Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Canada GDP YoY (Oct)

Canada GDP YoY (Oct)A:--

F: --

P: --

Canada GDP MoM (SA) (Oct)

Canada GDP MoM (SA) (Oct)A:--

F: --

P: --

U.S. Core PCE Price Index Prelim YoY (Q3)

U.S. Core PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. PCE Price Index Prelim YoY (Q3)

U.S. PCE Price Index Prelim YoY (Q3)A:--

F: --

P: --

U.S. Annualized Real GDP Prelim (Q3)

U.S. Annualized Real GDP Prelim (Q3)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Oct)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Oct)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)

U.S. Durable Goods Orders MoM (Excl.Transport) (Oct)A:--

F: --

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)

U.S. Real Personal Consumption Expenditures Prelim QoQ (Q3)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Oct)

U.S. Durable Goods Orders MoM (Oct)A:--

F: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. Manufacturing Output MoM (SA) (Nov)

U.S. Manufacturing Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Manufacturing Capacity Utilization (Nov)

U.S. Manufacturing Capacity Utilization (Nov)A:--

F: --

U.S. Industrial Output YoY (Nov)

U.S. Industrial Output YoY (Nov)A:--

F: --

P: --

U.S. Industrial Output MoM (SA) (Nov)

U.S. Industrial Output MoM (SA) (Nov)A:--

F: --

P: --

U.S. Capacity Utilization MoM (SA) (Nov)

U.S. Capacity Utilization MoM (SA) (Nov)A:--

F: --

U.S. Richmond Fed Manufacturing Shipments Index (Dec)

U.S. Richmond Fed Manufacturing Shipments Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Dec)

U.S. Richmond Fed Services Revenue Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Dec)

U.S. Conference Board Consumer Expectations Index (Dec)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Dec)

U.S. Conference Board Present Situation Index (Dec)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Dec)

U.S. Richmond Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Dec)

U.S. Conference Board Consumer Confidence Index (Dec)A:--

F: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)A:--

F: --

P: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

Canada Federal Government Budget Balance (Oct)

Canada Federal Government Budget Balance (Oct)--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The U.S. Supreme Court rejected former President Donald Trump’s bid to deploy the National Guard in Chicago to control immigration protests, with a majority ruling that the legal threshold for military intervention was not met...

The U.S. economy grew faster than expected in the third quarter, driven by robust consumer spending, but momentum appears to have faded amid the rising cost of living and recent government shutdown.

Gross domestic product increased at a 4.3% annualized rate last quarter, the Commerce Department's Bureau of Economic Analysis said in its initial estimate of third-quarter GDP on Tuesday. The economy grew at a 3.8% pace in the second quarter. Economists polled by Reuters had forecast GDP would rise at a 3.3% pace.

The data was delayed by the 43-day government shutdown and is now outdated. Consumer spending increased at a 3.5% rate last quarter after advancing at a 2.5% pace in the second quarter.

Much of the consumer spending acceleration resulted from a rush to buy electric vehicles before the September 30 expiration of tax credits. Motor vehicle sales dropped in October and November, while spending elsewhere was mixed.

The nonpartisan Congressional Budget Office has estimated the shutdown could slice between 1.0 percentage point and 2.0 percentage points off GDP in the fourth quarter. It projected most of the GDP drop would be recovered, but estimated between $7 billion and $14 billion would not.

Surveys suggest consumer spending is being driven by higher-income households, thanks to a stock market boom that has inflated household wealth. In contrast, middle- and lower-income consumers are struggling amid the rising cost of living resulting from President Donald Trump's sweeping tariffs, economists said, creating what they call a K-shaped economy.

That phenomenon also is playing out among businesses. Economists said large corporations have mostly managed to withstand the blow from the import duties, which have increased costs, and are investing in artificial intelligence. But smaller businesses are struggling with tariffs.

Trump's policies are contributing to what economists have termed an affordability crisis that is denting his approval ratings. Households also face higher utility bills as the rapid growth of AI and cloud computing data centers boosts electricity demand. Some will face skyrocketing health insurance premiums in 2026.

The Federal Reserve this month cut its benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range, but signaled borrowing costs were unlikely to fall in the near term as policymakers await clarity on the direction of the labor market and inflation.

Korea will extend its consumption tax cut on passenger cars for an additional six months through the end of June next year, the finance ministry said Wednesday.

Under the latest extension, the individual consumption tax on passenger vehicles will be lowered to 3.5 percent from the original 5 percent, according to the Ministry of Economy and Finance.

