Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japanese government bond yields soared to levels not seen in decades as markets braced for possible fiscal loosening ahead of the Upper House election....

Key Insights:

Over the years, crypto stock and associated currencies have solidified their position as a significant asset class. The market continues to attract interest from both individual and institutional investors.

The current bull run in the market is further fueling investor interest in stocks associated with crypto-based firms. Cryptocurrency stocks allow investors to benefit from both the traditional stock and crypto prices.

As market participants turn their attention to Q3, here are three top crypto stocks to look out for:

Despite a mild correction, Circle CRCL remains a top performer among other crypto stocks. According to data from TradingView, the CRCL stock was priced at $187.33, up 0.92% in pre-market trading.

Circle began trading on the New York Stock Exchange (NYSE) on June 5, 2025, following its Initial Public Offering (IPO). The stock opened at $69, surged to $103.75 intraday, and closed at $83.23.

Circle stock jumped 800% in just 18 days to trade at $279. Circle CRCL has rallied approximately 550% since the initial public offering. This rapid increase indicated strong demand and effective positioning.

As of July 14, 2025, the stock had a market capitalization of $42.64 Billion at the time of filing this story. Circle is the issuer of USDC, the second-largest stablecoin by market cap, $63 Billion (press time).

Beyond stablecoin settlements, Circle has a partner network of over 500. Additionally, the US Senate passed the GENIUS Act with a 68–30 vote on June 17.

This legislation creates the first federal framework for dollar‑pegged stablecoins, further boosting CRCL’s outlook.

Using a 10-year discounted cash flow model, Bernstein analysts forecasted a $230 target for Circle stock.

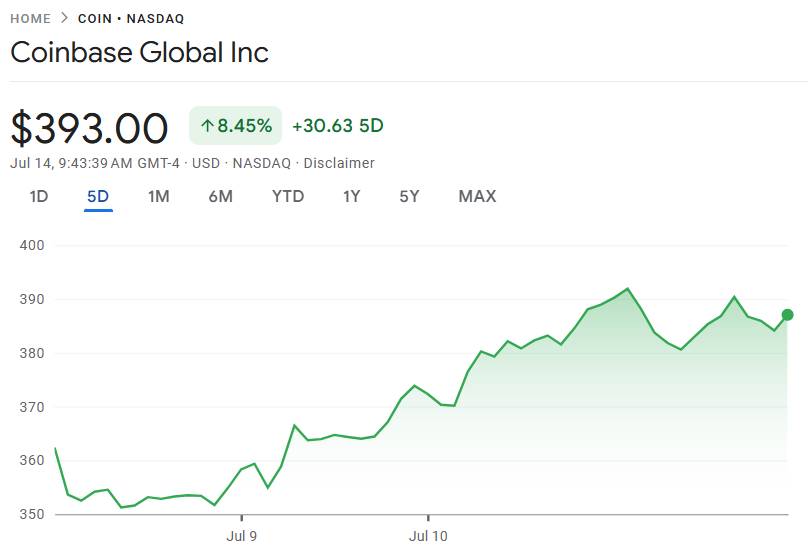

Coinbase is another promising stock to watch in the third quarter of 2025. COIN has rallied in pre-market trading on July 14, 2025, according to Google Finance data.

The stock is currently traded at $387.06, reflecting a 55% increase year-to-date. As of writing, COIN was trading at $393 atop 5-day rally of 8.45%.

Coinbase Price Chart | Source: Google Finance

Coinbase Price Chart | Source: Google FinanceThe Coinbase stock debuted at $381 on the Nasdaq Global Select Market on April 14, 2021. Price dropped below $50 in 2022, but it bounced back in 2023, 2024, and 2025.

The rally is supported by the growing popularity of Bitcoin Exchange-Traded Funds (ETFs) and the fourth Bitcoin halving.

Analysts are optimistic about the future outlook of COIN. Popular market analyst Ali Martinez recently predicted a $2,000 target for COIN, citing a rare bullish pattern on the COIN chart.

Moreover, COIN recently rose as high as $388.96, despite Ark Invest selling 16,627 units of its Coinbase stock.

Separately, the Czech National Bank has recently announced the acquisition of $18 Million worth of Coinbase shares during the second quarter of 2025.

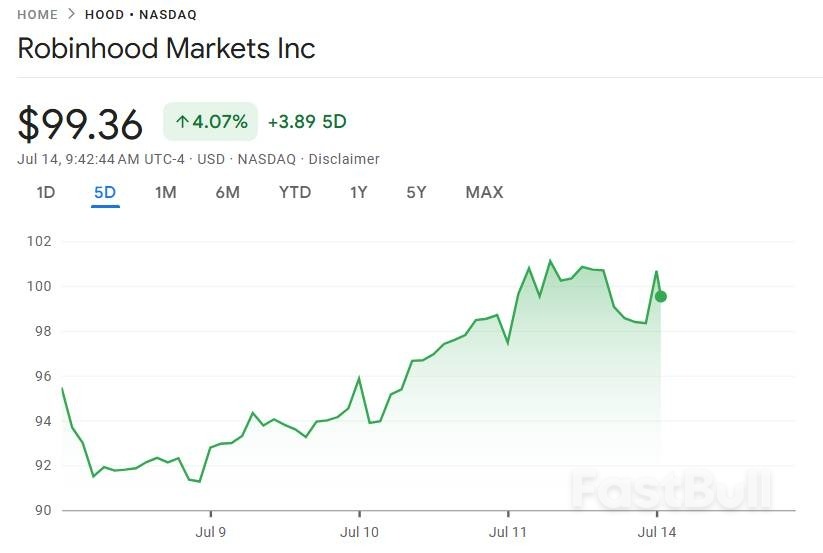

Robinhood Markets, Inc. is the third crypto-related stock to consider in Q3 2025. HOOD opened at $98.34 on July 14, 2025, with a market capitalization of $86.78 Billion.

As of writing, it was up 4.05% in the last 5 days to $99.36.

Robinhood Price Chart | Source: Google Finance

Robinhood Price Chart | Source: Google FinanceRobinhood Markets has a fifty-two-week low of $13.98 and a fifty-two-week high of $101.50. HOOD surged over 163% year-to-date and 310.7% within the past year.

Analysts noted a strong rising trend, with some predicting a 117% rise in the next three months.

In a research note on Tuesday, July 1, KeyCorp boosted its price objective on HOOD shares from $60 to $110. The bank-based financial services company gave the HOOD stock an “overweight” rating.

In its last quarterly earnings released on April 30, Robinhood reported $0.37 earnings per share (EPS) for the quarter. This figure comes short of analysts’ consensus estimates of $0.41.

However, the firm reported revenue of $927.00 Million for the quarter, higher than the consensus estimate of $917.12 Million.

Historically, the altcoin season follows Bitcoin’s strong rallies and subsequent consolidation.According to CoinMarketCap data, Bitcoin has hit a new all-time high of $123,000, driven by positive market sentiments.

This rally creates an opportunity for prices to consolidate, giving room for altcoins to shine.Ethereum often leads altcoin rallies, as its performance against Bitcoin signals broader altcoin market strength.

In the past 24 hours, ETH has surged over 2.7% to $3,046. Blockchains like Solana and Avalanche have also benefited from the recent BTC rally.

Additionally, altcoins like Aave and Toncoin are seeing renewed interest due to their scalability and DeFi innovations.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up