Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

Mexico Unemployment Rate (Not SA) (Nov)

Mexico Unemployment Rate (Not SA) (Nov)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

Japan Construction Orders YoY (Nov)

Japan Construction Orders YoY (Nov)A:--

F: --

P: --

Japan New Housing Starts YoY (Nov)

Japan New Housing Starts YoY (Nov)A:--

F: --

P: --

Turkey Capacity Utilization (Dec)

Turkey Capacity Utilization (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Unemployment Rate (Nov)

Japan Unemployment Rate (Nov)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Dec)

Japan Tokyo Core CPI YoY (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Dec)

Japan Tokyo CPI YoY (Dec)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Nov)

Japan Jobs to Applicants Ratio (Nov)A:--

F: --

P: --

Japan Tokyo CPI MoM (Dec)

Japan Tokyo CPI MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Dec)A:--

F: --

P: --

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)A:--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Nov)

Japan Industrial Output Prelim MoM (Nov)A:--

F: --

P: --

Japan Large-Scale Retail Sales YoY (Nov)

Japan Large-Scale Retail Sales YoY (Nov)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Nov)

Japan Industrial Output Prelim YoY (Nov)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Nov)

Japan Retail Sales MoM (SA) (Nov)A:--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)A:--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)--

F: --

P: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)--

F: --

P: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)--

F: --

P: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

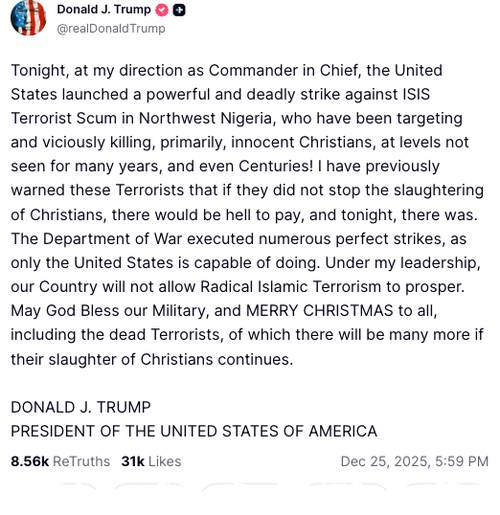

Trump has threatened to strike Nigeria to protect Christians; Government says it backed US strikes, not targeting any religion; Lakurawa sect possibly targeted, linked to past attacks.

By publicly cooperating with the United States on Christmas Day airstrikes, Nigeria's government may have averted humiliating unilateral military action threatened a month ago by President Donald Trump.

But security experts say it is unclear whether such strikes can do much to hinder Islamist militants who have long menaced communities in the area.

Trump announced on Truth Social on Thursday that U.S. forces had launched a strike against Islamic State militants in northwest Nigeria at the request of Nigeria's government.

Local media reported loud explosions in the village of Jabo in the evening of Christmas Day. Reuters has not been able to confirm whether there were casualties.

Abuja confirmed it had approved the operation. Foreign Minister Yusuf Tuggar said on Friday Nigeria had acted jointly with the U.S., but not targeting any specific religion.

"Nigeria is a multi-religious country, and we're working with partners like the U.S. to fight terrorism and protect lives and property," Tuggar told Nigeria's Channels Television.

Nigeria's population of over 230 million people is roughly evenly divided among Christians, who predominate in the south, and Muslims who predominate in the north.

Last month, Trump threatened to order his forces to take military action in Nigeria unless the authorities there acted to stop what he described as the persecution of Christians.

While Nigeria has had persistent security challenges, including violence and kidnappings by Islamist insurgents in the north, it strongly denies that Christians are subjected to systematic persecution.

Its government responded to Trump's threat by saying it intended to work with Washington against militants, while rejecting U.S. language that suggested Christians were in particular peril.

"After Trump threatened to come guns-blazing in Nigeria, we saw a Nigerian delegation visit the U.S.," Kabir Adamu, managing director of Abuja-based Beacon Security and Intelligence Limited, told Reuters.

"The Attorney General was involved, and agreements were signed. Then we learned of U.S. surveillance missions mapping terrorist locations."

