Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

During his first 15 years at Qatar Investment Authority, Mohammed Al Sowaidi helped establish its US presence and scout opportunities.

During his first 15 years at Qatar Investment Authority, Mohammed Al Sowaidi helped establish its US presence and scout opportunities. Now, as head of the $524 billion state-backed entity, he’s pledging to invest an amount nearly equal to the fund’s current size, as part of a major commitment by the Gulf nation.

QIA plans to invest an additional $500 billion in the US over the next decade, Al Sowaidi said in an interview in Doha. The sweeping new outlays will target areas traditionally favored by the fund — such as artificial intelligence, data centers and health care — while also aligning with President Donald Trump’s agenda to reindustrialize the US, he said.

The $500 billion accounts for nearly half of the total $1.2 trillion economic pledge by Qatar during Trump’s visit this week.

“We’re not shifting away from other markets — we’re increasing our exposure to the US,” Al Sowaidi said. The current US policy environment offers a “more promising direction” for long-term capital, he said.

To be sure, the QIA is not alone in pursuing an aggressive, US-focused investment strategy among Middle East funds. Saudi Arabia’s Public Investment Fund, state-owned entities in the United Arab Emirates, and the Kuwait Investment Authority are also looking to deploy billions across similar sectors — raising the likelihood of competition for the same deals and the risk of overpaying for assets.

Al Sowaidi took over as the chief executive officer last year during a pivotal moment for the fund, with an expansion of the country’s gas projects expected to funnel billions of dollars into its coffers. At the same time, Doha is no longer hamstrung by outlays for large projects like the 2022 FIFA World Cup, which is estimated to have cost $300 billion.

With fresh inflows expected, Al Sowaidi plans to steer the fund toward providing capital to large companies, taking stakes in listed businesses and prioritizing bigger deals.

That marks a departure from the QIA’s recent focus on smaller venture capital deals. Still, Al Sowaidi said the move isn’t “an actual strategic shift or pivot,” but rather a “further evolution” of the fund’s approach to keep pace with rapid global change.

The QIA is already the world’s eighth-largest sovereign wealth fund and owns a string of high-profile assets including London’s Harrods department store and the Shard skyscraper. But after years of relatively quiet dealmaking, Al Sowaidi’s plans show the fund is ready to be back in the spotlight.

Al Sowaidi joined the QIA in 2010, when it was led by Sheikh Hamad bin Jassim bin Jaber Al Thani, a former prime minister who’s widely regarded as among the most high-profile investors in the Middle East. Sheikh Hamad was ultimately replaced at the QIA by Ahmed Al-Sayed, who helped orchestrate large deals including Glencore Plc’s $29 billion takeover of Xstrata Plc.

Al Sowaidi, for his part, spent most of his early years at the fund in the Americas, where he helped establish a US office and eventually worked his way up to become chief investment officer for the region.

He holds bachelor’s degrees in finance and statistics from the University of Missouri, and has held roles including as the head of private equity funds and president of the QIA Advisory office in New York. The QIA was then known for its work in snapping up high-profile stakes in the likes of Barclays Plc and Credit Suisse.

Qatar is already one of the world’s richest nations and among the top exporters of liquefied natural gas. But the government’s plans to significantly expand that output is set to add more than $30 billion a year to state revenues.

Some of this cash will be funneled into the QIA. The research consultancy Global SWF recently projected the QIA’s total assets will surge to $905 billion by 2030, meaning it would be vaulted into the ranks of other high-profile investors across the region like Saudi Arabia’s PIF and the Abu Dhabi Investment Authority.

The QIA is already positioning itself to prepare for significant outlays.

Al Sowaidi said the fund typically takes minority stakes in successful businesses, with deal size varying widely by asset class. “In public equity, we can go big,” he said.

“In private equity, we’re capable of multibillion-dollar transactions, but we can also stay nimble — especially in sectors like technology or health care.”

Such a move would be welcome news for the private equity industry. For years, high interest rates have put a damper on global dealmaking. When private equity firms aren’t able to sell their portfolio companies at a healthy pace, they can’t return capital to their investors. Then that money can’t be recycled into new funds.

The QIA’s efforts in that space would help get fundraising moving for the industry again — and make up for the pullback that’s expected from the $925 billion PIF, which has started to increasingly focus on domestic investments.

