Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Oct)

U.S. Average Hourly Wage MoM (SA) (Oct)A:--

F: --

P: --

U.S. Average Hourly Wage YoY (Oct)

U.S. Average Hourly Wage YoY (Oct)A:--

F: --

P: --

U.S. Retail Sales (Oct)

U.S. Retail Sales (Oct)A:--

F: --

P: --

U.S. Core Retail Sales MoM (Oct)

U.S. Core Retail Sales MoM (Oct)A:--

F: --

U.S. Core Retail Sales (Oct)

U.S. Core Retail Sales (Oct)A:--

F: --

P: --

U.S. Retail Sales MoM (Oct)

U.S. Retail Sales MoM (Oct)A:--

F: --

U.S. Private Nonfarm Payrolls (SA) (Oct)

U.S. Private Nonfarm Payrolls (SA) (Oct)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Oct)

U.S. Average Weekly Working Hours (SA) (Oct)A:--

F: --

P: --

U.S. Labor Force Participation Rate (SA) (Nov)

U.S. Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

U.S. Retail Sales YoY (Oct)

U.S. Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Oct)

U.S. Manufacturing Employment (SA) (Oct)A:--

F: --

U.S. Government Employment (Nov)

U.S. Government Employment (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)

U.S. IHS Markit Manufacturing PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)

U.S. IHS Markit Composite PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. IHS Markit Services PMI Prelim (SA) (Dec)

U.S. IHS Markit Services PMI Prelim (SA) (Dec)A:--

F: --

P: --

U.S. Commercial Inventory MoM (Sept)

U.S. Commercial Inventory MoM (Sept)A:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Argentina GDP YoY (Constant Prices) (Q3)

Argentina GDP YoY (Constant Prices) (Q3)A:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Australia Westpac Leading Index MoM (Nov)

Australia Westpac Leading Index MoM (Nov)A:--

F: --

Japan Trade Balance (Not SA) (Nov)

Japan Trade Balance (Not SA) (Nov)A:--

F: --

P: --

Japan Goods Trade Balance (SA) (Nov)

Japan Goods Trade Balance (SA) (Nov)A:--

F: --

P: --

Japan Imports YoY (Nov)

Japan Imports YoY (Nov)A:--

F: --

P: --

Japan Exports YoY (Nov)

Japan Exports YoY (Nov)A:--

F: --

P: --

Japan Core Machinery Orders YoY (Oct)

Japan Core Machinery Orders YoY (Oct)A:--

F: --

P: --

Japan Core Machinery Orders MoM (Oct)

Japan Core Machinery Orders MoM (Oct)A:--

F: --

P: --

U.K. Core CPI MoM (Nov)

U.K. Core CPI MoM (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.K. Core Retail Prices Index YoY (Nov)

U.K. Core Retail Prices Index YoY (Nov)--

F: --

P: --

U.K. Core CPI YoY (Nov)

U.K. Core CPI YoY (Nov)--

F: --

P: --

U.K. Output PPI MoM (Not SA) (Nov)

U.K. Output PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Output PPI YoY (Not SA) (Nov)

U.K. Output PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. Input PPI YoY (Not SA) (Nov)

U.K. Input PPI YoY (Not SA) (Nov)--

F: --

P: --

U.K. CPI YoY (Nov)

U.K. CPI YoY (Nov)--

F: --

P: --

U.K. Retail Prices Index MoM (Nov)

U.K. Retail Prices Index MoM (Nov)--

F: --

P: --

U.K. CPI MoM (Nov)

U.K. CPI MoM (Nov)--

F: --

P: --

U.K. Input PPI MoM (Not SA) (Nov)

U.K. Input PPI MoM (Not SA) (Nov)--

F: --

P: --

U.K. Retail Prices Index YoY (Nov)

U.K. Retail Prices Index YoY (Nov)--

F: --

P: --

Indonesia 7-Day Reverse Repo Rate

Indonesia 7-Day Reverse Repo Rate--

F: --

P: --

Indonesia Deposit Facility Rate (Dec)

Indonesia Deposit Facility Rate (Dec)--

F: --

P: --

Indonesia Lending Facility Rate (Dec)

Indonesia Lending Facility Rate (Dec)--

F: --

P: --

Indonesia Loan Growth YoY (Nov)

