Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ahead of Wednesday’s Federal Reserve meeting, global markets tread lightly, anticipating a 25 basis point rate cut. Investors are cautious amid ongoing U.S.-China trade talks, TikTok deal developments, and large-scale AI investments in the U.K....

RBC BlueBay Asset Management has taken a long yen position, betting that Japan’s political transition and a possible Bank of Japan rate hike in October could drive further strength in the currency.“We initiated the position just below 150 on dollar-yen” using dollar shorts, chief investment officer Mark Dowding said in an interview. “We do think an October move is possible or likely. And so we think this is a more attractive moment to be long the yen, as long as Koizumi is the victor in the Liberal Democratic Party’s leadership contest.”

Investors view Agriculture Minister Shinjiro Koizumi, who on Tuesday officially joined the race for LDP leader, as more supportive of rate hikes than likely rival Sanae Takaichi, who is seen as favoring monetary easing and looser fiscal policy. The LDP, the largest party in the ruling coalition, will hold its leadership vote on Oct. 4, following Prime Minister Shigeru Ishiba’s decision to step down following a July election rout.BlueBay sees dollar-yen trading toward 140 in the near term, with a medium-term fair value closer to 135. Over the past three months, the yen was the worst performing G10 currency against the dollar, weakening 0.8%. The currency was up slightly to 146.51 as of 10:19 a.m. Tokyo time.

BlueBay’s view contrasts with hedge funds that increased their short positions against the yen for a fourth consecutive week through Sept. 2. Strategists at Bank of America Corp. and HSBC Holdings Plc also see the yen further weakening against the dollar.The London-based firm has added to its position over the past month as comments from BOJ Governor Kazuo Ueda and other board members suggested policy normalization remains on track, assuming political risks don’t derail it.

Traders have raised bets on new BOJ tightening after Bloomberg News reported the central bank could hike again this year regardless of political volatility. Overnight index swaps are now pricing in an about 60% chance of a move by year-end. BOJ policymakers are expected to keep the benchmark rate unchanged at 0.5% at its policy meeting this week.Political and fiscal uncertainty in Japan has pushed up super-long bond yields, with the 30-year reaching a record high of 3.285% earlier this month, levels which Dowding sees as attractive “on an outright basis.”

The firm is currently long 30-year Japanese government bonds against 10-year securities, after unwinding its long-standing short position earlier this year. Dowding said he would consider shifting to “go long duration” if Koizumi wins the LDP leadership race, and the BOJ follows through with a rate hike which would give him “confidence that policymakers are doing the right thing” to keep inflation under control.The BOJ rate decision expected Friday will follow a meeting of the US Federal Reserve’s policy committee, which is widely predicted to cut interest rates by 25 basis points.

In case you haven’t seen our introduction to bond yields and an explanation on their recent moves, I formally invite you to read it over which may help you to understand some of tomorrow’s moves.

Tomorrow, and as-usual for every FOMC meeting, the Federal Reserve will decide whether or not to change its Main policy rate, the Fed Funds, currently locked between 4.25% to 4.50% (Effective Fed Funds is at 4.33%, but that’s a technicity).You will usually see the higher bound of that range represented, which is why you usually hear the “4.50%” rate from US President Trump and media – We will use this rate for the article.The FOMC is closely watched due to all banks (Central Banks and all others), traders, investors using this rate as the main US Dollar financing rate.As the Reserve currency, the US Dollar and its supply will have a great influence on global yields, demand and prices.

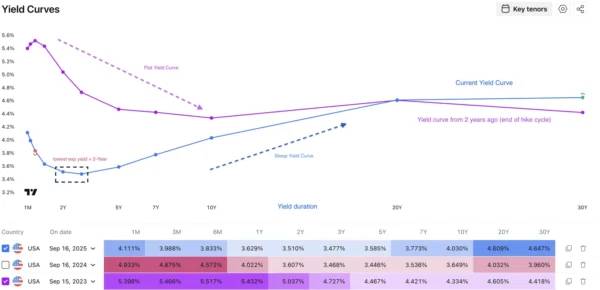

The current curve (blue) is inverted –compared to a Flattening yield curve in purple– which means that the market expects that the yield on short-term obligations will be lower than on long-term ones.

This is due to lower inflation expectations and a lower time compensation in the short run, compared to higher inflation expectations and higher risk to outstanding debt in the long run.The 2-Year yield is the closest to expiry and is the best view of where the market expects the Fed Funds rate to be within the next two years.The same is true for 5-year and longer-term yields, but these also include a time-risk premium (and of course, reflect demand).This is why, for example, 30-year yields will be tied to longer-run mortgages for consumers, as they tend to reflect longer-term risks for banks to lend.

