Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

London stocks rose slightly by midday amid optimism over possible peace negotiations in Ukraine, with the FTSE 100 up 0.2%.

It may be hard to believe, but the US currency is gradually turning the tide in its favour. Such a calm recovery may well be a concentration of forces (liquidity) before a new phase of decline for the US currency.

The dollar index reached its lowest point in this cycle on 1 July at 96.00. After that, we saw two impulses of growth and decline, and each time there were higher local lows and higher local highs. A support line passes through the lows, the last touch of which was on 15 August.

Also, over the past month, the downward trend has been broken, with the local high exceeding the peak levels of June.

For most of August, the dollar has been moving around its 50-day moving average, mostly above it. This is a significant change, as from February to July, this downward line acted as local resistance, and approaching it intensified the sell-off.

Also on the bulls’ side is the dollar’s oversold condition from its six-month decline and the touching of three-year lows.

Several fundamental factors are working in favour of the dollar. First, inflationary risks are mounting, including a shock PPI and accelerating consumer service prices. The data has swung expectations less dovish: markets are pricing in a 17% chance of the rate being held in September, although on 13 August, they were completely confident of a 25-basis-point cut and a 6% chance of a 50-basis-point cut. This revaluation is working in favour of the dollar.

Another fundamental factor is trade flows. At the beginning of the year, America sharply increased imports, seeking to avoid the introduction of tariffs. Now, imports are in sharp decline, compared to the background of full warehouses and less favourable prices for buyers. Temporarily, this abruptly shifts the influence of the trade balance in favour of the dollar.

However, it is too early to talk about a long-term change in the trend. We will be able to say this with greater certainty when (and if) the DXY exceeds 100 (+2.2% from the current 97.8), recovers above the 2023–2024 support level, and exceeds the 76.4 Fibonacci level from this year’s peak to bottom.

WHERE WE STAND – Many participants will have spent the bulk of yesterday asking themselves ‘is this thing on?'.That is, the participants that are actually still around. Judging by how much of a ghost town the Square Mile seemed to be yesterday, I think it's pretty safe to say that we are well into the thick of ‘summer markets' now.In fact, a quick glance at implied vols would support such an idea – the VIX sits at, as near as makes no difference, YTD lows; BofAML's MOVE index of Treasury vol is at its lowest since the first quarter of 2022; and, 1-week implieds across G10 FX all sit beneath the 10th percentile of their 52-week ranges. While this could well prove to be a ‘commentator's curse', I'd say that anyone desperate for vol probably shouldn't go holding their breath, at least not until we hear from Chair Powell at Jackson Hole on Friday.

Frankly, the ‘world and his wife' are waiting for those remarks, to see whether J-Pow leans into the market's view that a September rate cut is a fait accompli, or whether the Chair seeks to preserve a much greater degree of policy optionality. The latter seems a much more likely scenario to me, given the deluge of data still to come before that September policy meeting, and could elicit a knee-jerk hawkish market reaction as a result. In an odd sort of way, Powell trying not to ‘rock the boat' at Jackson Hole by sticking to his recent ‘wait and see', ‘data-dependent' script, would indeed rock said boat rather significantly, as a result of how sure markets are that a September cut is on the way.

Anyway, that's all a matter for later this week. As for yesterday, geopolitics remained in focus, though concrete developments towards a Russia-Ukraine peace deal, or ceasefire, remain elusive. Yesterday's 9-way talks in the White House appeared to yield little by way of significant progress, being very long on ‘noise', but very short on ‘signal', or definite next steps in attempting to resolve the conflict.All of that, though, had relatively little impact on financial markets, with price action across the board being akin to watching paint dry. Stocks were flat, Treasuries softened led by the long-end, while the dollar gained a touch.

None of this is especially worth writing home about, though in the interests of good order, I'll reiterate my stances – namely, as an equity bull, where solid earnings growth and a strong underlying economy, coupled with trade progress, should embed the ‘path of least resistance' to the upside; favouring a steeper Treasury curve amid the continued risk of inflation expectations un-anchoring; and, remaining a dollar bear as the Trump Admin continues to erode Fed policy independence. We will, though, probably spend a lot of this week just plodding along in sideways fashion into Jackson Hole.

