Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

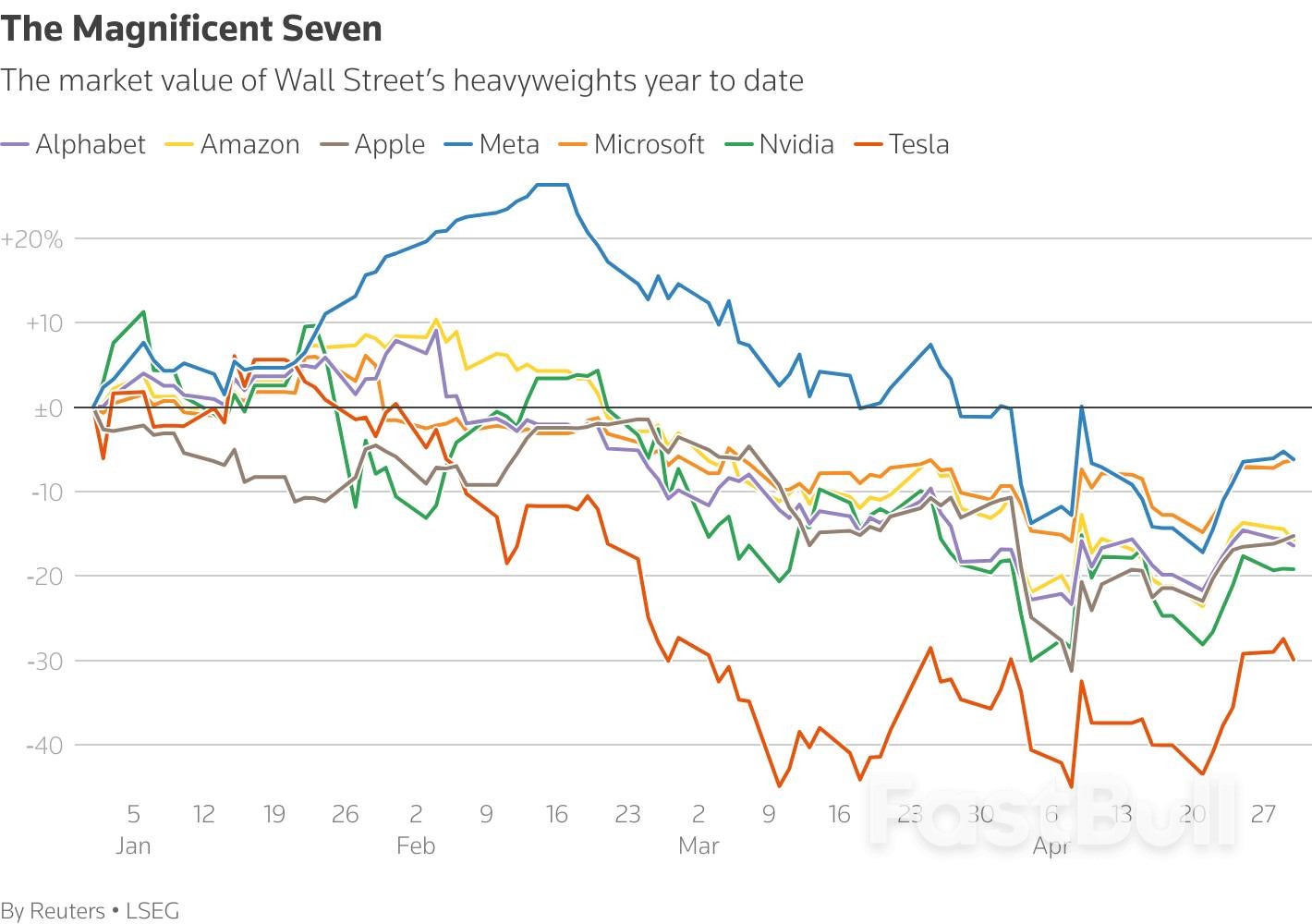

The Dow Jones Industrial Average rose 83.60 points, or 0.21%, to 40,752.96, the S&P 500 gained 35.08 points, or 0.63%, to 5,604.14 and the Nasdaq Composite gained 264.40 points, or 1.52%, to 17,710.74.

The US Bureau of Labor Statistics (BLS) is set to release employment data for the month of April tomorrow morning, Friday, May 2.