Also, one of the keys to understanding yields is that the higher the demand (or price), the lower the yield.Conversely, if fewer people want bonds, they will sell them, causing the yield to go up to attract more demand.One of the talks and curve pricing since Donald Trump’s investiture is how wider deficits steepens the curve even more (pressure for lower short-term rates puts pressure towards higher rates in the long-run).A jumbo cut tomorrow would hence boost economic activity and markets would hence price higher future inflation.

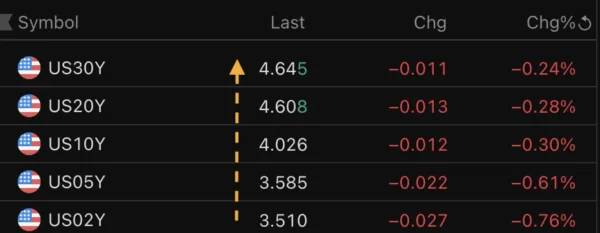

As you can see, these yields are showing another form of the blue curve observed just before.With the current huge selling in the US Dollar, market participants are hedging for an eventual 50 bps which is leading to big steepening in the curve.When the 2Y Yield decreases more than the 30Y, this is considered Bull steepening: Bond traders bought more the front (short-term bonds) than the back (long-term bonds).Let’s now look at different Bond charts and spot key levels for them.

2 Year US Treasury Bond

10 Year Treasury Bond

This bond is traditionally seen as the benchmark for the safest and most liquid financial product.Watch a break of the most recent highs (113.86) for further continuation towards the September 2024 highs. You may also check the equivalent Yields on the charts.Any downside below the Key 112.50 pivot (Yield = 4.25% to 4.30%) should lead to further increase in the yield.It is extremely difficult to anticipate what will be said in such a key FOMC but all eyes will be on the statement (14:00 ET) and Powell’s speech (14:30 ET).

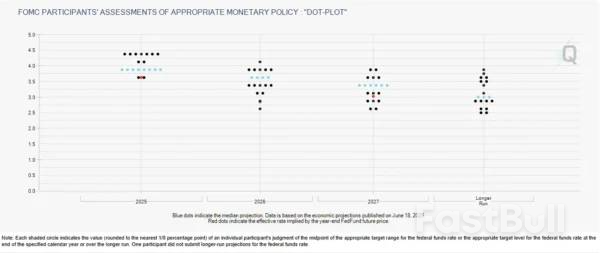

Watch for any clues on potential dovishness from Powell which may add more rates towards the end of 2025 (25 bps for each meeting, 3 meetings left is the current pricing).Any unexpected hawkishness could have different effects: Either take out rate cuts in 2025 (flattening the curve) or take out 2026 cuts (steepening the curve even more).Tomorrow will be essential for all assets, currencies and flows for the coming period.Of course, do not forget the Bank of Canada rate decisions at 9:30 tomorrow morning and the Bank of England rate decision at 7:00 on Thursday 18th.

The Federal Reserve’s upcoming meeting is a big deal for the US economy and financial markets as a whole.The latest economic data suggests the Fed should start lowering interest rates. However, the market already expects a rate cut and based on market moves it appears that it has largely been priced in.Because of this, the Fed’s announcement about their future plans will likely be more important than their actual decision at this meeting. That is likely to be what will really stoke volatility barring a surprise decision by the Fed.

The main concern is the weakening job market. While the economy grew by 3.3% in the second quarter, this was mostly due to a big change in trade, which hid the fact that consumer spending was weak. People were spending less because they were worried about tariffs, a cooling job market, and unstable wealth.This was confirmed by the Federal Reserve’s Beige Book, which showed little to no economic activity and declining consumer spending across the country. It also reported that most districts were not hiring and that the job market was slowing. Last Friday’s jobs report also showed a small increase in jobs, and unemployment went up. Revisions to job numbers from the past year showed the economy created less than half the jobs that were previously reported.

Even though inflation is still above the target, the risk to the job market now seems more urgent to the Fed. They’ll likely start to move toward a less restrictive policy.Three factors that drove inflation up in 2022—oil prices, housing rents, and wages—are now gone, and are even helping to lower inflation. A cooling economy with rising unemployment will also help bring inflation back down to 2% by the end of 2026.The Fed will probably lower its forecasts for economic growth and inflation while raising its unemployment projections. We expect the Fed to cut interest rates by 0.25% at their September 17 meeting, with more cuts to follow in October, December, January, and March. It’s possible the Fed could start with a larger cut of 0.50%, but a 0.25% cut is more likely because most members are still cautious about the impact of tariffs on inflation.

