Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

(Reuters) - Tech-billionaire and Tesla CEO Elon Musk made direct yet unsuccessful appeals to U.S. President Donald Trump to reverse tariffs over the past weekend, Washington Post reported on Monday citing two people familiar with the matter.

(Reuters) - Tech-billionaire and Tesla CEO Elon Musk made direct yet unsuccessful appeals to U.S. President Donald Trump to reverse tariffs over the past weekend, Washington Post reported on Monday citing two people familiar with the matter.

This exchange marks the highest profile disagreement between the President and Musk, the report said. It follows Trump's unveiling of a 10% baseline tariff on all imports to the U.S. along with higher duties on dozens of other countries.

The White House and Musk did not immediately respond to Reuters requests for comment.

Musk, a Trump adviser who has been working to eliminate wasteful U.S. public spending, called for zero tariffs between the U.S. and Europe during a virtual interaction at a congress in Florence of Italy's right-wing, co-ruling League Party over the weekend.

Tesla has seen its quarterly sales drop sharply amid a backlash against Musk's work with a new "Department of Government Efficiency." The company's shares are trading at $233.29 as of its last close on Monday, down over 42% since the beginning of the year.

Musk has previously said that the impact of U.S. President Donald Trump's auto tariffs on Tesla is "significant."

Economists say the tariffs could reignite inflation, raise the risk of a U.S. recession and boost costs for the average U.S. family by thousands of dollars - a potential liability for a president who campaigned on a promise to bring down the cost of living.

The tokenization of real-world assets has emerged as one of the most talked-about topics in the finance sector. Key figures like Ripple CEO Brad Garlinghouse, Coinbase CEO Brian Armstrong, and XRP legal advisor John Deaton have expressed that this process can lead to fundamental changes in the financial system. The advantages provided by digital asset technologies, such as flexibility and accessibility, have further amplified the discussion surrounding the topic. Comments indicating the inevitability of tokenization signal strong prospects for the future of the industry.

XRP legal advisor John Deaton emphasized via social media that the tokenization of real-world assets marks an irreversible transformation. He pointed out that influential figures like Ripple’s Brad Garlinghouse, Coinbase’s Brian Armstrong, and BlackRock’s Larry Fink are at the forefront of this change. According to him, these individuals are presenting significant ideas at the intersection of traditional finance and digital assets.

Coinbase CEO Brian Armstrong argues that all asset classes will eventually transition to blockchain-based systems. He showcases the increase in on-chain credit and borrowing instruments as a practical example of what tokenization offers. Deaton supports this view, labeling Armstrong’s approach as being “on the right track.”

Brad Garlinghouse’s comments focus on the XRP Ledger (XRPL) infrastructure developed by Ripple. He states that the tokenization of real-world assets is restructuring the financial system. In his view, this transition not only enhances asset accessibility but also elevates transaction efficiency to new heights.

Recent posts from Ripple’s social media have highlighted how the XRP Ledger has become a hub for tokenized treasury, commodities, and stable assets. The updates also included current performance metrics of the network. These insights demonstrate that Ripple is positioned not only as a provider of technological infrastructure but also as a pioneer in the sectoral transformation.

Galaxy Digital CEO Mike Novogratz provided another significant comment on the tokenization trend. He mentioned that this growing trend on a global scale will accelerate in the coming years. According to him, tokenization will open new doors for both investors and financial institutions.

John Deaton does not view the process merely as a technical advancement. He believes that the ability to divide tokenized assets into smaller shares can help reduce income inequality. Moreover, he argues that digital assets can establish a more accessible financial structure by diminishing reliance on traditional financial intermediaries.

The transition of real-world assets into the digital realm has the potential to transform not only the technological landscape but also the social and economic structures of the industry. Each new announcement in this context signals the construction of a future rooted in stronger foundations within the cryptocurrency world.

The post Tokenization of Real-World Assets Sparks Exciting Changes in Finance appeared first on COINTURK NEWS.

Before I unpack the economic and market implications of the sweeping tariffs the Trump administration introduced on April 2 (which have raised the effective tariff rate to the highest level since the 1930s), I want to acknowledge that this is an early response* to a nascent policy. The situation will very likely.

As part of this new policy, a universal 10% tariff on all countries will take effect on April 5. Additional, “reciprocal” tariffs will be implemented on April 9. These are a purported response to tariffs imposed by other nations toward the US. The presidential administration asserts these tariffs represent half the rate of the tariffs imposed toward the US by other countries and positions this halving as a kindness on the part of the US.

