Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Japan Chief Cabinet Secretary Kihara: United Arab Emirates Notified Japan That United Arab Emirates President's State Visit To Japan Will Be Delayed From Originally Scheduled Feb 8

[Bitcoin Surges Past $79,000] February 3Rd, According To Htx Market Data, Bitcoin Broke Through $79,000 With A 24-Hour Gain Of 1.52%

Korea Exchange Activates Sidecar On KOSPI After KOSPI 200 Futures Rise 5%, Programme Trading Halted For 5 Mins

Spot Gold Rose Above $4,800 Per Ounce, Up $130 On The Day; Spot Silver Is Currently Up 5.11% At $83.3 Per Ounce

Japan Finance Minister Katayama: If Necessary, Appropriate Action Will Be Taken In The Foreign Exchange Market

Japan Finance Minister Katayama: Expecting Excess Of 4.5 Trillion Yen From Currency Reserves In This Fiscal Year

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

"it would be nicer to do it without warfare, without people dying, it’s so much nicer to do it."

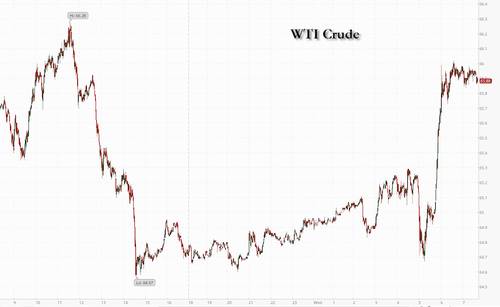

The NY Post has published a new Trump interview focused on apparently stalled Iran nuclear deal efforts which resulted in a surge in oil prices.

The President said in the interview he's getting "less confident" about ongoing nuclear negotiations with Iran, soon after which oil rose as well as benchmark treasury yields and gold, as investors weigh the possibility of US-Iran nuclear talks falling apart.

Trump was asked whether he thinks the Islamic Republic will agree to shut down its nuclear program. "I don’t know. I did think so, and I’m getting more and more — less confident about it," he responded.

"They seem to be delaying, and I think that’s a shame, but I’m less confident now than I would have been a couple of months ago," Trump continued. "Something happened to them, but I am much less confident of a deal being made."

Then the question was raised by the Post, "what happens then?" To which Trump responded:

“Well, if they don’t make a deal, they’re not going to have a nuclear weapon,” Trump answered. “If they do make a deal, they’re not going have a nuclear weapon, too, you know? But they’re not going a have a new nuclear weapon, so it’s not going to matter from that standpoint.

“But it would be nicer to do it without warfare, without people dying, it’s so much nicer to do it. But I don’t think I see the same level of enthusiasm for them to make a deal. I think they would make a mistake, but we’ll see. I guess time will tell.”

On the question of China's influence on Tehran, Trump described, "I just think maybe they don’t want to make a deal. What can I say?” he said. “And maybe they do. So what does that mean? There’s nothing final."

Via AFP

Via AFPOn Tuesday Trump acknowledged in a Fox News interview that Iran is becoming "much more aggressive" in these negotiations. And the day prior he had told reporters that the Iranians are "tough negotiators" and sought to clarify that he would not allow Tehran to enrich uranium on its soil, after some recent contradictory reports suggested the White House had backed off this demand.

Washington is awaiting a formal response from the Islamic Republic, which is expected to submit a counter-proposal in the coming days, just ahead of an expected sixth round of indirect talks with the US in Muscat, Oman, slated for Sunday, June 15.

More geopolitical headlines via Newsquawk:

Headline CPI rose 2.4% YoY last month, a modest uptick from April, but in line with expectations, while core prices rose 2.8% YoY over the same period, 0.1pp cooler than consensus, and unchanged from last time out. In addition, the so-called ‘supercore' inflation metric, aka core services less housing, rose 2.9% YoY, a notable rise from the 2.7% YoY prior, bucking the trend of coolness elsewhere.

Meanwhile, on an MoM basis, both headline and core prices rose just 0.1% MoM, both also considerably cooler than had been expected, with the expected price pressures from tariff pass-through thus far elusive.

As is usually the case, annualising this data helps to provide a clearer picture of underlying inflationary trends, and the broader backdrop:

•3-month annualised CPI: 1.0% (prior 1.6%)

•6-month annualised CPI: 2.6% (prior 3.0%)

•3-month annualised core CPI: 1.7% (prior 2.1%)

•6-month annualised core CPI: 2.6% (prior 3.0%)

The details of the CPI report, though, are of considerably more importance this time around than the headline metrics, as participants and policymakers alike continue to try and gauge the degree to which tariffs are being passed on to consumers in the form of higher prices. On that note, and again contrary to expectations, the pace of core goods inflation remained subdued, at just 0.3% YoY, while core services prices rose 3.6% YoY, unchanged from last time out.

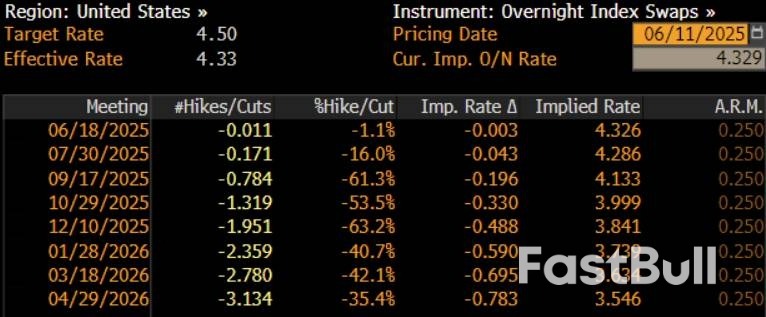

As the data was digested, money markets repriced marginally in a dovish direction, once again fully discounting two 25bp cuts by year-end, up from around 44bp pre-release.

Taking a step back, the May CPI figures reinforce the FOMC's ongoing ‘wait and see' approach, and shan't significantly alter the monetary policy outlook. Despite being cooler than consensus, upside inflation risks from tariffs clearly remain.

Policymakers, hence, will remain on the sidelines for the time being, seeking to ‘buy time' in order to assess the impacts of the tariffs which have been imposed, and how this alters the balance of risks to each side of the dual mandate. Concurrently, the Committee are also attempting to ensure that inflation expectations remain well-anchored, despite the trade-induced ‘hump' in inflation that we are now likely to see through to the end of summer.

Overall, Powell & Co. seem highly unlikely to deliver any rate cuts before the fourth quarter, with just one 25bp cut in December my base case, even if the direction of travel for rates clearly remains to the downside. Next week's FOMC is unlikely to ‘rock the boat' especially much, merely being a ‘placeholder' as policymakers continue to stand pat for the time being.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up