Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Mexico Unemployment Rate (Not SA) (Dec)

Mexico Unemployment Rate (Not SA) (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)

U.S. Non-Defense Capital Durable Goods Orders MoM (Excl. Aircraft) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)

U.S. Durable Goods Orders MoM (Excl. Defense) (SA) (Nov)A:--

F: --

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)

U.S. Durable Goods Orders MoM (Excl.Transport) (Nov)A:--

F: --

P: --

U.S. Durable Goods Orders MoM (Nov)

U.S. Durable Goods Orders MoM (Nov)A:--

F: --

U.S. Chicago Fed National Activity Index (Nov)

U.S. Chicago Fed National Activity Index (Nov)A:--

F: --

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Jan)

U.S. Dallas Fed General Business Activity Index (Jan)A:--

F: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

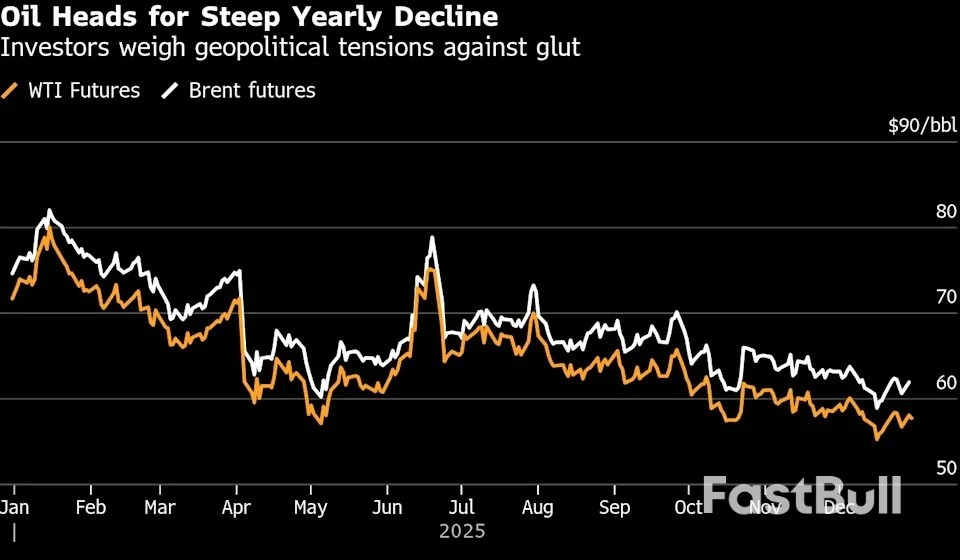

Oil headed for its deepest annual loss since the pandemic in 2020, with prices undermined by concerns about a punishing surplus that's set to dominate market sentiment and trading into the new year.

Oil headed for its deepest annual loss since the pandemic in 2020, with prices undermined by concerns about a punishing surplus that's set to dominate market sentiment and trading into the new year.

US benchmark West Texas Intermediate was below $58 a barrel, on track for a fifth monthly loss and down by almost 20% this year. Brent for March closed above $61. Traders' near-term focus was on an upcoming OPEC+ meeting, a bearish US industry report, and a slew of geopolitical tensions.

Crude has slumped this year as supplies swelled from OPEC+ and its rivals, while world demand growth slowed. Top forecasters including the International Energy Agency are predicting a huge glut next year, and even OPEC's secretariat — usually more bullish than others — projects a modest surplus.

OPEC+ members — scheduled to meet by video conference on Jan. 4. — are expected to stick with a plan to pause further supply hikes amid growing evidence of the surplus, according to three delegates.

Ahead of that, the industry-backed American Petroleum Institute reported crude inventories increased 1.7 million barrels last week. That would be the biggest build since mid-November, if confirmed by official data later Wednesday. The API also saw bigger holdings of gasoline and distillates.

Among geopolitical tensions, the United Arab Emirates said that it would withdraw forces from Yemen following a flare-up in tensions with Gulf ally Saudi Arabia over military operations in the conflict-hit country. Saudi Arabia and the UAE are both important members of OPEC.

Elsewhere, traders are tracking a partial US blockade of crude shipments from Venezuela. President Donald Trump has revealed a covert US strike against what he said was a drug-trafficking facility, raising fresh questions about how far Washington is willing to go to pressure the regime of Nicolas Maduro.

Most Federal Reserve officials saw additional interest rate reductions as appropriate so long as inflation declines over time, though they remained deeply divided over when and how far to cut, a record of the central bank's December meeting showed.

Minutes of the Dec 9-10 Federal Open Market Committee gathering, released on Dec 30, pointed to the difficulty policymakers faced in their most recent decision, which modestly reinforced expectations the Fed will hold rates unchanged when they meet again in January.

"A few of those who supported lowering the policy rate at this meeting indicated that the decision was finely balanced or that they could have supported keeping the target range unchanged," the minutes said.

Following the minutes' release, the likelihood of a January cut based on federal funds futures contracts dropped slightly to about 15 per cent.

The vote in favour of a cut from a finely divided committee showed chair Jerome Powell's continued influence, according to Stephen Stanley, chief US economist at Santander US Capital Markets.

"The committee could easily have gone either way, and the fact that the FOMC eased is clear evidence that chairman Powell pushed for a cut," Mr Stanley said in a note to clients.

Officials earlier in December voted 9-3 to lower their benchmark interest rate by a quarter percentage point for the third straight time, to a range of 3.5 per cent to 3.75 per cent. Governor Stephen Miran voted against the action in favor of a half-point cut, while Chicago Fed president Austan Goolsbee and Kansas City's Jeff Schmid dissented in favour of keeping rates unchanged.

Rate projections for 2025 pointed to an even deeper split among the larger group of 19 policymakers. Six officials signalled their opposition to the rate reduction by recommending the benchmark rate should stand at 3.75 per cent to 4 per cent at the end of this year – where it stood before the December meeting.

In line with those projections, the minutes showed that some officials believed "it would likely be appropriate to keep the target range unchanged for some time after a lowering of the range at this meeting."

While the median rate projection from officials released after the meeting pointed to one quarter-point cut in 2026, individual projections ranged widely. Investors expect at least two reductions in 2026.

The minutes continued to point to considerable differences among policymakers over whether inflation or unemployment posed the greater peril to the US economy.

"Most participants noted that a move toward a more neutral policy stance would help forestall the possibility of a major deterioration in labor market conditions," the minutes noted.

At the same time, it continued, "several participants pointed to the risk of higher inflation becoming entrenched and suggested that lowering the policy rate further in the context of elevated inflation readings could be misinterpreted as implying diminished policymaker commitment to the 2 per cent inflation objective."

Speaking to reporters following the meeting, Mr Powell suggested the Fed had lowered rates enough to guard against a more serious deterioration in the labour market while leaving rates high enough to continue weighing on inflation.

Officials lacked the typical level of economic data due to the government shutdown that lasted for all of October and nearly half of November. Policymakers noted, however, that new data could help them in coming weeks.

"Some participants who favored or could have supported keeping the target range unchanged suggested that the arrival of a considerable amount of labor market and inflation data over the coming intermeeting period would be helpful in making judgments on whether a rate reduction was warranted," the minutes said.

Since the meeting, fresh data has done little to resolve divisions at the Fed. In November unemployment rose to 4.6 per cent, its highest level since 2021, and consumer prices increased by less than expected. Both releases bolstered the case for those supporting lower rates.

But the economy grew in the third quarter at an annualised rate of 4.3 per cent, the fastest pace in two years, likely fanning worries over inflation for those who opposed the December cut. BLOOMBERG

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up