Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Oil prices slipped in early Asian trade on Tuesday as market participants contemplated planned three-way talks among Russia, Ukraine and the U.S. to end the war in Ukraine, which could lead to an end to sanctions on Russian crude.

Oil prices slipped in early Asian trade on Tuesday as market participants contemplated planned three-way talks among Russia, Ukraine and the U.S. to end the war in Ukraine, which could lead to an end to sanctions on Russian crude.

Brent crude futures fell 7 cents, or 0.11%, to $66.53 a barrel by 0000 GMT. U.S. West Texas Intermediate crude futures for September delivery, set to expire on Wednesday, fell 6 cents, or 0.09%, to $63.36 per barrel.

The more active October WTI contract was down 9 cents, or 0.14%, at $62.61 a barrel.

Prices settled around 1% higher in the previous session.

Following talks with Ukraine President Volodymyr Zelenskiy and a group of European allies in the White House on Monday, U.S. President Donald Trump said in a social media post he had called his Russian counterpart Vladimir Putin and begun arranging a meeting between Putin and Zelenskiy, to be followed by a trilateral summit among the three presidents.

"An outcome which would see a ratcheting down of tensions and remove threats of secondary tariffs or sanctions would see oil drift lower toward our $58 per barrel Q4-25/Q1-26 average target," Bart Melek, head of commodity strategy at TD Securities said in a note.

Zelenskiy described his direct talks with Trump as "very good" and said they had spoken about Ukraine's need for U.S. security guarantees.

Trump has pressed for a quick end to Europe's deadliest war in 80 years, but Kyiv and its allies worry he could seek to force an agreement on Russia's terms.

"A result which would see the U.S. apply pressure on Russia in the form of broader secondary tariffs against Russia's oil customers (as those now faced by India) would no doubt move crude to the highs seen a few weeks ago," Melek added.

Brazil is forcefully rejecting Washington’s allegations of unfair trade practices, describing an investigation launched by the US Trade Representative into the matter as an illegitimate use of unilateral US trade law.

In a 91-page response to the so-called Section 301 probe, Brazil said its digital, intellectual property, ethanol and environmental policies are consistent with international trade rules. Brazil’s comments were submitted to the USTR earlier on Monday and published on its website a few hours later.

Launched in July, the investigation is seen as an attempt to justify the 50% tariffs imposed by President Donald Trump on all Brazilian exports to the US, excluding some 700 items ranging from aviation parts to select agricultural exports.

Trump has linked the penalties to Brazil’s prosecution of former President Jair Bolsonaro, portraying the case as a US national security concern. Brazil countered that the tariffs are political in nature and not grounded in economic harm to American firms.

In its filing, the government stressed the US has consistently run a trade surplus with Brazil — $29.3 billion in 2024 — and that American firms already enjoy broad access to the Brazilian market. More than 70% of US exports enter duty-free, while Brazil’s fast-growing electronic payments system, Pix, is open to global platforms such as Google Pay and WhatsApp. Officials also pointed to joint enforcement efforts on corruption and intellectual property, citing US recognition of Brazil’s progress in reducing patent backlogs and cracking down on piracy.

The submission also devotes significant attention to environmental concerns, asserting that deforestation has dropped by nearly 50% since 2023 thanks to stricter enforcement of the Forest Code and satellite monitoring systems. It argued that Brazil’s major US-bound farm exports — coffee, orange juice, sugar and tobacco — are not related to Amazon clearing.

On ethanol, Brazil contrasted its own 18% tariff with Washington’s 52.5% levy on Brazilian shipments, accusing the US of protecting subsidized corn-based ethanol while blocking sugarcane-based fuel that meets California’s low-carbon standards.

“Unilateral measures under Section 301 risk undermining the multilateral trading system and could have adverse consequences for bilateral relations,” the filing said.

President Luiz Inacio Lula da Silva has promised to keep channels of dialogue open while taking the dispute to the World Trade Organization. He has also rolled out domestic credit lines to cushion exporters from the sudden tariff shock.

US President Donald Trump's meeting with a coterie of European leaders, including Ukraine President Volodymyr Zelenskyy, did not yield any immediate progress on peace in the Russia-Ukraine conflict on Aug. 18, with the prospect of potential secondary sanctions on crude purchases from Russia undecided and Republicans in the US Senate still pushing a harsh sanctions bill on buyers of Russian crude.

