Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. crude futures jumped 7% on June 13 to around $73 a barrel, after Israel struck Iran, the largest single day rise since July 2022.

The narrative surrounding the “dollar’s death” as the world’s reserve currency has been on the rise recently. However, this happens whenever the dollar declines relative to other currencies. We previously wrote about the false claims of the “dollar’s death” in 2023 (see here, here, and here). The recent decline in the dollar relative to other currencies is well within historical norms. Notably, previous declines were much larger without the “fear-mongering” from the “experts of doom.”

The “dollar’s death” frequently appears in financial discussions. Of course, that is often when geopolitical tensions, economic disruption, or market fluctuations are on the rise. Yes, there are valid concerns about the U.S. dollar’s long-term dominance. However, the notion that the dollar’s death is imminent, leading to a catastrophic economic collapse, is vastly overstated. The dollar remains the cornerstone of global finance due to structural, economic, and geopolitical factors unlikely to shift abruptly. Below, I outline five reasons why the dollar’s death narrative is exaggerated.

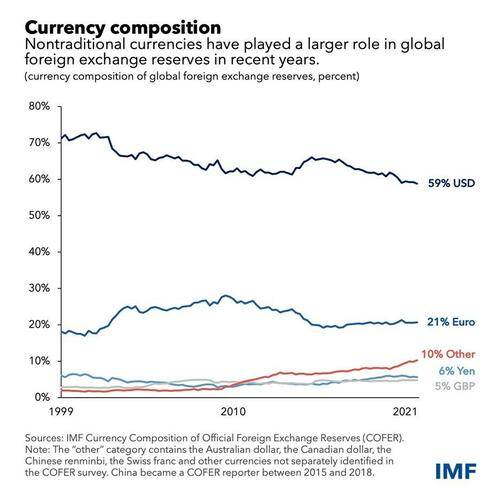

Lack of a Viable Alternative Currency – The dollar’s reserve status persists because no credible rival exists. The euro, holding 20% of global reserves compared to the dollar’s ~58% (IMF, Q2 2024), is constrained by the eurozone’s fragmented bond markets and political volatility. Despite increasing use (2–3% of reserves), China’s renminbi is limited by capital controls and restricted convertibility, rendering it unfit for global reserve status. Other currencies, such as the Japanese yen (6%) or smaller ones like the Canadian or Australian dollar, lack the economic scale or liquidity to challenge the dollar. Without a currency matching the dollar’s deep, liquid markets and global trust, the dollar’s death remains improbable in the near term.

Strength of the U.S. Economy – The U.S. economy, accounting for 26% of global GDP, anchors the dollar’s dominance. Its large, dynamic economy, supported by the rule of law and robust capital markets, positions the dollar as a haven, particularly during global instability. While critics highlight rising U.S. debt ($35 trillion, ~120% of GDP), the dollar’s reserve status enables borrowing at lower rates, sustaining deficits without immediate crisis. Compared to other economies—Japan’s slow growth, China’s restricted markets, or Europe’s fragmentation—the U.S. offers stability, making the dollar’s death unlikely in the foreseeable future.

Network Effects and Global Financial Inertia – Network effects perpetuate the dollar’s dominance: its widespread use enhances its value. It constitutes ~88% of global foreign exchange transactions (SWIFT data) and ~60% of international debt and trade invoicing. Transitioning to another currency would demand extensive coordination among central banks, governments, and markets, incurring significant costs and risks. Historical currency transitions, such as from the pound to the dollar, spanned decades and required major geopolitical shifts, which are absent today. This inertia renders the dollar’s death a distant prospect.

Limited Scope of De-Dollarization Efforts – Although countries like China, Russia, and BRICS nations advocate for trade in local currencies (e.g., China’s renminbi in 56% of its bilateral trade), these efforts have limited global impact. The dollar’s share of reserves has dipped gradually (from 67% to 58% over two decades). However, this reflects diversification, not the dollar’s death, often into allied currencies like the Canadian or Australian dollar. China holds ~$2 trillion in dollar-denominated assets, underscoring its reliance. Geopolitical moves, such as Russia’s shift to gold or renminbi, are constrained by the small scale of non-dollar systems (e.g., China’s CIPS vs. SWIFT). These fragmented efforts fall short of triggering the dollar’s death.

