Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

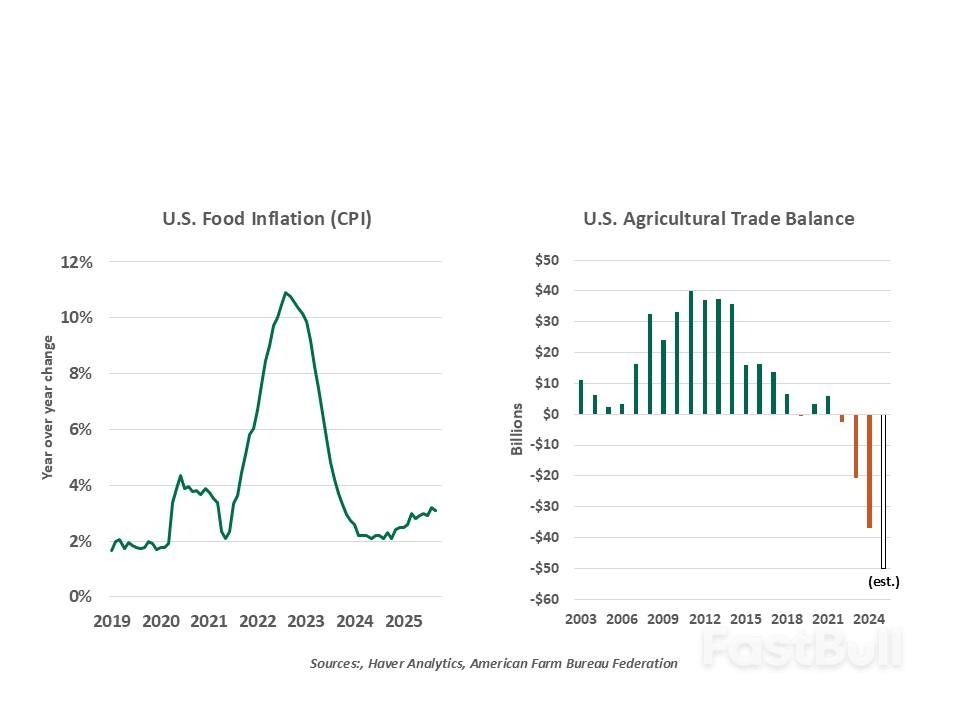

Moderation in the cost of the holiday meal is welcome, but food prices otherwise are on the rise. Tariffs are one of the main reasons why.

We have a crowd of about 30 people coming to Thanksgiving dinner. Feeding all of them will require a lot of preparation, but that may not be our biggest challenge. Finding places for all of them to sit and making sure that certain people sit far away from certain other people is absorbing a great deal of attention. We've had a few food fights on the holiday in the past, and I'd like to spare my carpeting.

The inflated number of guests will contribute to significant inflation in the cost of the meal. Fortunately, the American Farm Bureau Federation estimates that prices for the items on this year's Thanksgiving buffet have declined by 5% since last year. Avian flu has afflicted turkey flocks in the last month, but the frozen birds used by most American cooks have been unaffected.

Moderation in the cost of the holiday meal is welcome, but food prices otherwise are on the rise. Tariffs are one of the main reasons why.

The United States is a country of abundance. Its agricultural production ranks third in the world, and it exports twice as much food as any other nation. Nonetheless, the U.S. had a trade deficit in food of almost $32 billion last year, and the shortfall is projected to be even larger this year.

There are several basic reasons for this. While the U.S. has immense surpluses of grains like corn and soybeans, it has deficits for fruits and vegetables. The growing season in the U.S. is limited by climate, so securing year-round availability requires bringing produce in from overseas. Americans also have appetites for foods that cannot easily be grown in the United States. Coffee and bananas are two leading examples.

This year's trade friction has hit the agricultural sector in a number of ways. Foods were not exempt from the across-the-board reciprocal tariffs announced in April; supplemental levies on particular countries followed. This raised the cost of inbound shipments, and prices to U.S. consumers. The Tax Foundation estimates that almost three-quarters of American food imports are being assessed higher import taxes than they were at the start of 2025.

In retaliation for U.S. tariffs, several countries struck back by sanctioning U.S. exports. China once again banned soybean imports in May, replacing them with supply from South America. Canada placed 25% tariffs on all U.S. imports in May, responding to charges imposed by Washington.

This year's trade battles have been particularly hard on agriculture.

These circumstances have produced the unwelcome combination of higher prices for consumers and poor results for farmers. The economic and political ramifications of this have led Washington to change course.