In other news, and in contrast to the move seen Stateside, BoE rate expectations continued to reprice in a hawkish direction as the new trading week got underway. The GBP OIS curve now favours no further Bank Rate cuts this year, while also discounting less than 50bp of easing over the next 12 months.

For me, it's now time to start fading this move. In an economy as weak as the UK appears to be right now, particularly with the labour market continuing to soften at a rate of knots, this pricing appears far, far too hawkish. The risk/reward favours a dovish U-turn now, with just one soft-ish CPI report, or even some dovish overtures from the FOMC, likely being enough to turn the tide. I'd rather express this view in the STIRs space, however, by buying the Mar & Jun 2026 SONIA futures, as that's a much cleaner trade than trying to pick a top in cable.

LOOK AHEAD – A pretty light docket today, as we wait for Powell on Friday, and as both trade and geopolitical tensions remain in focus.

In terms of scheduled releases, though, we do have the latest US housing starts and building permits stats this afternoon, though neither is likely to be market-moving. Nor is the July CPI report out of Canada, though markets do see a 1-in-4 chance of a September BoC cut, the outlook there hinges more on any tariff developments prior to the next meeting.Finally, earnings are due from Home Depot (deh-pow, not dee-pow, thank you) before the market open, ahead of other retail earnings from the likes of Target tomorrow, and Walmart on Thursday. Not only will these figures be a useful gauge of consumer health, but participants will also be keen to see how the firms are navigating the ever-changing trade landscape.

Subdued world markets eyed proposals for a Ukraine-Russia summit with caution, while updates on the shaky U.S. housing market on Tuesday and this week's Federal Reserve conference in Jackson Hole dominated thinking.

European stock benchmarks nudged higher and the defence sector slipped after U.S. President Donald Trump told his Ukrainian counterpart Volodymyr Zelenskiy that Washington would help guarantee Ukraine's security in any peace deal to end Russia's war. Germany said Zelenskiy and Russian President Vladimir Putin would meet within the next two weeks. In response, the euro firmed against the dollar, crude oil ticked lower and gold edged up.

* U.S. Treasuries have been on the backfoot since the alarming U.S. producer price report last week, with 30-year bond yields holding just shy of 4.95% on Tuesday and the two-to-30 year yield curve gap firming above 117 basis points for the first time since January 2022. With July housing starts on the diary later, along with a retail update from Home Depot, Fed futures currently price just over an 80% chance of a quarter point rate cut next month. Fed Chair Jerome Powell gives his keynote Jackson Hole speech on Friday.

* S&P Global on Monday affirmed its 'AA+' U.S. sovereign credit rating and assigned it a stable outlook, saying the revenue from Trump's tariffs will offset the deficit hit from his recent fiscal bill and the budget gap would average 6% of GDP during the 2025-2028 period - down from 7.5% in 2024. Wall Street stock futures were flat ahead of Tuesday's bell after ending little changed yesterday, with Chinese and Japanese stocks in the red earlier.

* Palo Alto Networks forecast revenue and profit above estimates on Monday, betting on growing demand for its artificial intelligence-powered cybersecurity solutions - sending its shares up 5% in extended trading. In other tech news, Intel is getting a $2 billion capital injection from SoftBank Group in a vote of confidence for the troubled U.S. chipmaker and Nvidia is developing a new AI chip for China based on its latest Blackwell architecture that will be more powerful than the H20 model it is currently allowed to sell there.

* Intel(INTC.O),is getting a $2 billion capital injection from SoftBank Group, in a major vote of confidence for the troubled U.S. chipmaker that is in the middle of a turnaround effort.

* Nvidia(NVDA.O),is developing a new AI chip for China based on its latest Blackwell architecture that will be more powerful than the H20 model it is currently allowed to sell there, two people briefed on the matter said.

* U.S. PresidentDonald Trumptold President Volodymyr Zelenskiy on Monday that the United States would help guarantee Ukraine's security in any deal to end Russia's war there, though the extent of any assistance was not immediately clear.

* Trump’shigh-stakes diplomacyto resolve thewar in Ukraineis unlikely to jolt oil and gas markets, no matter the outcome, writes ROI energy columnist Ron Bousso.

* Consumer spending's surprising resilience is a key reason why the economy has not only avoided recession, but continued to grow at a solid clip. The big question now, writes ROI markets columnist Jamie McGeever, is whether American households can keep that going, especially with higher, tariff-fueled prices coming down the pike.

