Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Asian stocks rose on Fed cut hopes and Trump’s Japan deal. UK retail sales beat forecasts, Europe edged higher before U.S. payrolls, while oil slipped and major currencies gained.

The Hong Kong 33 CFD Index (a proxy for Hang Seng Index futures) delivered the anticipated bullish run between 13 and 25 August, reaching the short-term resistance level of 25,750 and posting an intraday high of 25,946 on 25 August.Thereafter, its price actions have evolved into a choppy minor corrective decline sequence of -4.3% (high to low) within a medium-term uptrend phase from 25 August to 28 August, as short-term traders took profit due to fears of an overheated bull-run seen in the China “A” shares market towards the end of August

Margin financing in the Shanghai stocks rose to record highs in line with the Shanghai Stock Exchange Composite Index hitting a 10-year high, bringing the memories of the bursting of the 2015 stock market bubble in China that saw a massive decline of close to -50% in their respective benchmark stock indices.

Fundamentals continued to improve in the Chinese stock markets

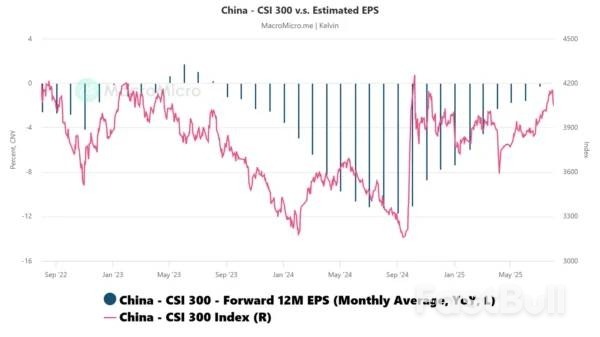

The monthly average of the 12-month forward earnings per share (EPS) growth for China’s CSI 300 (comprising component stocks from Shanghai and Shenzhen stock exchanges) has improved significantly in the past eight months; it rose from -7.4% y/y in January 2025 to -1.8% y/y in August 2025 (see Fig. 1).

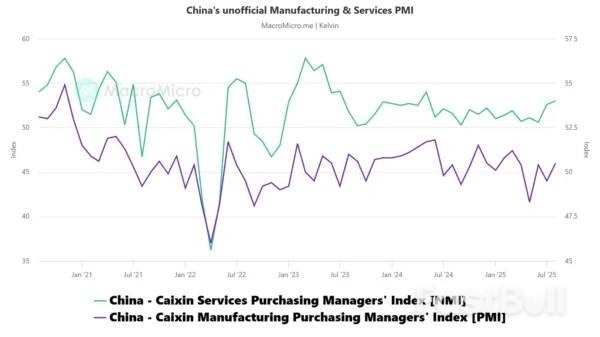

The privately compiled (non-official) Manufacturing and Services PMIs, which track small and medium-sized enterprises in China, have returned to expansionary territory. The Manufacturing PMI rose to 50.5 in August 2025, recovering from a near three-year low of 48.3 in May. Similarly, the Services PMI strengthened to 53 in August, up from 50.6 in June (see Fig. 2).

These improvements in leading Chinese economic indicators suggest that deflation risks have eased, creating the potential for a positive feedback loop that could further support the Chinese stock market and, by extension, benefit Hong Kong equities.

Right now, let’s take a deep dive into the short-term (1 to 3 days) directional bias and key levels to watch on the Hong Kong 33 CFD Index.

The minor corrective decline from the 25 August 2025 high to the 28 August 2025 low of the Hong Kong 33 CFD Index is likely to have ended where a potential fresh bullish impulsive up move is in progress.

Bullish bias above 24,880 key medium-term pivotal support for the Hong Kong 33 CFD Index. A clearance above 25,490 intermediate resistances sees the next resistances coming in at 25,690, 25,890, and 26,120 in the first step (see Fig. 3).

