Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)A:--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)A:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)A:--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)A:--

F: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)A:--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)A:--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)A:--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)A:--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo RateA:--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)A:--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)A:--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Exports (Sept)

U.S. Exports (Sept)A:--

F: --

P: --

U.S. Trade Balance (Sept)

U.S. Trade Balance (Sept)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)A:--

F: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Canada Trade Balance (SA) (Sept)

Canada Trade Balance (SA) (Sept)A:--

F: --

Canada Exports (SA) (Sept)

Canada Exports (SA) (Sept)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Sept)

U.S. Wholesale Sales MoM (SA) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. Yield--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)--

F: --

P: --

U.K. Services Index MoM (SA) (Oct)

U.K. Services Index MoM (SA) (Oct)--

F: --

P: --

U.K. Services Index YoY (Oct)

U.K. Services Index YoY (Oct)--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)--

F: --

P: --

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoM--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)--

F: --

P: --

U.K. Manufacturing Output MoM (Oct)

U.K. Manufacturing Output MoM (Oct)--

F: --

P: --

U.K. Monthly GDP 3M/3M Change (Oct)

U.K. Monthly GDP 3M/3M Change (Oct)--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

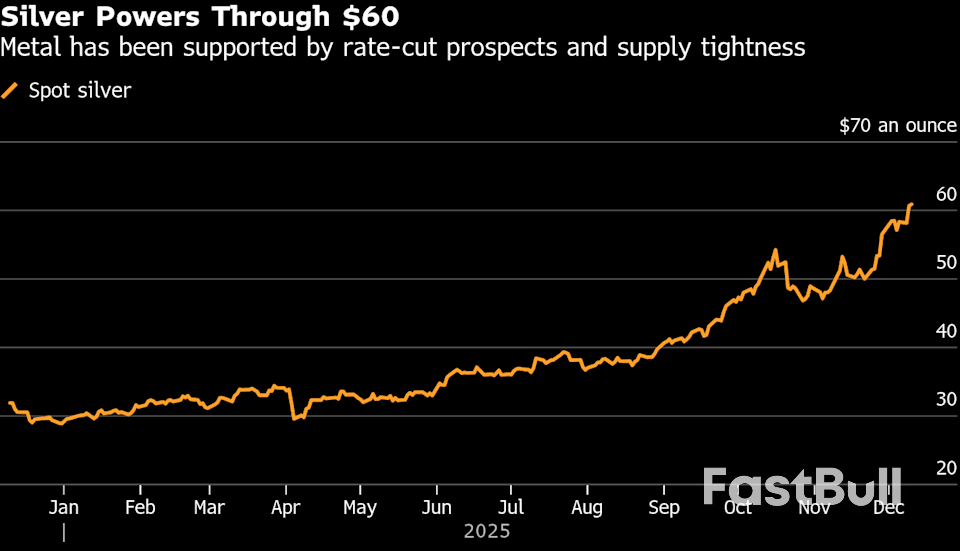

Silver surged above $60/oz to record highs, driven by supply tightness and speculation on Fed easing. Heavy ETF inflows and retail momentum fuel the rally, though analysts warn prices look overextended.

US labour costs increased slightly less than expected in the third quarter as a softening labour market curbed wage growth, which bodes well for services inflation.

The Employment Cost Index (ECI), the broadest measure of labour costs, rose 0.8% in the last quarter, after gaining 0.9% in the second quarter, the Labor Department's Bureau of Labor Statistics said on Wednesday. Economists polled by Reuters had forecast the ECI advancing 0.9%.

Labour costs increased 3.5% in the 12 months through September after rising 3.6% in the year through June.

The report was delayed by the 43-day government shutdown, which ended last month.

The ECI is viewed by policymakers as one of the better measures of labour market slack and a predictor of core inflation because it adjusts for composition and job-quality changes.

