Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

For the first time since September 2022, Russian President Vladimir Putin and French President Emmanuel Macron resumed direct communication in a surprise phone call on July 1, 2025...

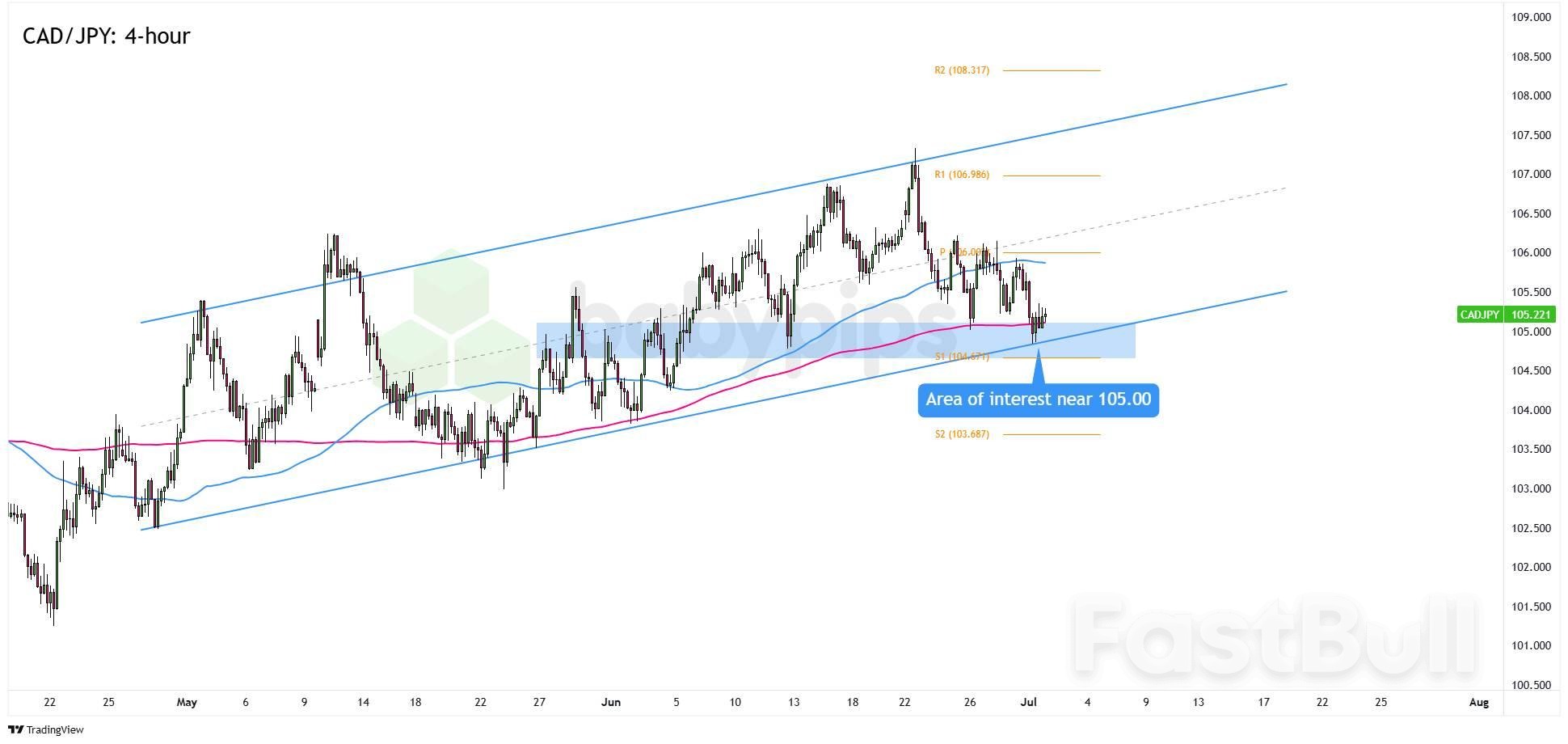

The Loonie is having trouble extending its downswings near a key support zone!

Think it means CAD/JPY is ready to extend a longer-term uptrend?

Let’s take a closer look at the 4-hour time frame!

Japanese yen traders found some support from slightly better-than-expected manufacturing surveys and comments from BOJ Governor Ueda at the ECB Forum, where he noted that underlying inflation remains below the central bank’s 2% target. Still, the yen gave back some of its weekly gains on Tuesday as geopolitical tensions and trade war concerns began to ease.

Over in Canada, a modest rebound in crude oil prices and signs of progress on a potential U.S.-Canada trade deal helped limit the Loonie’s losses, even though it remains one of the less favored major currencies when risk appetite returns.

Remember that directional biases and volatility conditions in market price are typically driven by fundamentals. If you haven’t yet done your homework on the Canadian dollar and the Japanese yen, then it’s time to check out the economic calendar and stay updated on daily fundamental news!

CAD/JPY has been slipping since hitting resistance at 107.00 last week, and is now trading near the 105.00 psychological level.