Already, financial firms are eager for the chance to work more closely with the QIA. Eduardo Saverin’s B Capital, for instance, unveiled plans to set up offices in Qatar earlier this year. Days later, BlackRock Inc.’s Global Infrastructure Partners, said it would set up in Doha too.

Those outside Doha will get more insight into Al Sowaidi’s thinking next week, when he speaks at the annual Qatar Economic Forum, where top finance executives from around the world and key names from Trump’s orbit — including his son Eric and Tesla Inc.’s Elon Musk — are scheduled to speak.

Doha had until recently largely stayed away from the race for regional financial dominance, even as a flurry of Wall Street firms announced plans to set up their regional headquarters in Riyadh and hedge funds flocked to Abu Dhabi.

But Al Sowaidi’s plans show the gas-rich nation is intensifying efforts to catch up.

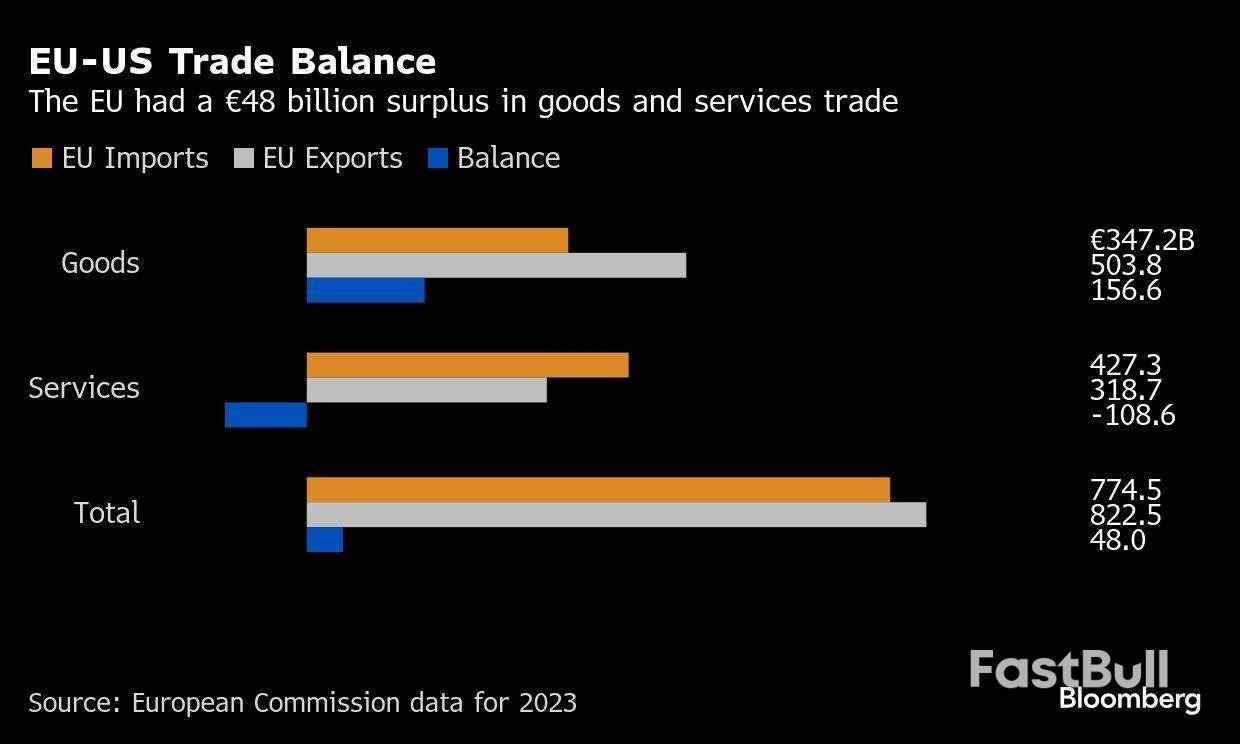

The European Union is revising its proposals for a potential trade deal with the US as the two sides move to accelerate serious negotiations, even though the Trump administration continues to provide little clarity and make demands that negotiators see as unrealistic, according to people familiar with the matter.

The new EU proposal would provide more details on ways to lower trade and non-tariff barriers, as well as boost European investments within the US and purchases of US goods, including liquefied natural gas and semiconductors for use in artificial intelligence, said the people, who asked for anonymity to discuss sensitive talks.