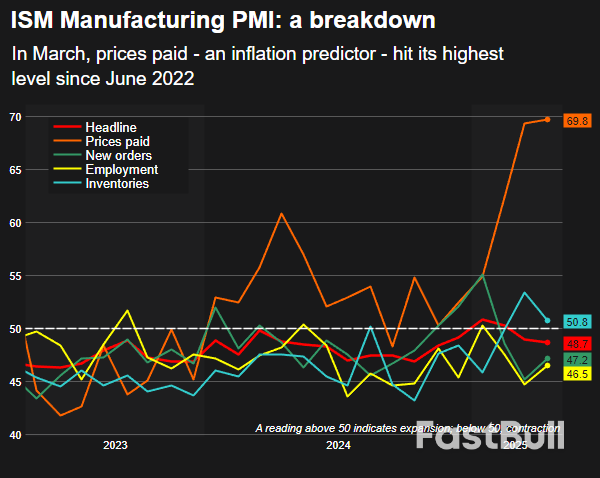

breaking news here. We're getting manufacturing data. We also have your ISM and S&P manufacturing data for April coming in line with estimates just above the key 50 level, which separates growth from contraction. The ISM numbers showing economic activity in the manufacturing sector contracting in April for the second month in a row. The reading comes after GDP data on Wednesday showed the US economy contracted in the first quarter for the first time in three years. Joining me now, Paul Gruenwald, S&P Global Ratings Global Chief Economist, Paul, great to speak with you. I do want to start on this April manufacturing data here because some interesting things under the hood. Production falling to the lowest level since May of 2020. Prices paid, highest reading since June of 2022. What does that tell you about manufacturing?

Um, well, it tells me that this process that started with the um the uh policy uncertainty and then moved to the markets is now starting to show up in the real data. That's kind of the last leg of this transmission. We had a decent first quarter. Maybe we can talk about that uh in a minute, but uh we've been waiting for this to sift into the real economy. The PMIs uh weak for manufacturing are just signaling that there's probably some weakness on the real side ahead.

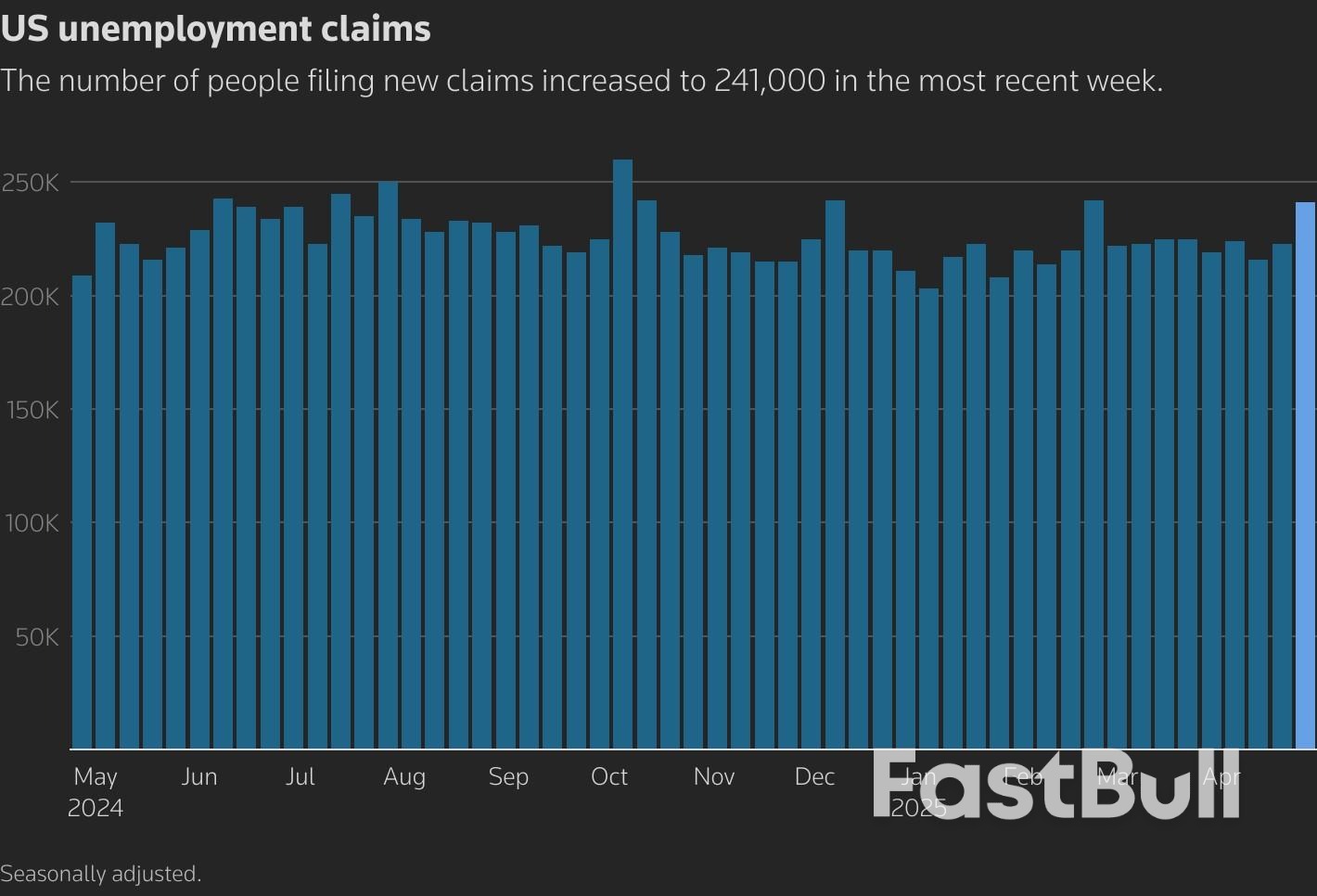

And talk to me too about the employment number here rising. There was a little bit of concern this morning when jobless claims came in just a touch higher than anticipated. Is this a sign that the employment situation is intact?

