Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Investors have begun to scale back their expectations for a rate cut after the latest employment data exceeded expectations.

LPL Financial Chief Economist Jeffrey Roach said in an assessment he made on the Yahoo Finance program Morning Brief that this week’s meeting will most likely be “boring.” Roach said that Fed officials will prepare markets for the first rate cut in June with domestic and international speeches they will make during this process.

Roach said he expects three interest rate cuts during the year, adding that these could be quarter-point cuts in June, October and December, respectively. He noted that there are positive signals, especially in non-housing services inflation, which is called “super core.”

Roach also made assessments of employment data, stating that the latest figures do not fully reflect the truth and that some temporary hirings (such as in the warehousing sector) make the picture look stronger than it is. He also pointed out that the data could be misleading because federal employees are still on the payroll due to severance pay or early retirement.

However, Roach said that the persistent demand for labor in the health sector provides stability to the labor market, and that the general trend is a slowdown in employment growth over the last year and a half but still positive. He added that as long as the average employment growth remains above 125,000, the message of stability will continue to be given to the markets.

Roach said that businesses tend to hold on to their current employees because of the difficulties they face in finding qualified workers, and that this could limit layoffs. However, he also noted that wage increases could slow down.

Noting that there has been a rapid increase in the number of people unemployed for a long time, Roach added that this rate has reached pre-pandemic levels but does not yet show signs of recession. For this reason, he stated that the markets reacted positively to the employment data announced last Friday.

According to Roach's assessment, the Fed will not change interest rates this week, but will begin to lay the groundwork for a possible cut in June.

