Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Cleveland Fed CPI MoM (SA) (Nov)

U.S. Cleveland Fed CPI MoM (SA) (Nov)A:--

F: --

P: --

U.S. Kansas Fed Manufacturing Composite Index (Dec)

U.S. Kansas Fed Manufacturing Composite Index (Dec)A:--

F: --

P: --

Mexico Policy Interest Rate

Mexico Policy Interest RateA:--

F: --

P: --

Argentina Trade Balance (Nov)

Argentina Trade Balance (Nov)A:--

F: --

P: --

Argentina Unemployment Rate (Q3)

Argentina Unemployment Rate (Q3)A:--

F: --

P: --

South Korea PPI MoM (Nov)

South Korea PPI MoM (Nov)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan National CPI MoM (Not SA) (Nov)

Japan National CPI MoM (Not SA) (Nov)A:--

F: --

P: --

Japan CPI MoM (Nov)

Japan CPI MoM (Nov)A:--

F: --

P: --

Japan National Core CPI YoY (Nov)

Japan National Core CPI YoY (Nov)A:--

F: --

P: --

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)

Japan CPI YoY (Excl. Fresh Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI MoM (Excl. Food & Energy) (Nov)

Japan National CPI MoM (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Excl. Food & Energy) (Nov)

Japan National CPI YoY (Excl. Food & Energy) (Nov)A:--

F: --

P: --

Japan National CPI YoY (Nov)

Japan National CPI YoY (Nov)A:--

F: --

P: --

Japan National CPI MoM (Nov)

Japan National CPI MoM (Nov)A:--

F: --

P: --

U.K. GfK Consumer Confidence Index (Dec)

U.K. GfK Consumer Confidence Index (Dec)A:--

F: --

P: --

Japan Benchmark Interest Rate

Japan Benchmark Interest RateA:--

F: --

P: --

BOJ Monetary Policy Statement

BOJ Monetary Policy Statement Australia Commodity Price YoY

Australia Commodity Price YoYA:--

F: --

P: --

BOJ Press Conference

BOJ Press Conference Turkey Consumer Confidence Index (Dec)

Turkey Consumer Confidence Index (Dec)A:--

F: --

P: --

U.K. Retail Sales YoY (SA) (Nov)

U.K. Retail Sales YoY (SA) (Nov)A:--

F: --

U.K. Core Retail Sales YoY (SA) (Nov)

U.K. Core Retail Sales YoY (SA) (Nov)A:--

F: --

Germany PPI YoY (Nov)

Germany PPI YoY (Nov)A:--

F: --

P: --

Germany PPI MoM (Nov)

Germany PPI MoM (Nov)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Jan)

Germany GfK Consumer Confidence Index (SA) (Jan)A:--

F: --

U.K. Retail Sales MoM (SA) (Nov)

U.K. Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

France PPI MoM (Nov)

France PPI MoM (Nov)A:--

F: --

P: --

Euro Zone Current Account (Not SA) (Oct)

Euro Zone Current Account (Not SA) (Oct)A:--

F: --

P: --

Euro Zone Current Account (SA) (Oct)

Euro Zone Current Account (SA) (Oct)A:--

F: --

P: --

Russia Key Rate

Russia Key Rate--

F: --

P: --

U.K. CBI Distributive Trades (Dec)

U.K. CBI Distributive Trades (Dec)--

F: --

P: --

U.K. CBI Retail Sales Expectations Index (Dec)

U.K. CBI Retail Sales Expectations Index (Dec)--

F: --

P: --

Brazil Current Account (Nov)

Brazil Current Account (Nov)--

F: --

P: --

Canada Retail Sales MoM (SA) (Oct)

Canada Retail Sales MoM (SA) (Oct)--

F: --

P: --

Canada New Housing Price Index MoM (Nov)

Canada New Housing Price Index MoM (Nov)--

F: --

P: --

Canada Core Retail Sales MoM (SA) (Oct)

Canada Core Retail Sales MoM (SA) (Oct)--

F: --

P: --

U.S. Existing Home Sales Annualized MoM (Nov)

U.S. Existing Home Sales Annualized MoM (Nov)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Final (Dec)