As you can see, this area lines up with the 100 SMA on the 4-hour chart, the S1(104.67) Pivot Point, and the ascending channel support that has held since May.

If the pair holds above 105.00 and prints bullish candlesticks, it could resume its longer-term uptrend. A move toward the 106.00 Pivot Point or even a retest of the 107.00 highs would be on the table.

But if downside momentum picks up and CAD/JPY breaks below the channel support, the uptrend could be in trouble. In that case, watch for a possible drop toward the 104.00 handle or the S2 Pivot Point near 103.69.

Whichever bias you end up trading, don’t forget to practice proper risk management and stay aware of top-tier catalysts that could influence overall market sentiment.

A seasonal lift for Asian equities in July may be hard to come by this year, as tariff and macroeconomic concerns dampen sentiment.

Markets are bracing for heightened volatility ahead of the July 9 deadline for countries to cut trade deals with the US. Uncertainty over the outcome of these negotiations poses a hurdle for regional shares to maintain an average return of 1.36% for July — the second-best performing month of the year — over the past decade.

Investors are “somewhat holding back on fresh allocations to emerging Asia,” said Christian Nolting, global chief investment officer at Deutsche Bank’s Private Bank. “While recent comments from high-level negotiators suggest constructive progress in ongoing talks with major Asian trading partners,” uncertainties remain high, given that trade disputes during US President Donald Trump’s first term lasted one and a half years, he added.

While the MSCI Asia Pacific Index has gained for three consecutive months through June, a potential return of “Liberation Day” tariff rates could send shares plunging in a similar way they did in early April.

Trump ruled out delaying the July 9 deadline for imposing higher levies on trading partners and renewed threats to hike tariffs on Japan. That saw Japanese shares leading losses in Asia early on Wednesday, with the Nikkei 225 down about 1%.

Even if trade deals materialise, some levels of tariffs are likely to stay. That would be a drag on the region’s export-led economies. A number of central banks in Asia have lowered their growth outlooks for the year. Meanwhile, elevated US interest rates may curb the scope for Asian central banks to further lower borrowing costs.

“The third quarter looks to have lots of dangerous potholes, with higher inflation and the prospect of slower growth,” said Gary Dugan, chief executive officer of the Global CIO Office. “We are not so convinced [that] the US Federal Reserve (Fed) will have sufficient reasons to cut rates at the pace the market prices.”

To be sure, a milder-than-expected tariff outcome and more dovish signalling from the Fed may encourage flows into the region. Current positioning in Asian assets leaves room for upside, said Gary Tan, a portfolio manager at Allspring Global Investments.

The US central bank has refrained from cutting interest rates this year, as it assesses the impact of Trump’s tariffs on inflation. The Trump administration though, has been applying pressure to lower borrowing costs, and two Fed governors in recent days have said a cut could be appropriate as soon as July.

The MSCI Asia Pacific gauge has risen 12% so far this year, outperforming the US, with shares in South Korea and Hong Kong seeing renewed interest. Still, some markets in Southeast Asia, where countries were hit with among the highest tariff rates, remain under pressure.

“We continue to expect choppy markets over the summer,” Nomura Holdings Inc strategists, including Chetan Seth, wrote in a recent note. “We recommend [that] investors focus on stock selection and on idiosyncratic themes that provide insulation from policy uncertainty and ones that offer better visibility.”

Bitcoin prices faced a correction on July 2, 2025, fueled by announced tariff measures from President Donald Trump, influencing market sentiments and trading activity on Indonesian exchange Tokocrypto.

This event highlights the enduring impact of geopolitical factors on cryptocurrency markets, with immediate market reactions suggesting increased volatility and strategic adaptability from exchanges like Tokocrypto.

On July 2, 2025, Bitcoin's price experienced a notable correction driven by tariffs announced by Donald Trump. Tokocrypto, Indonesia's prominent exchange, remains pivotal in managing the dynamics caused by such macroeconomic influences.

Tokocrypto's market leadership, underscored by its acquisition by Binance, highlights its role in the cryptocurrency exchange ecosystem in Indonesia. It now serves over 1.5 million users, holding a significant national market share.

Bitcoin's correction has sparked discussions about the exchange's strategic positioning to handle such market fluctuations. Traders and analysts watch for changes across other cryptocurrencies affected by broader market sentiments.

Historically, geopolitical changes like tariffs influence Bitcoin and Ethereum significantly. Such events might increase volatility on platforms aligned with asset diversification, as evidenced by Tokocrypto's recent expansion efforts in trading pairs.

Similar historical events, such as trade tensions, often lead to corrections in Bitcoin prices, affecting the wider crypto market landscape. Layer 1 assets like BTC and ETH historically react to these catalysts.

Expert analysis from Kanalcoin suggests potential outcomes influenced by historical trends. Tokocrypto's resilience is noted, supported by its comprehensive asset offerings designed to offset short-term disturbances.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up