Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices rose sharply in early Asian trade on Thursday after U.S. President Donald Trump announced sanctions on Russia's largest oil companies, a move that stands to potentially crimp global supplies.

Oil prices rose sharply in early Asian trade on Thursday after U.S. President Donald Trump announced sanctions on Russia's largest oil companies, a move that stands to potentially crimp global supplies.

The development helped crude prices recover further from five-month lows hit earlier this week, with positive U.S. inventory data also providing support.

Brent oil futures for December jumped as much as 3% to $64.44 a barrel, while West Texas Intermediate crude futures rose 3% to $60.26 a barrel.

Trump's Treasury Department on Wednesday unveiled sanctions against Lukoil and Rosneft, Russia's two biggest oil companies, and called for an immediate ceasefire with Ukraine.

Treasury Secretary Scott Bessent said the companies funded "the Kremlin's war machine," and that the Treasury was prepared to take more action against Moscow.

The sanctions now stand to block a chunk of global oil supplies, and helped ease concerns over a looming supply glut.

Wednesday's announcement also marks a pivot in Trump's stance on Russia, who had so far not imposed any direct sanctions on the country in his second term. Trump had earlier this year attempted to pressure major buyers of Russian oil– India and China– and had slapped steep trade tariffs on New Delhi over its purchases of Russian oil.

Any more sanctions against Russia or its trading partners could further support oil prices. Recent reports said India was displaying some willingness to end its Russian oil buying, and could seek crude from other sources.

Separately, the European Union also imposed fresh sanctions on Russia, targeting Moscow's shadow fleet of tankers while also banning all Russian liquefied natural gas imports.

Oil prices recovered from five-month lows hit earlier this week after data showed U.S. inventories unexpectedly shrank in the week to October 17.

Inventories shrank by 0.96 million barrels, against expectations for a 2.2 million barrel build. Draws in gasoline and distillate stockpiles also helped spur some optimism over demand in the world's largest fuel consumer.

Markets are now seeking more cues on the U.S. economy from key consumer inflation data for September, which is due on Friday.

Concerns over the U.S. economy and fuel demand were a key weight on oil prices in recent weeks.

China is pushing ahead with imports of US-sanctioned Russian liquefied natural gas, after the White House stopped short of putting additional restrictions on the trade in its latest wave of sanctions.The Iris vessel, carrying a shipment from the blacklisted Arctic LNG 2 facility in Russia, is on its way to the Beihai import terminal in southern China, according to ship-tracking data compiled by Bloomberg. This will be China's 11th shipment of restricted Russian LNG since late-August.

The move comes after US President Donald Trump ramped up pressure on Russia by blacklisting state-run oil giants Rosneft PJSC and Lukoil PJSC, citing Moscow's lack of commitment to Ukrainian peace. However, the White House hasn't yet hit companies circumventing sanctions on LNG — a growing source of revenue for Moscow, which aims to triple exports of the superchilled fuel by 2030.The lack of new restrictions on Russian LNG is notable, given that the UK slapped sanctions on Beihai last week. Meanwhile, European Union nations have reached an agreement on a new package of sanctions aimed at Russia that will target 45 entities, including 12 companies in China and Hong Kong.

China had designated Beihai as the sole entry point for shipments from Arctic LNG 2 — a Russian project already sanctioned by the US in 2023. Arctic LNG 2 started delivering the blacklisted fuel to the Asian nation in late August, a move that coincided with a visit to Beijing by Russian President Vladimir Putin.The Iris vessel loaded an LNG shipment from a floating storage unit in eastern Russia in early October, according to ship-tracking data. The fuel in storage was sourced from the Arctic LNG 2 project. The storage facility and Iris have both been previously sanctioned by the US.

At least three more vessels carrying blacklisted Russian LNG are heading to the Beihai terminal, ship data shows. Satellite images taken on Oct. 18 showed an LNG tanker registered to a Hong Kong-based company receiving fuel from a sanctioned Russian tanker near Malaysia.

