Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Japanese and Taiwanese equity markets hit record highs as technology firms rallied, driven by optimism that upcoming U.S. inflation data will allow the Federal Reserve to implement interest rate cuts....

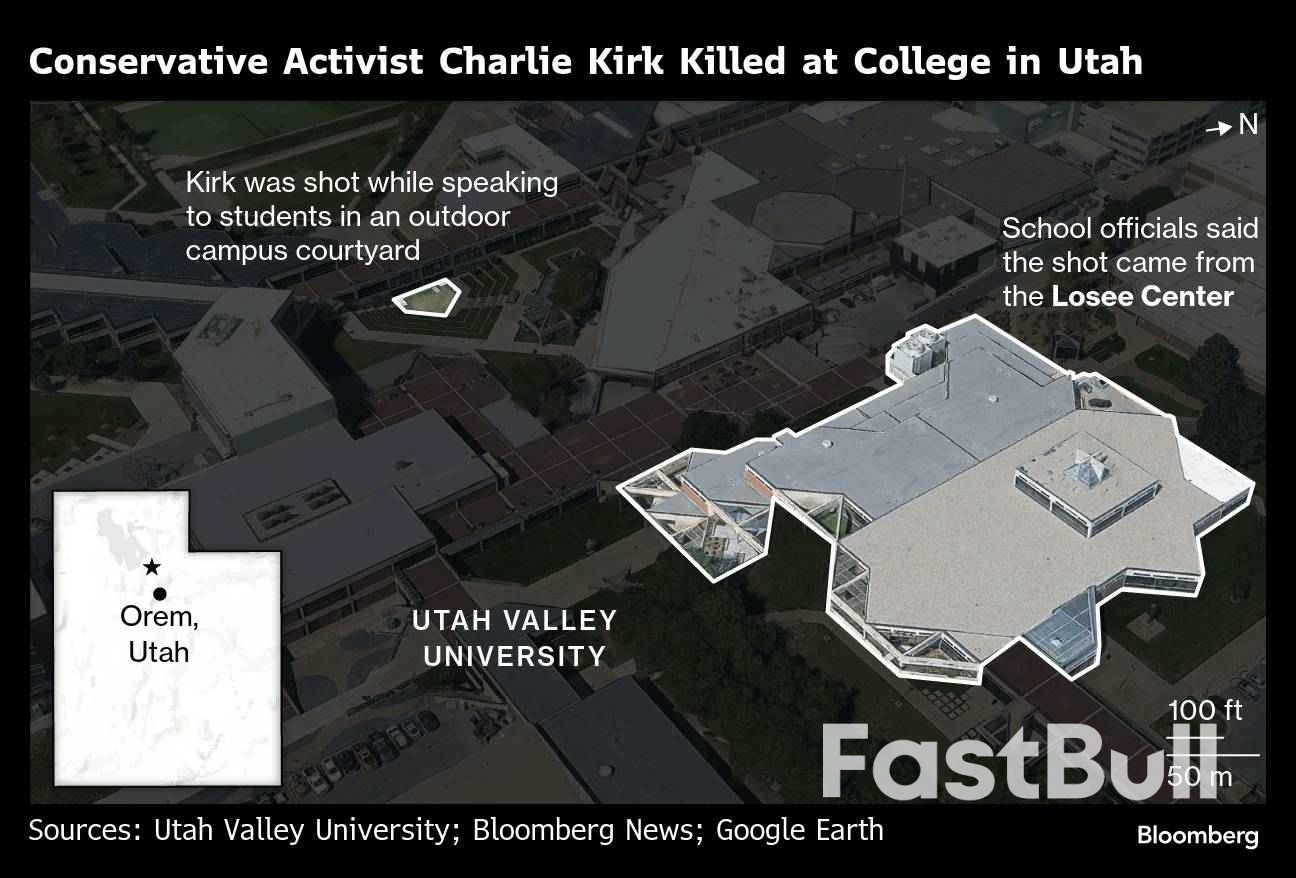

A search is underway for the killer of Charlie Kirk, a conservative activist and close ally of President Donald Trump who was fatally shot Wednesday at a Utah university.Kirk, executive director of the Turning Point USA advocacy group, was speaking at an outdoor event before a crowd at Utah Valley University when a single shot was fired from a nearby building, according to local police. Governor Spencer Cox described it as a “political assassination.”A person of interest was taken into custody and was later released, FBI director Kash Patel said in a social media post.