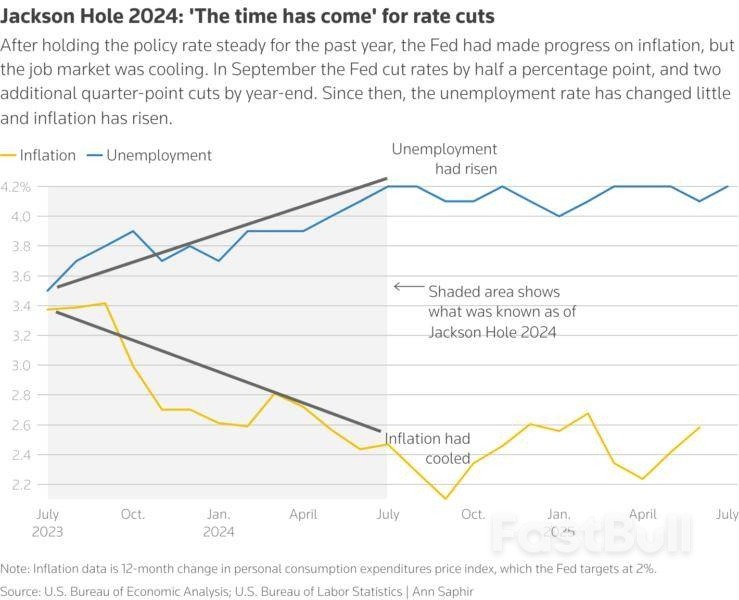

Thomson ReutersJackson Hole 2024: 'The time has come' for rate cuts

With Fed Chair Powell's speech at Jackson Hole on Friday watched closely for any signal about a resumption of Fed easing, the two key metrics on unemployment and inflation have changed little since the 2024 setpiece that flagged the first series of Fed cuts.

Today's events to watch

* U.S. July housing starts/permits (8:30 AM EDT); Canada July consumer prices (8:30 AM EDT)

* Federal Reserve Vice Chair for Supervision Michelle Bowman speaks

* U.S. corporate earnings: Home Depot, Medtronic, Keysight, Jack Henry

As U.S. debt swells and the White House leans on the Federal Reserve to cut interest rates, investors are weighing the risk of "fiscal dominance," a scenario where keeping government financing cheap eclipses the fight against inflation.

A budget bill passed last month by the Republican-controlled Congress is set to pile trillions onto the swelling U.S. debt load - raising the cost of servicing that debt. U.S. President Donald Trump has meanwhile made explicit calls for the Fed to cut rates, in part to lower the U.S. government's interest costs.

The White House's pressure campaign has raised concerns that the administration wants the Fed to return to a bygone era when it kept rates low in order to allow for lower-cost borrowing.

"(Fiscal dominance) is a concern ... There are risks on the horizon, both from the perspective of increasing debt loads and the probability for higher structural inflation, or at minimum, more volatility of inflation," said Nate Thooft, chief investment officer for equity and multi-asset solutions at Manulife Investment Management.

"The reason why the Trump administration and politicians in general ... would like to see lower rates, is because it actually requires lower rates to be able to afford the debt levels that we have outstanding," he said.

The U.S. experienced fiscal dominance during and shortly after World War Two, when the Fed was required to keep interest rates low for the war borrowing effort. The inflation spike that followed led to the 1951 Treasury-Fed accord that restored central bank independence.

High long-term Treasury yields and a sliding dollar already reflect that economic setup, some analysts say, as investors require more compensation to hold U.S. assets that could lose value if inflation rises.

"The administration wants to outgrow the debt ... but the other way to deal with the debt is to inflate it away," said Kelly Kowalski, head of investment strategy at MassMutual, who sees the dollar continuing to weaken.

Higher inflation would mean the real value of government debt shrinks.

Trump said last month that the Fed's benchmark interest rate should be three percentage points lower than the current 4.25%-4.50% range, arguing that such a reduction would save $1 trillion per year. He separately said the central bank could raise rates again if inflation rose. In the 12 months through June, inflation as measured by the Personal Consumption Expenditures Price Index advanced 2.6% - still above the Fed's 2% target.

