Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices hovered near two-month lows as oversupply concerns and rising inventories outweighed broader market optimism, despite geopolitical tensions and new U.S. sanctions on Venezuelan oil exports.

Russian state oil and gas revenue in December is likely to almost halve from a year earlier to 410 billion roubles ($5.17 billion) as a result of lower crude prices and a stronger rouble, Reuters calculations showed on Friday.

Oil and gas revenue is the leading source of cash for the Kremlin, making up a quarter of federal budget proceeds that have been drained by heavy defence and security spending since Russia began its military campaign in Ukraine in February 2022.

For the entire year, the revenue is set to fall by almost a quarter to 8.44 trillion roubles, below the Finance Ministry's 8.65 trillion rouble forecast, according to calculations based on data from industry sources and official statistics on production, refining and supplies.

Russia reported its lowest monthly oil and gas revenue of 405 billion roubles in August 2020, when oil prices tumbled during the COVID-19 pandemic.

Sergei Konygin, a senior analyst at Moscow-based investment bank Sinara, said that the budget deficit of 1.6 trillion roubles expected in December will be covered by state bonds, but 2026 will be more difficult.

"Next year is a big challenge to the budget as it was formed under an optimistic scenario of oil at $59 (per barrel) and the rouble at 92 (per dollar)," he said.

The Russian oil price used for taxation purposes decreased in November by 16.4% from October to $44.87 a barrel while the rouble strengthened to 80.35 per dollar.

Konygin expects amendments to the budget next spring to make use of the National Wealth Fund to address the deficit under a lower assumed price of oil.

Ukraine and its Western backers have repeatedly said they want to curb Russian oil revenue to force the world's second-largest oil exporter to end the war in Ukraine.

The Finance Ministry had initially expected 10.94 trillion roubles in oil and gas revenue this year but made a downward revision in October to account for global oil prices that have been driven lower by concern over a supply glut.

The Finance Ministry will publish its oil and gas revenue estimates for December on January 14.

Chicago Federal Reserve President Austan Goolsbee on Friday explained why he voted against this week's interest rate cut, saying policymakers should have waited until they had more information before easing further.

"I'm pretty optimistic that for 2026 rates will will be able to be a fair bit lower than they are today," the central banker said during a CNBC interview. "But I've just been uncomfortable front loading too many rate cuts and assuming that what we've seen in inflation will be transitory."

Goolsbee was one of three Federal Open Market Committee members to vote against the quarter percentage point reduction, the third consecutive easing measure. He was joined by Kansas City Fed President Jeffrey Schmid, as well as Governor Stephen Miran, who preferred a steeper cut.

While he has said in the past he sees room for rates to come down further, Goolsbee said a lack of progress on inflation argued against moving now.

"While I voted to lower rates at the September and October meetings, I believe we should have waited to get more data, especially about inflation, before lowering rates further," the policymaker said in a post on the Chicago Fed's website.

"Given that inflation has been above our target for four and a half years, further progress on it has been stalled for several months, and almost all the businesspeople and consumers we have spoken to in the district lately identify prices as a main concern, I felt the more prudent course would have been to wait for more information." he wrote.

Goolsbee will not be a voter on the FOMC in 2026 but will still participate in meetings.

In the CNBC interview, he elaborated on his misgivings about cutting.

While other Fed officials have expressed concern about the weakening labor market, Goolsbee said data has shown conditions to be "pretty stable."

"I'm pretty optimistic that for 2026 rates will will be able to be a fair bit lower than they are today. But I've just been uncomfortable front loading too many rate cuts," he said in the interview. "We don't take a lot of extra risk, in my view, to just wait to Q1 2026, and make sure that we're back on path at 2% inflation."

The FOMC on Wednesday voted to lower its benchmark rate to a range between 3.5%-3.75%.

In his post-meeting news conference, Chair Jerome Powell expressed worry that the labor market looks weaker than the headline numbers suggest, saying he expects official nonfarm payroll counts to be lowered and show losses in recent months.

For his part, Goolsbee said he is "one of the most optimistic people" that rates will be lower in the year ahead.

Schmid also released a statement Friday explaining his dissent. He also voted against a rate cut in October.

"Inflation remains too high, the economy shows continued momentum, and the labor market—though cooling—remains largely in balance," Schmid said. "I view the current stance of monetary policy as being only modestly, if at all, restrictive. With this assessment, my preference was to leave the target range for the policy rate unchanged at this week's meeting."

Earlier Friday morning, Philadelphia Fed President Anna Paulson, who will vote in 2026, said she views policy as "somewhat restrictive" and is more worried about unemployment than inflation.