Participating in the strikes could raise a risk that the government could be perceived as endorsing Trump's language on wider sectarian strife, a sensitive issue throughout Nigeria's history.

"Trump is pandering to domestic evangelical Christian objectives with his 'Christian genocide' narrative," Adamu said.

The northwestern area where Thursday's airstrikes took place has been plagued since 2024 by increasing violence from members of the Lakurawa sect, a strict Sunni Islamist movement that claims affiliation with the Islamic State group.

Formed as a vigilante outfit, the group evolved into a jihadist movement enforcing strict Islamist rule across hundreds of villages in the area. Nigeria declared the group a terrorist organisation early this year.

"It's very likely this is the group Trump referred to when mentioning U.S. military strikes in Nigeria," said Confidence MacHarry, senior analyst at Lagos-based SBM Intelligence. "They've also been linked to widespread cattle theft, with most of the stolen animals ending up in markets along the Nigeria-Niger border."

But Adamu questioned whether the strikes would do much to counter the insurgents, noting that the particular village hit was not previously known for harbouring militants.

"We were told the Nigerian government okayed the attack, but why Jabo when there is no record of any group there?" he said.

Some households in East Sussex have had no water on Christmas Day after supplier Southern Water experienced a problem while trying to restore service following a burst water main.

Southern Water blamed "very low levels" at Fairlight reservoir, adding that the facility had "now reached its final reserves".

Areas affected included TN34, TN35, TN37 and TN38, with customers living at higher elevations more likely to be hit.

The utility company said: "We're sorry customers in Hastings may currently be experiencing low pressure and, in some cases, a temporary loss of water supply.

"We understand how disruptive this can be, especially at this time of year, and we're doing everything we can to restore supplies as quickly as possible."

Southern Water said it had reports of low pressure or intermittent supply from from fewer than 100 customers in Hastings.

The incident follows reports on Tuesday morning of a burst mains pipe in a woodland north of Hastings, which the company had raced to fix before supplies cut out over Christmas.

A short power outage on Thursday at Brede water supply works then affected the remaining levels in the Fairlight reservoir.

It is not the first time burst pipes have caused an outage in the area. Hastings residents were left without water for four days in May 2024 after a pipe burst, which was flagged for replacement in 2007 but never fixed. Multiple pipes in the Hastings area have previously been listed by the company as "aged assets prone to failure".

A bottled water station in Pelham Place car park on Carlisle Parade in Hastings was open until 10pm on Christmas Day.

Southern Water has deployed a fleet of tankers to inject water into the network and the reservoir, saying: "This process takes time, but we're already seeing gradual improvements."

The problems are expected to be "temporary", the supplier said, adding: "If you do have water, please use it responsibly, as reservoir levels remain low and demand is very high."

Helena Dollimore, the Labour MP for Hastings, Rye and the Villages, said: "I'm angry that Hastings once again is paying the price for the failures of Southern Water.

"Our town's water infrastructure is not fit for purpose after years of neglect, and Southern Water must do better.

"I am pushing Southern Water to get us back in supply as quickly as possible and minimise the impact on residents by supplying bottled water and opening plenty of water stations.

"I'm also asking them to supply extra water to our pubs and restaurants who are particularly busy at this time of year. Once we are through this incident, Southern Water must get their act together.

"After a major five day water outage last May when the same pipe burst, and an environmental disaster last month when millions of plastic beads escaped their wastewater plant, we cannot endure any more."

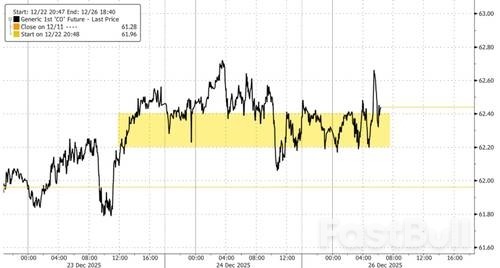

Bitcoin whales do not need headlines to move markets. Their actions alone can change sentiment. On December 25, that quiet influence returned when large Bitcoin transfers reached centralized exchanges. The surprise was not the movement itself. It was the calm response that followed.