Fed Chair Jerome Powell, however, has explicitly said that the U.S. central bank does not consider managing government debt when setting its monetary policy.

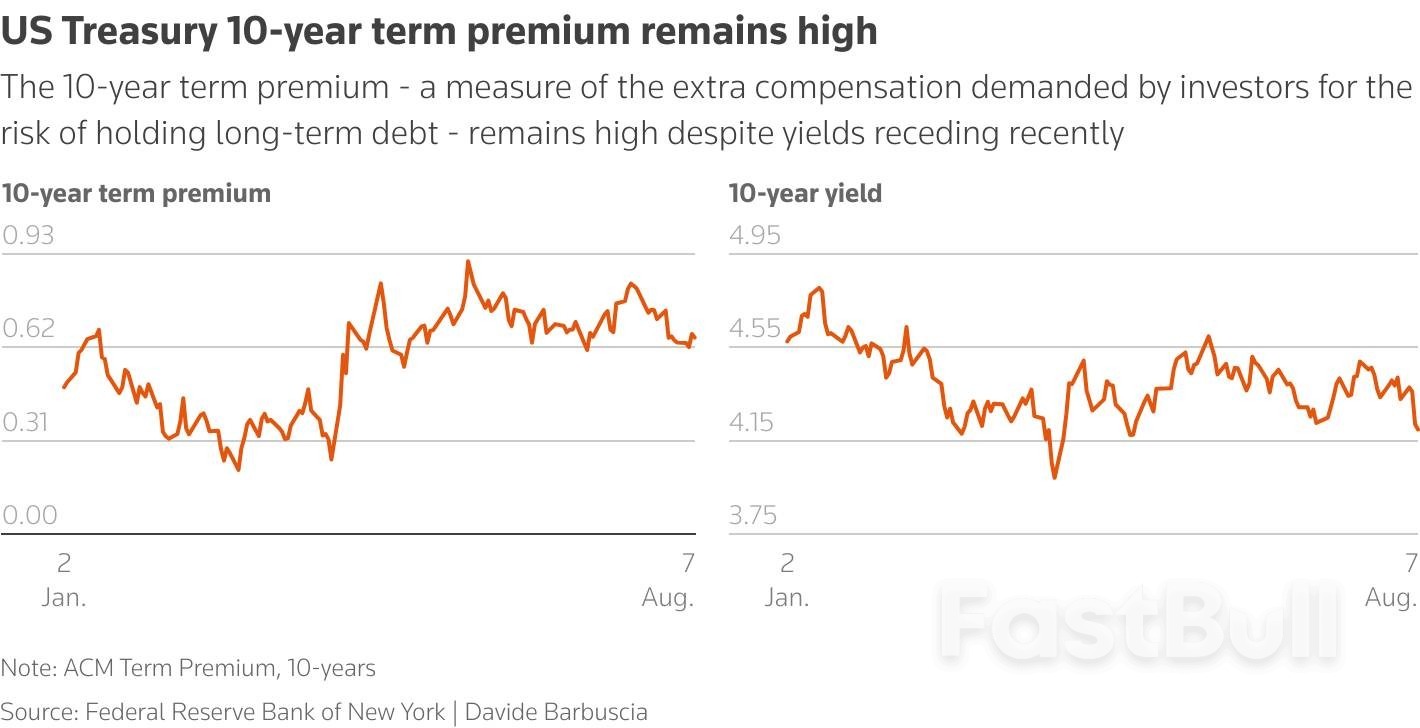

Some investors argue fiscal dominance lies on an uncertain horizon, with rising debt yet to trigger unsustainable interest rates, while others see it already seeping into markets as long-term yields remain elevated even amid expectations of Fed rate cuts.

White House spokesperson Kush Desai said the Trump administration respects the Fed's independence, but that, with inflation having come down significantly from its highs in recent years, Trump believes it's time to reduce rates.

The U.S. central bank so far has resisted those demands, though it is expected to lower borrowing costs at its September 16-17 meeting.

It declined to comment on this story.

The dollar is down about 10% this year against a basket of major currencies while Treasury term premiums - the extra compensation investors demand for holding long-term debt - are high, even as yields have recently dipped amid slowing economic growth.

"It's difficult to be bullish (on) long bonds in this environment," said Oliver Shale, an investment specialist at Ruffer, citing government spending that could keep inflation elevated and erode bond values.

