Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A Republican bill to fund the government for seven weeks failed to gain a sufficient majority in the Senate on Tuesday evening, opening the door for a U.S. government shutdown from midnight.

A Republican bill to fund the government for seven weeks failed to gain a sufficient majority in the Senate on Tuesday evening, opening the door for a U.S. government shutdown from midnight.

The bill failed in a 55 to 45 vote, having required at least 60 votes to pass. This was the second Senate vote on the bill after it failed to pass in mid-September.

The bill was overwhelmingly opposed by the Democrats, with only Senators John Fetterman of Pennsylvania, Catherine Cortez Masto of Nevada, and Angus King of Maine (an independent who is allied with the Democrats) voting in favor of the bill.

Senator Rand Paul of Kentucky was the sole Republican dissenter.

The federal government is now expected to begin shutting down from midnight Tuesday (0400 GMT), as funding expires. Government agencies will now have to discontinue all but essential activities, threatening disruptions across swathes of the country.

Friday’s upcoming nonfarm payrolls report is also expected to be delayed because of the shutdown.

A Democrat-backed spending bill was rejected by the Senate earlier on Tuesday. The Republican-backed bill was approved by the House of Representatives in September, but failed to make headway in the Senate.

The political impasse is centered around disagreements over spending on healthcare and insurance. Democrats have repeatedly called for including healthcare subsidies in a spending bill, while Republicans have argued that the issue should be discussed separately.

U.S. President Donald Trump, before Tuesday’s vote, threatened to fire more federal workers if the government shut down.

It remained unclear just how long the shutdown will last. Congress has shut down the government 15 times since 1981.

The last shutdown occurred during Trump’s first term– 35 days between late-2018 and early-2019- with the Congressional Budget Office estimating an impact of $11 billion to gross domestic product.

Senate Republican leader John Thune said the body will vote on the House-passed spending bill later in the week.

Key points:

The United States and South Korea agreed that foreign exchange interventions should be reserved for combating excessive volatility, without targeting exchange rates for competitive purposes, according to a joint statement released on Wednesday.The statement mirrors an agreement between the U.S. and Japan announced last month and does not include a bilateral currency swap line, requested by Seoul to address the foreign exchange implications of a $350 billion investment package included in a framework trade deal reached in July.

"The United States and the Republic of Korea reconfirmed they have undertaken under the IMF Articles of Agreement to avoid manipulating exchange rates or the international monetary system to prevent effective balance of payments adjustment or to gain an unfair competitive advantage," the statement said, using South Korea's official name.The two countries agreed that "any macroprudential or capital flow measures will not target exchange rates for competitive purposes," according to the statement.

Compared with Japan's, there was no mention that foreign exchange rates had to be "market determined". South Korea said there would be continued efforts to monitor currency market "stability", a point not included in Japan's agreement."Government investment vehicles invest abroad for risk-adjusted return and diversification purposes, and not to target the exchange rate for competitive purposes," the statement also said.However, it did not explicitly mention South Korea's National Pension Service, the world's third-largest pension fund, which has emerged as a point of concern in talks with Washington.

In the foreign exchange report released in June, in which South Korea was listed on a monitoring list, the U.S. Department of the Treasury noted increasing foreign assets of the NPS and its swap line with the Bank of Korea, raising concern among market participants that it might be seen as a tool for currency intervention.The two countries agreed in the joint statement that market intervention "should be reserved for combating excess volatility and disorderly movements in exchange rates" and would be "considered equally appropriate for addressing excessively volatile or disorderly depreciation or appreciation."

South Korea agreed in the statement to exchange with the U.S. its market intervention operations on a monthly basis. Public disclosures will continue to be on a quarterly basis, with a three-month delay, according to a South Korean official.Seoul will also disclose foreign exchange reserves data and forward positions on a monthly basis, as well as the currency composition of central bank reserves on an annual basis, which are already public.South Korea and the U.S. have consulted on currency policy via a channel between finance officials since it was put on the agenda at the opening round of trade talks in April.

Their negotiations to formalise a July deal reducing U.S. tariffs on Korean imports, including automobiles, to 15% from 25%, in return for South Korea's investment of $350 billion in the U.S., have stalled due to Seoul's concerns over the foreign exchange implications.The wonhas weakened 3% so far in the second half of this year to trade around a psychological barrier of 1,400 per dollar, underperforming most emerging Asian currencies, on uncertainty over trade talks with the U.S.

