Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

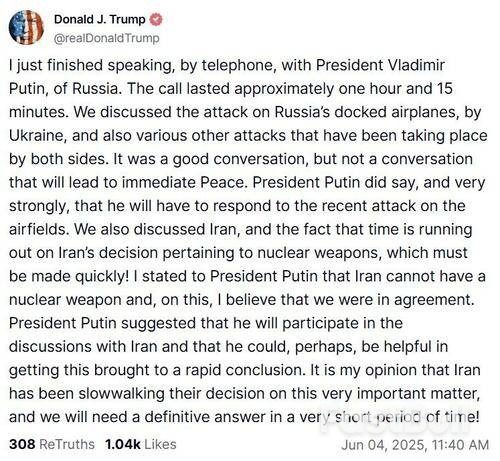

The war in Ukraine is intensifying after nearly four months of cajoling and threats to both Moscow and Kyiv from Trump, who says he wants peace after more than three years of the deadliest conflict in Europe.

After two days of deafening silence from the White House on Ukraine's Sunday massive drone assault, dubbed 'Operation Spider's Web' - which took out many key Russian aircraft, including long-range strategic bombers and likely even Russia's extremely rare A-50 Radar Plane - President Trump has finally reacted publicly.

The president revealed he has held a phone call with President Vladimir Putin on Wednesday, which significantly lasted about an hour and fifteen minutes. Trump warned that peace is not very close on the horizon and that the two leaders covered several pressing issues in their conversation.

"We discussed the attack on Russia’s docked airplanes, by Ukraine, and also various other attacks that have been taking place by both sides." Trump went on to call it a good conversation, however "not a conversation that will lead to immediate Peace."

That's when Trump clarified that "President Putin did say, and very strongly, that he will have to respond to the recent attack on the airfields."

The Russian leader's words are consistent with Dmitry Medvedev's ominous words issued the day prior, wherein the deputy chairman of Russia’s Security Council, said "retribution is inevitable". Medvedev had warned of what's coming:

"Our Army is pushing forward and will continue to advance. Everything that needs to be blown up will be blown up, and those who must be eliminated will be."

Below: Ukraine on Wednesday released additional footage of strikes on four Russian air fields, including on two A-50 aircraft in Ivanovo...

Trump didn't reveal much further in the way of details, after the White House in a Tuesday briefing again affirmed that President Trump did not have foreknowledge of the Ukrainian cross-border operation. (But did US intelligence? very likely so.)

The fresh Truth Social statement was further taken up with Iran. "I stated to President Putin that Iran cannot have a nuclear weapon and, on this, I believe that we were in agreement. President Putin suggested that he will participate in the discussions with Iran and that he could, perhaps, be helpful in getting this brought to a rapid conclusion," he wrote.

The US President concluded, "It is my opinion that Iran has been slowwalking their decision on this very important matter, and we will need a definitive answer in a very short period of time!"

The full statement:

This comes after the Ayatollah dismissed the latest US proposal which was submitted over the weekend. The central issue is the US demand that uranium enrichment be taken down to zero.

Whether Iran, Ukraine-Russia, or Gaza - conservative voices have been urging Trump to stand by his campaign promises to end conflicts in hotspots around the world. But the fact remains that the US is still funding and weaponizing one side of these various wars, especially in the case of Ukraine.

Of note in Trump's phone call with Putin is that nothing was stated from Trump in the way of a US demand that Putin not retaliate against Ukraine (or at least which was not disclosed in his Truth Social post).

The absence of a preemptive condemnation for any major retaliation is interesting also combined with the White House Press Secretary saying yesterday to reporters that the war is very far away, which suggests it's no longer a top administration priority.

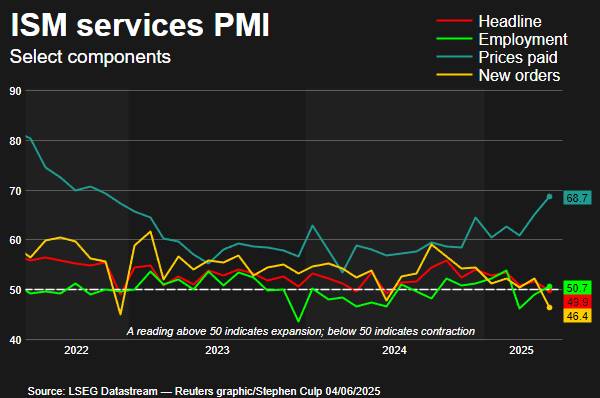

The U.S. services sector contracted for the first time in nearly a year in May while businesses paid higher prices for inputs, a reminder that the economy remains in danger of experiencing a period of very slow growth and high inflation.

The survey from the Institute for Supply Management (ISM) on Wednesday showed uncertainty was the dominant theme among businesses as they tried to navigate President Donald Trump's constantly shifting trade policy.

The whiplash from the tariffs that Trump has announced, paused, and imposed has left most businesses in limbo and struggling to plan ahead, to the detriment of the economy. The Trump administration has given U.S. trading partners until Wednesday to make their "best offers" to avoid other punishing import levies from taking effect in early July.

