Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

South Korea Welfare Ministry: National Pension Fund Committee To Swiftly Review Forex Financing Plans, Forex Hedging Policies

Mitsubishi Corp CFO: Our Coking Coal Production In Australia Is Expected To Be Significantly Impacted By Heavy Rainfall And Other Factors In Q4

Czarnikow Forecasts EU Sugar Production In 2026/27 Of 15.5 Million Metric Tons, Down From 17.1 Million In 2025/26

Statistics Indonesia Chief: Fiscal Stimulus, Stable Purchasing Power Supported Household Consumption In Q4

[Ethereum Drops Below $2100] February 5Th, According To Htx Market Data, Ethereum Fell Below $2,100, With A 24-Hour Percentage Decrease Expanding To 8.66%

[Minneapolis Mayor Calls For End To Federal Immigration Enforcement] On April 4, Local Time, In Response To US President Trump's Statement That Federal Immigration Enforcement Needed A "more Lenient Approach," Minneapolis Mayor Jacob Frey Said That Such A Change Was Welcome. However, He Emphasized That The Presence Of 2,000 Federal Law Enforcement Officers In Minneapolis Is Still Insufficient To Ease The Situation, And The Federal Government Should Terminate Its Immigration Enforcement Operations In The City

[Bitcoin Drops Below $71,000] February 5Th, According To Htx Market Data, Bitcoin Fell Below $71,000, With A 24-Hour Decline Expanding To 7.56%

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)A:--

F: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)A:--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)A:--

F: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)A:--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)A:--

F: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Jan)

U.S. ISM Non-Manufacturing Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Jan)

U.S. ISM Non-Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

Australia Trade Balance (SA) (Dec)

Australia Trade Balance (SA) (Dec)A:--

F: --

Australia Exports MoM (SA) (Dec)

Australia Exports MoM (SA) (Dec)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction YieldA:--

F: --

P: --

Indonesia Annual GDP Growth

Indonesia Annual GDP GrowthA:--

F: --

P: --

Indonesia GDP YoY (Q4)

Indonesia GDP YoY (Q4)A:--

F: --

P: --

France Industrial Output MoM (SA) (Dec)

France Industrial Output MoM (SA) (Dec)--

F: --

P: --

Italy IHS Markit Construction PMI (Jan)

Italy IHS Markit Construction PMI (Jan)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Jan)

Euro Zone IHS Markit Construction PMI (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Jan)

Germany Construction PMI (SA) (Jan)--

F: --

P: --

Italy Retail Sales MoM (SA) (Dec)

Italy Retail Sales MoM (SA) (Dec)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Jan)

U.K. Markit/CIPS Construction PMI (Jan)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales YoY (Dec)

Euro Zone Retail Sales YoY (Dec)--

F: --

P: --

Euro Zone Retail Sales MoM (Dec)

Euro Zone Retail Sales MoM (Dec)--

F: --

P: --

U.K. BOE MPC Vote Cut (Feb)

U.K. BOE MPC Vote Cut (Feb)--

F: --

P: --

U.K. BOE MPC Vote Hike (Feb)

U.K. BOE MPC Vote Hike (Feb)--

F: --

P: --

U.K. BOE MPC Vote Unchanged (Feb)

U.K. BOE MPC Vote Unchanged (Feb)--

F: --

P: --

U.K. Benchmark Interest Rate

U.K. Benchmark Interest Rate--

F: --

P: --

MPC Rate Statement

MPC Rate Statement U.S. Challenger Job Cuts (Jan)

U.S. Challenger Job Cuts (Jan)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Jan)

U.S. Challenger Job Cuts MoM (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Jan)

U.S. Challenger Job Cuts YoY (Jan)--

F: --

P: --

Bank of England Governor Bailey held a press conference on monetary policy.