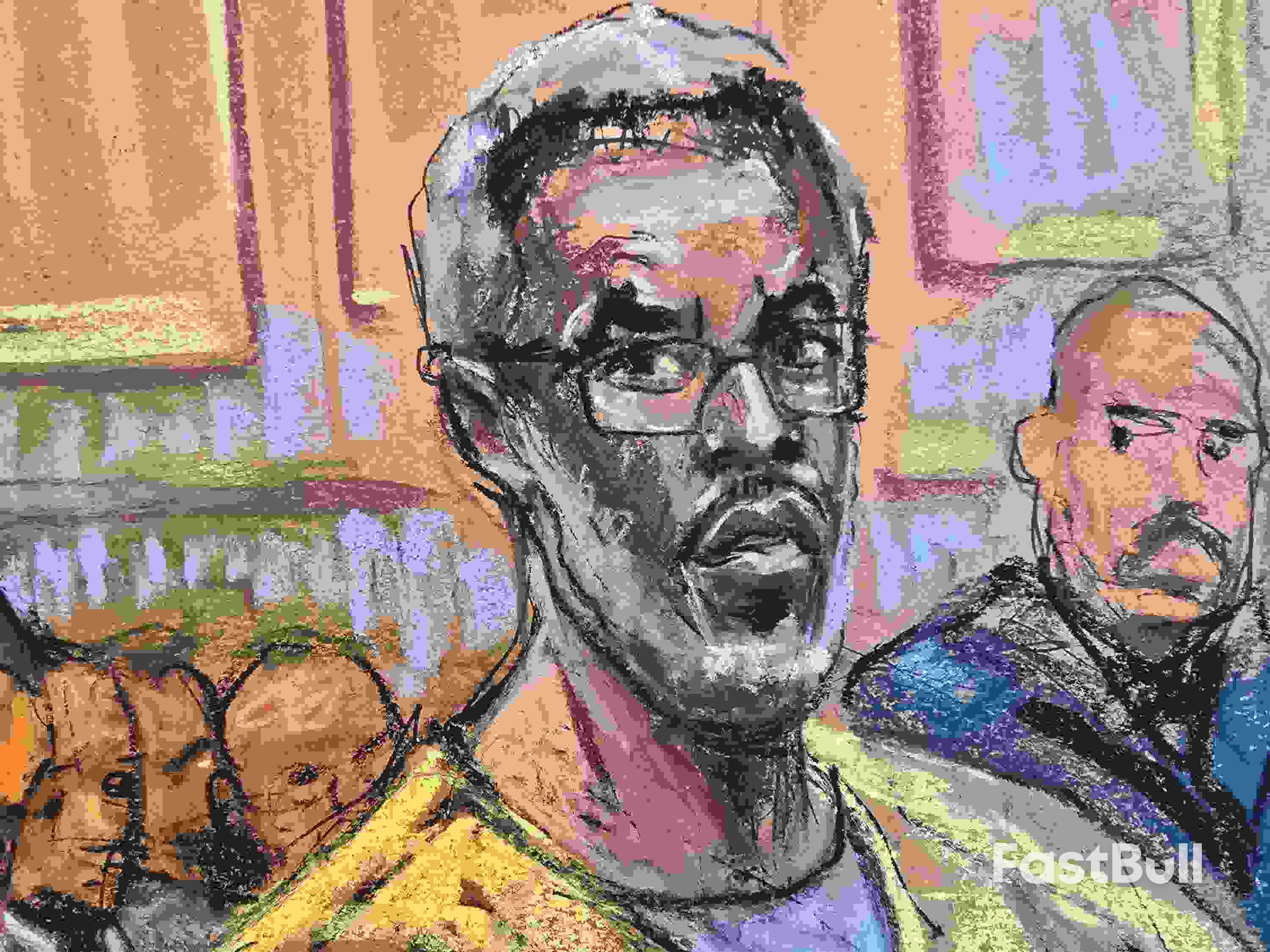

A U.S. judge rejected on Tuesday a bid by Sean "Diddy" Combs to overturn his criminal conviction on felony prostitution-related charges, with the hip-hop mogul facing up to 20 years in prison at his sentencing.The decision was issued by U.S. District Judge Arun Subramanian in Manhattan.Jurors found Combs, 55, guilty in July on prostitution charges following a two-month trial but acquitted him of more serious counts of sex trafficking and racketeering.Combs was accused of paying male escorts to travel across state lines to have sex with his girlfriends, while he recorded video of their activity and masturbated.He had pleaded not guilty to all charges, which could have landed him in prison for life.