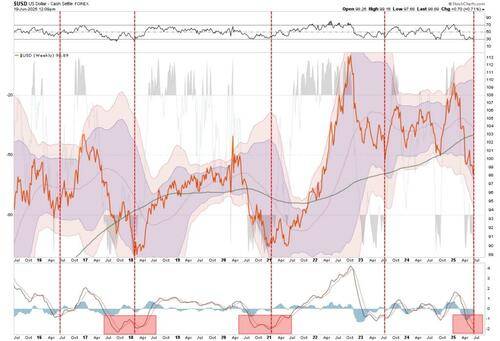

Resilience Amid Policy Challenges – Critics argue that U.S. policies—like tariffs, sanctions, or Federal Reserve actions—undermine confidence in the dollar. For instance, Trump’s tariffs in 2025 caused a ~9% dollar decline, fueling dollar death fears. However, economists note such fluctuations are cyclical, not structural, with the dollar still robust compared to its 2011–2022 peak (up ~40% against a currency basket). Sanctions, such as those on Russia in 2022, have not significantly reduced global dollar holdings, as most reserve currencies are held by U.S. allies who joined sanctions. The Federal Reserve’s swap lines and liquidity support further reinforce the dollar’s role in crises.

As shown, the dollar dominates the composition of global currency transactions.

However, there is a reason that the recent dollar decline could be nearing its end.

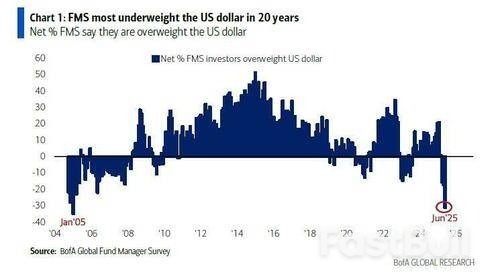

This isn’t the first time the “dollar’s death” has made the news. In 2022, “de-dollarization” narratives filled the bearish narratives, with everyone saying the dollar’s death was imminent. Yet, that “frenzy of doom” marked the bottom of the dollar before a robust rally. We could be setting up for another similar rally for two reasons.

First, from the technical perspective, the dollar selloff has become rather extreme. Using weekly data, the dollar is now oversold on a momentum basis as it was in early 2021 and late 2018. These previous oversold conditions set the dollar up for a strong counter-trend rally.

Furthermore, everyone from the “shoe-shine boy to the street corner vendor” is shorting the dollar. According to BofA’s fund manager survey, the short position against the US Dollar is at the highest level in 20 years. As such, any reversal in the dollar could be substantial if those “shorts” are forced to reverse their positions.

The question is, what must change for a dollar price reversal currently? That brings us to the second reason the dollar could rally: the ECB’s rate cuts.

As the reserve currency, foreign sovereign nations hold reserves in U.S. dollars to facilitate trade. If the dollar is too weak or strong relative to another currency, it can negatively impact that nation’s economy. Therefore, when the dollar drifts too far from another currency, that country can intervene to stabilize its currency. That intervention is achieved by increasing or decreasing U.S. dollar reserves. It can do this by buying or selling U.S. Treasuries, gold, or other dollar-denominated assets. In the majority of cases, it is either U.S. treasuries or gold.

The ECB has been aggressively cutting rates, eight times in this recent cycle, while the U.S. Federal Reserve remains on hold. The result is a divergence that is developing between U.S. Treasury bond yields and, for example, the German Bund.

There are three primary reasons this is crucial for investors to understand.

Higher Yields Attract Capital Inflows – Historically, rising U.S. Treasury yields draw foreign investment due to higher returns compared to other major economies’ bonds. For instance, 10-year Treasury yields surged from 3.65% in September 2024 to 4.8% by early 2025. However, European bond yields (e.g., German 10-year Bunds) remain lower due to ECB easing. This yield differential incentivizes foreign investors, including central banks and institutional investors, to buy Treasuries. That buying increases dollar demand and supports appreciation.