Bank of England Governor Bailey held a press conference on monetary policy. Euro Zone ECB Marginal Lending Rate

Euro Zone ECB Marginal Lending Rate--

F: --

P: --

Euro Zone ECB Deposit Rate

Euro Zone ECB Deposit Rate--

F: --

P: --

Euro Zone ECB Main Refinancing Rate

Euro Zone ECB Main Refinancing Rate--

F: --

P: --

ECB Monetary Policy Statement

ECB Monetary Policy Statement U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

ECB Press Conference

ECB Press Conference U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Mexico Policy Interest Rate

Mexico Policy Interest Rate--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

No matching data

View All

No data

Spot silver slumped as much as 16.7% to $73.5565 an ounce, coming back in sight of lows hit following last week's rout. Silver futures for March delivery tumbled more than 10% to $73.383/oz.

Silver prices tumbled in Asian trade on Thursday, leading losses across precious metals as the sector faced a wave of renewed selling that largely wiped out a short-lived rebound this week.

Spot silver slumped as much as 16.7% to $73.5565 an ounce, coming back in sight of lows hit following last week's rout. Silver futures for March delivery tumbled more than 10% to $73.383/oz.

Losses in the silver metal came abruptly during the Asian session, and were accompanied by a small uptick in the dollar.

Chris Weston, head of research at Pepperstone, noted that the move in silver stemmed from China, starting with a slide in Shanghai silver futures, which then spilled over into CME futures and spot silver prices.

Strength in the dollar had been a major weight on precious metals over the past week, as the greenback rebounded from near four-year lows after U.S. President Donald Trump's nominee for the next Federal Reserve Chair, Kevin Warsh, was viewed as being less dovish than markets were hoping.

This notion continued to chip away at metal prices in recent sessions.

Traders also remained largely biased towards the dollar ahead of key central bank meetings in Europe on Thursday, and U.S. nonfarm payrolls data due on Friday.

The Trump administration is advancing a plan to create a critical minerals trade bloc with allied nations, a direct challenge to China's dominance in the global supply chain for strategic materials.

At the inaugural Critical Minerals Ministerial in Washington, U.S. Vice President JD Vance announced the proposal, which aims to secure the resources needed for semiconductors, electric vehicles, and advanced weaponry. The core of the strategy involves establishing coordinated price floors, enforced by tariffs, to protect and expand production among partner countries.

Vance argued that the U.S.-China trade war of the past year exposed a critical vulnerability: the West's heavy dependence on minerals largely controlled by Beijing. He stressed that collective action is now essential for achieving self-reliance.

"We want members to form a trading bloc among allies and partners, one that guarantees American access to American industrial might while also expanding production across the entire zone," Vance stated at the meeting.

The objective, he explained, is to prevent market manipulation that harms domestic industries. "We want to eliminate that problem of people flooding into our markets with cheap critical minerals to undercut our domestic manufacturers," Vance said, without explicitly naming China.

The proposed mechanism relies on a system of managed pricing to ensure stability and competitiveness within the bloc.

"We will establish reference prices for critical minerals at each stage of production," Vance detailed. "For members of the preferential zone, these reference prices will operate as a floor maintained through adjustable tariffs to uphold pricing integrity."

This tariff-backed price floor is designed to create a protected market that encourages investment in mining and refining capabilities outside of China.

The Washington meeting, hosted by Secretary of State Marco Rubio, drew officials from 55 nations across Europe, Asia, and Africa. Key attendees included South Korea, India, Thailand, Japan, Germany, France, Britain, Australia, and the Democratic Republic of Congo—countries with varying levels of mining and refining capacity.

Rubio remarked that the supply of these minerals is "heavily concentrated in the hands of one country," a situation that has become a "tool of leverage in geopolitics."

Alongside the main initiative, several smaller agreements were announced. U.S. Trade Representative Jamieson Greer revealed bilateral plans with Mexico and trilateral agreements with the European Union and Japan aimed at strengthening critical mineral supply chains.

Separately, Argentina's Ministry of Foreign Affairs confirmed an agreement with the United States to diversify its supply chains. The South American country aims to leverage the partnership to increase its exports of copper and lithium.

Notably, Greenland and Denmark, the NATO ally responsible for the mineral-rich Arctic island, were not present at the meeting.

Israeli Prime Minister Benjamin Netanyahu delivered a direct message to the United States on Tuesday, cautioning that Iran cannot be trusted as a U.S. envoy prepares for potential diplomatic talks. The warning came during a meeting in Jerusalem with U.S. envoy Steve Witkoff, who is expected to meet with Iranian Foreign Minister Abbas Araghchi.

