Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

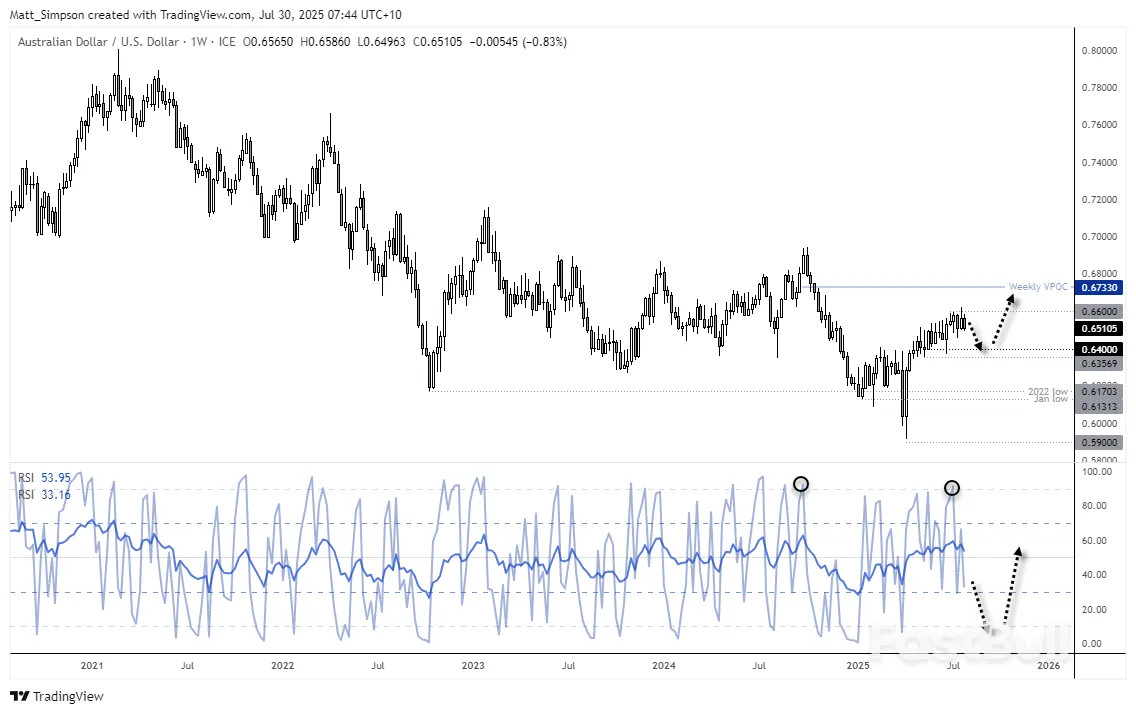

Aussie weakened broadly on Asian session after Australia’s Q2 CPI data cemented expectations for another RBA rate cut in August. However, the decline in Aussie lacks strong momentum so far.

The softness in both headline and core inflation readings has effectively given the central bank the green light to proceed with its cautious easing cycle. But the absence of more significant economic weakness—especially in labor markets—means there’s little pressure to accelerate easing. Governor Michele Bullock’s recent dismissal of June’s uptick in unemployment supports the case for steady, quarterly rate reductions.

Elsewhere in the currency markets, Yen is leading gains as traders brace for Thursday’s BoJ meeting, with speculations of a hawkish tilt in tone or projections. Kiwi and Euro are also firm. Aussie is sitting at the bottom, followed by Sterling and Dollar. Loonie and Swiss Franc are largely in the middle of the pack.Markets are facing a busy schedule ahead, with Eurozone GDP, US ADP employment, and US Q2 GDP advance release coming in quick succession. These will be followed by the BoC and FOMC rate decisions. The combination of macro data and central bank signals could drive sharp intraday moves across currencies and yields.

On trade, US-China negotiations in Stockholm ended without breakthrough. Officials indicated it’s now up to US President Donald Trump to determine whether to extend the current tariff truce past the August 12 deadline. A failure to do so could see tariff rates snap back to triple-digit levels.US Treasury Secretary Scott Bessent stressed that only Trump can finalize any extension. He hinted at another round of discussions in about 90 days and noted “good personal interaction” with Chinese Vice Premier He Lifeng. Talks reportedly made progress on technical matters like rare earth exports.