Key elements

Alternative trend bias (1 to 3 days)

A break below the 24,880 key support jeopardizes the medium-term uptrend phase of the Hong Kong 33 CFD Index for an extension of the corrective decline to expose the next support zone of 24,730/24,620 in the first step.

Copper prices rose on Friday as a weaker dollar and hopes for stronger demand in China provided support ahead of a U.S. jobs report later in the session that may provide more clarity on the U.S. interest rate trajectory.

Three-month copper on the London Metal Exchangerose 0.4% to $9,939.50 per metric ton by 1023 GMT. The contract touched a five-month high of $10,038 on Wednesday on mounting expectations of the U.S. interest rate cut later in the month.

Lower interest rates improve prospects for growth-dependent metals, while a weaker U.S. currency, last down 0.3%, makes dollar-priced metals more attractive for other currency holders.

Indicating that tight copper concentrate supply kept hitting smelters in Asia, one of Japan's top copper smelters JX Advanced Metalssaid it was likely to cut copper production by tens of thousands of tons in the fiscal year ending in March.

In the U.S., inventories in the Comex-owned warehouses (HG-STX-COMEX) already at their 22-year-high kept climbing up this week due to the remaining premium of the Comex copper futures against the LME benchmark, recently at 1-2%.

The premium (LMECMXCUc3) saw a slump at the end of July as Washington excluded refined copper metal from its import tariffs on some copper products, but the fall has not been enough to cause an outflow from the U.S. stocks, a copper trader said.

Stocks in the LME-registered warehouses (MCUSTX-TOTAL) were broadly stable, having risen 74% since late June, and keeping the discount for the cash over the three-month forward (CMCU0-3) at $67 a ton.

"Even as copper remains distorted by the hangover of U.S. stock building, LME spread weakness has been suggestive of a loosening ex-China market but any price weakness appears to have been met by Chinese buying," analysts at Macquarie said in a note.

The Yangshan copper premium (SMM-CUYP-CN), which reflects demand for copper imported into China, was steady on Friday at its three-month high of $57 a ton.

Among other London metals, aluminiumrose 0.5% to $2,603.50 a ton, zincincreased 0.6% to $2,860.50, leadclimbed 0.4% to $1,993, tingained 0.4% to $34,630, while nickelwas up 0.3% at $15,270.

Lawmakers of Japan's ruling party will vote on Monday whether to hold an extraordinary leadership election that could oust embattled premier Shigeru Ishiba and have a significant impact on the world's fourth largest economy.

Concern over political uncertainty has led to a sell-off in the yen and Japanese government bonds (JGB) this week, with the yield on 30-year bonds hitting a record high on Wednesday.

While the policy paralysis around such a vote could add pain for an economy hit by US tariffs, markets are focusing more on the chance of Ishiba's replacement by an advocate of looser fiscal and monetary policy such as Sanae Takaichi, who has criticised the Bank of Japan's interest rate hikes.

"The dominant market bet is for the LDP to hold a leadership race and for Ishiba, known as a fiscal hawk, to lose his job," said Katsutoshi Inadome, senior strategist at Sumitomo Mitsui Trust Asset Management.

"We'll likely see further selling in Japanese government bonds, as whoever succeeds Ishiba probably will be more open to loosening fiscal policy than him."

Ishiba has refused calls from within his Liberal Democratic Party (LDP) to step down and take responsibility for its July loss in an upper house election.

Staying in power, however, has become increasingly hard for him. Having lost a majority in both houses of parliament, his ruling coalition needs opposition support to pass legislation.

Wary of being attached to the unpopular premier, opposition parties have refused to cooperate. Even some of Ishiba's cabinet members are now calling for the choice of a new party leader.

Party rules require at least half the LDP members to request holding the race, which could follow this month or in October.

Such a contest could delay parliament's passage of an expected supplementary budget aimed at cushioning the blow to households from rising living costs.

Ishiba told reporters on Friday he plans to compile this autumn a package of measures to support the economy. Asked whether he would step down, he said: "All I can say is that my government will fulfil its responsibility to the public."

