Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Amid rising geopolitical tensions and expiring U.S. listing approvals, China's autonomous driving firm Momenta is exploring a 2026 IPO in Hong Kong, reflecting a broader strategic pivot among Chinese tech firms toward regional capital markets....

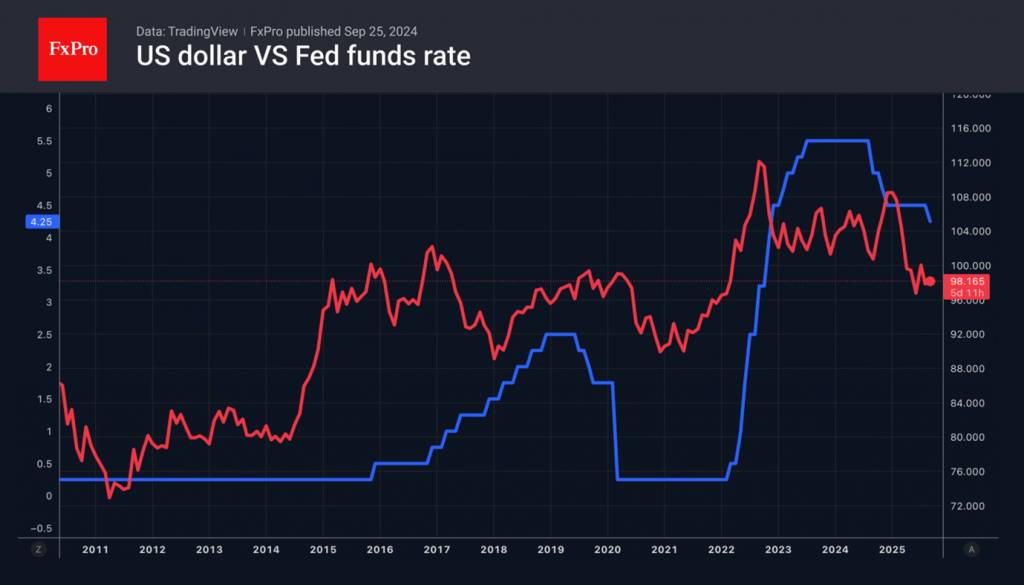

The US dollar has recovered thanks to the Fed chair’s reluctance to signal a rate cut in October, a correction in stock indices, and rising geopolitical risks. Each of the USD’s main competitors has its own Achilles heel. The euro is disappointed by Friedrich Merz’s fiscal stimulus measures. The leadership battle in the Liberal Democratic Party weighs down the yen. The pound is concerned about the Treasury’s ability to plug a £35 billion hole in the budget.

Scott Bessent expressed surprise that Jerome Powell did not signal further rate cuts in October. According to the Treasury Secretary, the federal funds rate should fall by 100-150 basis points before the end of 2025. However, many FOMC members are concerned about the possibility of accelerating inflation. The split within the Fed is playing into the hands of the US currency.

The greenback continues to act as a safe-haven asset, and the United States is a net exporter of energy commodities. Therefore, rising oil prices amid increasing geopolitical risks have provided support for the USD index.

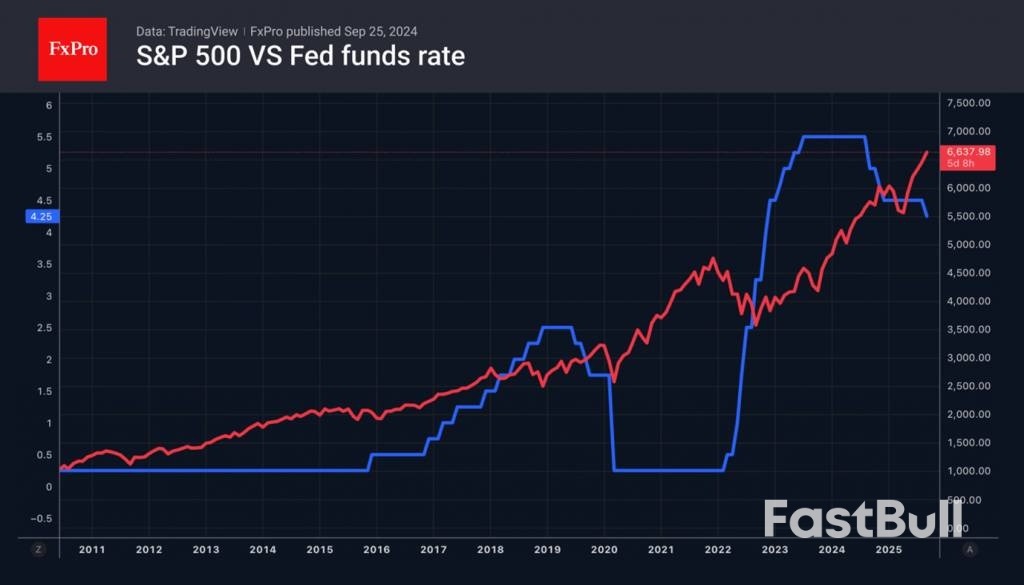

The fall in US stock indices resembles a sell-the-fact after a large-scale buy rumour after the Fed has lowered its rate. After the S&P 500 rose on news of Oracle and NVIDIA’s deals with OpenAI, asset managers bought $58 billion worth of US stocks. This is the largest inflow since the beginning of the year. This seems logical against the backdrop of numerous record highs for the broad stock index.