Technically, EUR/USD is hovering near its 55-day EMA. Bulls will want to see support hold to maintain the view that the pullback from 1.1829 is corrective. A sustained break below, however, would open up deeper losses toward 1.1198, the 38.2% retracement of the 1.0176 to 1.1829 advance.

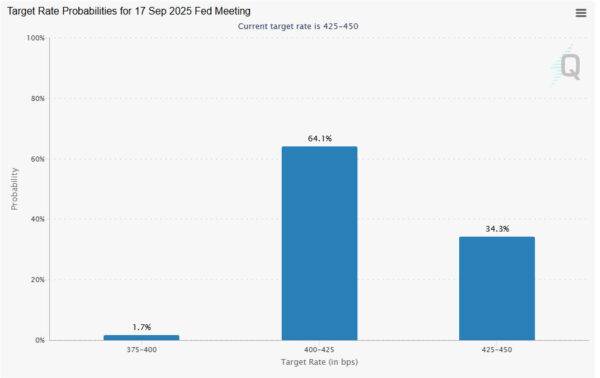

Fed is widely expected to keep interest rates unchanged 4.25–4.50%. Markets have priced in over a 97% chance of a hold, making the decision a foregone conclusion. However, the markets would watch out for any dovish signals from the Fed, which could put pressure on the Dollar, particularly if policy language starts to point more clearly toward a September cut.

Key to the announcement will be whether dovish members like Governors Christopher Waller and Michelle Bowman begin to shift their rhetoric into formal dissent— casting votes for an immediate cut. If additional policymakers join them, markets will likely interpret it as confirmation that a policy pivot is nearing. Fed Chair Jerome Powell’s tone in the post-meeting press conference will also be crucial in guiding expectations into the fall.Currently, futures markets see a roughly 65% chance of a rate cut in September. Any softening in Powell’s stance or language around tariff uncertainty and inflation could raise those odds.

Economic data released ahead of the Fed will help set the stage. A 2.4% annualized Q2 GDP print is expected, following Q1’s surprising -0.5% contraction. However, this strength is largely technical, driven by a reversal in imports following tariff-related stockpiling in Q1, rather than an underlying surge in domestic activity.

Technically, USD/JPY’s rebound from 145.84 lost momentum ahead of 149.17 resistance. Intraday bias is turned neutral first. On the upside, firm break of 149.17 will resume whole rally from 139.87 and target 100% projection of 139.87 to 148.64 from 142.66 at 151.43, which is close to 151.22 fibonacci level. Nevertheless, break of 147.50 minor support will extend the corrective pattern from 149.17 with another falling leg towards 145.84 first.

BoC is widely expected to hold its overnight rate steady at 2.75% today, marking a third consecutive pause in its rate-cut cycle. The slight improvement in the labor market, with unemployment edging back down to 6.9% in June, gives the central bank breathing space to maintain its current stance. However, core inflation pressures remain stubborn, with CPI common stuck at 2.6%, far from the bank’s comfort zone.With policy already sitting in the neutral range, the BoC is likely opting for a wait-and-see approach, especially given ongoing trade uncertainties and the potential for delayed tariff pass-throughs to consumer prices later in the year. While underlying growth concerns persist, there’s a case for keeping policy steady until inflation dynamics become clearer.

Markets continue to expect further easing this year. A Reuters poll shows that nearly two-thirds of economists forecast a 25 basis point cut in September, followed by another by year-end. That would bring the policy rate down to 2.25%, aligning with weakening demand and persistent disinflation pressures if they materialize.

Technically, considering bullish convergence condition in D MACD, USD/CAD’s break of 55 D EMA this week suggests that it might already be correcting the whole fall from 1.4791. Further rebound is likely in the near term. Though, strong resistance should emerge below 1.4014 (38.2% retracement of 1.4791 to 1.3538 at 1.4017 to limit upside.