The shooting, the latest in a spate of political violence in the US, drew an outpouring of shock and condemnation from Republicans and Democrats alike. Kirk, 31, started Turning Point USA more than a decade ago and had turned it into one of the most influential groups helping to rally young voters to conservative causes. He leaves behind a wife and two young children.“Charlie was a patriot who devoted his life to the cause of open debate and the country that he loved so much,” Trump said in a video Wednesday evening in which he blamed rhetoric from the “radical left” for contributing to the violence.

“It’s long past time for all Americans, and the media, to confront the fact that violence and murder are the tragic consequence of demonizing those with whom you disagree day after day, year after year, in the most hateful and despicable way possible,” he said.Former Democratic presidents Joe Biden and Barack Obama denounced the violence and offered sympathies to his family. The Republican National Committee praised Kirk as a “dedicated patriot who spent his life defending conservative values and inspiring young Americans.”

Kirk was at UVU for his group’s American Comeback Tour, and was scheduled to set up a table called Prove Me Wrong, where the audience attempts to stump the pundit. There were more than 3,000 people in attendance, said Jeff Long, the university’s police chief, as well as six local police and Kirk’s personal security detail.

At approximately 12:20 pm Mountain time, about 20 minutes after Kirk began speaking, a single shot was fired from a building about 200 yards away. A supporter of gun rights, he had just began answering a question on the number of mass shooters in America over the last decade.

Gold prices are holding in and around the $3650/oz handle. The precious metal is benefitting from the perfect combination of political uncertainty, geopolitical risk and of course Fed rate cut bets.

On Wednesday, Poland, with help from its NATO allies, shot down what they believed to be Russian drones that had entered Polish airspace. This is the first time a NATO country has fired shots during the conflict between Russia and Ukraine.Poland’s Prime Minister, Donald Tusk, told parliament that this was “the closest we have been to open conflict since World War Two.” However, he also added that he doesn’t believe they are on the verge of war.Tusk called the incident a “large-scale provocation” and said he had activated Article Four of NATO’s treaty, under which alliance members can demand consultations with their allies.

Moscow has denied responsibility for the attack. The Russian Defence Ministry said its drones carried out strikes on military targets in Western Ukraine

So far nothing much has changed except an increase in haven demand and a rise in Oil prices. If NATO does decide to respond in some way that could be seen as aggression by Russia, Gold could be set for further gains.

The Israel attack on Qatar yesterday has also added to the risk premium while political turmoil in France has done the same. Hence why I am saying we are currently seeing the perfect cocktail for Gold prices to remain elevated.

Add to that the expectations for Federal Reserve rate cuts which received a boost as US PPI data came in well below expectations.

Markets will be focused on the US CPI inflation numbers out tomorrow while the discussions between NATO members may also factor into where gold prices head to next.

From a technical standpoint, Gold continues to hover near its all time highs.Momentum indicators are all in sync with the current bullish narrative with a selloff proving elusive thus far.The one positive for potential short sellers comes from the fact that the PPI data and downward revisions to the job numbers did not push Gold beyond the $3700/oz handle.

This suggests that we could get a pullback toward the $3600/oz before Gold is able to gain acceptance above the $3700/oz handle.Downside support may be found at the recent swing low at the $3620 handle before $3600 comes into focus.A move to fresh all time highs will have to gain acceptance beyond the $3700 handle if the bullish rally continues. This may require further geopolitical risk or a really big downside miss by the US CPI data.

Gold (XAU/USD) 30M Chart, September 10, 2025

Client Sentiment Data – XAU/USD

Looking at OANDA client sentiment data and market participants are Short on Gold with 59% of traders net-short. I prefer to take a contrarian view toward crowd sentiment and thus the fact that the majority of traders are net-short suggests that Gold prices could continue to rise in the near-term.