While the moderation suggested wages posed no threat to inflation, price pressures remain elevated because of tariffs on imports. Cooler wage growth could also hamper consumer spending.

Federal Reserve officials are expected to cut the US central bank's benchmark overnight interest rate by another 25 basis points to the 3.50%-3.75% range at the end of a two-day meeting later on Wednesday out of concern for the labour market.

The Fed has lowered borrowing costs twice this year.

Wages and salaries, which account for the bulk of labour costs, rose 0.8% last quarter after increasing 1.0% in the April-June quarter. They increased 3.5% on an annual basis. When adjusted for inflation, overall wages rose 0.6% in the 12 months through September after advancing 0.9% in the second quarter.

For income investors, the days of easy returns are vanishing.

In recent years, investors were paid handsomely to play it safe. Short-term US Treasuries offered yields above 5% — a rare chance to earn solid returns without locking up capital or chasing risk. For pensions, insurers and endowments, it marked a decisive break from the post-crisis decade of near-zero interest rates. Even if high inflation tempered real returns, institutions that once had to reach for yield suddenly had room to sit still.

That window is closing anew. The Federal Reserve is expected to cut rates again this week, part of an easing cycle that has already dragged yields well down from their post-pandemic highs. For income-focused portfolios, the easy gains from safe assets are fading. At the same time, conventional alternatives, from corporate bonds to global equities, look richly priced, leaving less cushion and fewer obvious paths forward.

The pressure has been building for months. A broad cross-asset rally, powered by AI exuberance and resilient US growth, has driven returns lower across public markets. For investors managing long-term liabilities, the trade-offs are sharpening: to keep pace, portfolios must stretch duration, give up liquidity, or take on more risk.

Public markets offer little relief. Dividend yields on global equities, as tracked by the MSCI All Country World Index, remain near their lowest levels since 2002. Investment-grade credit spreads are just above multi-decade lows, leaving scant margin for error should the economic outlook worsen.

The Fed's expected cut is a reminder that "today's yields may not always be available," said James Turner, co-head of global fixed income for EMEA at BlackRock in London. Pension and insurer clients are looking toward high yield, emerging-market debt, AAA rated collateralized loan obligations and securitization investments, to "enhance income and diversify," he said.

Private credit, long pitched as a diversification trade, has already absorbed hundreds of billions of dollars from institutions searching for returns beyond listed debt. While that appetite has cooled this year due to concern about deal quality and saturation, lower Treasury yields will help private-asset advocates make their sales pitch, as allocators reassess their income mix.

JPMorgan Asset Management anticipates more movement toward the private markets for income. Despite recent concerns, investors will be "rewarded for the extra risk you're taking in private credit," said Kerry Craig, global market strategist at the money manager in Melbourne.

Other investors agree.

"As rates have fallen and spreads have compressed, it's more of a challenge to get a reasonable rate of interest," said Nick Ferres, chief investment officer at Vantage Point Asset Management in Singapore. The firm launched an Australian income fund last year and has recently added private credit on a selective basis to help generate yield, he said.

The broader scramble for return never really stopped. The "hunt for yield" became shorthand in the zero-interest-rate policy — ZIRP — era, but the dynamic has persisted, even as the higher-for-longer interest rate outlook took hold, supporting Treasury yields. Bets on growth assets, AI hype and resurgent risk appetite have kept flows tilted toward higher-volatility exposure. As safe returns decline, the incentive to move out the risk curve is building afresh.

Capital is also flowing into more esoteric corners of financial markets.

Catastrophe bonds and insurance-linked securities — instruments that monetize rare-event risk — are drawing renewed institutional demand for their uncorrelated payouts. The Victory Pioneer CAT Bond Fund, launched in early 2023, now has $1.6 billion of assets. The fund continues to attract investors "facing that yield challenge," portfolio manager Chin Liu said.

Equities are offering less ballast for income-seeking portfolios. Global stock dividend yields have slumped as soaring equity prices, especially in tech, compress yields, while companies increasingly favor buybacks over dividends for flexibility.