Eurasia Group gave odds of 60% that Ishiba would not survive.

"Ishiba's poor performance as party leader in lower and upper house elections and events in recent days, including former prime minister Aso Taro announcing his support for the special election, has turned the tide against Ishiba," said David Boling, director of Japan and Asian Trade at Eurasia.

That puts the focus on his potential successor.

While the LDP lacks a majority in parliament, its leader would still be the favourite to become next prime minister, due to a fragmented opposition.

The choice could affect not just the scale of fiscal stimulus, but the timing of the BOJ's next interest rate hike, analysts say.

Front-runners include 44-year-old Shinjiro Koizumi, a charismatic agriculture minister popular with the public, but whose views on economic policy are unknown.

Takaichi, who represents the LDP's right wing, is also seen by some analysts as a strong candidate to become Japan's first female prime minister. She lost the September leadership race to Ishiba in a run-off vote.

While several other candidates are expected to be in the fray, Takaichi stands out for her vocal opposition to BOJ rate hikes and calls to ramp up spending to underpin the fragile economy.

After ending a decade-long, massive stimulus programme last year, the BOJ raised interest rates to 0.5% in January on the view that Japan was on the cusp of sustainably meeting its inflation target of 2%.

Most economists polled by Reuters expect the central bank to raise rates again this year, with some betting on a hike in October.

"Under Takaichi, fiscal discipline will be out the window," Inadome said. "Markets still remember the time she made it to the run-up in September, and triggered huge selling in JGBs."