The ministry said the measure will be terminated after June 30, 2026, taking into account recent signs of recovery in domestic demand.

The government first introduced the tax cut in July 2018 and has since repeatedly extended it to help boost domestic consumption, particularly during the COVID-19 pandemic.

Separately, the government will also extend its fuel tax cuts for an additional two months through the end of February to ease the burden on consumers amid continued volatility in global oil prices.

Under the latest extension, the current tax reductions — 7 percent on gasoline and 10 percent on diesel and liquefied petroleum gas (LPG) — will remain in place until Feb. 28.

The latest decision took into account the uncertainty in domestic and international oil prices, as well as consumer prices, and aims to alleviate fuel cost pressures on the public, according to the ministry.

Korea first introduced the fuel tax cut in November 2021 as a response to rising energy prices. The government has since extended the measure, adjusting the rates in accordance with changes in the global energy market.

This latest move marks the 19th extension of the fuel tax relief program.

Korea, which depends heavily on imports for energy, is particularly vulnerable to external price shocks, which often lead to domestic inflation.

Oil held a five-day gain as traders weighed escalating geopolitical tensions against swelling inventories.

West Texas Intermediate traded near $58 a barrel after gaining almost 6% in the prior five sessions, while Brent settled above $62 on Tuesday. Washington is still in pursuit of a third oil tanker off the coast of Venezuela as the White House ramps up pressure on Nicolás Maduro's government.

Meanwhile, Russian crude is building up at sea, with the volume jumping 48% since the end of August. The US actions in Venezuela may be raising concerns among shippers and buyers of Russian barrels, who worry their cargoes could also be targeted.

In the US, an industry report showed crude stockpiles increasing by 2.4 million barrels last week, with holdings of gasoline and distillate both rising. Official data is set to be released on Dec. 29, rather than Wednesday as originally planned, after President Donald Trump declared a federal holiday.

A Bank of Japan rate hike and surging Japanese Government Bond yields led to the unthinkable this week. USD/JPY rallied to 157.765 on December 19, while 10-year JGB yields soared to 2.1% on December 22, before dropping to 2.026% on December 23.

Monetary policy uncertainty, concerns about the coming year's fiscal budget and likely bond issuances, and intervention warnings clashed. Japan's Finance Minister Satsuki Katayama threatened yen interventions for two consecutive days as USD/JPY climbed toward 158. The two days of warnings briefly sent the pair below 156.

Fiscal concerns have festered since Prime Minister Sanae Takaichi became the frontrunner to be Japan's first woman prime minister. USD/JPY has risen 8.46% in H2 2025, while 10-year JGB yields have soared 0.60 basis points to 2.1%, the highest since February 1999.

10-Year JGB Yields – USDJPY – Daily Chart – 241225

10-Year JGB Yields – USDJPY – Daily Chart – 241225Crucially, intervention threats overshadowed fiscal concerns and strong US economic data, supporting a bearish USD/JPY outlook. Japanese economic indicators will likely add to the market volatility as the Japanese government and the BoJ grapple with yen stability.

Below, I'll discuss the macro backdrop, the near-term price catalysts, and technical levels traders should closely watch.

Following the choppy start to the week, the market focus will briefly shift to the Japanese economic calendar. The Conference Board Leading Economic Index (LEI) will give insights into the domestic demand outlook.

The LEI rose from 108.2 in September to 110.0 in October, indicating a pickup in business and consumer sentiment. Typically, a higher LEI reading indicates rising business investment, increasing employment, and stronger wage growth.

Higher wages would boost households' purchasing power, fueling consumer spending and demand-driven inflation. This chain of events would support a more hawkish BoJ policy stance, strengthening the yen.

However, the weaker yen has pushed import prices higher, dampening households' purchasing power and curbing private consumption. The effects of higher import prices on private consumption have been a key concern for the BoJ and the Japanese government, leading to yen intervention warnings.

An upward revision to the October LEI would align with improving sentiment toward the Japanese economy and strengthen the yen. However, USD/JPY losses will likely be limited, considering the ongoing fiscal concerns and the BoJ's cautious policy outlook and fading bets on a March Fed rate cut.

An unexpected surge in US GDP growth and a hotter-than-expected US price deflator tempered expectations of a March rate cut on Tuesday. A sharp increase in PCE prices signaled a sticky inflation outlook, while concerns mount about a decoupling of the labor market from GDP growth.

Later on Wednesday, initial jobless claims will come under scrutiny after last week's weak US jobs report. Economists forecast initial jobless claims to slip from 224k (week ending December 13) to 223k (week ending December 20).