There are a few particularly notable aspects of the new policies I’d like to point out. First, the tariff rate for China appears to be “stacking,” meaning that while the new, “reciprocal” tariff is 34%, the effective rate is 54% given 20% was imposed earlier this year. It also ends duty-free de minimis treatment for covered goods. Next, exemptions to future Section 232 tariffs — applied to gold, autos, and energy/critical materials — were mentioned. Investigations into pharma and semiconductors are expected, as well. Finally, on a relative basis, Canada and Mexico will continue to receive no tariffs on USMCA-compliant goods, a 25% tariff on non-USMCA compliant goods, and a 10% tariff on non-USMCA-compliant energy and potash.

Let’s turn our attention back to timing. In theory, because the “reciprocal” tariffs are meant to be enacted a week after the announcement was made, there is room for negotiation. In my view, the administration is likely calculating that using an aggressive starting point increases the probability that other countries make concessions, which the US could accept before/immediately following implementation. I suspect the administration would view such concessions as both a testament to US strength and a means of retaining some revenue from a fiscal perspective. The latter point is important — a reconciliation process may lead to higher debt levels over the medium term with a current policy baseline and the addition of further tax cuts beyond the extension of the Tax Cuts and Jobs Act (TCJA).

As part of this conversation, it’s worth noting the April 2 judicial election results revealed that voters are souring on the Trump administration. This type of feedback can be a disciplinarian, but President Trump is steadfast in his conviction in the efficacy of tariffs, which he seems to view as a solution to structural issues around labor share of income and income inequality. It remains to be seen whether they will achieve the desired outcome over time.

The magnitude of the tariffs will erode, if not destroy, trust among US allies. A loss of trust may make allies less likely to engage in negotiations than the administration bargains on — a dynamic that is likely to become clearer in the coming days. What’s more, a decline in institutional integrity undermines the status of the US dollar as reserve currency. This risk has now accelerated, and even if the administration walks the tariffs back before implementation, this is unlikely to dissipate. In the short and medium term, these actions:

This all said, I’ll be surprised if all these tariffs go into effect as announced, which makes analysis of the situation difficult. Uncertainty multiplier effects can be large — especially when bilateral negotiations with 60 countries may be looming large and potential shifts in tariff rates by the day/week are likely.

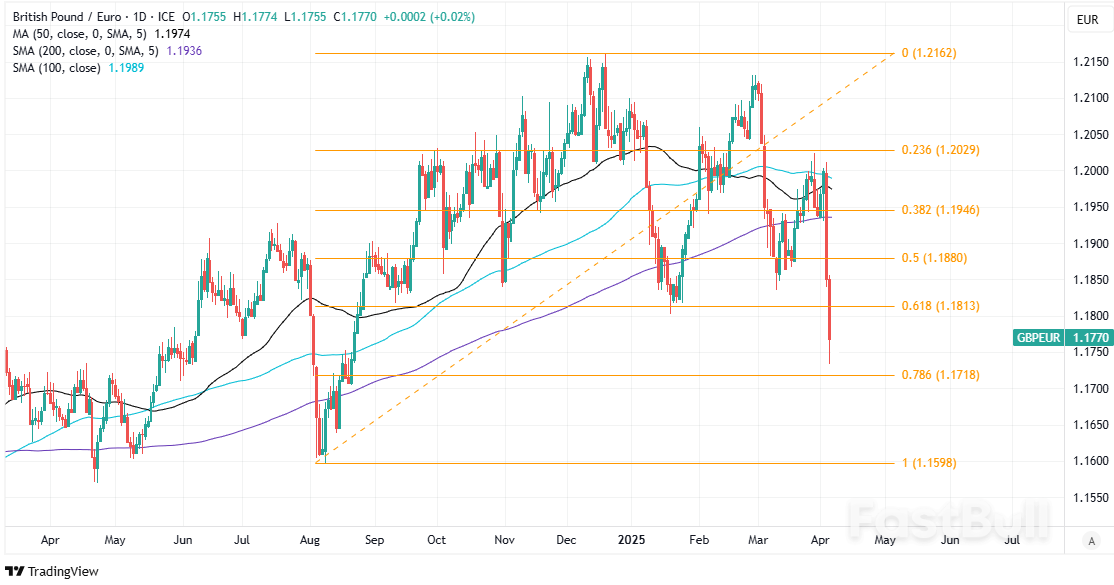

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of August to December uptrend indicating possible areas of technical support for Sterling. Click for closer inspection.

Above: Pound to Euro rate shown at daily intervals with Fibonacci retracements of August to December uptrend indicating possible areas of technical support for Sterling. Click for closer inspection.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up