In the second half of December, on-chain data flagged multiple high-value transfers tied to long-inactive wallets and institutional custodians. On-chain tracking data shows one institutional wallet transferred more than 2,200 Bitcoin to a U.S. exchange, while a separate wallet dormant for nearly eight years moved 400 Bitcoin to an offshore platform. Together, the transfers exceeded $230 million at prevailing market rates.

Historically, exchange inflows from Bitcoin whales tend to trigger caution. Large deposits often precede selling, or at least raise the risk of it. Academic research on crypto liquidity patterns shows that heavy inflows into exchanges can suppress short-term momentum even when broader trends remain intact.

This time, the BTC price held steady near the mid-$87,000 range. That stability puzzled traders. Market observers noted that there was no sudden spike in spot selling following the transfers. Instead, buyers absorbed available supply, keeping price action contained. Market data suggested the inflows did not immediately translate into spot selling, limiting downside pressure despite the size of the transfers.

Data from a public market tracker confirms Bitcoin traded within a narrow band during the session, reflecting balance rather than fear.

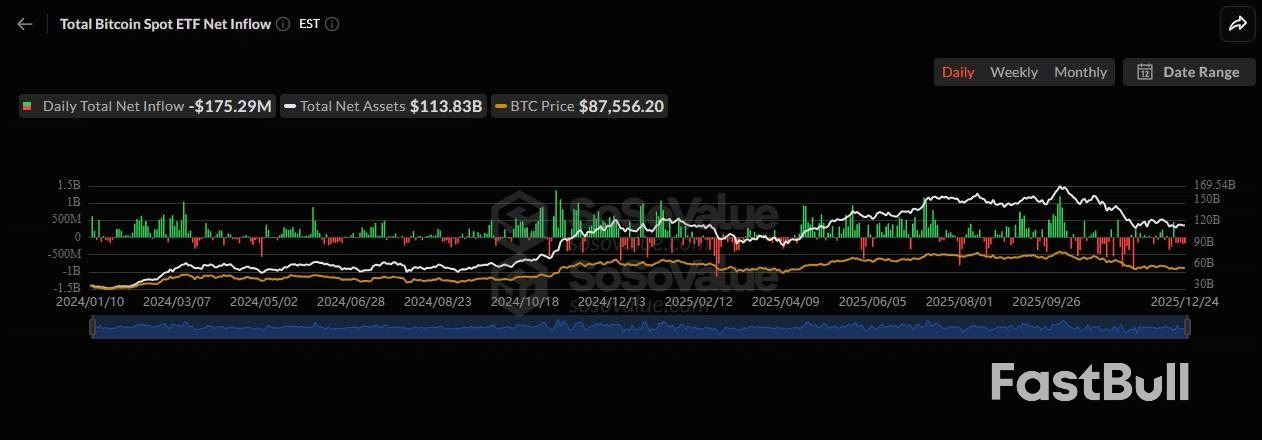

While whales drew attention, another signal added weight beneath the surface. U.S. spot Bitcoin exchange-traded funds recorded five consecutive days of net outflows. Persistent redemptions often reflect institutional caution, especially during low-liquidity holiday periods.

Despite that backdrop, the BTC price avoided a breakdown. Analysts who study ETF flows note that outflows do not always imply bearish conviction. In many cases, they reflect portfolio rebalancing or year-end risk trimming rather than directional bets.

Aggregate ETF flow data shows institutions reduced exposure without accelerating downside momentum.

Source: Sosovalue

Source: SosovalueDerivatives markets offered another layer of insight. Open interest across Bitcoin futures declined modestly as the price stalled. The decline in open interest suggested traders were reducing exposure ahead of potential volatility rather than positioning for a sharp breakdown. That shift signaled traders were unwinding leverage rather than building aggressive positions.