Even if overall inflation slows next year as the U.S. Federal Reserve anticipates, President Donald Trump will still face political headwinds over the cost of living with home mortgage rates expected to remain comparatively high, tariff-related price increases on goods seen persisting through the first part of the year, and cost pressures building around items like beef and electricity that can have an outsized influence on consumer perceptions.

Fed economic projections issued on Wednesday held good news for the administration, with policymakers expecting inflation to cool over the coming year, while economic growth accelerates.

Read about innovative ideas and the people working on solutions to global crises with the Reuters Beacon newsletter. Sign up here.

Across the broad array of services that account for most economic activity, "disinflation appears to be continuing," Fed Chair Jerome Powell said, while goods inflation should "come down in the back half" of 2026 as firms finish dividing tariff costs among consumers, their suppliers and their own operating margins.

But in a midterm election year Trump and Republicans face a problem all politicians share. Consumers - voters - focus far less on the macroeconomic generalities analyzed by economists, for whom inflation is a carefully weighted average rate of price changes across all goods and services, and more on what their local grocery charges for milk, how much the utility bill has risen, and what insurers charge to renew their homeowners policy.

Trump, whose administration has become concerned about low poll numbers particularly on the economy, with affordability a central issue, can rightfully note that overall inflation has been pretty modest on his watch so far. The Consumer Price Index from his inauguration through September is up about 1.6%, equivalent to a roughly 2.4% annual pace and not far off of the central bank's 2% target, though that is measured slightly differently. Food at home, the rough equivalent of grocery prices, is up even less at 1.4%.

But prices haven't fallen as Trump promised during his election campaign and early on in his administration, with consumers still struggling through what has now become a nearly five-year case of rolling sticker shock.Some prominent CPI line items have in fact spiked sharply in recent months, a fact that may turn hamburger into the same sort of political cudgel for Democrats that egg prices were for Trump last year.

In September, ground beef was 14% more expensive than when Trump resumed office; electricity prices were up over 4%, or around 6% on an annualized basis, and expected by many forecasters to go higher; and homeowners insurance was rising at a roughly 10% annual pace.

There were also cautionary notes in Powell's commentary to indicate the affordability fight will persist.

Powell singled out the housing market as one part of the economy that continues to struggle, with likely little respite coming from the Fed's recent rate cuts. While its benchmark interest rate does influence long-term mortgage rates, government debt and other securities, Powell said the housing problem is one of chronic undersupply.Mortgage rates have moderated since nearing 8% a little over two years ago, but they've remained around 6.2% since September, after investors began pricing in what became quarter-point Fed rate cuts in September, October and December. With the Fed on hold for now and other factors holding up longer-term interest rates, they may not move much further.

Real estate firm Redfin this week reported both sellers and buyers pulling back, with sales prices rising nonetheless and mortgage rates likely to "remain largely unchanged in the near term."

Mortgage rates remain far above the ultra-low rates seen in the roughly 15 years following the 2007-to-2009 financial crisis, when Fed policy aimed specifically at holding down long-term borrowing costs.

Absent a serious recession or financial swoon, sub-3% mortgages are unlikely to reappear. The collapse of the housing industry during that crisis still echoes through what Powell said was years of underbuilding.

"We just haven't built enough housing for a long time...We can raise and lower interest rates, but we don't really have the tools to address a secular housing shortage," he said.

Home affordability remains a key issue for younger workers and families who've delayed homebuying and the increase in household wealth that typically accompanies it.

The Census Bureau's latest homebuilding data is from August, with reports still delayed by the government shutdown, but at that point new building permits were down 11% from the year before while new housing starts were off 6% from a year earlier.

Construction jobs, which hit a new high in mid-2022 during the rebound from the COVID-19 pandemic and kept growing until this year, have mostly flatlined at around 8.3 million since January.

There's been a general stall, in fact, in the blue-collar jobs Trump said he would revive. The manufacturing sector lost about 50,000 jobs from January through September; the much smaller mining and logging sector shed about 15,000.

To the upside: Workers' average hourly earnings have been growing faster than inflation, and some important costs, like rent, are now increasing at rates more in line with pre-pandemic norms.

But that hasn't made the public happy.

After tending to stay steady or even fall during the years of increasing globalization, goods prices in general are now rising following the imposition of tariffs, and even if that does not persist much longer it has meant higher costs for consumers during the holiday shopping season.

Opinion surveys have responded.

We have a crowd of about 30 people coming to Thanksgiving dinner. Feeding all of them will require a lot of preparation, but that may not be our biggest challenge. Finding places for all of them to sit and making sure that certain people sit far away from certain other people is absorbing a great deal of attention. We've had a few food fights on the holiday in the past, and I'd like to spare my carpeting.