A lower claims reading would ease immediate concerns about the labor market, while supporting a more hawkish Fed policy stance. However, an unexpected spike in claims could revive Fed rate cut bets, supporting a bearish USD/JPY price outlook.

According to the CME FedWatch Tool, the chances of a March Fed rate cut dropped from 52.9% on December 22 to 45.1% on December 23. The sharp drop reflected the impact of the Q3 US GDP report on sentiment toward the Fed policy stance.

While US data will influence US dollar demand and USD/JPY trends, risks of a yen carry trade unwind linger ahead of the holidays.

Elevated JGB and rising US Treasury yields will likely shift focus back to USD/JPY trends for early warning signs of an unwind. However, economists have mixed views on the USD/JPY's breaking point. 10-year JGB yields could boost demand from domestic investors. The prospect of a stronger yen on repatriations and higher yields reinforces the constructive short- to medium-term bias.

A drop below 155 could be crucial for the negative short- to medium-term bias, given Tuesday's low of 155.649.

With markets monitoring technical indicators and fundamentals, they will offer crucial signals into potential USD/JPY price trends.

Looking at the daily chart, USD/JPY remained above the 50-day and 200-day Exponential Moving Averages (EMAs), indicating a bullish bias. While technicals remained bullish, fundamentals are increasingly outweighing the technical structure, indicating a bearish outlook.

A drop below the 155 support level would bring the 50-day EMA into play. If breached, 150 would be the next key support level. Importantly, a sustained break below the 50-day EMA would signal a bearish near-term trend reversal, paving the way to the 200-day EMA and 150. A break below the 200-day EMA would reinforce the bearish medium- to longer-term USD/JPY price outlook.

USDJPY – Daily Chart – 241225 – EMAs

USDJPY – Daily Chart – 241225 – EMAsIn my view, intervention threats will continue to cap USD/JPY gains, while elevated JGB yields could boost yen demand, signaling a negative price outlook. However, the BoJ's messaging on the neutral interest rate will be crucial, given concerns about US inflation.

A higher neutral interest rate, neither accommodative nor restrictive, would signal multiple BoJ rate hikes and a sharp narrowing in US-Japan rate differentials. A less profitable yen carry trade into US assets and higher JGB yields would likely trigger a yen carry trade unwind, sending USD/JPY toward 130 in the longer term.

However, upside risks to the bearish outlook include:

This chain of events would fuel demand for the US dollar and send USD/JPY higher. However, yen intervention warnings are likely to cap the upside at around the 158 level, based on past communication.

In summary, USD/JPY trends reflect shifting sentiment toward narrowing rate differentials. Market focus remains on BoJ Governor Ueda's communications regarding the neutral rate.

A neutral rate at the higher end of the Bank's current 1% to 2.5% range would signal more aggressive rate hikes, supporting the bearish short- to medium-term outlook for USD/JPY. Furthermore, a more dovish Fed policy stance colliding with a hawkish BoJ will likely push USD/JPY toward 130 in the 6-12 month time horizon.

Colombia's leftist government said it will use emergency powers to raise taxes on the nation's richest citizens as well as on the financial services sector.

The government is decreeing an increase on the top wealth tax rate to 5%, from 1.5%, and would also slash the threshold at which it becomes payable to 2 billion pesos ($530,000) from 3.6 billion pesos, President Gustavo Petro said Tuesday, in a national address.

Those figures are unchanged from the rates the government sent in a bill to congress this year, which lawmakers rejected.

The surcharge on financial services company will triple to 15%, Petro said in a presentation.

The government declared an economic emergency this week, saying it was justified by a strained fiscal position, the need for higher spending on health care and security, and the rejection of the tax bill.

The declaration allows the government to increase taxes without congressional approval. However, economic emergencies are normally reserved for crises such as earthquakes and pandemics, and it is possible that the nation's Constitutional Court will overturn it.

