Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The most important day in a few trading months is coming up fast (two days left!).

The most important day in a few trading months is coming up fast (two days left!).The September FOMC rate decision is part of four quarterly meetings where key economic projections (SEP or Summary of Economic Projections) are published (don’t forget the 4 other meetings). They take place in March, June, September and December.These quarterly meetings tend to hold higher weight on potential changes to the FED’s tone. With Wednesday’s meeting in focus, markets are preparing for a change in tone and changing SEPs.While the decision itself may not surprise (25 bps is heavily priced in and should be the basis except for any surprise), the details in the projections and Powell’s tone at the press conference will dictate the market reaction.

One good thing to do is to also follow any pre-FOMC post from Wall Street Journal’s Nick Timiraos who re-guided wrongly priced markets during the 2022 hike cycle and is considered as an insider. The FED “leaks” their own info that way to avoid shaking markets too suddenly, with the US dollar’s central role in the global economy – As a reminder, FED members cannot speak on the Economic or financial outlook two weeks before the FOMC meeting in what is called the “Blackout period”.

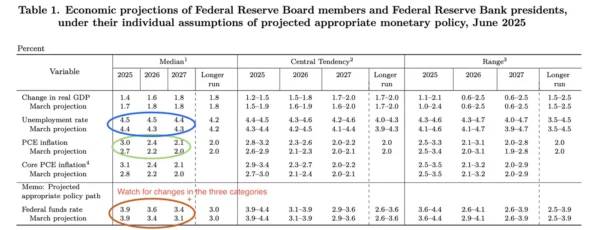

At the previous meeting (July 30, 2025), Powell struck a balanced but cautious tone amid still high tariff uncertainty.He acknowledged progress on disinflation but highlighted tariff-driven risks to the inflation outlook. His remarks left the door open to cuts later in the year, but the Fed emphasized it would remain data-dependent.The June last SEP reflected this stance: inflation forecasts were nudged slightly lower, growth remained resilient, and the famous dot plot still suggested two cuts before year-end — a point markets have since debated heavily.

You can access Powell’s July FOMC speech right here. I also invite you to balance these comments with what was said in his Jackson Hole speech (link available just above).Through his July speech, Powell emphasized the FED’s dual mandate (inflation and maximum employment) and could be expected to put an extra emphasis on the employment mandate with the Labor market data degrading.He also emphasized a moderating economic activity with tariff uncertainty (uncertainty should be expected to get less mentions).

Markets know by now that Powell’s tone matters as much as the text. Expect sharp reactions to how he balances:

Analysts tend to highlight the number of mentions for elements like: Employment/unemployment, inflation, tariffs etc to spot what the FED will focus on looking forward.

Market dynamics

Bond yields have already been retreating, with the 2Y at its lowest since April’s “Liberation Day” trough. Don’t forget to take a look at the 2-10s curve: Currently very steep due to higher short-term cut expectations but higher inflation (= higher long term rates)Risk assets are at all-time highs, therefore the Markets hold high expectations for a dovish tone, watch out for disappointments !FX markets remain rangebound, leaving the Dollar Index exposed to any surprises in the dot plot or Powell’s tone – One of the thesis I had been holding is the Seller’s inability to reach new lows in a hesitant Dollar, but its reaction is still binary.

With high expectations of a dovish speech, Powell could balance out recent dovish pricing with a more hawkish stance which would strengthen the US Dollar and hurt Equities a bit.

The Senate has approved one of President Donald Trump’s top economic advisers for a seat on the Federal Reserve’s governing board, giving the White House greater influence over the central bank just two days before it is expected to vote in favor of reducing its key interest rate.The vote to confirm Stephen Miran was largely along party lines, 48-47. He was approved by the Senate Banking Committee last week with all Republicans voting in favor and all Democrats opposed.

Miran’s nomination has sparked concerns about the Fed’s longtime independence from day-to-day politics after he said during a committee hearing earlier this month that he would keep his job as chair of the White House’s Council of Economic Advisers, though would take unpaid leave. Senate Democrats have said such an approach is incompatible with an independent Fed.Senate Democratic Leader Chuck Schumer said ahead of the vote that Miran “has no independence” and would be “nothing more than Donald Trump’s mouthpiece at the Fed.”The vote was along party lines, with Alaska Sen. Lisa Murkowski the only Republican to vote against Miran.