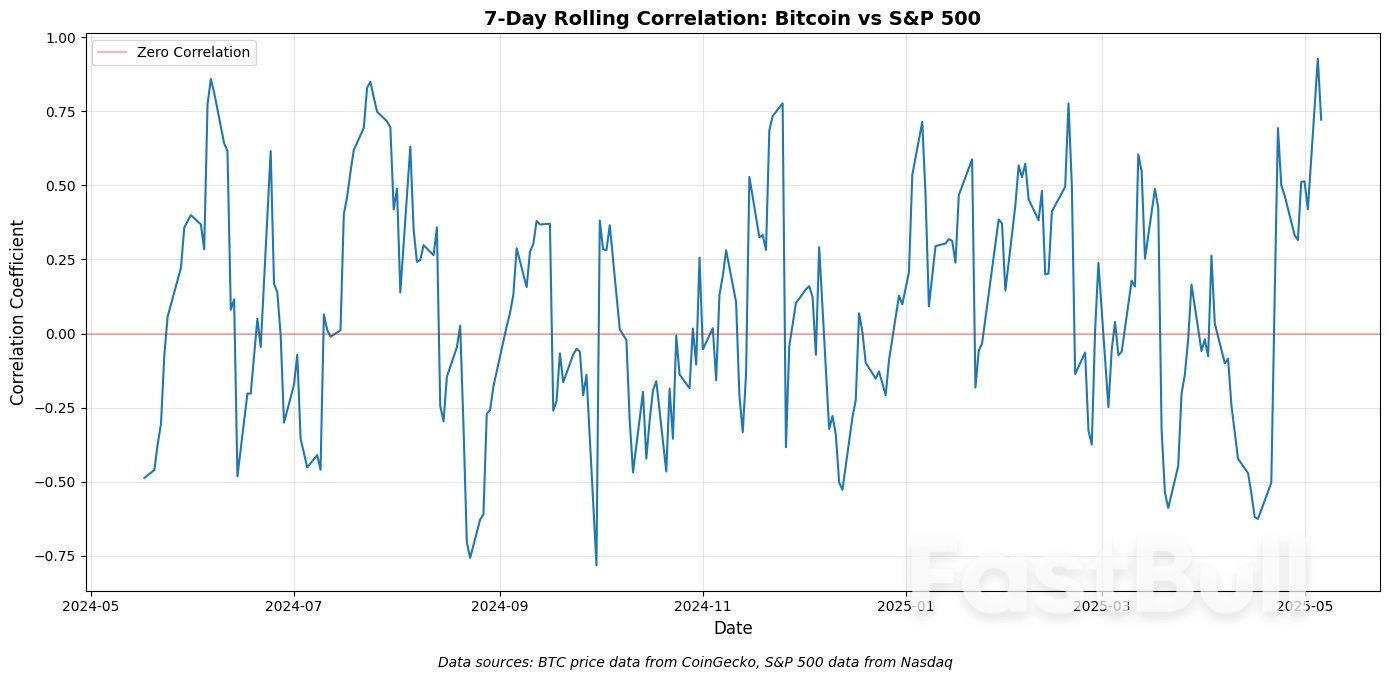

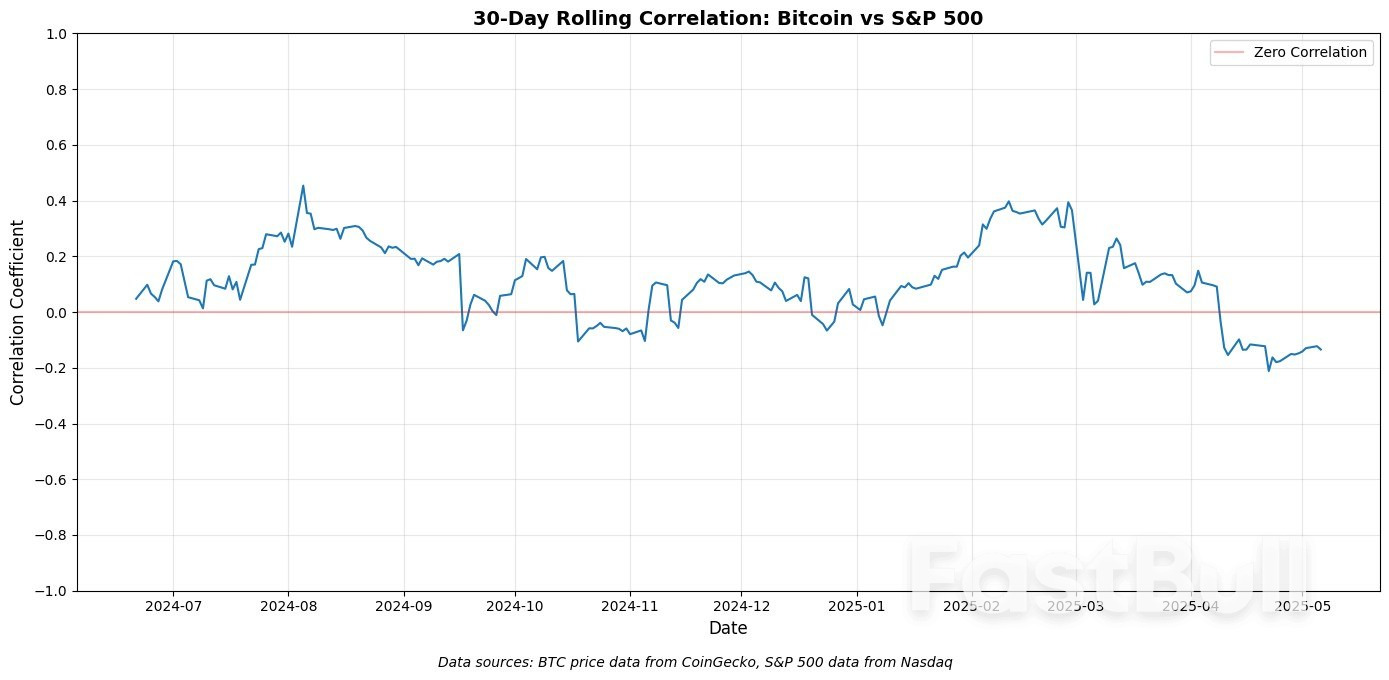

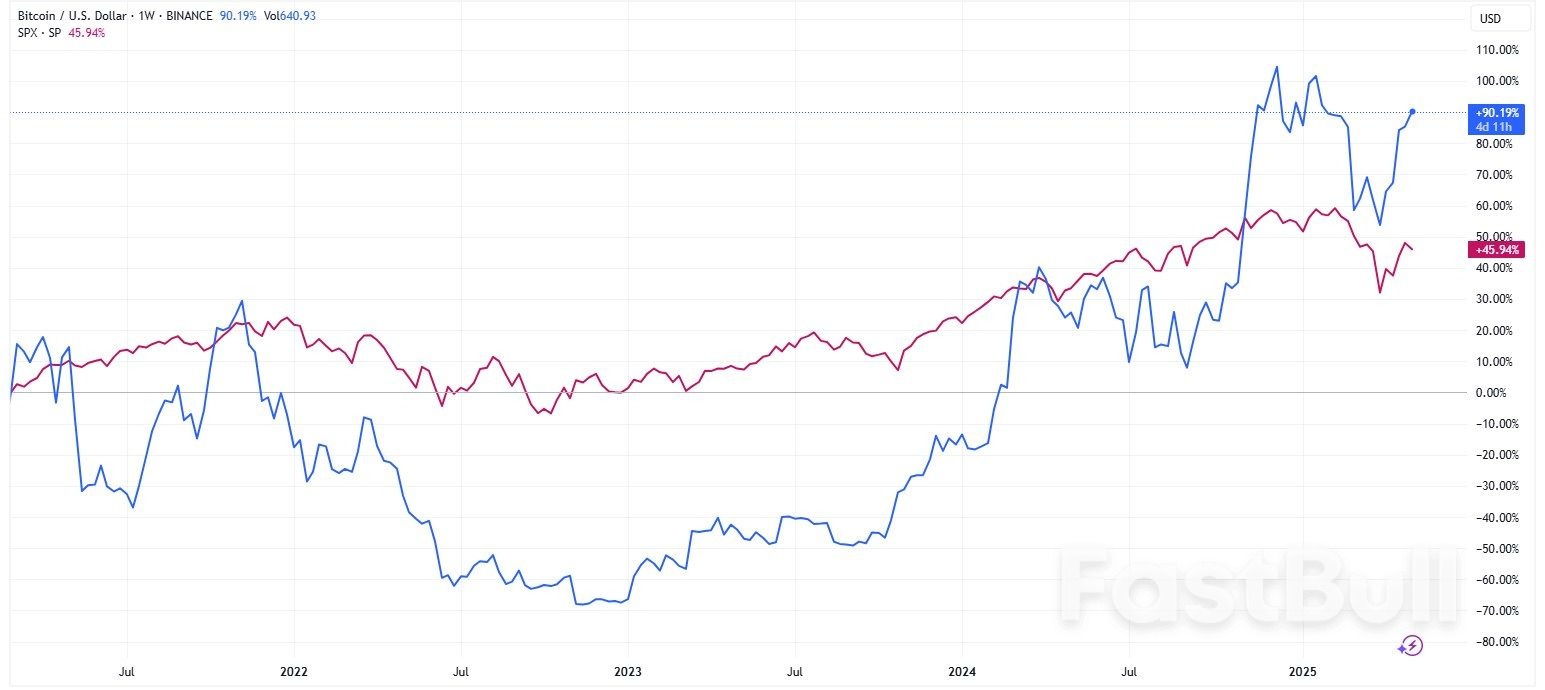

Bitcoin vs S&P 500 performance

Bitcoin vs S&P 500 performanceThe Southeast Asian nation’s trade minister and top negotiator, Nguyen Hong Dien, urged the firms, including in energy, mining, telecommunications and aviation, during a meeting in Hanoi to be “proactive” to help US-Vietnam trade reach its “great potential,” the government said in a statement.

Nguyen Hong Dien also met with the US Ambassador to Vietnam, Marc Knapper, “to promote the ongoing negotiation process aimed at addressing current bilateral economic and trade issues,” it said.

Vietnam is among a group of countries opening trade talks with the US that are facing some of the steepest tariffs imposed by President Donald Trump, aimed at reviving manufacturing that moved overseas in recent decades. Trump’s main target, China, is also a major trade partner for Vietnam but has challenged its access to offshore areas both countries claim in the South China Sea.

Vietnam’s trade surplus narrowed sharply in April in what could be an early indication of the impact of higher US tariffs. The surplus in April was $577 million, compared with the $1.64 billion reported for March, according to data released by the National Statistics Office in Hanoi Tuesday.