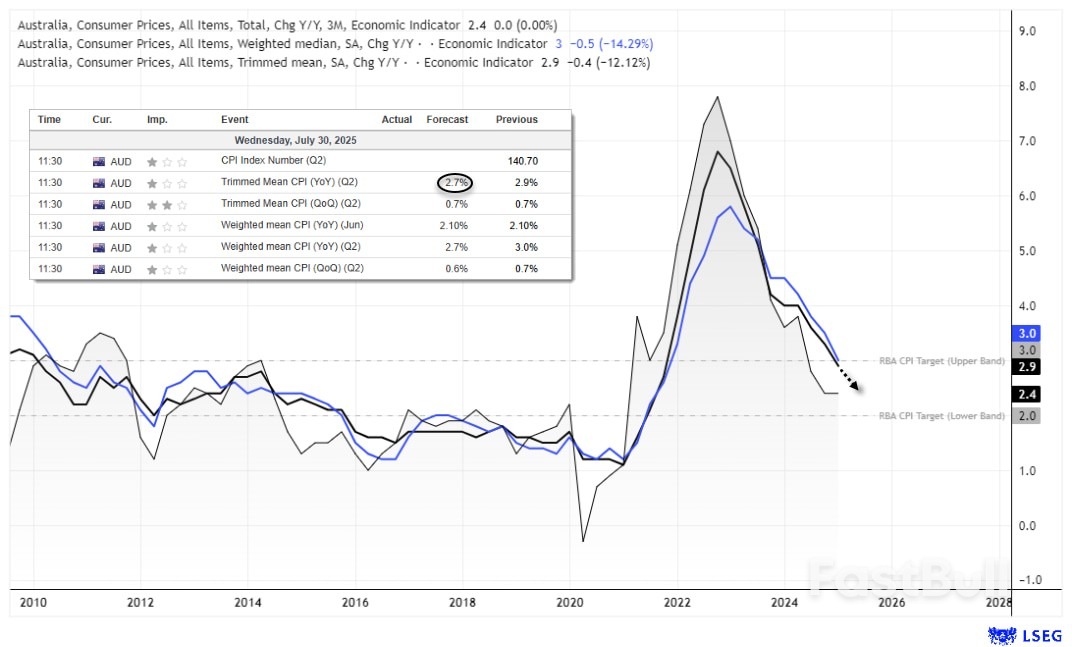

Australia’s inflation pressures continued to ease in Q2, reinforcing expectations for further policy easing from the RBA.Headline CPI rose 0.7% qoq, down from Q1’s 0.9% qoq and under the 0.8% qoq consensus. On an annual basis, CPI slowed from 2.4% yoy to 2.1% yoy, the lowest since early 2021, and below expectation of 2.2% yoy.Trimmed mean inflation, the RBA’s preferred gauge, also moderated from 0.7% qoq to 0.6% qoq. Annual rate fell from 2.9% to 2.7% yoy, matched expectations, and marking the lowest since Q4 2021.Underlying disinflation is broadening too. Annual services inflation cooled from 3.7% yoy to 3.3% yoy, the weakest since Q2 2022. Goods inflation dipped back to 1.1% yoy after a brief uptick from Q4’s 0.8% yoy to Q1’s 1.3% yoy.The June monthly CPI dropped from 2.1% yoy to 1.9% yoy, also below expectations of 2.1% yoy, and undershoots RBA’s 2-3% target band.

New Zealand’s ANZ Business Confidence ticked higher in July, rising from 46.3 to 47.8. Own Activity Outlook edged down slightly from 40.9 to 40.6. The share of firms expecting to raise prices over the next three months dropped to 43.5%—the lowest since December 2024. Inflation expectations also dipped from 2.71% to 2.68%.ANZ described the inflation signals as “benign,” noting declines across both cost and pricing expectations. The bank suggested that RBNZ may soon shift from worrying about inflation staying too high to concerns about it falling too low, implying a greater likelihood of deeper monetary easing than currently priced in by markets or flagged by the RBNZ itself.

Daily Pivots: (S1) 1.7694; (P) 1.7746; (R1) 1.7787;

EUR/AUD recovered after hitting 1.7717 support and intraday bias stays neutral. On the downside, decisive break of 1.7717 will revive the case that rise from 1.7245 has completed. Corrective pattern from 1.8554 should have then started the third leg. Deeper decline should be seen to 1.7459 support first. Nevertheless, strong bounce from current level, followed by break of 1.7972 resistance, will resume the rise from 1.7245 through 1.8094.