Trump has repeatedly threatened the largest buyers of Russian crude with sanctions if a deal to end the war in Ukraine is not reached. On Aug. 6, Trump issued an executive order raising tariffs on US imports from India from 25% to 50%, in response to what Trump described on Truth Social as India's "massive" purchases of Russian crude.

After the White House meetings, US Senate Majority Leader John Thune, Republican-South Dakota, wrote in a social media post that the Senate would pass its own sanctions package if the talks fail to lead to an agreement.

"As peace talks continue today in Washington, the US Senate stands ready to provide President Trump any economic leverage needed to keep Russia at the table to negotiate a just and lasting peace in Ukraine," Thune said.

The bipartisan Senate bill, the Sanctioning Russia Act of 2025, would impose a 500% duty on all goods or services imported by the US from any country that "knowingly sells, supplies, transfers, or purchases oil, uranium, petroleum products, or petrochemical products that originated in the Russian Federation."

Still, as long as negotiations continue, the US is unlikely to levy harsher penalties on Russia's crude buyers, Rachel Ziemba, Senior Advisor at Horizon Engage, said.

"While negotiations are in play, there is no prospect of new sanctions from the US that might reduce supplies of Russian energy," Ziemba said. "This was signaled by Trump after the Alaska meeting. Trump is unlikely to use either tariffs or sanctions until he believes that Putin is blocking an agreement."

India remains the largest buyer of Russian crude. On Aug. 18, India's state-run refiner India Oil Corp. said in an earnings call that it had continued its purchases despite sanctions and narrowing discounts for heavy Urals supply.

Between April and June, IOC used Russian crude to satisfy a quarter of its feedstock needs. "We are continuing to buy Russian crude in the ongoing quarter," IOC Director of Finance Anuj Jain said on the call. In 2026, the EU will impose an import ban on products made from Russian crude oil.

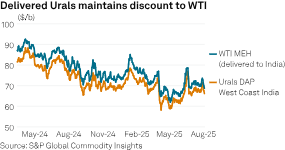

Platts, part of S&P Global Commodity Insights, assessed Urals crude at a $2.74/b discount to the Dubai benchmark on Aug. 15, reflecting a 76-cent wider discount for the grade than the previous week. However, the delta remains far below recent levels of over $5/b in January.

India, China and Turkey are the largest importers of Russian crude. In July, India received 1.7 million b/d, China received around 1 million b/d and Turkey received around 400,000 b/d, according to S&P Global Commodities at Sea data. Trump's additional tariffs on Indian goods, effective Aug. 27, combined with new EU policies targeting refined products made from Russian crude, are already impacting flows, CAS said on Aug. 14 in its Weekly Crude Oil Report.

On Aug. 18, White House trade advisor Peter Navarro wrote that India was "cozying up to both Russia and China," and said if "India wants to be treated as a strategic partner of the US, it needs to start acting like one."

"An outcome which would see a ratcheting down of tensions and remove threats of secondary tariffs or sanctions would see oil drift lower toward our $58/b average target," TD Securities Head of Commodity Strategy Bart Melek said. "In sharp contrast, a result which would see the US apply pressure on Russia in the form of broader secondary tariffs against Russia's oil customers (as those now faced by India) would no doubt move crude to the highs seen a few weeks ago.

The tone of Trump's meeting with Zelenskyy marked a contrast from their previous meeting in March, when an Oval Office press conference descended into an argument. The two met for several hours in the East Room of the White House on Aug. 18, per reports, after Trump's meeting with Russian President Vladimir Putin in Alaska on Aug. 15. Both pressed for a trilateral meeting of the US, Ukraine and Russia.

Trump continued to push back against reporters' questions that he had given Putin a diplomatic victory by hosting the Russian President in Alaska, while pledging support for Ukraine without specific defense guarantees. While Trump insisted Europe would be the first line of defense against further Russian aggression, the US would "help them out," Trump said.

"There'll be a lot of help when it comes to security," Trump said.

The crude futures market settled slightly higher on the day. NYMEX September WTI settled 62 cents higher at $63.42/b, and ICE October Brent climbed 75 cents to $66.60/b.

No agreement was reached, and the prospect of sanctions remained unknown.

"It's too early to talk substantially about sanctions relief, but I wouldn't see much more fuel production coming from Russia any time soon," Ziemba said. "Sanctions did more to cap new production than to reduce current volumes, although Ukrainian drone attacks on refineries have reduced some volumes. Overall, there are many questions whether sanctions will just be suspended or lifted in the case of any longer-lasting agreement."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up