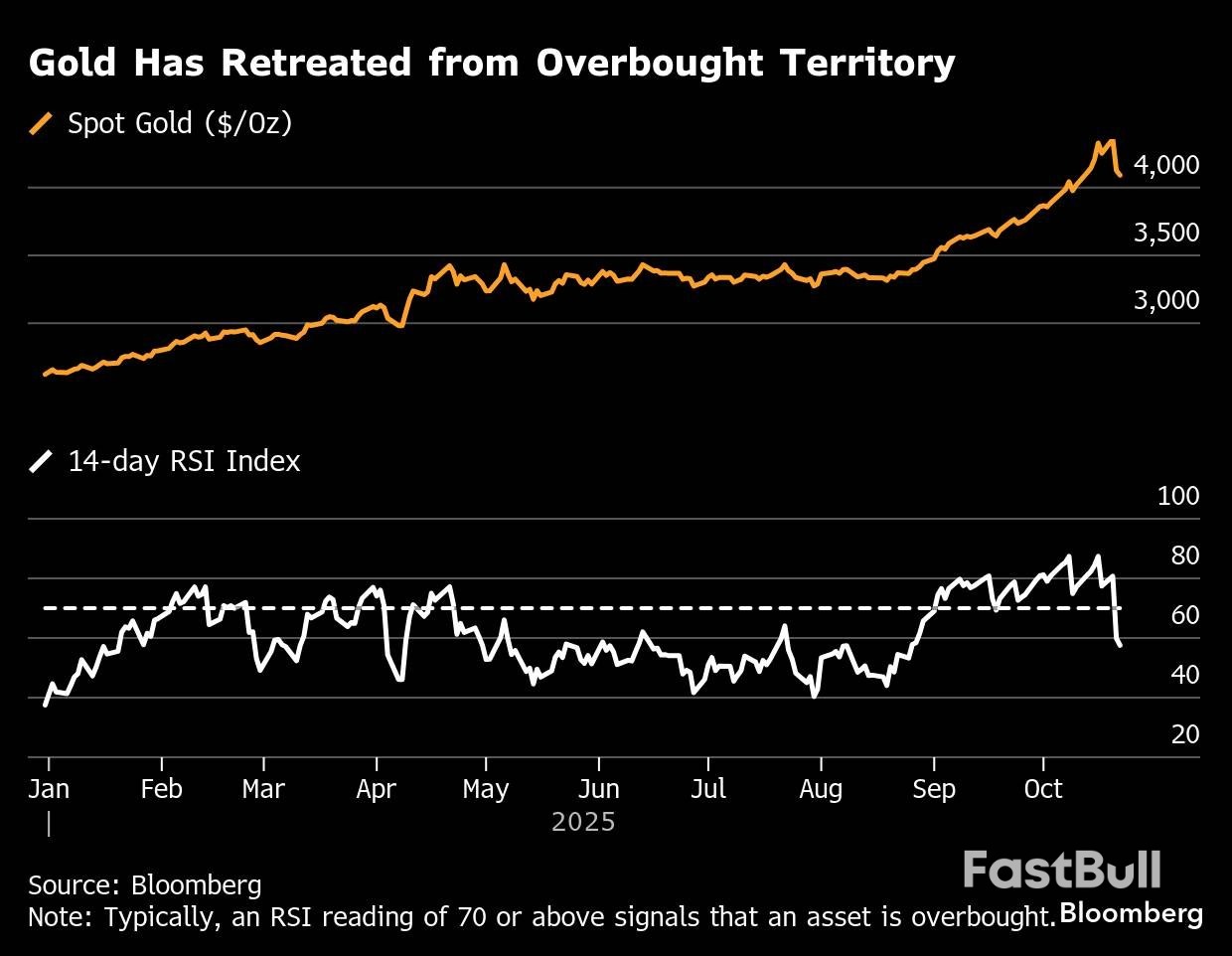

Gold declined for a third day, edging back in the direction of $4,000 an ounce on concerns a prolonged rally has become overheated.

Spot gold slipped to around $4,090 an ounce in early Asian trading on Thursday, reinforcing a technical reset, while investors also weighed the prospects for a US-China trade deal to relieve some of the geopolitical tensions that have bolstered demand for haven assets. The metal has dropped nearly 6% in the last two sessions from a record high.

Technical indicators have shown that the rally was likely overstretched, with this week's pullback taking some heat out of the market. The so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits, has been a driver of gold's growth since mid-August.

Gold is still up about 55% this year, with prices also supported in recent weeks by bets the Federal Reserve will make at least one quarter-point cut by the end of the year.

"After an overstretched rally, gold is behaving like an elastic band that's been pulled too far and is now snapping back hard," said Hebe Chen, an analyst at brokerage Vantage Global Prime Pty Ltd. "Prices holding firm above the $4,000 mark point to a technical reset rather than a fundamental shift, with safe-haven demand and the 'debasement trade' still very much intact."

Traders are also watching potential progress in talks between the US and China following a recent resurgence in tensions between the world's two largest economies. US President Donald Trump on Tuesday predicted an upcoming meeting with Chinese President Xi Jinping would yield a "good deal" on trade – while also conceding that the talks may not happen.