In an official statement following the discussion, Netanyahu's office clarified Israel's position. "The Prime Minister clarified his position that Iran has proven time and again that its promises cannot be relied upon," the statement read.

According to a report from Haaretz, President Trump’s son-in-law, Jared Kushner, was also present at the high-stakes meeting. Although Kushner holds no formal position within the Trump administration, he has played a central role in U.S. engagement with Israel and negotiations related to Gaza.

The planned talks between the U.S. and Iran are already encountering logistical challenges. While initial reports suggested Witkoff and Araghchi would meet in Turkey, the venue might be moved to Oman.

Adding to the uncertainty, Axios reported on Tuesday that Iran was introducing new demands concerning the talks. However, this claim was quickly disputed by Ali Vaez of the Crisis Group.

"A senior Iranian official just told me that this report is not accurate: 'Both sides are deciding together on the best format and venue,' he noted," Vaez stated on X, directly responding to the Axios story. The White House has since affirmed that the talks are still scheduled to proceed this Friday.

Despite the planned diplomatic engagement, the likelihood of a comprehensive deal between the U.S. and Iran remains low. A major sticking point is the Trump administration's insistence that any agreement must include restrictions on Tehran's missile program. Iranian officials have consistently described this condition as a non-starter.

The push for diplomacy comes against a backdrop of escalating military tension. President Trump has threatened to bomb Iran for weeks and has ordered a significant U.S. military buildup in the region. This has included the deployment of the aircraft carrier USS Abraham Lincoln and its strike group, along with additional air defense systems.

This pattern of simultaneous diplomatic outreach and military posturing has historical precedent. Before the launch of the 12-Day War, President Trump also publicly called for diplomacy, which was later seen as a deception campaign to catch Tehran off guard. Israel initiated that war on June 13, just days before another round of U.S.-Iran nuclear talks was scheduled. Hours before the first Israeli airstrikes, President Trump had publicly stated his commitment to diplomacy with Iran.

The last remaining nuclear arms control treaty between the United States and Russia expired at midnight GMT on Thursday, raising the threat of a renewed global arms race. The New START pact, which for decades limited the world's two largest nuclear arsenals, has officially lapsed without an extension.

With the treaty's expiration, both the US and Russia are no longer bound by its upper limits on strategic nuclear weapons. This development marks a significant shift in global security dynamics, ending a long-standing framework for nuclear stability.

Russia's Foreign Ministry stated that the country would act responsibly but warned it would take "decisive" measures if its security were threatened. Meanwhile, Washington has not announced any plans to voluntarily adhere to the treaty's former limits beyond the deadline.

The New Strategic Arms Reduction Treaty (START), signed in 2010, capped both the US and Russia at 1,550 deployed strategic nuclear warheads. Despite efforts to keep it alive, negotiations for an extension ultimately failed.

Russian President Vladimir Putin had previously proposed a one-year extension, a suggestion that US President Donald Trump initially called "a good idea" in October. However, no subsequent negotiations took place to formalize an agreement.

The primary sticking point became President Trump's insistence that any future arms control deal must include China. This demand was consistently rejected by Beijing and considered unnecessary by Moscow. In a video call with Chinese President Xi Jinping, Putin reiterated Moscow's commitment to "act in a balanced and responsible manner" while remaining open to negotiations.

US Secretary of State Marco Rubio affirmed this position on Wednesday, stating that Trump would decide on the treaty later but adding that "it's impossible to do something that doesn't include China, because of their vast and rapidly growing stockpile."

This view was echoed by German Foreign Minister Johann Wadephul, who called on China to show "restraint" in its weapons development and argued that future arms control efforts must include Beijing.

International leaders have expressed grave concern over the treaty's expiration. UN Secretary-General Antonio Guterres described it as a "grave moment for international peace and security." He warned that "the risk of a nuclear weapon being used is the highest in decades" and implored both nations to return to negotiations without delay.

Pope Leo XIV also weighed in during his weekly general audience, calling for de-escalation from a new arms race. "I urge you not to abandon this instrument without seeking to ensure that it is followed up in a concrete and effective manner," he stated.