Despite the slow progress in direct talks, European trade ministers said the EU and US are both moving to speed up the pace of negotiations after the US reached temporary trade truces with the UK and China.

Maros Sefcovic, the EU commissioner for trade and economic security, said he spoke by phone with US Commerce Secretary Howard Lutnick on Wednesday, with further meetings between the two planned.

“We had a good phone conversation — one of many,” Sefcovic said at a press conference in Brussels, following a meeting of EU trade ministers. “We agreed that we would accelerate our work.”

EU officials said the Trump administration’s willingness to strike a deal with the UK and significantly pull down its tariffs on China temporarily are a positive sign, though they emphasized they’re prepared to move forward with retaliatory levies against the US if talks fail.

The recent deal with the UK, however, leaves in a place a new baseline tariff of 10% and potentially sectoral duties, which may not be acceptable for many EU nations.

The Swedish minister for development cooperation and foreign trade, Benjamin Dousa, said that “if the UK-US deal is what Europe gets then the US can expect countermeasures from our side,” he said. “We will not be happy with that kind of deal.”

The US has welcomed some of the options proposed by the bloc as part of a potential deal, but EU officials remain unclear about what exactly US President Donald Trump is looking for, according to people familiar with the matter. One potential stumbling block is Trump’s charge that the EU’s value-added tax is a non-tariff barrier, since EU officials are adamant that it isn’t and that the bloc’s autonomy over tax and regulations isn’t negotiable.

US President Donald Trump says he’s ready to ease sanctions on Syria. He won’t be able to do it quickly.

The American leader sat down with Syrian counterpart Ahmed Al-Sharaa in Riyadh on Wednesday — the first meeting between heads of the two countries in 25 years — after unexpectedly saying he would drop all sanctions against the war-ravaged country and even look to normalize relations.

The move was seen as a highlight of Trump’s trip to the Arabian Peninsula this week, but actual implementation will be a protracted and thorny challenge. The White House also made clear it’s not a one-way street, saying the president urged Sharaa to take steps in return, including helping to fight terrorism and agreeing ties with Israel.

US Secretary of State Marco Rubio will have to wade through layers of strict restrictions imposed on Syria over the past 45 years — covering everything from finance to energy — and met his counterpart Asaad Al-Shaibani on Thursday in Turkey.

“President Trump has made clear his cessation of sanctions is meant to help stabilize and move Syria toward peace,” National Security Council spokesman James Hewitt said in a statement. “The State Department prepared for this moment by engaging across the U.S. government and our foreign partners since the fall of the Assad regime to review options and timing on sanctions relief.”

Trump can lift sanctions issued by executive order but some will need a vote in Congress to be repealed, according to Caroline Rose, a Syria expert and research director at the Washington-based New Lines Institute.

“The road ahead with sanctions relief will be long and complicated,” she said. “There are still many sceptics to Syria normalization and sanctions relief, particularly among Republican Party members.”

Another issue is that Sharaa, Shaibani and many other members of the present Syrian government are former commanders of an Al-Qaeda-affiliated group implicated by the United Nations Security Council in war atrocities. Sharaa, who previously ran an Islamist protostate in northwest Syria, overthrew long-time former President Bashar Al-Assad in December after a rebel offensive.

“There’s a lot that needs to be done, including by the Syrian administration,” Saudi Arabia’s Foreign Minister Faisal bin Farhan told reporters Wednesday. “Syria won’t be alone — the kingdom and the rest of our international partners will be at the forefront of those supporting this effort and economic rebirth.”

One immediate boost for Sharaa’s government will come from supporter Qatar, which has US backing to begin dispersing almost $30 million a month for civil servant salaries, according to two people involved in finalizing the arrangement and two others with knowledge of the matter.

That will provide at least a start for the new Syrian administration, which is faced with an economy devastated by more than a decade of war and in need of as much as $400 billion for rebuilding costs, according to the Carnegie Endowment for International peace.

“We welcome all investors: children of the nation inside and outside, our Arab and Turkish brothers and friends from around the world,” Sharaa said in a speech on Wednesday night.

Supporters of Sharaa inside and out of Syria, including Saudi Arabia, see Trump’s move as a brave decision that isolates extremists within the Syrian leader’s Islamist-dominated administration. The move also excludes Iran, Assad’s main patron, and helps ensure China doesn’t make significant inroads.