US officials late last month had draft plans to hold negotiations with about 18 countries over three weeks, using a template that lays out common areas of concern to help guide the discussions, including on tariffs, non-tariff barriers, digital trade, economic security and commercial concerns.

The US ran a nearly $124 billion trade deficit with Vietnam last year, according to the US Trade Representative, the third-highest after China and Mexico. The surge in trading in recent years is partly due to firms leaving China to avoid Trump’s trade war during his first term. Besides being a large apparel exporter, Vietnam has also become a manufacturing base for multinational companies including Apple Inc.’s suppliers and Samsung Electronics Co.

USTR Jamieson Greer in March told Nguyen Hong Dien in Washington that Vietnam must improve the trade balance and further open its market, which the government in Hanoi pledged to do via removing tariffs on US goods and buying more from the US. Vietnam also vowed to combat trade fraud and increase monitoring of products’ origin.

Trump imposed a 46% tariff on Vietnam on April 2, which was later suspended for 90 days to allow time for talks.

In its statement Wednesday, Vietnam said it had imported in recent years billions of dollars worth of US aircraft, machinery, power transmission systems, high-end semiconductors and raw materials.

The US normalized relations with Vietnam in 1995 after lifting a trade embargo the year before, a legacy of their conflict that ended in 1973. In 2023, President Joe Biden updated the relationship to a “comprehensive strategic partnership,” Hanoi’s highest diplomatic level and one it has used for India and China.

Vietnam has previously sought to improve it export options to the US by applying for “market economy” status from Washington regulators. That request was rejected last August by the Commerce Department as critics argued the government in Hanoi controls prices and production and subsidizes enterprises that compete with American firms.

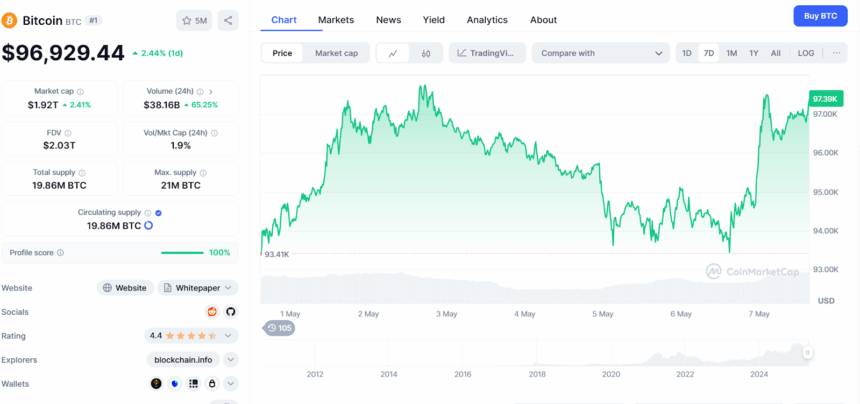

Bitcoin price has been consolidating between $93,410, and $97,000 for the past 7 days. As of now, traders are waiting on the FOMC meeting set for 2 p.m. ET today to know the next move. There’s a possibility that the BTC price will break above $100k following the meeting.

According to the data on CME FedWatch Tool, there’s a 97.7% chance the Fed will keep rates steady between 4.25% and 4.50%. Meanwhile, tension is rising as inflation stays sticky and rate-cut demands grow louder. But despite all this political pressure, Fed Chair Jerome Powell is expected to stick to his cautious approach.

At the time of writing, Bitcoin price is trading at $96,929, up 2.44% in the last 24 hours with a volume of $38.1 billion, according to CoinMarketCap.

Looking at the 4-hour chart, Bitcoin price recently bounced off a support zone at $93,000. Right now, the price is testing a resistance zone. If the price holds and gains strength, it could jump 5% toward $102,2500. If not, a drop to $88,772 is possible.

In a recent report on May 6, Crypto exchange Bitfinex confirmed that Bitc can hit a new all-time high only if the price manages to stay above the support level at $95,000. The exchange said “The $95,000 level—currently under consolidation—is a critical pivot point, acting as the lower boundary of a three-month range.” In short, if the price stays above this level may lead to a new all-time high, but dropping below could trigger a sharp fall.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up