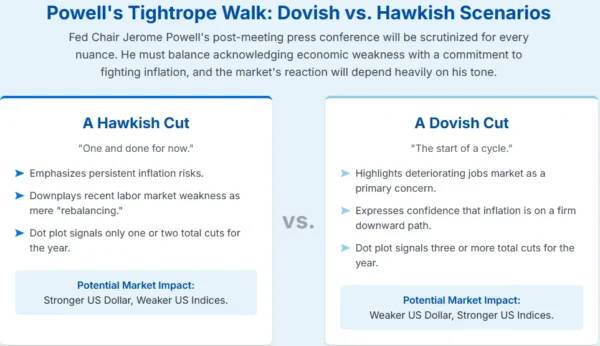

The Federal Reserve is in a tough spot. Even with evidence pointing to a need for lower interest rates, the market has already bet on a lot of rapid rate cuts. This creates a significant communication challenge for the Fed. They have to manage market expectations very carefully.

One possibility is that the Fed tries to meet or even beat the market’s high expectations. Traders are already anticipating a lot of cuts by the end of 2026. For the Fed’s announcement to truly be a positive surprise for the market, they would need to signal an even faster pace of rate cuts than what is already expected. If they simply use their normal cautious language, even when announcing a cut, the market might see it as a disappointment. The real risk here isn’t a wrong policy decision, but a gap between what the Fed says and what the market wants to hear.

A different view is that Fed Chair Powell will intentionally try to lower market expectations. This perspective suggests that he will push back against the idea of quick rate cuts in October and December. Instead, he would likely emphasize that the Fed will continue to be guided by incoming economic data, keeping their options open.This cautious approach is about protecting the Fed’s credibility. Having been criticized for underestimating inflation in the past, they don’t want to cut rates too soon only to have to reverse course if inflation spikes again. By remaining patient and focusing on data, Powell would be protecting the Fed’s reputation and ensuring they can react to the economy as it unfolds, rather than being forced into a schedule set by the market

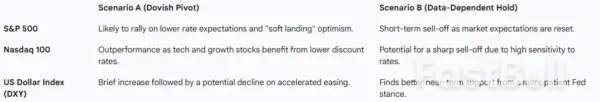

The market’s reaction to the FOMC meeting will translate the two primary scenarios into tangible consequences for US indices and other asset classes.The reaction to a dovish signal would likely be a boon for equities. The S&P 500 would likely rally, driven by the anticipation of lower borrowing costs and a broader “risk-on” sentiment. The Nasdaq 100, composed of technology and growth stocks, would likely outperform due to its higher sensitivity to changes in interest rates.

Conversely, a hawkish signal would be a source of disappointment for “doves,” potentially triggering a pullback in US indices as traders unwind their aggressive rate-cut bets. Tech and growth stocks would be particularly vulnerable. The following table summarizes the potential impact on key US indices and the U.S. Dollar Index (DXY) under the two scenarios.

Since the market is already highly dovish, the disappointment of a cautious Fed is significant. A potential sell-off might be sharp, but it could also be short-lived if the underlying macroeconomic data remains fundamentally sound. A cautious hold today might simply be a delay of an inevitable cut tomorrow. This understanding is critical for long-term investors aiming to distinguish between temporary market volatility and a fundamental shift in economic trajectory.Tomorrow’s meeting promises fireworks regardless of the decision. Volatility will definitely rear its head and the decision could have wider implications for global markets and risk sentiment.

Key points:

The US economy may be approaching a point of no return and tonight’s FOMC decision and messaging will shape the course of the debate over just how bad it will get over the next 12 months. Sounds pretty serious, doesn’t it? My opening statement is not meant to be alarmist – there is indeed growing evidence in the economic data that the US economy is on track for a slowdown (how bad is still what the market is trying to determine). Add to this fact, the Fed’s decision tonight will undoubtedly play a role in how things play out. Perhaps more important than the 0.25% rate cut that is already baked in is the Fed’s messaging: How much support will they provide – if any – after tonight’s move?

Wow, this is just sounding worse and worse! Well, much of the kerfuffle lies with the Trump administration’s fiscal and trade policies. Pitched as “pro-growth” and “pro-jobs”, they are arguably beginning to bear the wrong kinds of fruit. Some of these policies are bleeding into the Fed’s domain, putting it between the rock of stubbornly high inflation and the hard place of a weakening labour market.For investors, the message is clear: Risks are mounting and the outlook demands close attention. With the fate of the world’s economy to be decided within the next 24 hours , let’s investigate what’s at stake. Just how bad are things really for the US economy, and should you be worried about your portfolio?