"Markets are taking a balanced stance toward the trade and geopolitical noise — cautious, yet grounded in a realistic sense of optimism," said Chen.

Gold edged lower to $4,095 an ounce at 8:05 a.m. Singapore time. The Bloomberg Dollar Spot Index was steady. Silver extended a decline after dropping 7.6% in the past two sessions. Palladium gained, while platinum dropped.

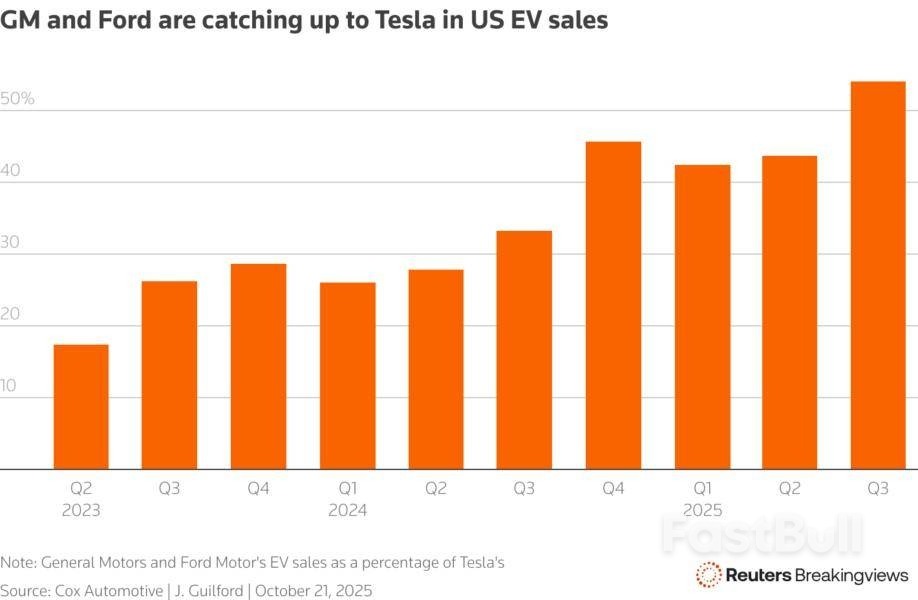

Teslahas blown past its last exit from a risky route. The electric-car maker posted better-than-expectedresultson Wednesday. Yet its best growth in years owes much to the impending expiry of customer subsidies in the United States, an industry-wide boon on which its rivals also capitalized. What remains is boss Elon Musk's all-or-nothing bet on autonomy.Third-quarter revenue of $28 billion came in 12% higher than last year and 6% above analysts' expectations, according to Visible Alpha data. Tesla's most important gauge - gross margin adjusted for sales of regulatory credits in its core automotive business - appears to have stabilized at 15.4% after a years-long slide. A 7% year-over-year bump in car deliveries represents the fastest growth since 2023.

The worst, then, might seem to be over. Save for one thing: Tesla did little to drive this bumper quarter. Overall U.S. electric vehicle sales soared 30% year-over-year in the third quarter, Cox Automotivereckons, as buyers rushed to nab tax credits for battery-powered purchases before the Trump administration axed them. Musk's rivals benefitted, too: Ford Motorand General Motorsfurther narrowed their gap to the market leader.

Moreover, profit tanked more than a third as operating expenses jumped 50%. Meanwhile, the long-awaited release of new, "affordable" cars was little more than a slight price cut on existing models that does little to expand the market.In that case, while Tesla's nadir may have passed, so too may its peak, at least as far as the humdrum business of "selling cars" is concerned. It's perhaps no surprise. The company once aimed to shift 20 million cars a year. A new proposed pay package for Musk has effectively ditched that, rewarding him with billions if he reaches that many sales since Tesla's founding.

Admittedly impressive growth in the company's other businesses, selling grid-scale batteries and services to drivers, isn't enough to support its $1.4 trillion valuation. The remainder is, as always, Musk's grandest plans: turning every car into an automated chauffeur, and deploying the humanoid Optimus into factories - though his talk on Wednesday of building a "robot army" over which he should exert influence will send some chills.Some of those visions are getting less outlandish, though. Alphabet'sWaymo has a robo-taxi business in operation right now. General Motors, earlier on Wednesday, said it would release its own "eyes-off" system in 2028. The difference is in approach. Rivals augment in-car cameras with LiDAR or radar, utilizing extra sensors - at extra cost - to navigate the road. Musk has stubbornly stuck to a cheaper, cameras-only approach.