Recent negotiations with China and Canada have resulted in the removal of the most punitive restrictions on agricultural imports. The U.S. Department of Agriculture is considering increasing levels of relief to growers who have struggled to sell their crops.

To improve affordability, the Administration recently dropped tariffs against a range of foodstuffs, including coffee. While households can substitute away from many products when they become more expensive, coffee drinkers are a dedicated lot. The 19% increase in the cost of morning joe over the last year has created considerable discontent.

The policy retreat is a subtle admission that tariffs are, in the main, being paid by households. And while food prices aren't considered in measures of "core" inflation, they have an outsized influence in peoples' perceptions of inflation. Discomfort over the costs of living were a major factor in last year's U.S. elections, and may have contributed to Democratic victories in the handful of races contested early this month. The politics of the pocketbook remain very powerful.

China said on Friday it had driven away a Philippine aircraft and multiple vessels near disputed atolls in South China Sea, in the latest in a series of confrontations in the strategic waterway in recent years.

The Chinese military said it issued strong warnings and "expelled" a Philippine aircraft that "invaded" airspace above the Scarborough Shoal, without giving a date for the incident.

China claims almost the entire South China Sea, overlapping the exclusive economic zones of Brunei, Indonesia, Malaysia, the Philippines and Vietnam. Unresolved disputes have festered for years over ownership of various islands and features.

In a separate statement, the Chinese Coast Guard said multiple Philippine vessels entered waters near Sabina Shoal to "cause trouble and provoke incidents".

The CCG said it took control measures against the vessels, including verbal warnings and forced expulsion.

The Embassy of the Philippines in Beijing, and the country's foreign ministry and maritime council did not immediately respond to requests for comment.

In 2016, the Permanent Court of Arbitration in The Hague ruled that China's sweeping claims in the region were not supported by international law, a decision that Beijing rejects.

Scarborough Shoal is one of Asia's most contested maritime features and a flashpoint for diplomatic flare-ups over sovereignty and fishing rights.

China in September approved the creation of a national nature reserve at the disputed atoll, drawing a strong reaction from Manila.

Sabina Shoal, which China refers to as Xianbin Reef and the Philippines as the Escoda Shoal, lies 150 km (93 miles) west of the Philippine province of Palawan, well within the country's exclusive economic zone.

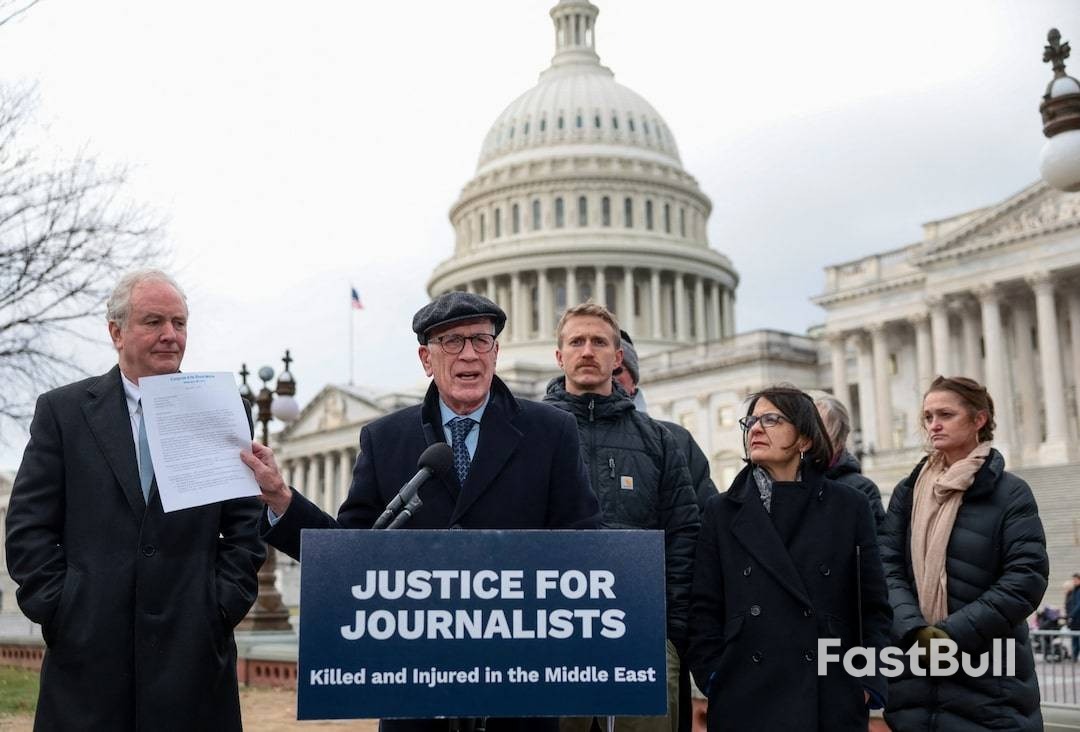

Four U.S. lawmakers on Thursday said there has been no accountability for an October 2023 attack by the Israeli military that struck a group of journalists in Lebanon, killing a Reuters correspondent and wounding others.