Miran is completing an unexpired term that ends in January, after Adriana Kugler unexpectedly stepped down from the board Aug. 1. He said if he is appointed to a longer term he would resign from his White House job. Previous presidents have appointed advisers to the Fed, including former chair Ben Bernanke, who served in president George W. Bush’s administration. But Bernanke and others left their White House jobs when joining the board.Miran said during his Sept. 4 hearing that, if confirmed, “I will act independently, as the Federal Reserve always does, based on my own personal analysis of economic data.”

Last year, Miran criticized what he called the “revolving door” of officials between the White House and the Fed, in a paper he co-wrote with Daniel Katz for the conservative Manhattan Institute. Katz is now chief of staff at the Treasury Department.Miran’s approval arrives as Trump’s efforts to shape the Fed have been dealt a setback elsewhere. He has sought to fire Fed governor Lisa Cook, who was appointed by former President Joe Biden to a term that ends in 2038. Cook sued to block the firing and won a first round in federal court, after a judge ruled the Trump administration did not have proper cause to remove her.

The administration appealed the ruling, but an appeals court rejected that request late Monday.Members of the Fed’s board vote on all its interest rate decisions, and also oversee the nation’s financial system.The jockeying around the Fed is occurring as the economy is entering an uncertain and difficult period. Inflation remains stubbornly above the central bank’s 2% target, though it hasn’t risen as much as many economists feared when Trump first imposed sweeping tariffs on nearly all imports. The Fed typically would raise borrowing costs, or at least keep them elevated, to combat worsening inflation.

Key points:

A U.S. appeals court declined on Monday to allowDonald Trumpto fire Federal Reserve Governor Lisa Cook - the first time a president has pursued such action since the central bank's founding in 1913 - in the latest step in a legal battle that threatens the Fed's longstanding independence.The decision by the U.S. Court of Appeals for the District of Columbia Circuit means that Cook can for now remain at the Fed ahead of its policy meeting on Tuesday and Wednesday where it is expected to cut U.S. interest rates to shore up a cooling labor market.

The D.C. Circuit denied the Justice Department's request to put on hold a judge's order temporarily blocking the Republican president from removing Cook, an appointee of Democratic former President Joe Biden. The administration is expected to appeal the ruling to theU.S. Supreme Court.

The decision was 2-1, with Circuit Judges Bradley Garcia and J. Michelle Childs in the majority, both of whom were appointed by President Joe Biden. Circuit Judge Gregory Katsas, a Trump appointee, dissented.U.S. District Judge Jia Cobb had ruled on September 9 that Trump's claims that Cook committed mortgage fraud before taking office, which Cook denies, likely were not sufficient grounds for removal under the law that created the Fed.A White House spokesperson did not immediately respond to a request for comment.

In setting up the Fed, Congress included provisions to shield the central bank from political interference. Under the law that created the Fed, its governors may be removed by a president only "for cause," though the law does not define the term nor establish procedures for removal. No president has ever removed a Fed governor, and the law has never been tested in court.Cook, the first Black woman to serve as a Fed governor, sued Trump and the Fed in late August. Cook has said the claims did not give Trump the legal authority to remove her and were a pretext to fire her for her monetary policy stance.

The Trump administration has argued that the president has broad discretion to determine when it is necessary to remove a Fed governor, and that courts lack the power to review those decisions.The case has ramifications for the Fed's ability to set interest rates without regard to the wishes of politicians, widely seen as critical to any central bank's ability to function independently to carry out tasks such as keeping inflation under control.Trump this year has demanded that the Fed cut rates aggressively, berating Fed Chair Jerome Powell for his stewardship over monetary policy. The Fed, focusing on fighting inflation, has not done so, though it is expected this week to make a cut.

The Supreme Court this year has allowed Trump to proceed with the removal of various officials serving on federal agencies that had been established by Congress as independent from direct presidential control.

But in a May order in a case involving Trump's dismissal of two Democratic members of federal labor boards, the Supreme Court signaled that it views the Fed as distinct from other executive branch agencies. It said the Fed "is a uniquely structured, quasi-private entity" with a singular historical tradition.

The Trump administration in a court filing on Thursday had asked the D.C. Circuit to move quickly so that Trump could remove Cook before the Fed's policy meeting on Tuesday and Wednesday. Administration lawyers said that allowing the president to fire Cook would "strengthen, not diminish, the Federal Reserve’s integrity."Cook's lawyers in a filing in response said removing Cook ahead of the meeting would impact U.S. and foreign markets, and that the public interest in keeping her in office outweighed Trump's efforts to take control of the Fed.