Defense lawyers had urged,Subramanian in a July 30 court filing to set aside the verdict because Combs did not himself have sex with the prostitutes or his girlfriends during the days-long, drug-fueled sex marathons sometimes known as "Freak Offs."They also argued that Combs was recording video of the encounters as "amateur pornography," which they called protected speech under the U.S. Constitution's First Amendment.Prosecutors with the Manhattan U.S. Attorney's office said in an August 20 filing that Combs did not need to have personally taken part in the sex acts to be convicted because he helped arrange for the male escorts to travel.

The prosecutors said he used the video as blackmail, opens new tab by threatening to release them if his girlfriends stopped taking part in the encounters.

Combs, the founder of Bad Boy Records, is credited with elevating hip-hop in American culture. He was arrested on sex trafficking charges on September 16, 2024, and has since been held at the Metropolitan Detention Center in Brooklyn.During his trial, prosecutors said he coerced two former girlfriends - rhythm and blues singer Casandra Ventura, known as Cassie, and a woman known by the pseudonym Jane - into the sexual performances.Both women testified that Combs physically attacked them and threatened to cut off financial support if they refused to participate in the sex performances.

Lawyers for Combs acknowledged that the physical attacks occurred, but argued there was no direct link between what they called domestic violence and the women's participation in the sex performances.They also said the two women consented to the encounters because they loved Combs and wanted to make him happy.

Confidence among big Japanese manufacturers improved slightly in the three months to September, a central bank survey showed on Wednesday, a sign the export-reliant economy was weathering the hit from U.S. tariffs, at least for now.

The outcome keeps alive market expectations the central bank could raise interest rates again as soon as this month.

The headline index measuring big manufacturers' business confidence stood at +14 in September, up from +13 in June and marking the highest level since December 2024, the "tankan" survey showed. It compared with a median market forecast for a reading of +15.

An index gauging big non-manufacturers' sentiment stood at +34 in September, unchanged from the level in June and matching a median market forecast.

But big manufacturers and non-manufacturers expect conditions to worsen three months ahead, the survey showed.

The tankan is among key data the BOJ will scrutinise in deciding whether to raise interest rates to 0.75% from 0.5% at its next meeting on October 29-30.

A hawkish board split at the BOJ's September meeting and calls for a near-term rate hike by a dovish policymaker have led markets to price in roughly a 60% chance of an October hike.

Big companies expect to increase capital expenditure by 12.5% in the current fiscal year ending in March 2026, the tankan showed, up from a 11.5% gain projected in June and above a market forecast for a 11.3% rise.

Japan's economy expanded an annualised 2.2% in the first quarter on robust consumption, underscoring the BOJ's view the country was on course for a moderate recovery.

U.S. President Donald Trump last month signed an executive order formalising the trade agreement with Japan, removing some worries in Tokyo about the implementation of the reduced tariff rate of 15% on key Japanese export items such as cars.

But exports and factory output slumped in August, a sign the pain from higher U.S. levies could intensify in coming months.

The BOJ ended a massive, decade-long stimulus programme last year and raised rates to 0.5% in January, on the view that Japan was on the cusp of durably hitting its inflation target of 2%.

While inflation has exceeded 2% for more than three years, Governor Kazuo Ueda has stressed the need to tread cautiously to scrutinise the extent to which tariffs and slowing U.S. growth could hit firms' profits and wage-hike appetite.

U.S. government services would be disrupted if President Donald Trump and Congress do not agree on a spending bill by midnight on Tuesday.

Hundreds of thousands of federal employees deemed to be not essential to protecting people and property would be sent home.

The impending shutdown would differ from past government closures because Trump has threatened to lay off more federal workers if lawmakers do not pass legislation to avert the closures. His administration has not outlined what cuts to expect.

"We will be looking for opportunities" to reduce the size of the federal government, said White House budget director Russ Vought in a television interview.