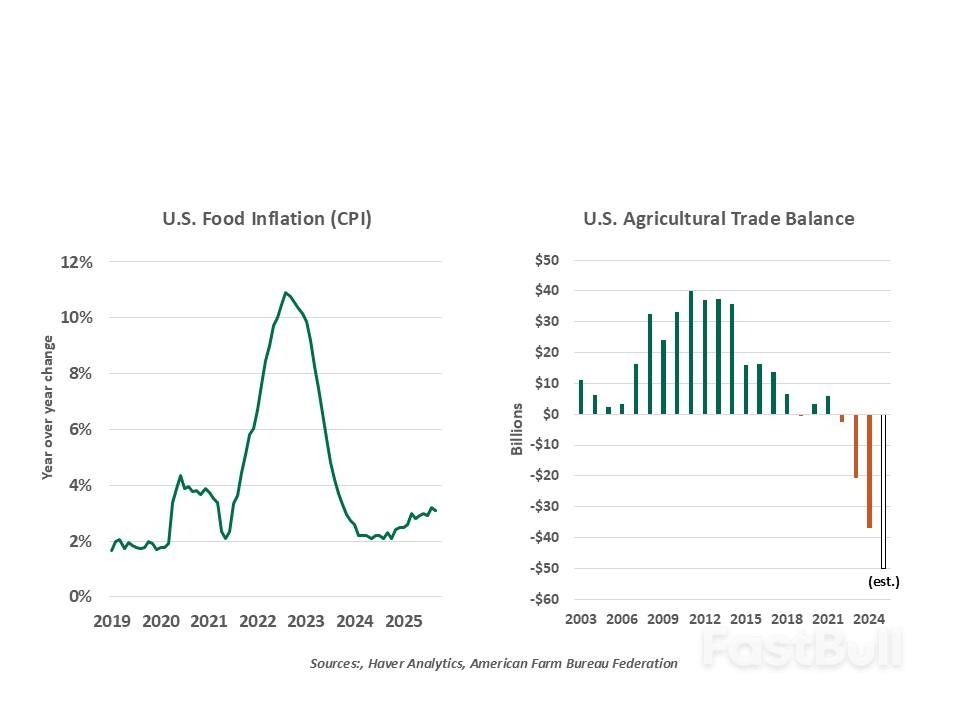

The inflated number of guests will contribute to significant inflation in the cost of the meal. Fortunately, the American Farm Bureau Federation estimates that prices for the items on this year's Thanksgiving buffet have declined by 5% since last year. Avian flu has afflicted turkey flocks in the last month, but the frozen birds used by most American cooks have been unaffected.

Moderation in the cost of the holiday meal is welcome, but food prices otherwise are on the rise. Tariffs are one of the main reasons why.

The United States is a country of abundance. Its agricultural production ranks third in the world, and it exports twice as much food as any other nation. Nonetheless, the U.S. had a trade deficit in food of almost $32 billion last year, and the shortfall is projected to be even larger this year.

There are several basic reasons for this. While the U.S. has immense surpluses of grains like corn and soybeans, it has deficits for fruits and vegetables. The growing season in the U.S. is limited by climate, so securing year-round availability requires bringing produce in from overseas. Americans also have appetites for foods that cannot easily be grown in the United States. Coffee and bananas are two leading examples.

This year's trade friction has hit the agricultural sector in a number of ways. Foods were not exempt from the across-the-board reciprocal tariffs announced in April; supplemental levies on particular countries followed. This raised the cost of inbound shipments, and prices to U.S. consumers. The Tax Foundation estimates that almost three-quarters of American food imports are being assessed higher import taxes than they were at the start of 2025.

In retaliation for U.S. tariffs, several countries struck back by sanctioning U.S. exports. China once again banned soybean imports in May, replacing them with supply from South America. Canada placed 25% tariffs on all U.S. imports in May, responding to charges imposed by Washington.

This year's trade battles have been particularly hard on agriculture.

These circumstances have produced the unwelcome combination of higher prices for consumers and poor results for farmers. The economic and political ramifications of this have led Washington to change course.

Recent negotiations with China and Canada have resulted in the removal of the most punitive restrictions on agricultural imports. The U.S. Department of Agriculture is considering increasing levels of relief to growers who have struggled to sell their crops.

To improve affordability, the Administration recently dropped tariffs against a range of foodstuffs, including coffee. While households can substitute away from many products when they become more expensive, coffee drinkers are a dedicated lot. The 19% increase in the cost of morning joe over the last year has created considerable discontent.

The policy retreat is a subtle admission that tariffs are, in the main, being paid by households. And while food prices aren't considered in measures of "core" inflation, they have an outsized influence in peoples' perceptions of inflation. Discomfort over the costs of living were a major factor in last year's U.S. elections, and may have contributed to Democratic victories in the handful of races contested early this month. The politics of the pocketbook remain very powerful.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up