U.S. UMich Consumer Sentiment Index Final (Dec)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Oct)

U.S. Dallas Fed PCE Price Index YoY (Oct)--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Nov)

U.S. Conference Board Employment Trends Index (SA) (Nov)--

F: --

P: --

Euro Zone Consumer Confidence Index Prelim (Dec)

Euro Zone Consumer Confidence Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Final (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Final (Dec)

U.S. UMich Consumer Expectations Index Final (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Final (Dec)

U.S. UMich Current Economic Conditions Index Final (Dec)--

F: --

P: --

U.S. Existing Home Sales Annualized Total (Nov)

U.S. Existing Home Sales Annualized Total (Nov)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)--

F: --

P: --

China, Mainland 5-Year Loan Prime Rate

China, Mainland 5-Year Loan Prime Rate--

F: --

P: --

China, Mainland 1-Year Loan Prime Rate (LPR)

China, Mainland 1-Year Loan Prime Rate (LPR)--

F: --

P: --

U.K. Current Account (Q3)

U.K. Current Account (Q3)--

F: --

P: --

U.K. GDP Final YoY (Q3)

U.K. GDP Final YoY (Q3)--

F: --

P: --

U.K. GDP Final QoQ (Q3)

U.K. GDP Final QoQ (Q3)--

F: --

P: --

Italy PPI YoY (Nov)

Italy PPI YoY (Nov)--

F: --

P: --

Mexico Economic Activity Index YoY (Oct)

Mexico Economic Activity Index YoY (Oct)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Industrial Product Price Index YoY (Nov)

Canada Industrial Product Price Index YoY (Nov)--

F: --

P: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)--

F: --

P: --

Canada Industrial Product Price Index MoM (Nov)

Canada Industrial Product Price Index MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices declined on Friday and were on track for a second consecutive weekly loss, driven by increasing optimism over a potential Russia-Ukraine peace deal and ambiguity surrounding U.S. enforcement of sanctions on Venezuelan oil tankers....

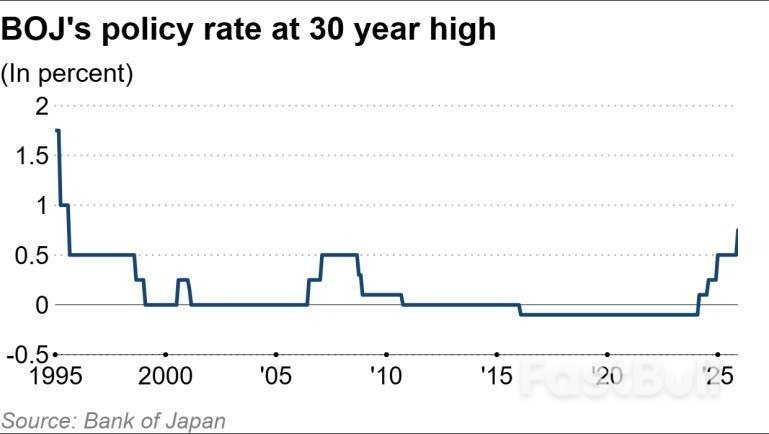

The Bank of Japan on Friday went ahead with the interest rate increase it had been foreshadowing, its first such move in 11 months and one that was made easier by wage growth momentum and receding uncertainty surrounding the impact of U.S. tariffs.

Following a two-day board meeting, the central bank announced that it will bump up its policy rate, an uncollateralized overnight call rate, by 25 basis points to 0.75%. This will be the BOJ's fourth interest rate increase since it exited from negative rates in March 2024.

The bank last hiked rates in January but then put its normalization cycle on pause due to U.S. President Donald Trump's tariff onslaught. Since then, Tokyo and Washington have reached a deal on tariffs, easing anxiety over policy uncertainty.

Board members have been laying the groundwork for a hike. Earlier this month, Gov. Kazuo Ueda hinted that an increase was on the table. At the BOJ's last meeting in October, two of the nine board members suggested a rate increase.

The BOJ's latest Tankan survey, released on Monday, reflected improving business sentiment among large manufacturers, in part thanks to the weak yen.