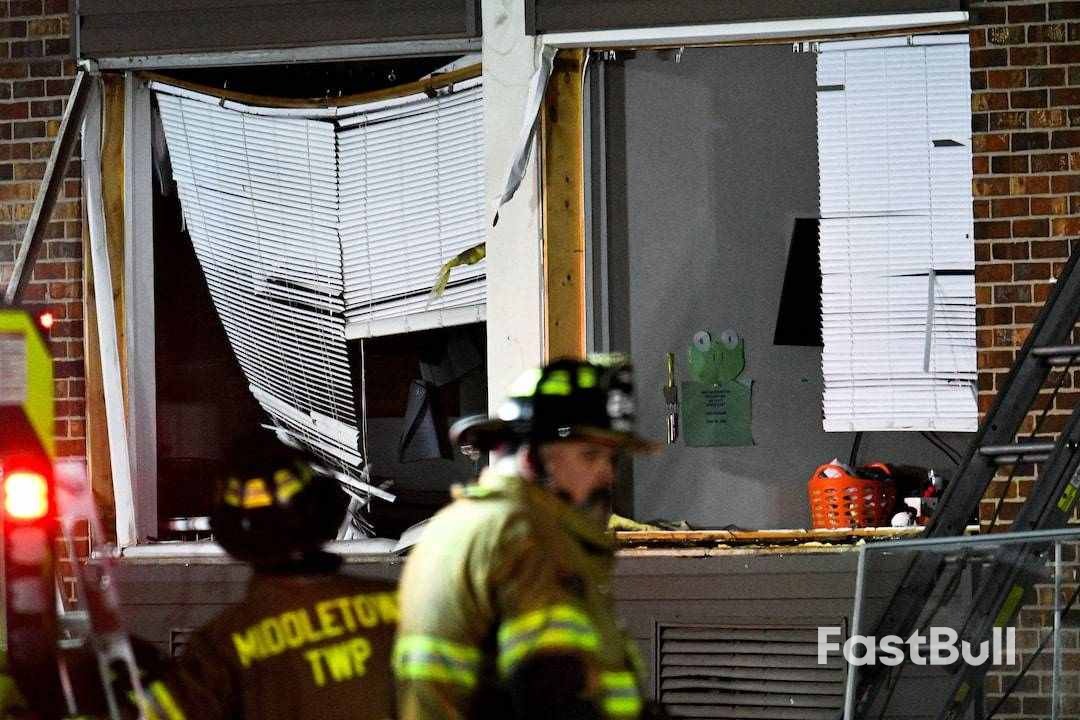

A pair of explosions and a fire, apparently sparked by leaking gas, ripped through a nursing home near Philadelphia on Tuesday, killing at least two people and prompting an intense search for victims in a collapsed portion of the building, officials said.

Five people were believed to be missing hours after the blasts and flames ravaged the Silver Lake Nursing Home in Bristol Township, about 21 miles (33 km) northeast of Philadelphia, Bristol Township Fire Marshal Kevin Dippolito said.

Besides the two people killed, an unspecified number of survivors were injured, Dippolito said, adding that numerous patients and staff initially trapped inside a demolished portion of the building were rescued.

The Bucks County emergency dispatch center received first reports of an explosion shortly after 2:00 p.m. EST (1900 GMT).

Dippolito said the first firefighters arriving on the scene, some from a fire-and-rescue station across the street, encountered "a major structural collapse," with part of the building's first floor crumbling into the basement below.

He said numerous victims were extricated from debris, blocked stairwells and stuck elevators, while firefighters ventured into the collapsed basement zone and pulled at least two more people to safety before retreating amid lingering gas fumes.

"We got everyone out that we could, that we could find, that we could see, and we exited the building," Dippolito said. "Within approximately 15 to 30 seconds of us exiting the building, knowing there was a heavy odor of natural gas around us, there was another explosion and fire."

The front of the structure appeared to have been blasted away from the inside, but the majority of the facility remained standing, though most of its windows were shattered, according to a Reuters photographer on the scene.

News footage from WPVI-TV, an ABC News affiliate, showed roaring flames and smoke billowing from the crippled building shortly after the first explosion.

The precise number of patients and staff inside at the time was not immediately known. The nursing home is certified for up to 174 beds, according to an official Medicare provider site.

More than 50 patients, ranging in age from 50 to 95, are typically in the building at any one time, WCAU-TV reported, citing a nurse employed by the facility who arrived on the scene after the blast. About five hours later, nursing home officials had informed authorities that all patients had been accounted for, Dippolito said.

In the early moments following the initial explosion, bystanders rushed to assist police and firefighters in escorting people to safety, Bristol Township Police Lieutenant Sean Cosgrove told local media earlier.

"This is the Pennsylvania way, neighbors helping neighbors in a moment of need," Governor Josh Shapiro said at the news briefing with fire and police officials.

Five hours after the incident, Dippolito said fire and rescue personnel were still treating the search effort as a rescue operation as heavy equipment was brought in to help clear away larger pieces of rubble.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up