Wholesale prices unexpectedly fell 0.1% in August, adding weight to growing expectations that the Federal Reserve will approve a rate cut in its upcoming policy meeting. The latest Producer Price Index (PPI) report from the Bureau of Labor Statistics came in well below the 0.3% increase forecasted by economists, offering the central bank a stronger justification for easing its policy stance. Core PPI, excluding food and energy, also dropped 0.1%, versus an expected 0.3% rise.

Markets quickly responded. Futures on the S&P 500 advanced following the softer inflation data, while Treasury yields dipped modestly. The benchmark 10-year Treasury yield declined to 4.068%, and the 2-year yield dropped 1 basis point to 3.529%, reflecting expectations of a dovish shift by the Fed. According to CME FedWatch, traders are now fully pricing in a rate cut in September.

A key driver of the weaker PPI was a 0.2% decline in services prices, with trade services down 1.7%. Notably, margins for machinery and vehicle wholesaling fell 3.9%. These sectors are closely monitored by the Fed for insights into broader pricing pressures and monetary policy impacts.

Goods prices inched up just 0.1%, held down by a 0.4% decline in energy costs. Food prices were marginally higher, rising 0.1%, while core goods excluding food and energy saw a 0.3% increase. Even with these modest gains, overall price pressures appeared subdued.

Though inflation remains above the Fed’s 2% target, officials have pointed to easing rent and wage pressures as reasons for patience. However, Trump-era tariffs continue to impact specific categories, including a 2.3% surge in tobacco prices. The broader concern remains whether these tariffs, combined with slowing job growth, could weigh more heavily on economic activity.

Recent data revisions showing nearly 1 million fewer jobs created in the year ending March 2025 have heightened concerns over labor market health, even as Fed commentary continues to frame employment as “solid.” This reassessment could be another factor pushing policymakers toward easing.

The PPI data adds to the bullish narrative for a Fed rate cut next week. However, traders are watching Thursday’s Consumer Price Index (CPI) print closely for confirmation. If CPI also shows easing inflation, expectations for not just a rate cut—but potentially more than one—could solidify. For now, bond markets and equity futures suggest growing confidence that the Fed will deliver, keeping the short-term outlook for equities bullish and Treasury yields under pressure.

Reserve Bank of New Zealand Governor Christian Hawkesby reiterated that the bank’s central projection is for the Official Cash Rate to fall by another half-percentage point by year’s end, though the pace of reductions will depend on incoming data.

“While our central projection for the OCR is to fall to around 2.5% by the end of the year, that could occur faster or slower,” Hawkesby said Thursday in opening remarks to a financial conference. “Further data on the speed of New Zealand’s economic recovery will be what influences the future path of the OCR.”

The central bank last month resumed rate cuts after pausing in July as the sputtering recovery eased concerns about an uptick in price pressures. The RBNZ reduced the key rate to a three-year low of 3% as it said the economy had stalled, giving it scope to add stimulus as US tariffs and a stagnant housing market dented confidence.

“By the August Monetary Policy Statement, the main surprise was how much of a hit to domestic household and business confidence had occurred,” Hawkesby said Thursday. “The economy appeared to stall in the middle of the year, creating even more economic slack.”

He also signaled regret that while the RBNZ had been topical this year, it was for mainly wrong reasons

“It’s typical for the RBNZ to be ‘in the news’ for our policy decisions, publications and research,” he said. “But for too long this year the RBNZ has been ‘the news,’ following the departure of the Governor in March, the loss of our Board Chair in August, and everything in between.”

Reserve Bank of New Zealand Governor Christian Hawkesby reiterated that the bank’s central projection is for the Official Cash Rate to fall by another half-percentage point by year’s end, though the pace of reductions will depend on incoming data.“While our central projection for the OCR is to fall to around 2.5% by the end of the year, that could occur faster or slower,” Hawkesby said Thursday in opening remarks to a financial conference. “Further data on the speed of New Zealand’s economic recovery will be what influences the future path of the OCR.”

The central bank last month resumed rate cuts after pausing in July as the sputtering recovery eased concerns about an uptick in price pressures. The RBNZ reduced the key rate to a three-year low of 3% as it said the stalling economy gave it scope to add stimulus as US tariffs and a stagnant housing market dented confidence.“By the August Monetary Policy Statement, the main surprise was how much of a hit to domestic household and business confidence had occurred,” Hawkesby said Thursday. “The economy appeared to stall in the middle of the year, creating even more economic slack.”