Treasuries as a Preferred Store of Foreign Reserves – As noted above, U.S. Treasuries are the backbone of global foreign exchange reserves. Higher yields offer reserve managers better returns without sacrificing safety, unlike riskier assets like equities or emerging market bonds. For example, foreign demand for Treasuries has remained stable despite ECB rate cuts. This sustained demand supports the dollar, as central banks must buy dollars to purchase Treasuries, reinforcing its status as a reserve currency.

Dollar Appreciation Driven by Yield Differentials – The divergence in monetary policy—ECB’s dovish stance versus the Fed’s pause after 100 basis points of cuts in late 2024—has widened the interest rate gap, favoring the dollar. Higher U.S. yields, particularly on 10-year Treasuries (4.4–4.8% in early 2025), contrast with lower European yields, which could drive capital flows to the U.S. The demand for yield aligns with historical patterns where higher U.S. rates bolster the DXY, as seen during the 2016 post-election period when fiscal optimism pushed yields and the dollar higher. Despite tariff-related volatility, the dollar’s recent appreciation suggests that yield differentials are a key support.

The critical point is that this would be an attractive set-up for sovereign governments, wealth funds, and foreign investors. As foreign inflows are initially used to capture higher bond yields, investors also receive a double benefit of currency gains and higher bond prices (lower yields).

However, the dollar’s death narrative persists due to recent decoupling trends. Yields rose as the dollar weakened in early 2025, driven by fiscal concerns and tariff uncertainty. These recent concerns will pass, but the dollar’s role as a reserve currency for world trade will not.

The dollar’s death narrative often arises from concerns about U.S. debt, inflation, tariffs, or the geopolitical use as a weapon of the dollar (e.g., sanctions). These risks exist, but overstate their near-term impact. Losing reserve status could elevate U.S. borrowing costs, drive inflation through pricier imports, and diminish geopolitical influence. Still, the U.S. economy’s scale, military strength, and institutional stability make the dollar’s death improbable without a seismic global event (e.g., the loss of a major war as witnessed in the Weimar Republic). Despite a gradual decline, the dollar would likely remain a leading currency alongside others and would not vanish entirely.

This narrative is often amplified on platforms and media outlets that depend on “bearish narratives” to get clicks and views. While some posts exaggerate the “dollar’s death” to promote alternatives like gold or cryptocurrencies, these narratives are often misleading. Economists like Barry Eichengreen and Morgan Stanley’s James Lord contend that the dollar’s death is “greatly exaggerated,” citing its entrenched role and the absence of viable alternatives, as discussed above. Sure, the U.S. economy could face challenges from a weaker dollar, but a devastating collapse is unlikely due to its adaptability and global financial integration.

Most notably, as discussed in “Narratives Change, Markets Don’t,” it is essential to look past narratives to avoid the emotional biases that impact our investing outcomes. To wit:

“The need for a narrative is deeply rooted in our psychology. As pattern-seeking creatures, we crave coherence and predictability. Chaos triggers anxiety. It feels dangerous, uncontrollable, and unsettling. In investing, this anxiety is magnified by the direct impact on our wealth and financial security. We regain a semblance of control by latching onto the narrative, no matter how tenuous. The narrative tells us why things are happening and what might happen next, which soothes our natural fear of uncertainty.”

Humans are hardwired to prioritize negative information over optimistic information. From an evolutionary perspective, this bias was essential. Our ancestors learned to recognize threats (like predators) to survive.

This instinct, known as “negativity bias,” influences how we process information, including financial news and market narratives. Such is why “bearish” leaning podcasts and articles generate the most clicks and views.

Fear Is a Stronger Motivator Than Greed – While the hope of making money drives investors, the fear of losing money is more powerful.

Bearish Narratives Seem More “Rational” – Pessimism often feels safer and more cautious. During volatile markets, a bearish forecast can sound more analytical and responsible.

Media Amplifies Negative Headlines – News outlets know that fear sells. Sensational headlines like “MARKETS IN TURMOIL” or “CRASH COMING?” generate clicks and engagement.

Herd Behavior and Echo Chambers – Investors flock to bearish opinions for validation when markets are shaky. If others are cautious or fearful, this reinforces the idea that a downturn is imminent. This is the case even if the underlying fundamentals remain sound. Social media and financial news create echo chambers that amplify these fears.