"Until there is clarity on the trading environment, it appears that the business sector will remain wary of putting money to work," said James Knightley, chief international economist at ING.

The ISM said its nonmanufacturing purchasing managers index (PMI) dropped to 49.9 last month, the first decline below the 50 mark and lowest reading since June 2024. It stood at 51.6 in April.

Economists polled by Reuters had forecast the services PMI would rise to 52.0 following some easing in the U.S.-China trade tensions. A PMI reading below 50 indicates contraction in the services sector, which accounts for more than two-thirds of the economy. The ISM associates a PMI reading above 48.6 over time with growth in the overall economy.

"May's PMI level is not indicative of a severe contraction, but rather uncertainty," said Steve Miller, chair of the ISM Services Business Survey Committee. "Respondents continued to report difficulty in forecasting and planning due to longer-term tariff uncertainty and frequently cited efforts to delay or minimize ordering until impacts become clearer."

The ISM on Monday reported that manufacturing contracted for a third straight month in May, with suppliers taking the longest time in nearly three years to deliver inputs amid tariffs.

Retailers, airlines and auto manufacturers are among the businesses that have either withdrawn or refrained from giving financial guidance for 2025. While economists do not expect a recession this year, stagflation is on the radar of many.

Public administration, utilities, educational services, information as well as healthcare and social assistance were among the 10 services industries reporting growth. Eight industries, including retail trade, construction, transportation and warehousing, reported contraction.

Businesses in the construction industry said "tariff variability has thrown residential construction supply chains into chaos," adding that "major heating, ventilation and air conditioning equipment manufacturers are passing on their cost increases due to higher refrigerant and steel commodity prices."

They also noted that "planning is difficult for community projects that could be scheduled for the next 22 to 30 months."

Trump on Tuesday doubled steel and aluminium duties to 50%. Businesses in the information sector said tariffs were a challenge "as it is not clear what duties apply," adding "the best plan is still to delay decisions to purchase where possible." Transportation and warehousing businesses said the import duties had "increased the cost of doing business."

The White House's unprecedented campaign to slash spending also impacted purchasing decisions by companies in the healthcare and social assistance industry. But tariffs are boosting demand for retailers as some customers pull purchases forward to avoid higher prices. Demand for data centers was driving activity for businesses in the utility industry.

Stocks on Wall Street were largely flat. The dollar eased against a basket of currencies. U.S. Treasury yields fell.

The ISM survey's new orders measure dropped to 46.4, the lowest reading in nearly 2-1/2 years, from 52.3 in April, likely as the boost from front-running related to tariffs faded. Data on Tuesday showed the new light vehicle sales rate slumped in May by the most in about five years.

Services sector customers viewed their inventory as too high in relation to business requirements, which does not bode well for activity in the near term. Backlog orders were the lowest in nearly two years.

Suppliers' delivery performance continued to worsen. This, together with lengthening delivery times at factories, points to strained supply chains that could drive inflation higher through shortages. Businesses are also seeking to pass on tariffs, which are a tax, to consumers.

That effort was corroborated by a report from the New York Federal Reserve showing the majority of businesses in its district said they had passed on at least some of the tariffs in the form of higher prices in May. Companies also flagged considerable confusion and uncertainty in navigating the duties.

The ISM survey's supplier deliveries index for the services sector rose to 52.5 from 51.3 in April. A reading above 50 indicates slower deliveries. A lengthening in suppliers' delivery times is normally associated with a strong economy. Delivery times are, however, likely getting longer because of supply-chain bottlenecks.

That situation was reinforced by a surge in the survey's measure of prices paid for services inputs to 68.7, the highest level since November 2022, from 65.1 in April. Most economists anticipate the tariff hit to inflation and employment could become evident in the so-called hard economic data by this summer.

Services sector employment picked up. The survey's measure of services employment rose to 50.7 from 49.0 in April. Some companies said "higher scrutiny is being placed on all jobs that need to be filled." The index is generally consistent with a steadily cooling labor market.

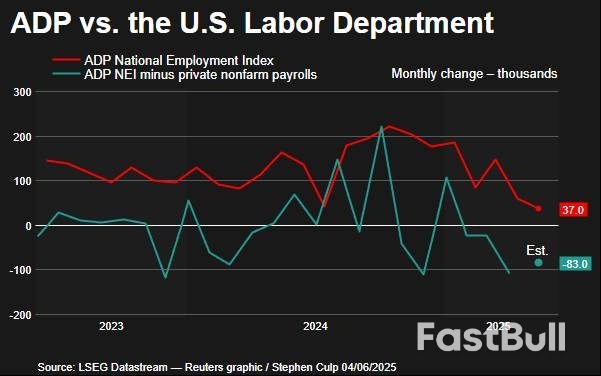

Economists shrugged off the release on Wednesday of the ADP National Employment Report, which showed private payrolls increased by only 37,000 jobs in May, the smallest gain since March 2023, after a rise of 60,000 in April. They noted ADP had a poor record predicting the government's closely watched employment report.

The government is expected to report on Friday that nonfarm payrolls increased by 130,000 jobs in May after advancing by 177,000 in April, a Reuters survey of economists showed. The unemployment rate is forecast to hold steady at 4.2%.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up