In the bigger picture, price actions from 1.8554 medium term top are seen as a corrective pattern. While deeper pullback might be seen, downside should be contained by 38.2% retracement of 1.4281 (2022 low) to 1.8554 at 1.6922 to bring rebound. Up trend from 1.4281 is expected to resume at a later stage.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 01:00 | NZD | ANZ Business Confidence Jul | 47.8 | 46.3 | ||

| 01:00 | NZD | ANZ Activity Outlook Jul | 40.6 | 40.9 | ||

| 01:30 | AUD | Monthly CPI Y/Y Jun | 1.90% | 2.10% | 2.10% | |

| 01:30 | AUD | CPI Q/Q Q2 | 0.70% | 0.80% | 0.90% | |

| 01:30 | AUD | CPI Y/Y Q2 | 2.10% | 2.20% | 2.40% | |

| 01:30 | AUD | Trimmed Mean CPI Q/Q Q2 | 0.60% | 0.70% | 0.70% | |

| 01:30 | AUD | Trimmed Mean CPI Y/Y Q2 | 2.70% | 2.70% | 2.90% | |

| 05:30 | EUR | France Consumer Spending M/M Jun | -0.30% | 0.20% | ||

| 05:30 | EUR | France GDP Q/Q Q2 P | 0.10% | 0.10% | ||

| 06:00 | EUR | Germany Retail Sales M/M Jun | 0.50% | -1.60% | ||

| 06:00 | EUR | Germany GDP Q/Q Q2 P | -0.10% | 0.40% | ||

| 08:00 | CHF | UBS Economic Expectations Jul | -2.1 | |||

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.00% | 0.60% | ||

| 09:00 | EUR | Eurozone Economic Sentiment Jul | 94.8 | 94 | ||

| 09:00 | EUR | Eurozone Industrial Confidence Jul | -11 | -12 | ||

| 09:00 | EUR | Eurozone Consumer Confidence Jul | -14.7 | -14.7 | ||

| 09:00 | EUR | Eurozone Services Sentiment Jul | 3.4 | 2.9 | ||

| 12:15 | USD | ADP Employment Change Jul | 75K | -33K | ||

| 12:30 | USD | GDP Annualized Q2 P | 2.40% | -0.50% | ||

| 12:30 | USD | GDP Price Index Q2 P | 2.30% | 3.80% | ||

| 13:45 | CAD | BoC Interest Rate Decision | 2.75% | 2.75% | ||

| 14:00 | USD | Pending Home Sales M/M Jun | 0.30% | 1.80% | ||

| 14:30 | CAD | BoC Press Conference | ||||

| 14:30 | USD | Crude Oil Inventories | -2.3M | -3.2M | ||

| 18:00 | USD | Fed Interest Rate Decision | 4.50% | 4.50% | ||

| 18:30 | USD | FOMC Press Conference |

Asian traders should remain alert for heightened volatility as markets shift from fading trade-deal optimism to new catalysts stemming from central bank meetings and key data releases. Defensive positioning is expected, with risk sentiment staying fragile ahead of U.S. and Japanese policy decisions, updated economic forecasts, and potential trade developments. On Wednesday, official quarterly inflation data for Australia will be released, a critical factor shaping the Reserve Bank of Australia’s monetary policy outlook. Any surprises could move the AUD and local rates markets as traders adjust expectations for next month’s RBA meeting.

The U.S. dollar is exhibiting a strong bullish trend today, supported by gains in trade policy, positive economic data, and increased global capital flows ahead of the upcoming Fed decision. Market participants should closely watch for any shift in the Fed’s tone, which could serve as the next key catalyst for the dollar’s direction. The U.S. Dollar Index (DXY) has extended its rally, trading above 98.8 after a 1% surge at the start of the week. This momentum positions the dollar for its strongest week of the year so far, bolstered by recent U.S. trade agreements, including a 15% tariff on EU imports that have strengthened the U.S. economy while pressuring the euro.Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

Gold is trading slightly higher early Wednesday, recovering from three-week lows as risk sentiment turns cautious and traders await clarity from the U.S. Federal Reserve meeting. For now, the yellow metal remains in a consolidation phase, with its direction hinging on upcoming policy decisions and economic headlines. Gold prices are currently around $3,327 per ounce, marking a modest 0.39% gain from the previous day. The precious metal remains within its recent range, holding above the key $3,300 support level despite ongoing market uncertainty.