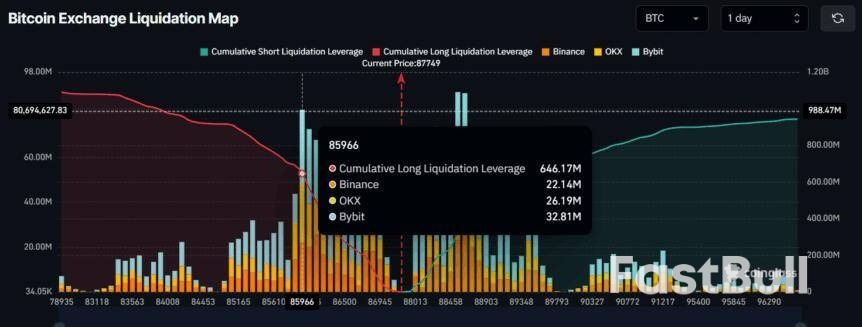

Liquidation maps revealed heavy long positioning near $85,900 and sizable short exposure above $88,600. This structure suggested traders believed downside risk remained limited while upside faced resistance. The BTC price reflected that tug-of-war.

Here, Bitcoin whales influenced psychology more than price. Their activity raised awareness, but not alarm.

Source: Coinglass

Source: CoinglassSince mid-November, Bitcoin has traded in between $86,000–$93,500. Historic studies find increased volatility often preempts powerful moves.

If Selling momentum builds and the price closes below support, momentum can quickly decay. If buyers reclaim the upper boundary, sidelined capital may return. Until then, Bitcoin whales continue to act as silent stress tests for market conviction.

At present, the BTC price sits at the center of that range, reflecting indecision rather than weakness.

Markets often reveal more through restraint than reaction. Bitcoin whales moved significant capital. ETFs leaked demand. Leverage thinned. Yet price held.

This balance suggests confidence has not vanished, but conviction remains fragile. The BTC price now depends less on headlines and more on follow-through. A decisive break will require either renewed institutional demand or a shift in whale behavior. So far, neither has materialized.

Until that catalyst emerges again, Bitcoin's range-bound behavior reflects balance, not exhaustion, something fundamental lies behind meaninglessness.

Until then, Bitcoin whales remain the quiet force shaping sentiment beneath a steady chart.

President Trump telegraphed the move last month, warning that US military intervention in West Africa was certaintly on the table after what he described as the mass killing of Christians by Islamic terrorists in Nigeria. Now, the president says the US military forces carried out powerful strikes against ISIS targets, framing the operation as a direct response to militants "viciously killing, primarily, innocent Christians."

"Tonight, at my direction as Commander in Chief, the United States launched a powerful and deadly strike against ISIS Terrorist Scum in Northwest Nigeria, who have been targeting and viciously killing, primarily, innocent Christians, at levels not seen for many years, and even Centuries!" Trump wrote on Truth Social on Christmas Day.

Trump continued, "I have previously warned these Terrorists that if they did not stop the slaughtering of Christians, there would be hell to pay, and tonight, there was."

"The Department of War executed numerous perfect strikes, as only the United States is capable of doing. Under my leadership, our Country will not allow Radical Islamic Terrorism to prosper," the president declared.

U.S. Africa Command (AFRICOM), the U.S. military's unified combatant command responsible for operations and security cooperation across Africa, said on X that, acting at the direction of Trump and the Secretary of War and in coordination with Nigerian officials, it carried out strikes against ISIS terrorists in Nigeria on Christmas Day, in Sokoto State.

Defense Secretary Pete Hegseth wrote on X that Trump was very clear last month: "The killing of innocent Christians in Nigeria (and elsewhere) must end," adding, "The @DeptofWar is always ready, so ISIS found out tonight — on Christmas. More to come…"

As we've previously reported, Christianity is facing an existential threat in Nigeria...

Trump Threatens US Military Action In Nigeria Over 'Killing Of Christians'

Nigeria's Christians Are Caught in A Tide Of Jihadi Violence

It seems Nicki Minaj has become the spokeswoman to address the persecution of Christians in Nigeria and around the world.

The energy market reaction was muted during the thin holiday trading, with Brent crude prices flat despite Nigeria's status as an OPEC member.

Trump has previously designated Nigeria as a Country of Particular Concern over religious freedom, a label rejected by Nigerian President Bola Ahmed Tinubu, who has faced growing ISIS pressure in the northeast.