In blocking Cook's removal, the judge found that the "best reading" of the 1913 law is that it only allows a Fed governor to be removed for misconduct while in office. The mortgage fraud claims against Cook all relate to actions she took prior to her U.S. Senate confirmation in 2022.Trump and his appointee William Pulte, the Federal Housing Finance Agency director, have claimed that Cook inaccurately described three separate properties on mortgage applications, which could have allowed her to obtain lower interest rates and tax credits.

A loan estimate for an Atlanta home purchased by Cook shows that she had declared the property as a "vacation home," according to a document reviewed by Reuters, information that would appear to undercut the allegations against her. And the property tax authority in Ann Arbor, Michigan, said in response to a Reuters inquiry that Cook has not broken rules for tax breaks on a home there that Cook had declared her primary residence.The finding, which came in response to a Reuters request that the city review Cook’s property records, could boost Cook’s defense against efforts by the Trump administration to remove her from the Federal Reserve board.

Trump's Justice Department also has launched a criminal mortgage fraud probe into Cook, and has issued grand jury subpoenas out of both Georgia and Michigan, according to documents seen by Reuters and a source familiar with the matter.

A small toy monster with a toothy grin, known as a Labubu doll, has taken the world by storm, adorning the bags of millions of consumers — including popstar Rihanna and tennis champion Naomi Osaka.Among the most popular Labubus is a bag charm, which is sold in a mystery “blind box” so the buyer doesn’t know which kind they’ll get. Fans have become hooked on hunting down rare models and completing full sets, fueling global sales. Other Labubu dolls have fetched thousands of dollars as collectors’ items in the resale market.

Pop Mart International Group Ltd., the Chinese company that manufactures these toys, has hit the jackpot. It reported a 204% jump in revenue in the first half of 2025. Its founder and chief executive officer has been vaulted into the ranks of China’s wealthiest people.But cracks are beginning to show amid hints the craze may not be sustainable. Following a downbeat assessment of Pop Mart’s outlook by JPMorgan Chase & Co on Sept. 14, the company’s share price slumped, wiping out almost a quarter of its value after it had hit a record high just three weeks earlier.

The Labubu doll is a collectible toy with a quirky, eye-catching design. It features tall, rabbit-like ears and wide, expressive eyes framed by fierce brows. Its oversized mouth stretches up toward its temples, exposing nine sharp teeth and a sly, mischievous grin.The dolls are based on a magical character from a book series called The Monsters Trilogy by Hong Kong-born illustrator and toy designer Kasing Lung. Pop Mart manufactures many toys; the Labubu doll falls under its Monsters line. Each Labubu is released as part of a series that showcases a distinct style or theme. These include the Exciting Macarons series in 2023, featuring candy-colored figures, the Have a Seat series that followed in July 2024, with toys in seated poses, and the vibrant tie-dye Big into Energy series in 2025.

Pop Mart has rolled out country-specific Labubu editions, including the Singapore-exclusive Hide and Seek doll, and has collaborated with other brands. A prominent example is the Labubu X Vans Oldskool Monsters series, which became a global hit.Labubu dolls come in a variety of sizes and formats, but it’s the bag charm with a vinyl face that’s ignited a worldwide sales frenzy. Sold in blind boxes, these lightweight plush figures stand around 15 to 17 centimeters (6 to 6.7 inches) tall and are attached to a metal ring that can be clipped to bags, purses or even belts. There are six types of these bag-charm dolls in each series, along with a special edition doll that’s particularly hard to track down.

Pop Mart began selling Labubu toys after striking a licensing deal in 2018 with artist Kasing Lung — but for years the figurines remained relatively niche.That changed in April 2024, when one of the world’s most popular K-pop stars, Lisa from the band Blackpink, showcased several Labubu dolls on Instagram. She has since frequently been spotted with dolls in different sizes and styles. Fans rushed to buy their own, and TikTok exploded with Labubu-related content, including unboxing videos, fueling a surge in global demand.Rihanna, one of the world’s biggest popstars, added to the hype earlier this year when she was spotted with a pink Labubu dangling from her Louis Vuitton bag. Other celebrities including Dua Lipa, Naomi Osaka and Kim Kardashian have also been seen with the dolls. The bag-charm versions are the ones most often carried by celebrities — and the key driver of the craze.