As of Tuesday afternoon, at least 21 of the 23 largest federal agencies posted details about which employees they would furlough. Here is a guide to what would stay open and what would close in a government shutdown, according to plans released so far:

Congress writes detailed spending legislation for most U.S. government agencies each year, but rarely finishes before the fiscal year starts on October 1. Lawmakers typically pass stopgap spending bills to avoid disruption for several weeks or months while they finish their work.

The current stopgap bill is due to expire on September 30. Republicans and Democrats appeared unlikely to reach an agreement on some sort of extension that Trump would sign into law before midnight on Tuesday. This would mean wide swaths of the government would lack funds to continue their operations.

The Social Security Administration would keep issuing retirement and disability benefits, but would furlough 12% of its staff and pause marketing campaigns, according to the agency’s shutdown plan.

Payments would likewise continue under the Medicare and Medicaid healthcare programs.

The Supplemental Nutrition Assistance Program, the nation's largest food aid program, and the Special Supplemental Nutrition Program for Women, Infants and Children, known as WIC, would continue operations during a shutdown as funds allow, according to a shutdown planning document published by the U.S. Department of Agriculture.

The U.S. Postal Service would be unaffected because it does not depend on Congress for funding, USPS said in a statement. Post offices will be open.

The IRS will be fully staffed for five days, according to agency shutdown plans published Monday.

The strategy does not say what the IRS, which lost about a quarter of its staff this year and now employs about 75,000 people, would do if the shutdown lasts longer than five business days. An agency spokesperson declined to comment.

More than 13,000 air traffic controllers would continue working, but without pay until the shutdown ends, according to the Federal Aviation Administration.

Most TSA employees would continue working, according to an agency statement.

Last week, the federal judiciary warned that the courts could run out of money to fully sustain operations as soon as Friday if Congress fails to pass a spending bill.

That is a shift. The courts sustained operations for five weeks when the government shut down during Trump's first term.

The 2 million U.S. military personnel would remain at their posts without pay until the shutdown ends, according to a Department of Defense statement.

National Guard forces Trump has deployed to U.S. cities must also continue to work.

Contracts awarded before the shutdown would continue, and the department could place new orders for supplies or services needed to protect national security.

Trump has ordered the department to rename itself the Department of War, a change that will require action by Congress.

Agents at the FBI, the Drug Enforcement Administration, Coast Guard and other federal law enforcement agencies would remain on the job.

Justice Department staff that administer the immigration court system will largely stay on the job because Trump declared illegal immigration a national emergency, according to a department statement.

Employees that communicate with state and local officials about immigrant arrests would also keep working, according to the statement. Border patrol and immigration enforcement agents would stay at their posts, as would most customs officers, according to the Department of Homeland Security’s shutdown strategy.

Tariff collections would continue, according to the strategy.

Publication of major U.S. economic data, including employment and GDP reports of critical importance to policymakers and investors, would be suspended.

The Small Business Administration would furlough 24% of its staff, according to a statement. It would not approve new loans for small businesses to buy equipment and upgrade buildings. Lending to help businesses recover from natural disasters would continue.

The Federal Emergency Management Agency has about $2.3 billion available in its Disaster Relief Fund, according to a September 15 report, meaning the agency should function if a hurricane or other natural disaster strikes. About 4,000 FEMA employees would be furloughed, according to an agency statement.

The U.S. and South Korea are working closely to advance their trade and investment partnership including by processing appropriate visas for qualified South Korean workers, the U.S. State Department said.

U.S. Deputy Secretary of State Christopher Landau stressed the "critical role" of skilled workers of foreign companies investing in the U.S. at the first working group meeting on new visas for South Korean companies, the State Department said in a statement.

The meeting between senior State Department and South Korean foreign ministry officials aimed at improving U.S. visa programmes for South Korean businesses was held in Washington on Tuesday.

Landau said the United States was committed to encouraging investment by companies from South Korea as one of the leading foreign investors in the U.S., the statement said.

The talks were set up in the aftermath of a massive immigration raid at a Hyundai Motor (005380.KS) car battery facility under construction in the U.S. state of Georgia in September where hundreds of South Korean workers were arrested.

The arrests, which stunned the South Korean government and public, highlighted the lack of access to the right class of U.S. visas for specialised South Korean workers needed at investment sites.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up