Indonesia Loan Growth YoY (Nov)--

F: --

P: --

South Africa Core CPI YoY (Nov)

South Africa Core CPI YoY (Nov)--

F: --

P: --

South Africa CPI YoY (Nov)

South Africa CPI YoY (Nov)--

F: --

P: --

Germany Ifo Business Expectations Index (SA) (Dec)

Germany Ifo Business Expectations Index (SA) (Dec)--

F: --

P: --

Germany Ifo Current Business Situation Index (SA) (Dec)

Germany Ifo Current Business Situation Index (SA) (Dec)--

F: --

P: --

Germany IFO Business Climate Index (SA) (Dec)

Germany IFO Business Climate Index (SA) (Dec)--

F: --

P: --

Euro Zone Core CPI Final MoM (Nov)

Euro Zone Core CPI Final MoM (Nov)--

F: --

P: --

Euro Zone Labor Cost YoY (Q3)

Euro Zone Labor Cost YoY (Q3)--

F: --

P: --

Euro Zone Core HICP Final YoY (Nov)

Euro Zone Core HICP Final YoY (Nov)--

F: --

P: --

Euro Zone Core HICP Final MoM (Nov)

Euro Zone Core HICP Final MoM (Nov)A:--

F: --

P: --

Euro Zone Core CPI Final YoY (Nov)

Euro Zone Core CPI Final YoY (Nov)--

F: --

P: --

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)

Euro Zone HICP MoM (Excl. Food & Energy) (Nov)--

F: --

P: --

Euro Zone CPI YoY (Excl. Tobacco) (Nov)

Euro Zone CPI YoY (Excl. Tobacco) (Nov)--

F: --

P: --

Euro Zone HICP Final YoY (Nov)

Euro Zone HICP Final YoY (Nov)--

F: --

P: --

Euro Zone HICP Final MoM (Nov)

Euro Zone HICP Final MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Despite headline figures, Japan's $550 billion US fund will consist mostly of loans and guarantees, with just 1–2% allocated to direct investment...

Key Points:

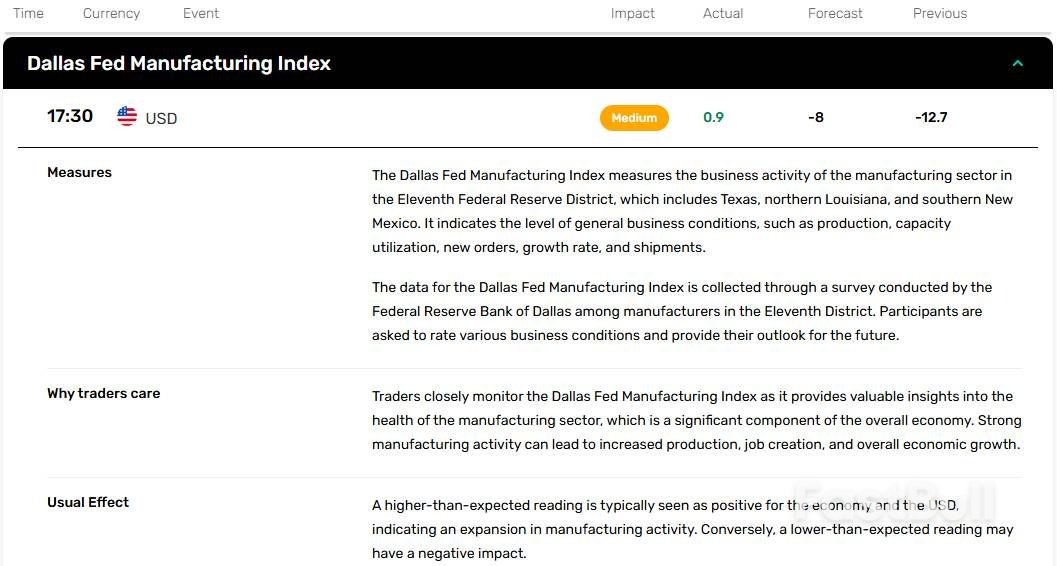

On July 28, 2025, the Federal Reserve Bank of Dallas released Dallas Fed Manufacturing Index report for July. The report indicated that Dallas Fed Manufacturing Index improved from -12.7 in June to +0.9 in July, compared to analyst forecast of -8.