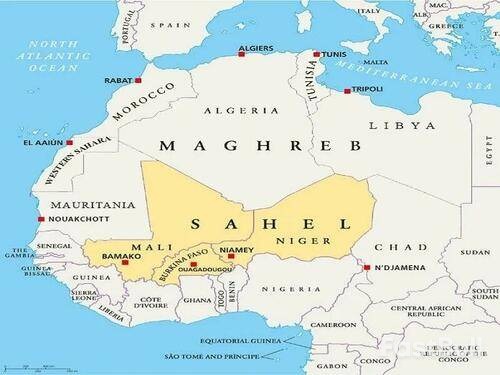

The United States is launching a high-stakes diplomatic effort in West Africa, sending the chief of its Bureau of African Affairs to Mali to "chart a new course" in the relationship. While the official announcement speaks of respecting Mali's sovereignty, the visit signals a broader American push to reshape the security landscape in the Sahel, potentially at Russia's expense.

This engagement targets not just Mali but its partners in the recently formed Alliance of Sahel States (AES), which also includes Burkina Faso and Niger. The move comes as the U.S. looks to consult with these governments on shared security and economic interests, setting the stage for a major geopolitical realignment.

The context for this diplomatic outreach is critical. The AES was formed after patriotic military coups in all three member nations, leading to a strategic pivot away from their former colonial power, France. This new bloc is evolving into a confederation and has forged a strong military alliance with Russia to assist with "Democratic Security"—a term for ensuring political stability and countering persistent terrorist threats.

Since expelling French forces, the AES has accused France of backing terrorist groups in retaliation, an act they see as revenge for strategic setbacks that have damaged France's image as a global power. Meanwhile, reported coup attempts, particularly in Burkina Faso, continue to challenge the region's stability.

For the United States, this situation presents an opportunity. If Washington can persuade the AES to replace or even "balance" Russia's role as its primary security guarantor, it could deliver a significant blow to Moscow's international prestige. This would add to a series of strategic setbacks Russia has experienced in regions like Armenia-Azerbaijan, Kazakhstan, Venezuela, and Syria since the start of its special operation.

The U.S. approach appears to be a classic carrot-and-stick strategy, presenting the AES with an offer that may be difficult to decline.

The Diplomatic Path

The "easy way" for the AES would be to voluntarily comply with U.S. overtures. This deal could be sweetened with offers of large-scale aid or reduced tariffs, granting the bloc's members preferential access to the massive U.S. market.

The Coercive Path

If diplomacy fails, the U.S. could pursue a "hard way" through indirect military coercion. This strategy would leverage a combination of escalating pressures:

• US-backed Nigerian military action: Using anti-terrorism as a pretext, the U.S. could support military pressure from neighboring Nigeria.

• French-backed terrorist advances: Washington could leverage France's alleged support for insurgent groups to destabilize the region further.

• Direct US military strikes: The U.S. could conduct its own anti-terrorist strikes, with or without the approval of AES governments.

A recent U.S. bombing of ISIS in Nigeria on Christmas has already set a precedent for direct American military intervention in the region. Furthermore, the U.S. is reportedly considering deploying spy planes and potentially armed drones in the Ivory Coast, which borders Mali and Burkina Faso, to facilitate cross-border operations.

The timing of the U.S. initiative is no accident. All three AES members are already struggling to contain terrorist advances, even with Russian assistance. Moscow's capacity to provide further aid is limited as it prioritizes its special operation. Unlike the Soviet Union's decisive intervention to save Ethiopia from Somalia in the late 1970s, modern Russia is unable to rush to the rescue of its African allies with overwhelming force.

Both the U.S. and France are keenly aware of Russia's constraints. This understanding appears to be driving their coordinated strategy: France allegedly fuels instability through terrorist proxies, while the U.S. arrives with a powerful diplomatic and military proposition.

For the Sahelian Alliance, the choice is stark. The best-case scenario involves their armed forces achieving a decisive breakthrough against terrorists with Russia's help, thereby thwarting the external pressure campaign. However, given their recent setbacks, this outcome is far from certain. The worst-case scenarios—capitulating to U.S. demands or collapsing under the combined military and political pressure—remain distinct possibilities.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up