"Finding yield is getting tougher" in global stocks, said Duncan Burns, head of investments for Asia Pacific at Vanguard in Melbourne. "We're seeing a trend of buybacks picking up and it looks like some of that's coming from the dividend side of things."

Still, yields don't move in a straight line. Even as the Fed prepares another rate cut, longer-maturity Treasury yields have climbed to multi-month highs as traders scale back expectations for 2026 easing. While short-term rates remain tightly linked to policy, longer-dated debt reflects growth, inflation and fiscal risk. For income investors, that means returns depend as much on timing and conviction as on central bank cues.

A few tactical bright spots remain. Sticky inflation in Australia has fueled expectations of further rate hikes. In the UK, longer-maturity gilt yields have risen on the back of government borrowing. But these are exceptions to the rule: across global markets, the income backdrop is tightening.

"Lower US rates are shaping a tougher landscape for income investors," said Hebe Chen, an analyst at Vantage Markets in Melbourne. "Falling Treasury yields and near record-tight credit spreads are pushing investors further out on the risk curve for slimmer rewards."

For the fourth straight meeting, the Federal Reserve's policymaking panel is expected to have a divided vote on borrowing costs Wednesday, showcasing the challenge that outgoing Chair Jerome Powell will have in offering some sort of outlook for where the US central bank is heading in 2026.

While a 25 basis-point rate cut is widely expected by economists and investors, Fed watchers see the potential for two votes against the move — a reflection of broader concerns among non-voting Fed reserve bank presidents about still-too-high inflation. Trump's chief economist, Stephen Miran (temporarily on leave from his post while he's at the Fed board) is expected to dissent in favor of a bigger 50 basis-point cut.

After Wednesday's anticipated reduction, the benchmark will be down to a 3.5% to 3.75% range, some 1.75 percentage points lower than the 2023-24 peak. The key question will be, after three reductions this year on top of a similar triple sequence last year, is that it for the cycle? Bond traders round the world already are starting to raise that question (see below.)

The Fed's preferred core inflation gauge was at 2.8% in the latest reading, still well above the 2% target. And while official up-to-date jobs data won't be out until next week, some recent signs — such as jobless claims and job openings — suggest employment isn't collapsing.

"It leaves the Fed in this position of having to walk a fine line," said Diane Swonk, chief economist at KPMG. "My sense is that they're going to pause as they await more data now, because they have put some rate cuts into the system already."

With policymakers submitting updated economic projections this time around, attention at 2 p.m. in Washington will quickly shift to the year-end 2026 median forecast for the policy benchmark. Back in September, eight officials favored ending next year where the rate's expected to be Wednesday. Two had one more trim for 2026, while nine saw two or more moves.

The fewer the projections for further rate cuts, the harder the challenge will be for Powell's successor to marshal a majority around the further easing that Trump has called for.

One more area to keep an eye on: with signs of strain in key US money markets, the bond market will be on watch whether the Fed unveils plans to rebuild liquidity buffers.

As a group, central banks appear to have begun a transition point from easing toward tightening, and it all risks playing out "faster than we expected," Stephen Spratt at Societe Generale wrote in a note Tuesday.

While any given monetary policy panel has its own domestic considerations, history shows that, broadly, "policy directions tend to trend together," given the common factors central bankers face, Spratt noted. And taking a look at a rolling tracker of decisions over the past 12 months, the peak for rate cuts was already reached four months back, SocGen analysis shows.

Stripping out rate expectations from the short-term portion of the bond market, there's a clear upward shift since late October, Spratt wrote. Moves began in the Asia-Pacific, with Australia and New Zealand among the places expectations shifted quickest. Canada joined in bigtime on Friday, when a surprisingly strong jobs gain prompted markets to price in a rate hike by the end of 2026, Spratt wrote.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up