Investment opportunities will instead fall to regional powers friendly to the US, like Saudi Arabia, Turkey and the United Arab Emirates.

“The main concern in the business community has been that we don’t want to be seen working with what has been designated as a terrorist government by the West,” said Majd Abbar, a Dubai-based Syrian-American information-technology executive, who has lobbied officials in Washington to lift sanctions and met with Sharaa multiple times.

“Now that these sanctions will be lifted, everyone is going to jump on board to invest in Syria,” he said. “It’s practically a white canvas — there’s nothing there.”

Syria, which is technically still at war with Israel, has been under myriad US sanctions since its 1979 designation by Washington as a state sponsor of terrorism.

Relations thawed in the 1990s when Damascus joined the US-led coalition that ousted Saddam Hussein from Kuwait and engaged in peace talks with Israel. But after replacing his father in 2000, Assad deepened ties with Iran and was accused by the US of supporting the insurgency in Iraq following the 2003 US-led invasion.

That triggered additional sanctions by Washington, and further rounds followed from 2011 when Assad mounted a brutal crackdown against his opponents, spawning a decade-long conflict that killed almost 500,000 people and displaced millions more. Just before his toppling in December, the US renewed the 2019 Caesar Syria Civilian Protection Act, which penalizes anyone that does business with the Syrian government except for exempted humanitarian reasons.

Before Trump’s announcement, many in his administration, such as Sebastian Gorka, were strongly opposed to removing sanctions or dealing with Sharaa, seeing him as a committed jihadist who is masking his real intentions. The State Department had demanded Sharaa’s government show progress on a number of critical issues as a precondition for the lifting of sanctions.

At their meeting in Riyadh, Trump urged Sharaa to take certain steps, according to a White House readout of the conversation, which was attended by Saudi Crown Prince Mohammed bin Salman. Those include the deportation of Palestinian militants and other foreign fighters from Syria, helping with the effort to prevent the resurgence of Islamic State and normalizing relations with Israel.

Israel was quick to intervene militarily after Assad’s ouster, launching a series of airstrikes on arms-storage sites and extending its occupied land in Syria’s southwest. It also stepped in to defend the Druze community after violent clashes between the minority group and government forces.

The country’s attitude toward Syria “is more sceptical, we are approaching matters in a slower manner,” Danny Danon, Israel’s ambassador to the United Nations, told Army Radio on Thursday. “We want to see that there really is stability in Syria, that this regime doesn’t only talk, it also takes action.”