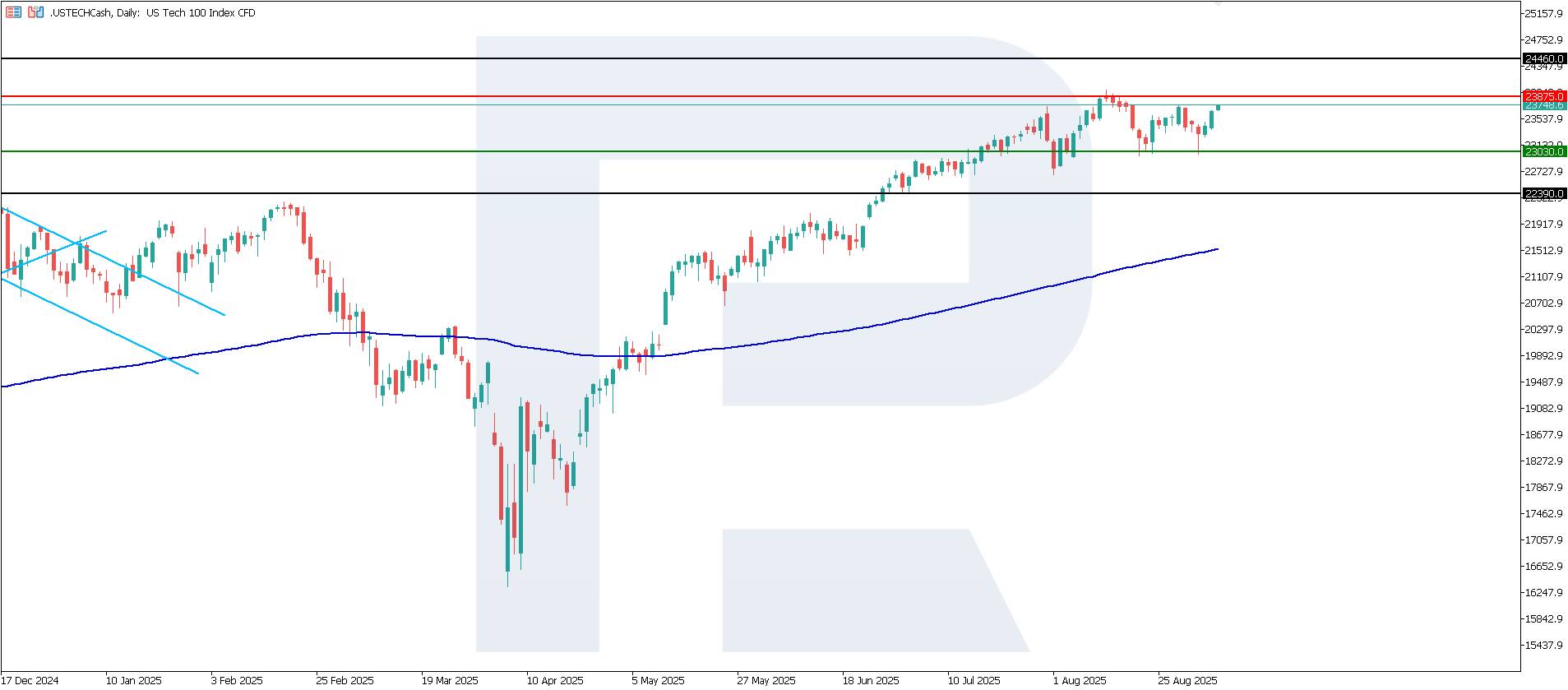

The downward correction in the US Tech stock index is coming to an end. The US Tech forecast for next week is positive.