As soon as the S&P 500 took a step back, the bulls became nervous. Jerome Powell contributed to the pullback. The Fed chairman said that US stocks are overvalued. Until then, the markets had not attached any significance to the Price-to-Earnings Ratio rising to 22.9. The broad stock index has only traded above this level twice this century — during the dot-com crisis and the pandemic.

Bank of America notes that 19 out of 20 fundamental valuation metrics for the S&P 500 indicate that the market is overheated. However, corporations’ current positions look much better than in the past, so the current valuations may be justified. This gives investors the opportunity to use the good old strategy of buying on dips.

The US has agreed to consider granting tariff exemptions — specifically zero tariff rates — for several commodity products proposed by Malaysia, including palm oil and cocoa, which are expected to be finalised next month.Malaysia’s chief negotiator for the official tariff negotiations, Mastura Ahmad Mustafa, said the US is also considering zero tariffs for furniture, automotive parts and components, as well as aerospace parts and components.She said the US side had conveyed the matter in several prior negotiation sessions.

Mastura is the deputy secretary general (trade) of the Ministry of Investment, Trade and Industry (Miti).“As mentioned, we are currently in the process of detailing the agreement on reciprocal tariffs. Starting yesterday (Thursday), we have arranged several virtual sessions with the US to finalise the agreement.“In these negotiations, the US side indicated that they are open to considering several goods which, in their view, cannot be produced domestically in the US.

“For such products, they will consider granting exemptions in the form of zero tariffs under this unilateral tariff arrangement,” she told Bernama in an exclusive interview here on Friday.

A two-day rally by the US dollar brought it to its highest levels in about a month. The trade-weighted index closed at 98.55 yesterday. EUR/USD dipped to 1.1666, extending the correction lower from mid-September’s failed attempt for a topside break from the sideways trading range. USD/JPY came just shy of the 150 big figure. Renewed dollar strength came on the heels of a strong set US economic data. US Q2 GDP was revised upwards on higher personal consumption and jobless claims for a second week straight unexpectedly dropped. The level (218k) was the lowest since July and sowed doubts on whether the labour market is as weak(ening) as the Fed currently believes. With a stronger dollar came higher US yields. Net daily changes varied between +5.1 (2-yr) and near-flat (30-yr). European yields rose as well, with the belly underperforming the wings. The 2-yr swap yields punched through the recent September highs to close at levels last seen early April, prior to president Trump’s Liberation Day. Gilts underperformed. Yields rose 6.6-8.8 bps across the curve with the long end slightly lagging the rest. Demand in a series of sub-par gilt auctions this week was the lowest in several years. While the DMO easily raised the amounts targeted, it does indicate markets’ declining appetite for gilts as we go into the annual Autumn Budget announcement end November. Sterling grinded lower. EUR/GBP’s closing level was the highest since end 2023 (0.8741).

Overnight news flow is dominated by President Trump announcing some new tariffs and reviving the trade topic in doing so. Branded pharmaceuticals will be slapped a 100% tariff, starting October 1. Exemptions are offered to companies that are either “breaking ground” and/or already constructing manufacturing sites in the US. Other tariff announcements include a 25% levy on heavy trucks and a 50% charge on kitchen cabinets and bathroom vanities. They are introduced under Section 232 of the Trade Expansion Act, so falling outside the scope of the reciprocal tariffs that are currently being investigated for its legality while remaining in place at least through October 14. The impact for regions such as the EU could (conditional tense intended) stay limited since the 15% trade deal struck with the US is considered to be overruling. The US is said to announce other duties as well in coming weeks, including on semiconductors and critical minerals. In the meantime and from a daily perspective, we’ll be looking at the release of the August PCE deflators. A slight acceleration is expected on a headline basis to 2.7% while the core measure should match July’s 2.9%. The attention is focused at whether or not we’ll see more tariff-related inflation filtering through. If so, that could further question the Fed’s ability to deliver two more cuts this year. Money markets aren’t so sure anymore and that’s been supportive to (ST) yields and the dollar. EUR/USD 1.1557/1.1573 serves as a first support.

Inflation in the Japanese capital region declined by 0.1% M/M in September to stabilize at a downwardly revised 2.5% Y/Y. Consensus feared an acceleration to 2.8% Y/Y. Core measures slowed even more. Without fresh food prices, prices fell by 0.2% M/M (2.5% Y/Y stable). Also abstracting energy prices left them 0.3% lower (2.5% Y/Y from 3% Y/Y). Lower services prices (-0.4% M/M) contrasted with region goods prices (+0.2% M/M). The unexpected slowdown in Tokyo inflation has likely to do with local legislation (waiver of childcare fees for firstborns) and is unlikely to be repeated in national numbers to be released on October 24, one week before a potential pivotal Bank of Japan meeting (Oct 30; first rate hike since January?).

Dallas Fed president Logan made the case for modernizing the FOMC’s operating target rate. The FOMC began publicly targeting the fed funds rate in the mid-1990s which is now outdated. A repo rate would provide a more robust target and allow the Fed to adjust proactively and planfully. She proposes switching to the tri-party general collateral rate (TGCR) which is cleaner as it incorporates more than $1tn a day in risk-free transactions that represent a marginal cost of funds and marginal return on investment for a large number of participants.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up