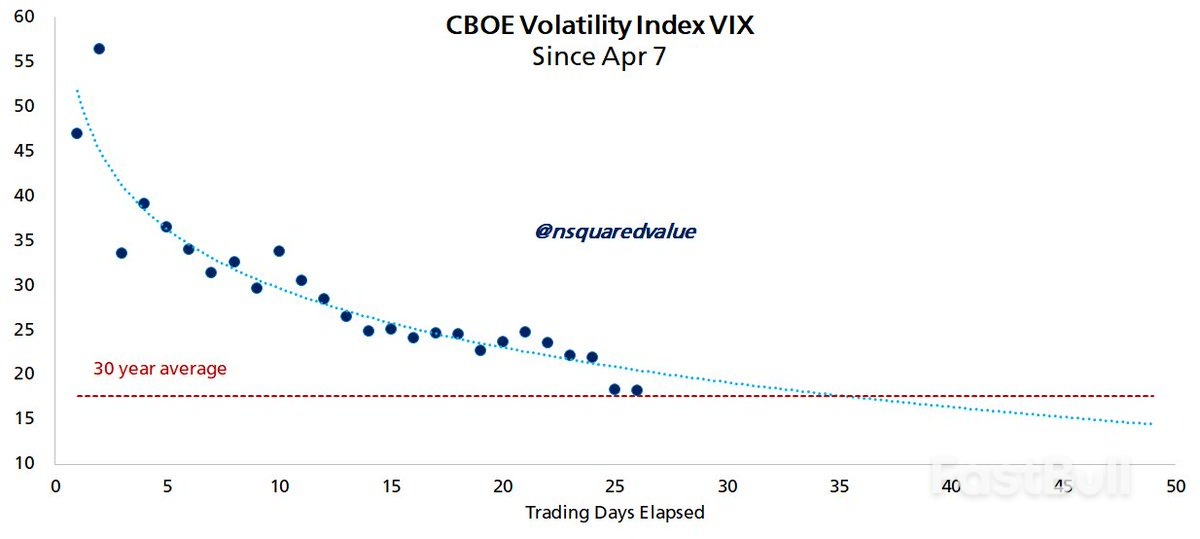

CBOE Volatility Index. Source: Timothy Peterson

CBOE Volatility Index. Source: Timothy Peterson

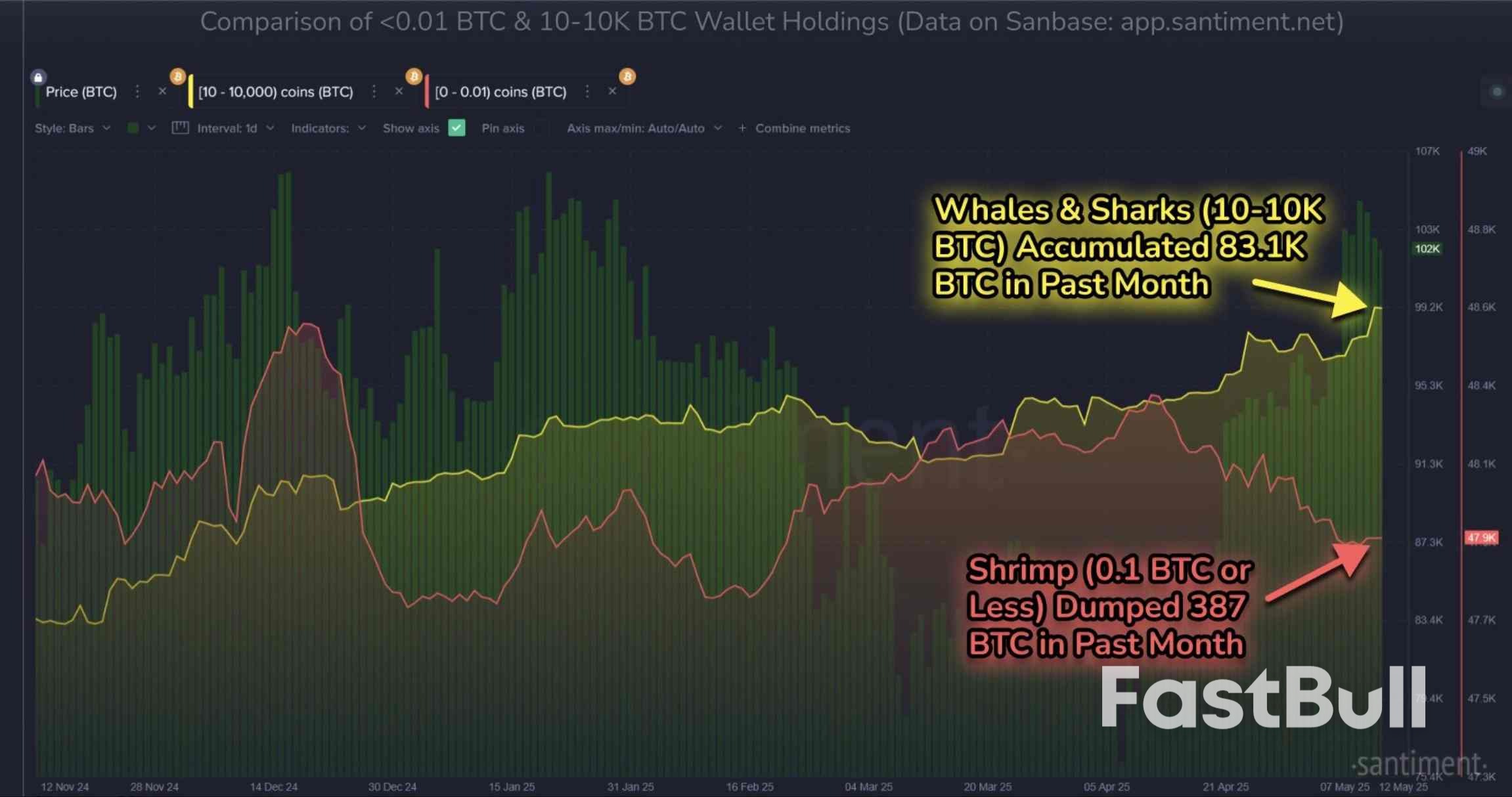

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

Source: Ted Boydston

Source: Ted Boydston

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up