While the RBNZ and many economists expect the economy contracted in the second quarter, growth is expected to resume in the second half of 2025 as lower borrowing costs encourage household spending.Hawkesby said the “confidence shock” the economy suffered in the middle of the year stemmed from uncertainty about the impact of US tariff policies, though cost-of-living pressures and sluggish house prices also weighed on domestic sentiment.Going forward, policymakers will continue to monitor second-round impacts of US tariff policies on both global growth and New Zealand businesses, the governor said in response to a question. However, he said, leading economic indicators for July were “better” and consistent with the RBNZ’s expectations of growth returning in the third and fourth quarters.

Hawkesby also signaled regret that while the RBNZ had been topical this year, it was for mainly wrong reasons“It’s typical for the RBNZ to be ‘in the news’ for our policy decisions, publications and research,” he said. “But for too long this year the RBNZ has been ‘the news,’ following the departure of the Governor in March, the loss of our Board Chair in August, and everything in between.”Hawkesby said the RBNZ “is not all about one person” and has structures in place that ensure it can handle a turnover in leadership.

“We are facing a test of trust and confidence in us as an organization,” he said. The governance structure “means that in times like these with turnover in leadership, we have the continuity to push ahead with an ongoing emphasis on delivering our mandate.”Hawkesby, who has put his name forward to be Adrian Orr’s permanent replacement, said he like all central bankers was watching developments in the US that may impact on the independence of the Federal Reserve.In New Zealand, local politicians — including Prime Minister Christopher Luxon — have suggested the RBNZ could have been more aggressive with its rate cuts. Hawkesby said his job is to ignore the political talk and deliver on his inflation mandate.

Israel's leaders are doubling down on (indirect) threats toward Qatar after Tuesday's surprise strike on a Doha home and office which killed five top Hamas leaders and negotiators.

Qatari leaders have expressed outrage over the violation of their country's sovereignty, but Israeli Ambassador to the US, Yechiel Leiter, has said Wednesday that Israel could strike Qatar again if it harbors terrorists - though oddly, the Hamas team was there as part of public US-backed diplomatic talks.

"If we didn’t get them this time, we’ll get them the next time," Amb. Leiter told Fox News. He further declared that the strikes on Qatar's capital might "actually advance the efforts for a ceasefire and peace." President Trump had actually said something similar.

"Right now, we may be subject to a little bit of criticism," the Israeli diplomat said. "They'll get over it. And Israel is being changed for the better. The region is being changed for the better as we remove these enemies of peace and these enemies of Western civilization from their ability to implement terrorism," he added.

"Right now, we may be subject to a little bit of criticism," the Israeli diplomat said. "They'll get over it. And Israel is being changed for the better. The region is being changed for the better as we remove these enemies of peace and these enemies of Western civilization from their ability to implement terrorism," he added.Israeli Prime Minister Benjamin Netanyahu said something similar, which is sure anger Qatari leaders further. "I say to Qatar and all countries that provide shelter to terrorists, either deport them or bring them to justice. Because if you don't, we will," he said.

And referencing 9/11 memorial events in the Wednesday comments, Netanyahu said: "Tomorrow is September 11th. We remember September 11th. On that day, Islamist terrorists committed the worst crime on American soil since the founding of the United States. We also have September 11th."

He continued, "We remember October 7th. On that day, Islamist terrorists committed the worst crime against the Jewish people since the Holocaust. What did America do in the wake of September 11th? It promised to hunt down the terrorists who committed this terrible crime, wherever they may be."

This suggests Israel believes itself to have 'freedom of action' to conduct 'counter-terror' operations across the whole region.

Netanyahu gave his televised address in English:

Meanwhile, Qatar's relations with the US also looked strained, as its Foreign Ministry has rejected that the country was notified of the attack ahead of time. "I completely reject that the Americans informed us before the attack. Israel's action is a terrorist act," a statement said. This despite Doha hosting US CENTCOM operational headquarters, and having close ties with US intelligence as well as Gulf GCC countries.

The Abraham Accords could unravel, or at the very least it is not expected the Trump-brokered pact will expand.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up