Next 24 Hours Bias

Weak Bearish

The Australian Dollar remains weak and range-bound above 0.6500, with global risk sentiment, a firm US Dollar, and upcoming domestic inflation data and rate decisions shaping market tone. The outcome of Wednesday’s CPI report and the RBA’s response next week will be decisive for AUD direction in the near term. Key risks include trade headlines, signals from the Federal Reserve, and ongoing volatility in global equity and commodity markets, particularly as China–U.S. negotiations continue.

Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

The NZD remains weak today, driven by a stronger US dollar, uncertainty surrounding future US tariff policies, and a risk-off sentiment in global markets. With no major domestic news, the outlook depends largely on international developments and central bank signals over the next 24–48 hours.The New Zealand dollar (NZD/USD) continued its decline, trading around 0.595–0.596—near a one-week low and extending its losing streak to a fourth consecutive session. Over the past month, the NZD has lost about 2.2% in value, reflecting broad weakness against a stronger US dollar, and it is down approximately 0.87% over the past seven days.

Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

The Japanese yen is trading near multi-session lows, weighed down by external trade dynamics and defensive positioning ahead of the Bank of Japan’s upcoming policy meeting. While markets expect cautious policy signals and an upward revision to the inflation forecast, any unexpected guidance or political developments could trigger volatility in both the yen and Japanese assets over the next 24–48 hours.

Currently, the yen (JPY) is hovering around 148.3–148.5 per U.S. dollar after a sharp three-session decline. The currency is down approximately 3.2% for the month but held relatively steady overnight as traders await central bank decisions and key international developments.

Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

Today, the euro remains under selling pressure, driven by investor disappointment over the U.S.–EU trade agreement, muted regional data, and caution ahead of the Federal Reserve’s decision. The currency is expected to stay sensitive to macroeconomic headlines and central bank policies as the session unfolds. The euro remains weak and is likely to stay volatile amid export headwinds from U.S. tariffs, a cautious ECB stance, and cooling sentiment ahead of key economic data and a major Fed announcement.Central Bank Notes:

Next 24 Hours Bias

Medium Bearish

The Swiss franc has softened slightly as global risk sentiment improves and the U.S. dollar rebounds on trade news and Fed policy expectations. The SNB’s policy remains steady following its June rate cut, with near-term direction likely influenced by cross-asset risk trends, U.S. monetary developments, and potential renewed safe-haven demand. The franc faces competing forces, its continued safe-haven appeal versus reduced demand amid improving trade relations. While the SNB’s dovish stance and readiness to intervene highlight concerns about franc strength, recent improvements in inflation may limit the need for further aggressive easing.

Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

The pound remains soft and defensive heading into July 30, 2025, weighed down by slowing growth, persistent inflation, and expectations of BoE rate cuts. GBP/USD is trading near multi-month lows, while GBP/EUR saw a brief rebound but continues to hover near its 2023–2024 lows. Domestic economic weakness and strong U.S. dollar demand keep sterling under pressure.

Markets are positioned cautiously ahead of the August 7 Bank of England meeting, with at least one rate cut priced in. Focus remains on UK growth signals, particularly monthly GDP releases, alongside evolving labor market data and shifts in core inflation. GBP volatility continues to track developments in global risk sentiment, U.S. dollar strength, and changes in trade policy outlook.Central Bank Notes:

Next 24 Hours Bias

Weak Bearish

The Canadian dollar entered July 30 under pressure from a strengthening U.S. dollar and ongoing trade uncertainty. With the Bank of Canada widely expected to hold interest rates steady at 2.75%, attention shifts to forward guidance and how policymakers will balance persistent inflation concerns against weak economic growth and external trade risks. Additionally, the Canadian dollar is weighed down by recent U.S. trade agreements with Japan and the EU, which have strengthened the U.S. dollar while leaving Canada without a comparable deal.Central Bank Notes:

Next 24 Hours Bias

Medium Bearish

Oil prices maintained their recent strength on Wednesday, supported by escalating geopolitical tensions following Trump’s Russia ultimatum, optimism surrounding U.S.-EU trade agreements, and a shift in market sentiment toward bullish positioning. The market remains highly sensitive to developments related to the Russia-Ukraine deadline, Federal Reserve policy signals, and upcoming OPEC+ production decisions.

Next 24 Hours Bias

Weak Bullish

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up