Production Index increased from 1.3 in June to 21.3 in July, while Capacity Utilization grew from -1.0 to 17.3. It should be noted that Production Index reached its highest level in more than three years.

Prices Paid for Raw Materials declined from 43.0 in June to 41.7 in July, while Wages and Benefits decreased from 13.4 to 13.2.

U.S. Dollar Index settled near session highs as traders reacted to the better-than-expected Dallas Fed Manufacturing Index report. Currently, U.S. Dollar Index is trying to settle above the 98.30 level. U.S. dollar is also supported by the U.S. – EU trade deal.

Gold is trading near session lows as traders focus on the strong U.S. dollar. Gold has recently made an attempt to settle below the $3300 level.

SP500 pulled back towards the 6400 level as traders took some profits off the table near historic highs. It remains to be seen whether the encouraging Dallas Fed Manufacturing Index report will provide sufficient support to SP500 as traders may stay focused on Trump’s tariff policy.

The United States and European Union have agreed a trade deal in which a 15% tariff is set to be placed on most EU exports entering the US market, though a final decision is yet to be made on alcohol.

Yesterday (27 July), the EU Commission announced that besides the 15% levy, the US and EU had also agreed on "zero-for-zero tariffs" on several goods, including "certain agricultural products".

When asked in a press conference following the deal whether the zero-for-zero agreement included alcohol, spirits and wine, president of the Commission Ursula von der Leyen said "no decision” had been made yet.

She added that the topic was something that would be discussed in the “next days".

In the Commission's statement, the president added that the deal creates "more predictability for our businesses".

She added: "We are ensuring immediate tariff relief. This will have a clear impact on the bottom lines of our companies. And with this deal, we are securing access to our largest export market. At the same time, we will give better access for American products in our market.

"This will benefit European consumers and make our businesses more competitive. This deal provides a framework from which we will further reduce tariffs on more products, address non-tariff barriers, and cooperate on economic security."

Secretary general of The Brewers of Europe, Julia Leferman said that the United States is the "second most significant export market for European breweries, accounting for over a quarter of total European beer exports."

She added: “As it emerges that no decision has yet been taken on the treatment of alcoholic beverages and negotiations continue on the list of products - including agri-food, that could be covered by a zero-for-zero arrangement - The Brewers of Europe calls on EU and US negotiators to put beer on this list and also remove beer from the aluminium derivatives tariffs set by the US."

Reflecting on the news, president of the European wine trade body Comité Européen des Entreprises Vins (CEEV) Marzia Varvaglione said: "We are still awaiting the full details of the agreement reached today and are watching with great anticipation the outcome of the upcoming negotiations regarding the list of products that will be included under the zero-for-zero tariff arrangement, among them some agricultural products”

"We truly believe the trade of wine is of great benefit for both EU and U.S. companies, and it must be included in the zero-for-zero tariff arrangement.

Cast your mind back to 2017. The cryptocurrency landscape was a wild west of innovation mixed with rampant speculation. While Bitcoin was making headlines with its parabolic surge, it was also attracting its fair share of critics. Many traditional financial experts and media outlets openly questioned its legitimacy, often labeling it as a Ponzi scheme or a tool for illicit activities. The term ‘scam’ was frequently associated with digital assets, fueled by:

During this period, Crypto Adoption was primarily driven by early tech enthusiasts, libertarians, and risk-tolerant investors who saw its revolutionary potential despite the prevailing skepticism.

Fast forward to today, and the conversation around crypto couldn’t be more different. Richard Teng’s observation of crypto’s journey from ‘scam’ to ‘sensation’ is a testament to several pivotal developments that have fueled this incredible transformation. What exactly ignited this shift in public and institutional perception, accelerating Crypto Adoption to unprecedented levels?

This confluence of factors has propelled crypto from the fringes to the forefront of global finance and technology, making its presence undeniable.

As we look towards 2025 and beyond, the trajectory for Crypto Adoption appears to be one of continued growth and integration. Richard Teng’s remarks underscore that we are merely at the cusp of this transformative era. What does this mean for the future?