The strike against ISIS fits into a broader pattern of Trump using military force abroad, including recent large-scale airstrikes in Syria and Iran and gunboat diplomacy in the Caribbean to accelerate regime instability in Venezuela.

The Malaysian government is expected to table the National Climate Change Bill (also known as the RUUPIN) in parliament in the coming months, providing a legal framework for climate action and anchoring market-based financing for adaptation and resilience. Malaysia's global climate pledges, including the goal of cutting methane emissions by 30% by 2030, were reaffirmed by the then acting minister of natural resources and environmental sustainability Datuk Seri Johari Abdul Ghani when announcing this timeline.

Methane, the primary component of natural gas, is also a potent greenhouse gas responsible for roughly 30% of global warming, because it traps over 80 times more heat than carbon dioxide in a 20-year period. Methane reduction is fast emerging as a defining front in the global fight against climate change.

The Environmental Defense Fund (EDF) is a global non-profit driving practical solutions for a safer climate and a more resilient energy future. For more than a decade, EDF has advanced scientific and economic efforts to highlight how methane mitigation is a rare opportunity to address emissions while benefiting energy supply, economic development, and the climate. About 25% of human-made methane comes from the oil and gas sector; reducing these emissions is an economic and climate relief opportunity.

Momentum is building across Southeast Asia to curb methane emissions from the oil and gas sector. The region's efforts gained structure in 2023 with the launch of the Asean Energy Sector Methane Leadership Program (MLP) in Kuala Lumpur — an initiative backed by Petroliam Nasional Bhd (PETRONAS) and the Japan Organization for Metals and Energy Security, now entering its second phase (MLP 2.0). PETRONAS set a regional benchmark at COP28 by becoming the first national oil company in Asean to commit to halving methane emissions by 2025. The following year, Asean energy ministers spotlighted MLP as a model of regional cooperation. By COP29, that collaboration deepened, as leading national oil companies across Asean pledged a joint path forward — to establish a regional methane emissions baseline by 2025 and set measurable reduction targets for 2030, underscoring a collective drive towards a lower emission energy future.

Progress followed by these pledges is evident. PETRONAS has already achieved a 62% methane reduction a year ahead of schedule. PETRONAS, Indonesia's Pertamina and Thailand's national oil company PTTEP have joined the UN Environment Programme Oil and Gas Methane Partnership 2.0, committing to higher standards of monitoring and transparency. In May 2025, Cambodia became one of the first least-developed countries to submit its National Methane Roadmap, aiming to increase the country's climate ambition and inform updates to its Nationally Determined Contribution. In June 2025, the Methane Management Roadmap for Oil and Gas in Asean was released by the Asean Centre for Energy (ACE), Asean Council on Petroleum and the World Bank. Most recently, in October 2025, the Asean Plan of Action for Energy Cooperation 2026-2030 includes action plans to set and promote initiatives to reduce methane emissions in oil and gas activities.

Two new studies by EDF, Swinburne University of Technology Sarawak and the Institute of Strategic and International Studies Malaysia suggest that cutting methane emissions in the country's oil and gas industry could deliver not only climate benefits but also strong economic gains.

The first study found that up to 63% of methane emissions from Malaysia's upstream oil and gas sector could be mitigated at no net cost — largely through measures such as rerouting vented gas to fuel systems and replacing high-emission equipment with zero emission alternatives. Even a 30% reduction could yield net revenues of US$8 million (RM32 million) to US$11 million, offering a clear business case for action. The findings provide Malaysia-specific data to guide investment and technology choices in the Asean region, filling a gap often dominated by US-centric data used by regional energy companies.

The second study highlights methane abatement as a potential job creator. Opportunities are expected to emerge across fields such as remote sensing, drone inspection, measurement, monitoring, reporting and verification. The oil and gas services and equipment sector stands to gain the most, with additional employment growth anticipated across downstream operations — signalling that methane reduction could become both an environmental and economic win for Malaysia.

Methane management stands out as a rare win-win for Malaysia and the broader Asean region — a strategy that strengthens both climate ambition and economic resilience. By embedding methane reduction targets into the forthcoming National Climate Change Bill, Malaysia can turn commitment into leadership, aligning the bill with its Climate Change Policy 2.0 and setting a powerful precedent for neighbours like Thailand, which is also developing climate legislation.