"If you have an economy that's running above its natural output, that's going to result in inflation or have important implications for inflation, interest rates, and probably the currency," he said.

Thooft at Manulife said he was bearish on long-dated Treasuries as higher inflation would require higher term premiums.

Despite years of economic growth, U.S. deficits have continued to balloon. Debt now stands at more than 120% of GDP, higher than after World War Two.

The Fed normally manages inflation while Congress maintains fiscal discipline. That balance inverts under the fiscal dominance scenario, with inflation driven by fiscal policies and a Fed trying to manage the debt burden, said Eric Leeper, an economics professor at the University of Virginia.

"The Fed cannot control inflation and keep interest payments on the debt low. Those are in conflict," Leeper said.

One red flag for investors is the narrowing gap between interest rates and economic growth. Benchmark 10-year yields have hovered around 4.3% in recent weeks, while nominal GDP grew at an annual rate of 5.02% in the second quarter.

When interest rates exceed the growth rate, debt as a percentage of gross domestic product typically rises even without new borrowing, making the debt increasingly unsustainable.

"Risks to Fed independence stemming from fiscal dominance are high," Deutsche Bank analysts said in a recent note, citing high deficits and long-term rates close to nominal GDP growth.

History offers cautionary tales. Extreme fiscal dominance triggered hyperinflation in Germany in the early 1920s and in Argentina in the late 1980s and early 2000s. More recently in Turkey, pressure on the central bank to keep interest rates low undermined policy credibility and fueled a currency crisis.

A majority of economists polled by Reuters last month said they were worried the Fed's independence was under threat. Despite a barrage of criticism from Trump and administration officials, Powell has vowed to remain Fed chief until his term expires in May 2026.

"It seems relatively clear that whoever is nominated for the seat, regardless of whatever views they've espoused in the past, is likely to articulate a dovish bias in order to be nominated," said Amar Reganti, a fixed income strategist at Hartford Funds and former Treasury official.

Lower interest rates, however, might only be a temporary fix.

The administration may be hoping to "juice nominal growth," despite the risk of creating higher inflation, to get to a place where real growth makes the debt trajectory sustainable, said Brij Khurana, a fixed income portfolio manager at Wellington.

"The problem they have is ... the central bank is saying: 'I don't want to make that bet with you.'"

Malaysia’s trade performance returned to positive growth in July 2025, rebounding by 3.8% year-on-year (y-o-y) to RM265.92 billion, the highest monthly trade value ever, according to the Ministry of Investment, Trade and Industry (Miti).In a statement on Tuesday, Miti said exports grew by 6.8% to RM140.45 billion, the highest monthly value since September 2022, while imports edged up by 0.6% to RM125.47 billion.Trade surplus continued for the 63rd consecutive month, valued at RM14.98 billion for July 2025, it added.

The ministry noted that exports of electrical and electronics (E&E) products improved significantly by nearly RM12 billion to RM63.31 billion, an increase of 22.5% y-o-y, compared to July 2024.“It remained the key driver of Malaysia’s export growth, alongside optical and scientific equipment, as well as processed foods.“All these product categories recorded the highest export value thus far. Other contributors to export growth included machinery, equipment and parts, as well as palm oil-based manufactured products,” it said.According to Miti, exports to all key trading partners, namely Asean, China, the United States, Taiwan and the European Union, registered positive growth, with exports to Taiwan reaching its highest value to date.

It said exports to free-trade-agreement partners also expanded, with notable increases in shipments to Mexico and the Republic of Korea, driven primarily by higher exports of E&E products.For the period of January to July 2025, trade, exports, and imports achieved their highest cumulative value, with trade rising 4.7% to RM1.731 trillion y-o-y, exports expanding 4.3% to RM900.47 billion, and imports up by 5.1% to RM830.16 billion, resulting in a trade surplus of RM70.32 billion.

“Malaysia’s encouraging trade performance in the first seven months of 2025 comes amid a cautiously improving global trade outlook,” it added.Miti said the World Trade Organization has revised its growth forecast for global merchandise trade volume in 2025 to 0.9%, up from its earlier projection of a 0.2% contraction, largely driven by a surge in the US imports earlier in the year.