This is a difficult technological nut to crack, though the CEO said in a call with investors that Tesla taxis should soon operate without any humans at the steering wheel. In fact, he boasts that production will ramp up in anticipation of an autonomous future. At this point, he needs to be right. All other options are disappearing in the rear-view mirror.

Automaker Tesla said on October 22 that it generated roughly $28.1 billion in revenue for the third quarter of 2025, roughly 6% above analysts' expectations, according to Visible Alpha data.Revenue from the company's core automotive business came in 7% above estimates, at $21.2 billion. Excluding sales of regulatory emissions credits, the unit's gross margin reached 15.4%, versus an anticipated 14.9% and continuing its climb from a low point at the beginning of the year.

Andrew Cuomo sought to cast Zohran Mamdani as a frontrunner unprepared to actually be mayor of the largest US city in the final debate before New York City's mayoral election.The former New York governor is seeking to overturn a double-digit polling deficit with just two weeks left in the campaign."The issue is you have no experience, you have accomplished nothing," Cuomo told Mamdani in the second and final debate before the Nov. 4 election. Early voting in the election begins Saturday.

Mamdani, the 34-year-old Queens state lawmaker and democratic socialist, shocked New York City's establishment when he won the Democratic primary for mayor in June, besting Cuomo by more than 12 points in a race where nearly every poll predicted Cuomo would win. Cuomo is running on an independent ballot line in the November election.Mamdani, leading in both polls and political betting markets, cast Cuomo as a failure in Albany who couldn't bring change to the city.

"The issue is we've experienced your experience," Mamdani told Cuomo, in one of many tense moments between the pair.A Quinnipiac University poll taken in early October showed Mamdani leading Cuomo 46-33, with Sliwa earning 15% of voters' support. Most polls taken since the June 24 Democratic primary have shown Mamdani with a comfortable, double-digit lead, which he has maintained even in the weeks after incumbent Mayor Eric Adams announced he would withdraw from the race late last month.

The debate comes as some Republicans and prominent donors are calling upon GOP candidate Curtis Sliwa, founder of the Guardian Angels, to exit the race, helping improve former governor Andrew Cuomo's odds against Mamdani. Sliwa has insisted he will not exit the race, despite the pressure he faces to step aside. Earlier this week the five chairs of New York City's county Republican organizations issued a letter supporting Sliwa and urging him to remain in the race.

Sliwa, the third candidate on stage, was often overshadowed as Cuomo and Mamdani launched barbs at one another. Yet he showed no signs of leaving the race.Instead, Sliwa cast himself as the only option for voters uncertain about a pair of flawed alternatives."Zohran, your resume could fit on a cocktail napkin," Sliwa said. "And Andrew, your failures could fill a public school library in New York City."

Canadian Prime Minister Mark Carney on Wednesday said his government's first budget will reduce economic and security reliance on the United States and cut wasteful spending.

Carney, who was elected in April, stressed that his government's maiden budget will be about both austerity and big investments as he seeks to protect the Canadian economy from what he has called a crisis brought on by a newly protectionist U.S.

"The decades-long process of an ever-closer economic relationship between the Canadian and U.S. economies is over," Carney said in a televised address to a group of university students.

"Many of our former strengths — based on close ties to America — have become our vulnerabilities," he said.

As U.S. tariffs batter Canada's steel, aluminum and auto sectors, Carney pledged to double the country's non-U.S. exports over the next decade. The diversification will bring in an additional C$300 billion, he claimed.

Carney, under pressure to spur growth and assert Canada's sovereignty, has promised a massive scale-up in defense spending and housing infrastructure.

But he has also lost revenue due to tax cuts, scrapped retaliatory tariffs to try to strike a deal with U.S. President Donald Trump, and spent on relief measures for tariff-hit industries, straining government coffers.

His government has asked all ministries to cut spending.

In his address, he said the budget will present a strategy to cut wasteful expenditures and drive efficiency.

"When we have to make difficult choices, we will be thoughtful, transparent, and fair," he said.

Economists forecast the government's fiscal deficit for the year 2025/26 will be between C$70 billion and C$100 billion, one of the largest in decades and a massive jump from the projected C$43 billion for the fiscal year that ended March 2025.

The budget, which will be presented on November 4, will help to catalyze "unprecedented" investments in Canada over the next five years, Carney said. He plans to balance the operating budget in three years and said he will include a climate strategy.

But the budget, a major test for Carney, cannot be passed unless his minority government gathers support from some opposition members.

In an outreach effort, Carney met with leaders from other political parties on Wednesday including the main opposition leader Pierre Poilievre, who has urged restraint on the deficit.

"We won't play games. We won't waste time. And we won't hold back. We will do what it takes," Carney said in his remarks.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up