U.S. Senator Peter Welch from Vermont, the home state of one of the journalists wounded in the attack, accused Israel of not conducting a serious investigation into the incident, saying he had seen no proof of that.

He did not specify what details he had requested from the Israeli government, or what, if anything, he had been given.

Reuters was unable to independently confirm what specific efforts Israel has made to investigate the attack, which it has pledged publicly to review.

On October 13, 2023, an Israeli tank fired two shells in quick succession from Israel as journalists were filming cross-border shelling. The attack killed Reuters visuals journalist Issam Abdallah and severely wounded Agence France-Presse (AFP) photographer Christina Assi.

The Israeli military (IDF) has said it does not target journalists but has not offered an explanation for why that Israeli tank unit fired at the group of journalists.

In a news conference organized by two advocacy groups, Welch, a Democrat, said he had been given no written proof of an Israeli investigation into the attack, nor any evidence that Israeli officials have spoken with victims, witnesses, shooters or any of the independent investigators.

In June 2025, Senator Welch's office was told by the Embassy that the IDF had conducted an investigation into the incident and the conclusion was that none of the soldiers acted outside of the IDF's rules of engagement.

Standing next to AFP journalist Dylan Collins, an American citizen who was also wounded in the attack, Welch said the Israeli authorities have "stonewalled" him on his pleas for an investigation and gave him conflicting answers. Welch did not give further details about the interactions.

"The IDF has made no effort, none, to seriously investigate this incident," Welch said. "The IDF claimed they conducted an investigation but there's absolutely no evidence that there was any investigation," he added.

Welch said the Israeli government told his office the investigation was closed but separately told the AFP that the investigation was active and the findings have not been concluded.

"So which is it? Both can't be true," Welch said.

Asked by Reuters about Welch's comments and whether its investigation is concluded, an IDF spokesperson said: "The event is still being examined." The spokesperson did not provide further details.

AFP Regional Director for North America Marc Lavine said they had been seeking full accountability for what happened for more than two years.

"AFP calls on the Israeli authorities to reveal the results of any investigation and to hold those responsible to account," Lavine said.

Since 2023, Reuters has asked the Israeli military to carry out a swift, thorough and transparent probe into the strike that killed Abdallah. It has still received no explanation from the IDF on the reasons for that strike, according to the news agency.

Democratic U.S. Senator Chris Van Hollen said at the news conference that more needs to be done.

"We have not seen accountability or justice in this case," Van Hollen said. "It is part of a broader pattern of impunity, of attacks on Americans and on journalists by the government of Israel," he said.

U.S. Representative Becca Balint and independent U.S. Senator Bernie Sanders, both of whom are also from Vermont, said their efforts to seek justice for the journalists would continue.

In August this year, Israeli forces struck Nasser hospital in the south of the Gaza Strip, killing at least 20 people including journalists who worked for Reuters, the Associated Press, Al Jazeera and other outlets.

An Israeli military official told Reuters at the time that the two journalists for Reuters and the Associated Press who were killed in the Israeli attack were not "a target of the strike".

Ukraine's special forces said on Friday they had conducted an operation alongside what they described as a local resistance movement to hit two Russian ships transporting weapons and military equipment in the Caspian sea.

They did not specify when the strike took place. A Ukrainian official said on Thursday that Kyiv's drones had hit a Russian oil rig in the Caspian Sea for the first time, disabling the extraction of oil and gas from about 20 wells.

The special forces' statement on Telegram did not say how they had hit the vessels or what the extent of any damage was. They said the ships were hit off the coast of the republic of Kalmykia, a region of Russia.

They named the vessels as the Composer Rakhmaninoff and the Askar-Sarydzha, which they said were sanctioned by the U.S. for carrying military cargoes between Iran and Russia.

The statement said that the "Black Spark" resistance movement had provided detailed information on the movement and cargo of the ships.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up