With the Asean Methane Roadmap promising up to US$87 million in additional gas revenue alongside deep emission cuts, the case is clear: tackling methane is not a cost, but an investment in efficiency, innovation and regional energy security. The region can no longer afford to let methane leak away as lost value and rising pollution — it's time to capture its potential for a cleaner, more competitive future.

Dr Shareen Yawanarajah is senior director of Energy Transition at the Environmental Defense Fund. She leads EDF's Southeast Asia energy transition strategy and engagement agenda.

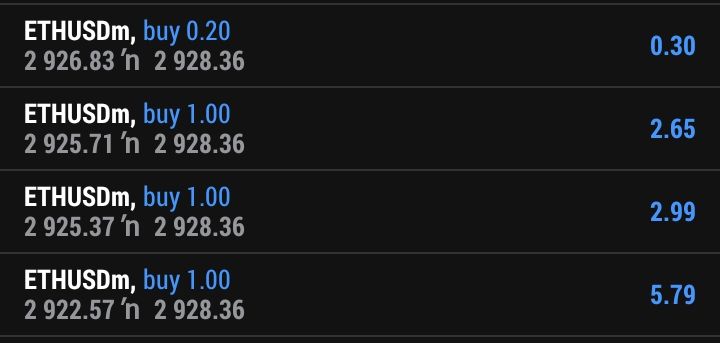

Bitcoin's price stayed subdued on December 25 as renewed activity from large holders, including whale transfers to exchanges, combined with continued outflows from US spot Bitcoin ETFs, unsettled market sentiment, raised concerns about potential sell pressure, and left traders cautious despite BTC holding above key technical support levels overall market.

A long-inactive Bitcoin whale and asset manager BlackRock moved large sums of BTC to centralized exchanges on the day according to blockchain analytics firm Onchain Lens.

BlackRock had invested 2,292 BTC that had a value of about 199.8 million dollars in Coinbase. In another transaction, a whale wallet that was dormant in eight years transferred 400 BTC, worth about 34.92 million, to the OKX exchange.

Traders keep a close eye on such transfers, which massive deposits to exchanges would typically suggest to them that there is sell-side pressure.

No direct spot selling was established, but the flows were sufficiently sufficing to place market participants on their toes.

The warning sound was supported by the ongoing weak institutional flows. According to the data provided by SoSoValue, U.S. spot Bitcoin ETFs experienced their fifth day in a row of net outflows. The continual withdrawals were an indication that the institutional demand was still weak despite the fact that Bitcoin was trading above key technical support levels.

Meanwhile, there was an overall fall in leverage in the derivatives market. BTC was trading around $87,700 at press time, falling about 0.35% on the day. According to CoinGlass, open interest was dropped at 0.99% to $57.42 billion, which means that traders were not taking on risk as they were not aggressively positioning themselves to expect a price breakout.

Positioning information suggested areas of bullish conviction in spite of the leverage pullback. The Liquidation Map of CoinGlass indicated that its largest concentration of leverage was on the downside and on the upside to $85,966 and 88,636 respectively.

The long leveraged positions (of a total of around 646.17 million) were concentrated nearer to the bottom whereas the short leveraged positions (of the total of around 422.42 million) were concentrated above the Bitcoin price, indicating that the traders were generally confident that BTC would be above the zone of support of 85,966.

In a larger technical context, BTC is stuck in a range of consolidation. The weekly chart analysis indicates that BTC has been trading at an average bottom of about $86,000 to a top of about $93,500 since mid-November. Such long periods of steady consolidation are, in the past, usually followed by sharp swings in one way or the other.

Since Bitcoin has been fluctuating around the lower part of this range, there has been an increased fear of a possible breakdown. Technical analysts believe that a daily close below the support of the $86,000 may open up to further decline.

On the contrary, the bearish view would be nullified in case BTC were to advance beyond the upper resistance at about 93,500 mark and herald another bullish breakout.

Whale action, ETF outflows, and to a certain extent, thinning leverage have so far joined hands to hold the Bitcoin traders squarely on the defensive side.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up