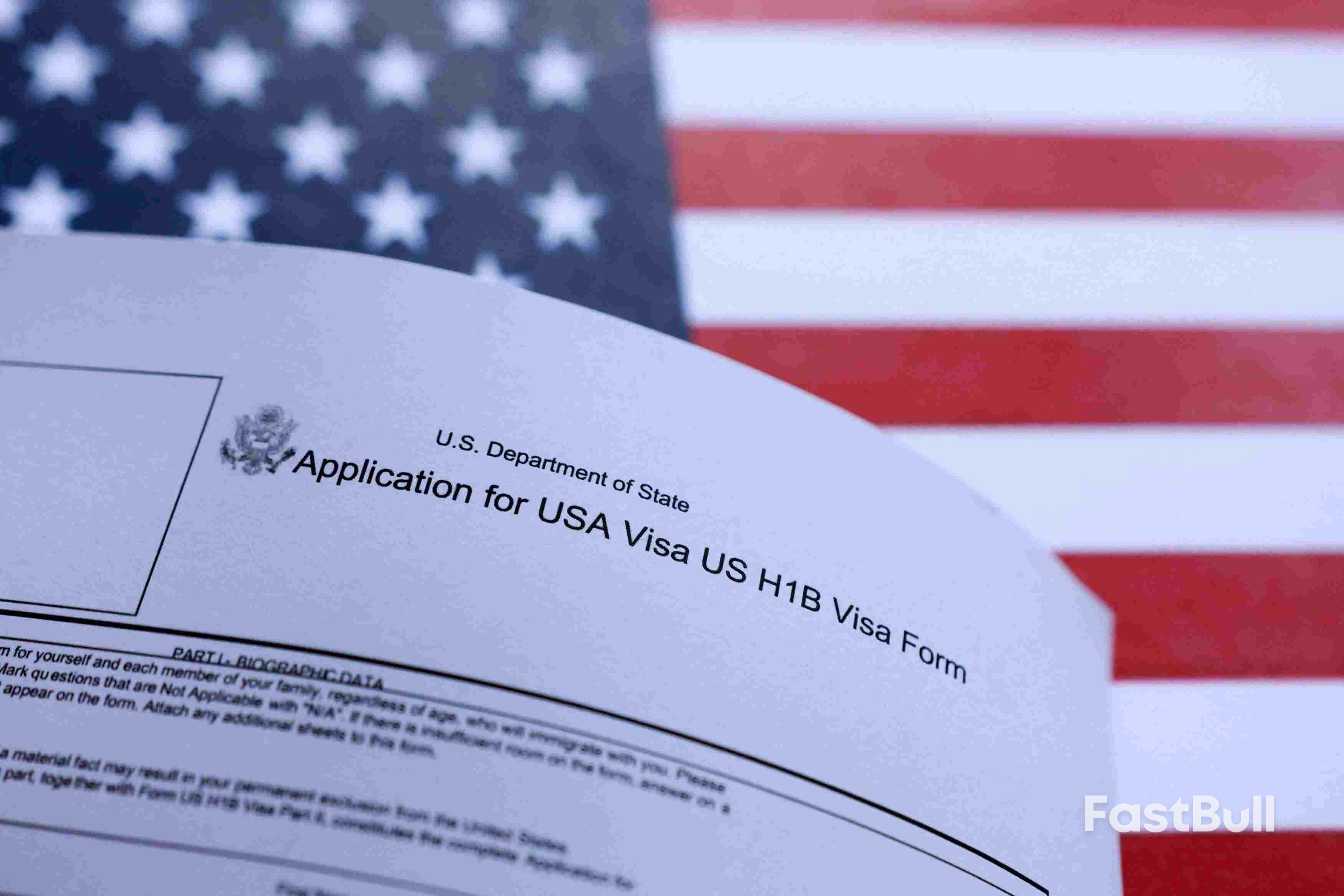

The Trump administration has ordered increased vetting of applicants for H-1B visas for highly skilled workers, with anyone involved in "censorship" of free speech considered for rejection, according to a State Department cable seen by Reuters.

H-1B visas are crucial for U.S. tech companies which recruit heavily from countries including India and China. Many of those companies' leaders threw their support behind Trump in the last presidential election.

The cable, sent to all U.S. missions on December 2, orders U.S. consular officers to review resumes or LinkedIn profiles of H-1B applicants - and family members who would be traveling with them - to see if they have worked in areas that include activities such as misinformation, disinformation, content moderation, fact-checking, compliance and online safety, among others.

"If you uncover evidence an applicant was responsible for, or complicit in, censorship or attempted censorship of protected expression in the United States, you should pursue a finding that the applicant is ineligible," under a specific article of the Immigration and Nationality Act, the cable said.

The enhanced vetting for H-1B visas, which allow U.S. employers to hire foreign workers in specialty fields, has not been previously reported.

The cable said all visa applicants were subject to this policy, but sought a heightened review for the H-1B applicants given they frequently worked in the technology sector "including in social media or financial services companies involved in the suppression of protected expression."

"You must thoroughly explore their employment histories to ensure no participation in such activities," the cable said.

The new vetting requirements apply to both new and repeat applicants.

The Trump administration has made free speech, particularly what it sees as the stifling of conservative voices online, a focus of its foreign policy.

Officials have repeatedly weighed in on European politics to denounce what they say is suppression of right-wing politicians, including in Romania, Germany and France, accusing European authorities of censoring views like criticism of immigration in the name of countering disinformation.