Wage-growth momentum has been another key measure Ueda has focused on. Positive signs in nominal wage growth -- major unions are preparing to demand a pay raise next fiscal year -- and a tight labor market supported the BOJ's decision to hike rates.

The market largely predicted the BOJ would move ahead with an increase. Data from Totan Research and Totan ICAP as of Thursday put the implied probability of a December rate hike at 97%.

The BOJ's decision comes after the U.S. Federal Reserve last week lowered interest rates for the third time this year.

All eyes are now on BOJ chief Ueda's press conference this afternoon. Market watchers will pay close attention to any comments that might indicate whether the board feels the terminally weak yen calls for the bank to speed up its rate hike cycle.

European Union leaders decided on Friday to borrow cash to fund Ukraine's defence against Russia rather than use frozen Russian assets, diplomats said.

"We have a deal. Decision to provide 90 billion euros of support to Ukraine for 2026-27 approved," EU summit chairman Antonio Costa posted on social media in the early hours of Friday morning after hours of talks.

Costa did not specify the source of the funding but a draft text of the summit's conclusions, seen by Reuters, said it would come from borrowing on capital markets, secured against the EU budget.

The deal will not affect the financial obligations of Hungary, Slovakia and the Czech Republic, which did not want to contribute to the financing of Ukraine, the text said.

At the same time, EU governments and the European Parliament would continue working on setting up a loan for Ukraine that would be based on the frozen Russian central bank assets, it said.

The loan to Ukraine based on the joint borrowing would only be repaid by Ukraine once it receives war reparations from Moscow. Until then, the Russian assets would remain immobilised and the EU reserved the right to use them to repay the loan, according to the text.

"It's good in the sense that Ukraine will secure funding for 2 years," one EU diplomat said.

The move follows hours of discussions among leaders on the technical details of a loan based on the frozen Russian assets, which turned out to be too complex or politically demanding to sort out at this stage, diplomats said.

"We have gone from saving Ukraine, to saving face, at least that of those who have been pushing for the use of the frozen assets," a second EU diplomat said.

The main difficulty in the use of the Russian money was providing Belgium, where 185 billion of the total 210 billion euros of Russian assets in Europe are held, with sufficient guarantees against financial and legal risks from potential Russian retaliation for the release of the money to Ukraine.

The EU sees Russia's war as a threat to its own security and wants to keep Ukraine financed and fighting.

With public finances across the EU already strained by high debt levels, the European Commission had proposed using frozen Russian central bank assets to secure a huge loan of 90 billion euros to Kyiv, with joint borrowing against the EU budget as a second option.

The joint borrowing was difficult because it requires unanimity. Moscow-friendly Hungary had said it would oppose it, just as it opposed the use of Russian assets.

But Hungarian Prime Minister Viktor Orban appeared to have agreed not to block the borrowing as long as his country, Slovakia and the Czech Republic were excluded from the guarantees for the debt.

"Orban got what he wanted: no reparation loan. And EU action without participation of Hungary, Czech Republic and Slovakia," a third EU diplomat said.

Several EU leaders arriving at the summit said it was imperative they find a solution to keep Ukraine financed and fighting for the next two years. They were also keen to show European countries' strength and resolve after U.S. President Donald Trump last week called them "weak".

"We just can't afford to fail," EU foreign policy chief Kaja Kallas said.

Ukrainian President Volodymyr Zelenskiy, who took part in the summit, urged the bloc to agree to use the Russian assets to provide the funds he said would allow Ukraine to keep fighting.

"The decision now on the table – the decision to fully use Russian assets to defend against Russian aggression – is one of the clearest and most morally justified decisions that could ever be made," he said.

Belgian Prime Minister Bart De Wever told his country's parliament early on Thursday that he had not yet seen guarantees that answered his concerns on legal and liquidity risks for Belgium to agree to the use of the Russian assets.

Russia's central bank has said the EU plans to use its assets are illegal. It filed a lawsuit in Moscow this week seeking $230 billion in damages from clearing house Euroclear.

The stakes for finding money for Kyiv are high because without the EU's financial help Ukraine will run out of money in the second quarter of next year and most likely lose the war to Russia, which the EU fears would bring closer the threat of Russian aggression against the bloc.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up