The dolls have become a global craze thanks in part to their mystery blind box packaging. Buyers don’t know which Labubu is inside until they open it — a tactic that encourages repeat purchases if it’s not the doll they had hoped for. Pop Mart stokes further competition, and urgency among collectors, by introducing rare edition toys to each series. The odds of landing one are typically one in 72.Scarcity has also added to the hype. Pop Mart’s chief executive officer Wang Ning told Chinese media in July that the dolls’ hand-sewn elements were slowing production. The company has said it is ramping up factory capacity to catch up.

Pop Mart also keeps the buzz alive by rolling out new versions of the toy. In August, it released phone-charm Labubus in a series called Pin for Love. These miniature toys are sold as part of two 14-doll box sets, along with two special edition dolls.Prices vary widely depending on the series, size and country where they’re purchased. In China, most bag-charm Labubus retail for 99 yuan ($14) each, while the newly launched mini version — the smallest Labubu plush doll — sells for 79 yuan ($11). Larger soft toys can cost up to 1,299 yuan ($182). Pop Mart also sells an 80-centimeter plastic Labubu for 5,999 yuan ($842). Labubus are generally more expensive outside China. In the US, bag charms retail for $27.99 — roughly double the price in China — while mini versions typically go for about $22.99.

On the resale market, prices can soar, especially for the rarest editions. At the height of the frenzy in June, bag charms were selling on Qiandao, a Chinese trading platform, for as much as three times the original, official retail price. A rare edition toy from the Big into Energy series was sold in June for 45 times the original retail price.Limited-edition collaborations have commanded even more eye-popping sums. The Labubu x Vans Oldskool Monsters Forever doll — a 38-centimeter toy dressed in Vans gear standing on a skateboard — sold on eBay in July for $10,585, according to a Forbes report. When the 3,275 dolls in the series were released in December 2023 they were priced at 599 yuan ($84). In June, a one-of-a-kind human-sized Labubu doll in mint green sold for $150,000 at a Beijing auction.

In China, Labubus can be bought from one of Pop Mart’s some 400 physical stores as well as from more than 2,000 vending machines known as “roboshops.” They are also sold online from Pop Mart’s official WeChat store as well as from major e-commerce platforms such as Tmall, JD.com and Douyin. Labubus can also be found on second-hand trading platforms like Qiandao and Alibaba’s Xianyu, as well as social media apps like Xiaohongshu.Outside of China, Pop Mart has physical stores in more than a dozen countries, including the US, Canada, the UK, France, Thailand, Singapore, Japan and Australia. Consumers can also access Labubus through e-commerce platforms. In Europe and the US, for example, shoppers can buy the dolls from Pop Mart stores on Amazon and TikTok.

Founded in 2010 by Wang Ning, Pop Mart has grown from a Chinese variety-store chain into the country’s largest toy company. After earlier hits such as the Molly figurine, Pop Mart listed on the Hong Kong stock exchange in 2020. But it’s Labubu that propelled the company’s growth to new heights.Pop Mart’s revenue surged to 13.9 billion yuan in the first half of 2025 — more than five times its full-year revenue in 2020. Overseas sales have driven a lot of this growth, jumping 440% in that period. Pop Mart plans to accelerate its global footprint with 60 new stores outside China by year-end, adding to its 140 already in operation.

The Labubu mania has also benefited Wang, whose fortune now stands at $21.4 billion, a 180% surge so far this year alone — making him the world’s fourth-richest person under 40, according to the Bloomberg Billionaires Index.The new mini Labubu series released in August sold out quickly, but weak demand in the secondary market has raised concerns among analysts and investors. On Sept. 14, analysts from JPMorgan flagged risks to Pop Mart’s outlook, citing stretched valuations and a lack of catalysts to spur future growth. Pop Mart shares fell sharply following the assessment, erasing almost a quarter of their value in the three weeks after they reached a record on Aug. 26.

In addition to secondary-market worries, Morningstar Inc. analyst Jeff Zhang pointed to “more negative feedback on the quality of new products, an issue that management needs to timely address.”Generally speaking, toy fads typically have lifecycles of around two to three years, according to a research note by investment bank Goldman Sachs Group Inc. The bank’s analysts said rolling out new collections can, however, extend a toy’s popularity.The frenzy over Labubu dolls has drawn comparisons to the Beanie Baby toy craze in the US three decades ago, when resale prices of the plush toys surged in the mid-1990s before fading within about four years. Other collectibles have, however, shown more staying power, including certain Mattel Inc. Barbie dolls, limited-edition Topps baseball cards and select Star Wars figurines.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up