In addition, the US government’s decision to cut reciprocal tariffs on Malaysian exports from 25% to 19% reflects Miti’s methodical and disciplined trade diplomacy efforts, it said.“This tariff rate, which is roughly in line with the rest of our peers in Asean, will continue to support our competitiveness,” said the ministry.

President Donald Trump stunned the logistics industry on Friday by widening his steel and aluminum tariffs to include more than 400 consumer items that contain the metals, such as motorcycles and tableware. Customs brokers and importers in the US were given little notice to account for the change, which went into effect Monday and did not exclude goods in transit.

The new tariff inclusion list was posted by the Customs and Border Protection agency just as many were leaving for the weekend and appeared in the Federal Register on Tuesday, creating fresh headaches for trade professionals. Official guidance has been muddled, especially for goods already on their way to the US, and it’s unclear whether the metals levies stack on top of country-by-country tariffs.

Having weathered six months of Trump’s trade war and a pandemic that triggered mass supply disruptions, it’s hard to rattle the freight carriers, cargo owners and middlemen that keep cross-border commerce moving. But the scope and implementation speed of this latest notice took many by surprise.

“We’ve had a lot of these 11th-hour implementations throughout 2025, this one in particular impacts every single client I have to an enormous degree,” Michigan-based customs broker Shannon Bryant said in an interview.

“Earlier announcements at least had some in-transit exemptions so at least importers could make reasonable buying decisions,” said Bryant, president of trade compliance advisory service, Trade IQ. “This one was unique in that way — it’s very much a ‘gotcha.’”

The new list includes auto parts, chemicals, plastics and furniture components — demonstrating the reach of Trump’s authority to use sectoral tariffs. That is separate from the executive power he invoked for his so-called reciprocal tariffs.

“Basically, if it’s shiny, metallic, or remotely related to steel or aluminum, it’s probably on the list,” Brian Baldwin, a vice president of customs in the US at logistics giant Kuehne + Nagel International AG, wrote in a post on LinkedIn. “This isn’t just another tariff — it’s a strategic shift in how steel and aluminum derivatives are regulated.”

The difficulty with applying tariffs to derivative products lies in determining what percentage of an item is made from the targeted materials.

Flexport, a digital freight forwarder, said in a blog post that “for many brands, this means chasing suppliers for detailed data: aluminum weight, percentage of customs value, and country of cast/smelt.”

The compliance burden, Flexport said, “is significant.”

This tranche of tariffs is also particularly expansive, including items such as motorcycles, cargo handling equipment, baby booster seats, tableware and personal care products that come in metal containers or packaging.

Jason Miller, a professor of supply chain management at Michigan State University, conservatively estimates that the metals tariffs now cover about $328 billion worth of goods, based on 2024 import data. That’s six times greater than in 2018 and a big jump from the $191 billion worth of goods covered prior to the change, he said in an email to Bloomberg News.

Bryant, whose clients include cosmetics and commercial cookware importers, sent a letter to her elected officials in Washington on Monday warning that the complexity of overlapping tariffs is becoming unworkable even for professionals. “For small importers,” she wrote, “it’s impossible.”

“I’m trying to think of a client that’s not impacted,” Bryant said. “These are American companies that employ American people that are being ambushed by their own government.”

Trump first imposed steel and aluminum tariffs in 2018 with the goal of boosting US output by making it more expensive for Americans to buy foreign material.

But several major suppliers including Canada, Mexico and the European Union were ultimately exempted, and US industries have said they’re still struggling to compete with imports.

In June, Trump fulfilled a campaign promise by doubling the levy on steel and aluminum to 50% and also sought feedback from industry on how to broaden it further.

Lourenco Goncalves, chief executive officer of US steelmaker Cleveland-Cliffs Inc., applauded the expanded tariff list in a statement on Monday, thanking the Trump administration for “taking decisive and concrete action that will deter tariff circumvention occurring in plain sight with stainless and electrical steel derivative products.”

There’s very likely more to come. At the end of July, the Trump administration imposed a 50% duty on semi-finished copper imports valued at more than $15 billion and ordered officials to come up with a plan to slap tariffs on an array of other copper-intensive goods.

“This isn’t over,” said Pete Mento, DSV’s global customs director, in a social media post on Monday. “The next list will surely be for copper and I expect that to be equally as miserable.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up