Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

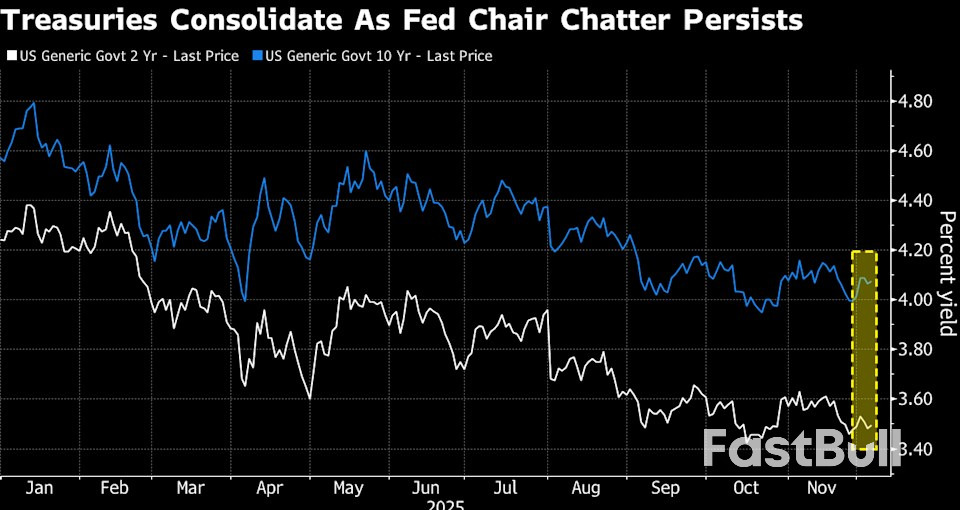

PGIM’s Gregory Peters says Kevin Hassett lacks the credibility to push aggressive Fed rate cuts, raising market concerns about Fed independence even as traders price in a more dovish policy path.

Last week, Bitcoin (BTC) rose nearly fifteen percent to over $93,000. However, this recovery didn't last. BTC experienced heavy selling on Monday, falling to $84,000, marking a rough start to both the week and December, the last month of the year.

However, this selling wave was short-lived. Bitcoin and altcoins quickly recovered after two days of declines.

As BTC surged back above $93,000, these sudden price swings have divided the market. Some analysts say the decline could continue, while others argue that Bitcoin is holding onto a strong support area and a bottom is near.

At this point, Bitfinex analysts also took the side that argued that the bottom was near.

Bitfinex argued in its weekly Alpha report that the Bitcoin price is showing signs of bottoming out.

The exchange pointed to several indicators, including excessive deleveraging, capitulation by short-term holders, and seller exhaustion, where selling pressure is rapidly diminishing, suggesting that Bitcoin is very close to the cycle bottom.

"The recent recovery aligns with our previous view that the market is approaching a local bottom in terms of time, although we don't yet know if we've seen a bottom in terms of price."

According to Bitfinex analysts, these factors suggest that the Bitcoin price has entered a stabilization phase, creating the necessary conditions for a sustained recovery in the short term.

While Bitfinex analysts stated that there are many indicators pointing to a bottom in Bitcoin, one analyst said that it is too early to say that Bitcoin has reached the bottom.

It's Too Early to Talk About a Bottom in Bitcoin!

Cryptocurrency analyst Ted Pillows argued in his latest analysis that it is too early to confirm a bottom has formed for Bitcoin because the asset has not yet established clear support.

Pillows noted that his bottom predictions were weakened as BTC failed to hold key support levels like $100,000, $95,000, and $90,000 and easily fell below them.

Stating that BTC is currently stuck at the $93,000-$94,000 level and cannot create a stable support, the analyst said that an upward break of this level again would open the door to $100,000.

On the other hand, a rejection from this level could push Bitcoin back below the $90,000 level.

Saudi Arabia cut the price of its main crude grade to Asia to the lowest level in five years, amid persistent signs of a surplus in global oil markets.

State producer Saudi Aramco will reduce the price of its flagship Arab Light crude grade to a 60 cents premium to the regional benchmark for January, according to a price list seen by Bloomberg. That's the lowest since January 2021. The cut was fractionally bigger than an expected 30 cents a barrel reduction, according to a survey of refiners and traders.

The Organization of the Petroleum Exporting Countries and its allies affirmed over the weekend a previous decision to pause production increases in the first quarter of next year. They will then consider resuming a program to roll back output quotas as the group seeks to reclaim market share. OPEC+ is eyeing weaker seasonal demand during winter months across much of Asia, Europe and North America.

Crude prices are down about 16% this year as booming supply from the Americas in tandem with hikes from the OPEC+ grouping itself exceeded subdued demand growth. The International Energy Agency has predicted a record glut in 2026, while Wall Street banks including Goldman Sachs Group Inc. see futures heading lower. Oil markets have also had to navigate the impacts of global trade disputes, wars and sanctions through this year.

President Donald Trump pardoned longtime sports and entertainment executive Tim Leiweke after he was criminally charged in July with bid-rigging related to the development of an arena at the University of Texas.

The Justice Department posted a notice of the pardon on its website on Wednesday afternoon. The notice was dated Dec. 2. The move stands out because the pardon comes just months after Leiweke was charged by the Justice Department under Trump's administration.

Leiweke expressed "profound gratitude" to Trump. "The president has given us a new lease on life with which we will be grateful and good stewards," he said in a statement.

The pardon also comes just before Leiweke is scheduled to be deposed by lawyers for the Justice Department and Live Nation Entertainment Inc. on Thursday in the DOJ's separate civil antitrust case against the company and its subsidiary Ticketmaster, according to people familiar with the matter who asked not to be named discussing a confidential matter.

Leiweke earlier unsuccessfully tried to avoid the deposition, citing liability from then pending criminal charges, according to court records.

A trial in the DOJ's antitrust case against Live Nation is set to start in early March in New York.

Spokespeople for the White House, DOJ and Live Nation didn't immediately respond to requests for comment. A spokesperson for Leiweke had no immediate comment on the deposition.

Leiweke's former company, Oak View Group LLC, entered into a non-prosecution agreement with the Justice Department that was announced in July and agreed to pay a fine of $15 million. Leiweke stepped down from his post as Oak View chief executive officer shortly after the charges were filed.

"We are happy for Tim that he can now put this matter behind him," Oak View Group said in a statement. "OVG has remained steadfastly focused on delivering exceptional outcomes for our clients under the leadership of our CEO Chris Granger."

The criminal case against Leiweke related to allegations that Oak View illegally coordinated with its rival Legends on the bidding to develop and operate the Moody Center, a $338 million arena at the University of Texas in Austin. Oak View ultimately won the contract in 2018 and the venue opened in 2022. Legends also signed a non-prosecution agreement with the Justice Department, resolving its case.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up