Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Inflation has been the big economic concern for several years now, across much of the globe (though not quite all, as we’ll see in a moment). But the tentative, broad view has been that prices are now sort-of, kind-of under control. Certainly enough so that markets largely expect central bank interest rates to keep falling, albeit slowly, over the next year or so.

Inflation has been the big economic concern for several years now, across much of the globe (though not quite all, as we’ll see in a moment). But the tentative, broad view has been that prices are now sort-of, kind-of under control. Certainly enough so that markets largely expect central bank interest rates to keep falling, albeit slowly, over the next year or so.

In the US, President Donald Trump has even gone so far as to put a great deal of pressure on Federal Reserve boss Jerome Powell to cut interest rates, pelting him with insults and even threatening to fire him (which may not even be possible).

The problem, however, is that prices don’t actually seem to be cooperating with the hopes and dreams of politicians and central bankers. In the UK, we’ve seen inflation come in “hotter” than hoped on a regular basis, with this week’s data no exception.

And over in the US, even without much obvious impact from tariffs as yet, inflation is nowhere near “beaten,” as my colleague John Authers pointed out earlier this week.

So progress toward a more “normal” world has been a lot slower than was expected a year ago. And that does rather raise a question. In yesterday’s piece, I pointed out that it’s actually quite tricky for the Bank of England to consider cutting rates aggressively when inflation is barely below Bank rate.

It’s not out of the question. As Vincent Deluard of global financial services company StoneX Group points out, Powell could be forgiven for leaving US interest rates on hold at the next Fed meeting.

Although US core CPI is rising at an annual rate of 2.7% (as per the June data released last week), US services inflation remains stubbornly high, and there are signs that tariffs may be adding to the cost of durable consumer goods, such as washing machines.

On this latter point, UBS economist Paul Donovan highlights that it might be easier for companies to push the rising cost of infrequently purchased goods onto consumers. It’s one thing to notice the price of milk or petrol going up, but if you last replaced your telly or washing machine five or more years ago, you’ll probably be less sensitive to price changes.

Moreover, as Bloomberg columnist Simon White points out, various leading indicators “point to re-acceleration in inflation in the second half of the year, almost regardless of where tariffs settle.” (Those of you with access to Bloomberg terminals can read his work by subscribing to the MacroScope column, which I’d highly recommend.)

Pricing pressures stem from factors including rising freight costs, rising industrial metals prices, and also food prices. But there’s another big potential inflationary force, coming from a surprising direction — China.

I say surprising because China has a long history of exporting deflation in the form of cheap goods. On top of that, China is among the few economies that are internally battling deflation.

Indeed, the Chinese government is very keen to put an end to deflation, as this fascinating piece by my Bloomberg Opinion colleague Shuli Ren explains. (One reason this piece in particular caught my eye is because “vicious” private sector competition is not necessarily something one associates with a communist economy.)

This isn’t a simple battle to win. However, as White notes, the pace of money growth in China now does look as though it’s accelerating. China is hugely significant in terms of the global money supply, so this is worth watching. Indeed, the country is so large that “money in China is the single most important driver of global liquidity,” White says.

Why does this matter? Without wanting to get too monetarist about it all, more money should mean more borrowing, more spending, more economic activity and more growth, and in turn, more inflation. Given China’s sheer scale, that means more inflation globally.

Adding it all up, there’s a risk that we’re all being a bit overconfident about the idea that inflation is now behind us as a major issue.

What could put a serious dent in this thesis? A recession is the most obvious outcome that might stifle inflationary pressure. But even then, any slowdown might take on more stagflationary than deflationary characteristics.

Also, despite vast government debts, leaders are under pressure to keep spending — or to at least duck hard choices — in order to appease irritated electorates. Japan is merely the latest economy whose election this weekend has been dominated by anger over the cost of living.

As far as what it all means for your money, all I can suggest is that you stay vigilant, be prepared for more potential bond-market drama, and hold at least some portion of your portfolio in “real” assets, which have a tendency to hold their value in inflationary times. My colleague Merryn had some thoughts on this in her newsletter last week.

Federal Reserve Governor Christopher Waller still supports interest rate cuts at the end of July, despite growing concerns over a possible tariff-induced inflation.

At a meeting of the Money Marketeers of New York University, he remarked, “I believe it makes sense to cut the FOMC’s policy rate by 25 basis points two weeks from now.”

According to Waller, the economic and labor market data show that the economy is still growing, though more slowly.