An interesting research report from major investment bank UBS lobbed onto my desk yesterday. Titled “US Economic Outlook 2025-2027: What next?”, it outlines the bank’s views on, well, as the title suggests, what’s coming next for the US economy!UBS notes that the US economy is slowing rapidly. After expanding by 3.2% in 2023, US gross domestic product (GDP), a measure of total economic output, slowed to 2.5% in 2024 and is expected to dip to just 1.1% in 2025. For comparison, the long-run average GDP growth rate for the US economy is around 3% p.a.Looking further forward, UBS forecasts that GDP will stabilise around 1.6-1.7% through 2026-2027 – which means we’re on track for around half of the US economy’s typical growth for the next few years.

For those of you whose brains just synapsed and flashed back to Year 11 Economics: GDP = Consumption + Business Investment + Government Spending + Net Exports. Yep, oops – 4 strikes and the US economy is OUT!

Some would call me a drama queen if I said that President Trump’s tariffs are at the heart of all the US’s GDP woes. Well, let me say this: Tariffs are very likely at the heart of the sharpest pressures on US economic growth.And UBS’s report backs me up. It notes that the effective US tariff rate has jumped sevenfold, to roughly 16%, driving up the cost of imported goods for consumers and businesses. This threatens to dent real incomes, and with savings buffers eroding, households are already feeling the pinch. UBS highlights that real consumption growth – the biggest component of GDP at around two-thirds – is slowing to about 2%.

For businesses, tariffs are pushing up input prices, weighing on confidence and investment. As the bank bluntly puts it: “The business sector of the economy seems likely to suffer from the tariffs.” On trade, UBS cautions: “the announced tariff actions are large enough we expect them to set in motion sizeable reordering of the United States’s trading relationship with the rest of the world and be a headwind to growth into 2026.”

Then there’s Trump’s immigration policy… Oh, don’t get me started (you can’t ship out a big whack of your workforce and not expect some nasty consequences). UBS agrees here too, noting that changes to immigration policy are slowing population growth and shrinking the labour force. That lowers the economy’s “speed limits,” it proposes. Translation: With fewer workers available, potential GDP growth gets capped – meaning any given pace of expansion generates more inflationary pressure.

Put it all together, and you’ve got a stagflationary shock – higher prices, weaker demand. And if you asked US Federal Reserve Chairman Jerome Powell what keeps him up at night, it would be just that: Stagflation. It’s the ultimate bane of a central banker’s existence because its impacts on the economy are severe and it’s notoriously difficult to fix.

Attention now turns to whether Washington can offset these headwinds. On the fiscal side, UBS finds little reason for optimism. While new tax cuts appear supportive at first glance, they are likely to be offset by the negative impacts of tariffs and spending cuts, leaving the deficit to widen and limiting growth benefits. State and local government hiring is also slowing, further reducing the fiscal contribution to economic growth.For the Federal Reserve, the dilemma is even sharper. Tariffs push up prices but sap demand and hiring. UBS writes: “The tool of the federal funds rate won’t stop cost-push price increases from tariffs. But it would make a weakening labor market even weaker.”

Still, rates are expected to fall to cushion the economy. UBS is forecasting the Fed will lower its funds rate from the current 4.25%-4.50% to 3.4% in 2026, and to 2.9% by 2027. Ultimately, the Fed will be forced to choose between tolerating higher inflation or risking higher unemployment. UBS argues it will choose jobs: “The FOMC will worry about inflation but likely react to the labor market slowdown when it becomes necessary.”In short, investors should not expect fast or decisive relief. With inflationary constraints still in play, the Fed is likely to be reactive rather than proactive.

So where does that leave us? UBS’s forecasts underline a US economy that’s losing momentum – slowing growth, sticky inflation, and with policy missteps compounding the risks. What matters most for investors now is the policy response.All eyes will be on the Fed tonight. The market has already priced in a 0.25% cut to the Fed Funds Rate due at 4:00 am Sydney time, but the real suspense lies in what Chairman Jerome Powell says at his press conference at 4:30 am. Will he hint at a path of deeper easing, acknowledging the threats of tariffs and fiscal drag? Or will he play hardball and signal wariness toward the looming inflationary threat?

The market response to either scenario is likely to be very different – euphoric relief in one case, downright soiling the bed in the other. Either way, the bottom line for investors today is clear: Prepare for volatility!

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up