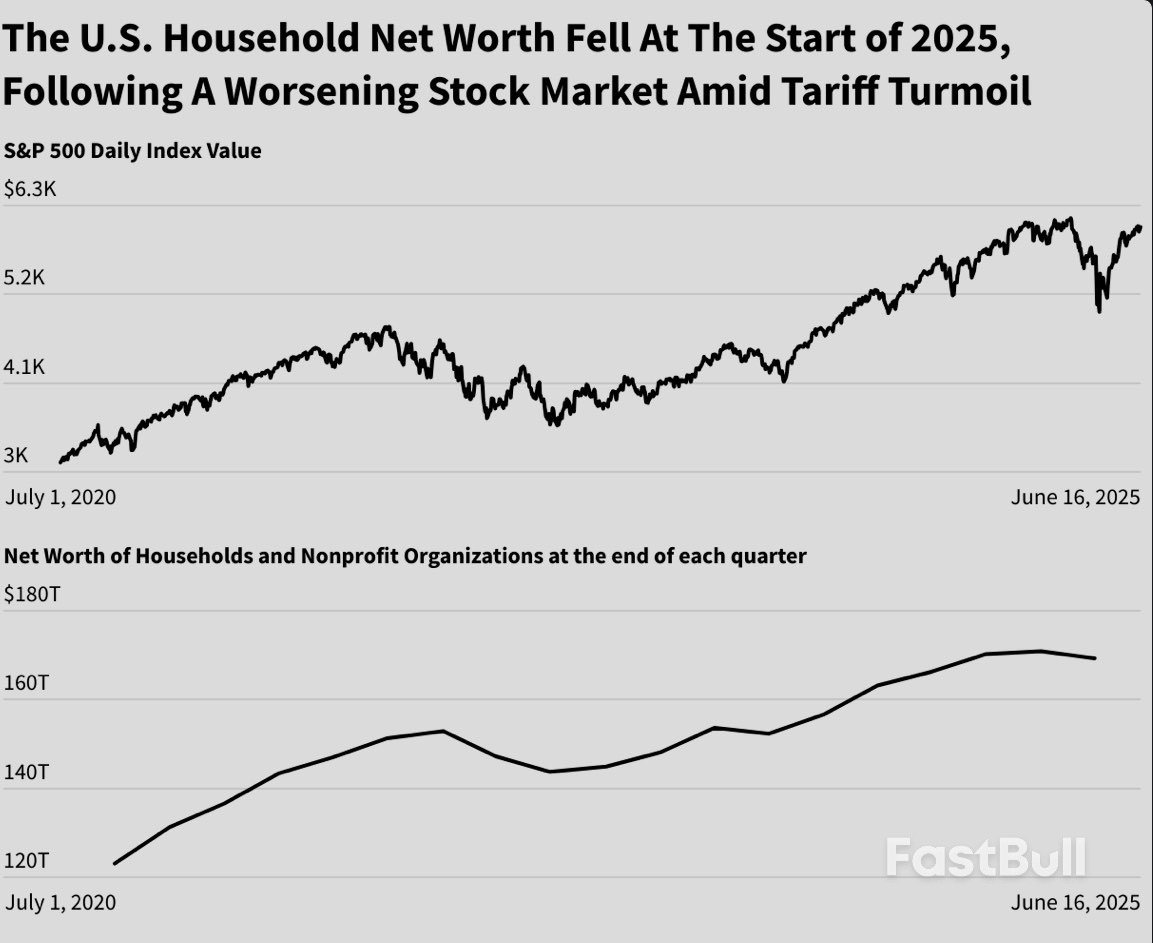

Most importantly to investors, the market absorbs all negative media narratives over the long term. The recent barrage of narratives surrounding debts, deficits, tariffs, and the “dollar’s death” feeds your negative bias. However, zooming out, investors who have stayed away from investing in the financial markets to “avoid the loss” of potential adverse outcomes have paid a dear price in reduced financial wealth.

In other words, there is always a “reason” not to invest. However, the current narrative will change, but the market won’t.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up