That's the critical variable, right? If you go back a couple of years to the inflation scare and the big rise in rates, we've been really focused on this resilience between consumer spending and the labor market. That's held up so far, but if you want to differentiate between the slowdown scenario and the recession scenario, it's going to center on the labor market. So if we start to see cracks in the labor market, that's going to take us into the recession scenario. Not there yet, but we're starting to see a little bit of weakness.

I like to uh I like to look at these PMI numbers like uh like business sentiment, just like consumer sentiment's very important for that part of the market. Yeah. So, um, you know, the sentiment seems to be pulling down, not surprisingly. The question is, is, you know, how how quickly are we going to really start to see this stuff show up uh in the so-called hard numbers. Although I look at these as hard numbers, but many would call them soft numbers, but for me, firms are uh are are they do the they do the right thing and they they don't have emotions involved. So when I see sentiment starting to drop, I start to get worried. I'm concerned.

Yeah. I think we're with you on that. I mean, it's not kind of a straight line and uh you're right, these are soft data because we're not measuring stuff, but certainly if you're looking at, you know, future orders or this is going to feed into CAPEX or something like that. It's definitely going to uh move the needle. We know that some of the shipments from China have slowed down dramatically. That's going to take a couple of weeks to work through the system. We know that the financial system's gummed up a bit on M&A and some of the, you know, spec grade issuance. So all that's going to take a little bit of time to feed through, but directionally it's very clear where we're going. It's just question of how steep the descent's going to be for the rest of year.

Let's talk about what you just mentioned with regards to China. Obviously, one of our top three importers, we had about a 3% pull forward in terms of demand in the GDP data. Yeah. When do you anticipate that we might start to see empty shelves because of that pressure?

Yeah, well, there's some stories floating around on timelines. The ships take a while to get from China to here, but uh you know, the timeline seems to be sometime in the next couple of months. Uh the ships will stop, then the ports will be empty, and then the shelves will be empty, and then we're going to see uh some of that pressure. The tariff rates on US and China from both sides are now triple digit, right? This is totally uncharted uh territory. The Chinese basically stopped the uh escalation. They said this isn't really meaningful anymore. So we're going to have to find an exit ramp to that or else that's going to feed through the economy and you know, put a big dent in our macro story.

So on the empty shelves piece. Yes. When might we see it and what does that cause in the economy?

Yeah, we're not we're not kind of forecasting that particular one. The stuff that I read that I agree with is probably sometime end of the second quarter. So it's going to be, you know, we're in May right now, so maybe the next couple of months.

Well, that's kind of factored in already. Let's remember US is a services economy, so it's 70% services, but certainly we're going to see some stress on the shipment. We're going to see some stress uh on consumer sentiment and uh yeah, we're going to have some soft spots before we uh maybe pull out of this next year, but we got a big descent in growth over the next couple of quarters.

You know, not surprisingly, you know, the numbers that we got the other day, the GDP numbers showed a lot of this front loading that we've been talking about, all these companies making purchases prior to uh the tariffs hitting. Um you know, I'm slightly concerned that, you know, all this front loading while it sort of helped last time, it's going to hurt us in the future, right? So uh purchases made today are not going to be made next quarter. Now, obviously, there are some intricacies there with inventories and things like that. Uh but are you feeling that that there might be some interesting negative surprises there too? I mean, consumers as well. Yeah. front loaded, but it didn't show up in the numbers, but

Yeah, well there was a funny print, right? Because the we had this massive negative uh contribution from imports and we didn't really get the full offset on stocking. So like there might be a missing hole, but um you're right, the consumer bit, which is what we watch, decelerated a bit in the first quarter. We're going to continue to see that uh throughout the year. We're thinking maybe you average the first two quarters together and maybe some of these one-off things are going to unwind, but the trend is pretty clear. But what we saw in the first quarter was maybe a slightly artificially low number for the US. And we also saw slightly artificially high number for China because they had the opposite thing where they're export boom. So all this messy stuff around the tariffs is going to take a couple of quarters to uh sift through. So we shouldn't be focusing too much on one particular data print and kind of looking at the whole the food chain there.

Well, it does seem like the bond market is hyperfocused on ISM at the moment. We're seeing treasuries pairing gains just a touch. To what extent do you think this market is aptly reacting to the stagflationary risks that are presented by so much of the economic data we're getting in right now?

Yeah, well, you've seen that a bit, right? And uh we know that prices are going to go up. We've got 4% inflation in the US at the end of this year. The question is, is that just a jump in the price level or is that really going to start lifting inflation continuously? Um longer-term inflation uh sort of uh sentiments crept up a bit, but uh you know, the bond market's trying to thread that needle, right? So the Fed's probably going to be cautious. We only have two cuts this year, the economy is slowing, less of stuff in the year. So I think the bond market looks like it's reflecting most of that.

Um, we're watching the one data point isn't uh isn't going to change our view, but again, we're expecting uh material slowdown in US growth this year and labor market's going to be part of that story.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up