In May, Rubio threatened visa bans for people who censor speech by Americans, including on social media, and suggested the policy could target foreign officials regulating U.S. tech companies.

The Trump administration has already significantly tightened its vetting of applicants for student visas, ordering U.S. consular officers to screen for any social media posts that may be hostile towards the United States.

As part of his wide-ranging crackdown on immigration, Trump in September imposed new fees on H-1B visas.

Trump and his Republican allies have repeatedly accused the administration of Democratic former President Joe Biden of encouraging suppression of free speech on online platforms, claims that have centered on efforts to stem false claims about vaccines and elections.

Joesley Batista, co-owner of a sprawling business empire led by the meat-processing giant JBS NV, is quietly positioning himself as a connector trying to defuse political tensions between the Trump administration and Venezuela's ruling regime.

Batista traveled to Caracas last week in a bid to persuade President Nicolás Maduro to heed Trump's call to step down and allow for a peaceful transition of power, according to people with knowledge of the trip. He met with Maduro on Nov. 23, days after US President Donald Trump held a phone call with the country's leader to urge him to leave Venezuela, according to the people, who asked not to be identified without permission to speak publicly.

Trump administration officials were aware of Batista's plans to visit Caracas and reinforce the president's message, but he went on his own initiative and wasn't asked to go on behalf of the US, according to some of the people familiar with the trip.

"Joesley Batista is not a representative of any government," said J&F SA, the Batista family's holding company, in a statement. It offered no further comment.

The White House declined to comment. Neither Venezuela's Information Ministry nor Vice President Delcy Rodriguez's office responded to requests for comment about Batista's visit.

The trip, which hasn't been previously reported, marks the latest attempt to defuse tensions after Trump threatened land strikes in Venezuela following months of lethal attacks against alleged drug trafficking boats. The US says the Maduro regime is illegitimate, a criminal group that stole an election last year and facilitates the export of cocaine from Colombia, resulting in American deaths.

Batista's effort to mediate with Maduro followed the biggest US military deployment in the waters around Latin America in decades, and more than 20 US attacks on alleged drug-running boats near the coasts of Venezuela and Colombia that killed more than 80 people. Trump on Wednesday reiterated that assaults on land will start very soon.

"We know every route, we know every house, we know where they manufacture," Trump said at a White House event.

Batista's efforts to add to various attempts at dialogue, including by US envoy Richard Grenell, Qatari diplomats, and financial and oil investors with interests in Venezuela. While the proposals vary regarding how long Maduro would remain in power and whether he would go into exile, they all aim to avoid an escalation of attacks that until now have been waged in international waters.

Secretary of State Marco Rubio in an interview broadcast this week cast doubt on the possibility that the US could negotiate a deal with Maduro to get him to stop drug traffickers, saying the Venezuelan leader has repeatedly broken commitments over the years. Rubio said it's still worth trying to reach an agreement.

In many ways, Batista has the perfect profile to bridge the divide with Maduro. He's the rare figure with good relationships with both Trump and the Maduro regime.

JBS owns Colorado-based chicken producer Pilgrim's Pride Corp., which gave $5 million to Trump's inaugural committee, the largest single donation. JBS this year won Securities and Exchange Commission approval to list its shares in New York, overcoming fierce opposition from environmental groups and advocacy investors over concerns about past bribery scandals involving the Batista brothers and the company's alleged role in cattle-driven deforestation of the Amazon.

Batista met with Trump earlier this year to advocate removal of tariffs on beef and a detente with Brazilian President Luiz Inácio Lula da Silva after a clash over the prosecution of his predecessor and Trump ally Jair Bolsonaro. JBS is the world's largest meat supplier and has more than 70,000 employees in the US and Canada.

The Batista family's ties to Venezuela go back at least a decade. JBS and Maduro years ago negotiated a $2.1 billion deal to supply Venezuela with meat and chicken at a time when the nation was experiencing acute food shortages and hyperinflation. The contract was facilitated by Venezuelan socialist hardline politician and current Interior Minister Diosdado Cabello.

Maduro has ruled Venezuela through increasing repression since 2013, weathering oil sanctions that Trump imposed in January 2019, under his first term.

J&F owns oil production in Argentina. The firm had considered investing in a Venezuelan oil joint venture centered on assets that belonged to ConocoPhillips and were seized by the government of Maduro's predecessor and patron, Hugo Chávez, in a wave of nationalizations in 2007.

Batista has become increasingly intertwined with power circles since helping transform the butcher shop founded by his father in the 1950s into the world's largest meat producer — with crucial help from Brazil's development bank during Lula's previous administrations. The company became the largest donor to political campaigns in Brazil in 2014, when Lula's successor, President Dilma Rousseff, was reelected.

Years later, Batista admitted to bribing hundreds of politicians — including a finance minister — in return for funding from state-run banks and pension funds. In 2017, he famously recorded an off-the-agenda meeting with President Michel Temer as part of a plea-bargain deal with Brazilian authorities in exchange for immunity. The scandal rocked the country and triggered one of the deepest stock-market routs in Brazil's modern history — a day that was subsequently branded "Joesley Day."

The Trump administration has continued its aggressive approach toward Venezuela. It designated the Cartel de los Soles, a narcotrafficking organization allegedly headed by Maduro and senior Venezuelan officials, as a foreign terrorist organization the day after Batista's visit to Caracas, ratcheting up pressure.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up