Mainstream Integration and Tokenization

Expect to see cryptocurrencies and blockchain technology seamlessly integrated into everyday life. This could manifest in:

Persistent Challenges in Crypto Adoption

While the outlook is overwhelmingly positive, the path to full Crypto Adoption isn’t without its hurdles. Key challenges include:

Despite the challenges, the benefits of widespread Crypto Adoption are compelling:

If Richard Teng’s insights have piqued your interest in the evolving world of crypto, here are some actionable steps:

Richard Teng’s observation is more than just a comment; it’s a powerful reflection of a monumental shift. What was once dismissed as a dubious experiment has blossomed into a vibrant, dynamic force shaping the future of finance and technology. The journey from widespread skepticism in 2017 to the growing institutional embrace of 2025 highlights not just the resilience of crypto, but its undeniable potential. As Crypto Adoption continues its phenomenal rise, it promises to unlock new possibilities, redefine traditional systems, and empower individuals globally. This isn’t just a sensation; it’s a revolution in progress.

Top U.S. and Chinese economic officials resumed talks in Stockholm on Monday to resolve longstanding economic disputes at the centre of a trade war between the world's top two economies, aiming to extend a truce by three months.

U.S. Treasury Chief Scott Bessent was part of a U.S. negotiating team that arrived at Rosenbad, the Swedish prime minister's office in central Stockholm, in the early afternoon. China's Vice Premier He Lifeng was also seen at the venue on video footage.

China is facing an August 12 deadline to reach a durable tariff agreement with President Donald Trump's administration, after Beijing and Washington reached preliminary deals in May and June to end weeks of escalating tit-for-tat tariffs and a cut-off of rare earth minerals.

Trump touched on the talks during a wide-ranging press conference with British Prime Minister Keir Starmer in Scotland.

"I'd love to see China open up their country. So we're dealing with China right now as we speak," Trump said.

Without an agreement, global supply chains could face renewed turmoil from U.S. duties snapping back to triple-digit levels that would amount to a bilateral trade embargo.

U.S. Trade Representative Jamieson Greer said he did not expect "some kind of enormous breakthrough today" at the talks in Stockholm that he was attending.

"What I expect is continued monitoring and checking in on the implementation of our agreement thus far, making sure that key critical minerals are flowing between the parties and setting the groundwork for enhanced trade and balanced trade going forward," he told CNBC.

The Stockholm talks follow Trump's biggest trade deal yet with the European Union on Sunday for a 15% tariff on most EU goods exports to the United States.

Trade analysts said another 90-day extension of a tariff and export control truce struck in mid-May between China and the United States was likely.

An extension would facilitate planning for a potential meeting between Trump and Chinese President Xi Jinping in late October or early November.

The Financial Times reported on Monday that the U.S. had paused curbs on tech exports to China to avoid disrupting trade talks with Beijing and support Trump's efforts to secure a meeting with Xi this year.

Meanwhile, in Washington, U.S. senators from both major parties plan to introduce bills this week targeting China over its treatment of minority groups, dissidents, and Taiwan, emphasizing security and human rights, which could complicate talks in Stockholm.

Previous U.S.-China trade talks in Geneva and London in May and June focused on bringing U.S. and Chinese retaliatory tariffs down from triple-digit levels and restoring the flow of rare earth minerals halted by China and Nvidia's (NVDA.O), opens new tab H20 AI chips, and other goods halted by the United States.

So far, the talks have not delved into broader economic issues. They include U.S. complaints that China's state-led, export-driven model is flooding world markets with cheap goods, and Beijing's complaints that U.S. national security export controls on tech goods seek to stunt Chinese growth.

"Geneva and London were really just about trying to get the relationship back on track so that they could, at some point, actually negotiate about the issues which animate the disagreement between the countries in the first place," said Scott Kennedy, a China economics expert at the Center for Strategic and International Studies in Washington.

Bessent has already flagged a deadline extension and has said he wants China to rebalance its economy away from exports to more domestic consumption -- a decades-long goal for U.S. policymakers.

Analysts say the U.S.-China negotiations are far more complex than those with other Asian countries and will require more time. China's grip on the global market for rare earth minerals and magnets, used in everything from military hardware to car windshield wiper motors, has proved to be an effective leverage point on U.S. industries.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up