He argued, however, that unemployment risks have risen, warranting a rate reduction. The Fed Reserve Governor believes a weaker job market is “greater and sufficient” to cut interest rates, adding that policymakers should not wait for a deeper decline in the labor market.

He added that they can choose to disregard the short-term impact of tariffs and instead prioritize broader economic concerns.

In his view, more attention should be directed toward underlying inflation, which is dangerously close to the Fed’s 2% goal, rather than temporary tariff-related price pressures. Even before Thursday, Waller had previously insisted that tariff effects would only be temporary.

The Feds are set to meet from July 29 to July 30 in Washington to discuss policies and possible rate cuts. So far, among Fed officials, Waller and Vice Chair for Supervision Michelle Bowman are the only two to express a willingness to consider rate reductions as early as this month.

Other officials like Governor Adriana Kugler and New York Fed President John Williams, however, over tariff fears, have suggested that policymakers should wait longer before slashing rates.

US June’s data showed a less-than-expected rise in core inflation for the fifth consecutive month, even as Trump’s April tariff announcements augmented the cost of certain items. Waller predicts that the economy will “remain soft” for the remainder of 2025 after only growing at a slow 1% rate in the first six months.

Nevertheless, most investors believe the central bank will maintain interest rates as they are after the meeting this month. However, they expect the Feds to reduce rates later in September.

Waller, when asked about possible September rate cuts, said that any additional cuts beyond this month would entirely rely on incoming economic data. He said he prefers they start now, not waiting until the labor market plunges.

Waller is still being considered to be one of the possible successors to Fed Chair Jerome Powell, when his term ends. However, Waller stated he has not discussed the position with any administration officials.

President Donald Trump has been at odds with Powell for months now. He has consistently asked Powell to lower interest rates, but those calls have been dismissed. Recently, the Fed chair also came under fire over the renovation at the central bank’s headquarters. Some Republicans have accused Powell of excessive spending on the project, urging more investigations into the matter.

When asked to comment on the renovation issue, Waller noted that in his experience, construction projects often face similar challenges, emphasizing that while he wasn’t defending the situation, it wasn’t uncommon. He added that inflation had turned out to be much higher than anticipated when bids were made in 2017, stating that it’s clearly a factor.

Dollar Index Price Chart

Dollar Index Price Chart

The gold market is trading higher ahead of the weekend after the latest data showed consumer sentiment in the U.S. improving more than expected, while near-term inflation expectations pulled back.

The University of Michigan announced on Friday that the preliminary reading of its Consumer Sentiment survey for July was 61.8, which was higher than June’s final reading of 60.7. The data was better than expectations, as the consensus forecast of economists called for a 61.5 reading.

“Consumer sentiment was little changed from June, inching up about one index point,” said Surveys of Consumers Director Joanne Hsu. “While sentiment reached its highest value in five months, it remains a substantial 16% below December 2024 and is well below its historical average.”

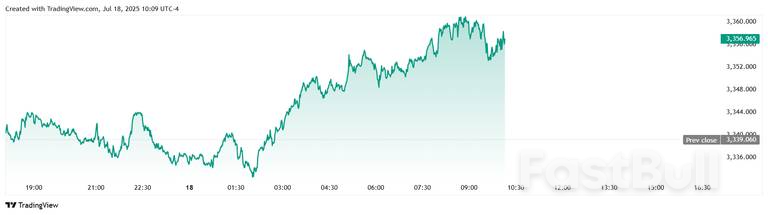

The gold market is trading near the upper edge of its daily range following the 10 am EDT data release, with spot gold last trading at $3,356.84 per ounce for a gain of 0.53% on the day.

The components of the July index were mixed, with a sharp rise in short-run expected business conditions and a significant drop in one-year inflation expectations, but longer-run inflation fears persisted.

“Short-run business conditions improved about 8%, whereas expected personal finances fell back about 4%,” Hsu noted. “Consumers are unlikely to regain their confidence in the economy unless they feel assured that inflation is unlikely to worsen, for example if trade policy stabilizes for the foreseeable future. At this time, the interviews reveal little evidence that other policy developments, including the recent passage of the tax and spending bill, moved the needle much on consumer sentiment.”

Year-ahead inflation expectations also fell for a second straight month, dropping from 5.0% in June to 4.4% this month. “Long-run inflation expectations receded for the third consecutive month, falling back from 4.0% in June to 3.6% in July,” she said. “Both readings are the lowest since February 2025 but remain above December 2024, indicating that consumers still perceive substantial risk that inflation will increase in the future.”

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price Chart

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up