US Tech forecast: key trading points

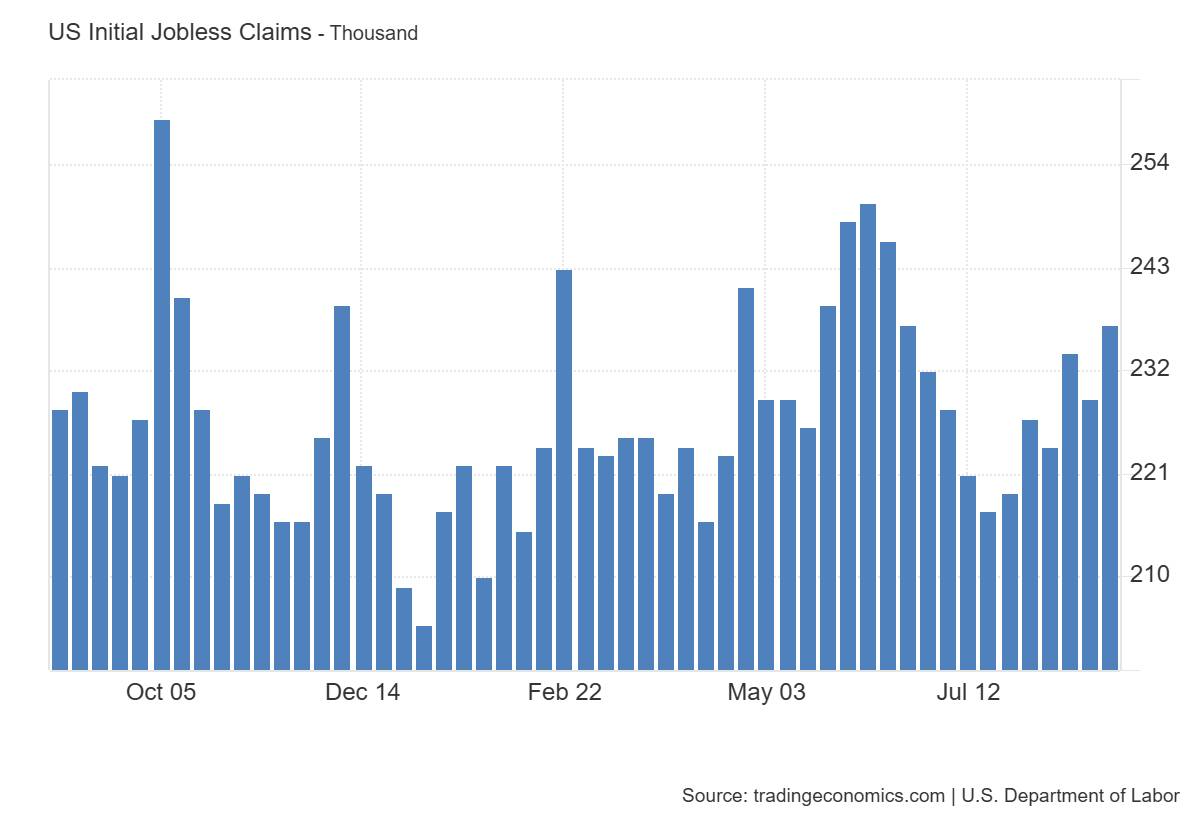

Initial jobless claims in the US reached 237 thousand compared to the forecast of 230 thousand and the previous 229 thousand. The figure is moderately above expectations and confirms a gradual softening of the labour market: layoffs are becoming more frequent and employment momentum is cooling. The level itself remains far from recessionary territory, but the trend indicates less economic overheating and weaker wage-driven inflationary pressure.

On the one hand, a softer labour market reduces inflation risks and increases the likelihood of earlier Federal Reserve policy easing, which supports equity valuations through lower Treasury yields. On the other hand, if jobless claims continue to rise, concerns over economic growth and corporate earnings will mount, limiting risk appetite.

The technology sector is sensitive to discount rates: falling yields typically expand multiples and support large growth companies, cloud services, and software with predictable subscription flows. However, worsening macroeconomic expectations may cool cyclical tech segments, particularly semiconductors and equipment, where demand depends on clients’ capital expenditure. Internet platforms and advertising benefit from steady consumer demand, while signs of a slowdown would have a neutral-to-negative effect. SaaS and cloud are relatively resilient due to their contractual model, yet remain rate-sensitive. Hardware manufacturers stay reliant on investment cycles.

US Tech technical analysis for 5 September 2025

The US Tech index broke below the previous support level at 23,465.0, with a new support line formed at 23,030.0. Resistance stands at 23,875.0. The downtrend is nearing completion, and the price will likely break above the resistance level, with the next upside target at 24,460.0.

The following scenarios are considered for the US Tech price forecast:

The persistence of deviations is critical: several weeks with claims above 250 thousand would strengthen the signal of slowing employment. The market will compare data with the jobs report, inflation indicators, and Treasury yield dynamics. Lower yields would likely support the US Tech index; however, if recession fears intensify, valuation effects could be offset by weaker profit expectations. The nearest upside target remains at 24,460.0.

Ahead of fundamental data releases from the eurozone and the US, the EURUSD pair may test the 1.1750 level. Discover more in our analysis for 5 September 2025.

EURUSD forecast: key trading points

GDP is the total value of all goods and services produced in the country, calculated based on final output excluding raw materials.The forecast for 5 September 2025 does not appear optimistic, suggesting that eurozone GDP may remain at 0.1%. If the actual reading is equal to or below expectations, it may negatively affect the euro and trigger a correction in the EURUSD rate.

According to the forecast for 5 September 2025, US Nonfarm Payrolls may increase to 75 thousand from 73 thousand in the previous period. If actual results match expectations, markets may see increased volatility and temporary US dollar strength. The release of Nonfarm Payrolls almost always stirs market activity and can either support the US dollar or cause it to lose ground.Today’s EURUSD forecast also takes into account that the US unemployment rate for August may rise to 4.3% from 4.2% previously.

On the H4 chart, the EURUSD pair formed an Inverted Hammer reversal pattern near the lower Bollinger Band. At this stage, it continues to develop an upward wave in line with the signal. Since the pair remains within an ascending channel, it still has chances for growth towards the nearest resistance level at 1.1750. A breakout above this resistance would open the way for further upward momentum.

At the same time, the EURUSD rate could correct towards 1.1625 before resuming growth.

Today’s EURUSD forecast favours the USD, as eurozone data may weaken the euro. However, EURUSD technical analysis suggests potential growth towards the 1.1750 resistance level.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up