Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Top USA And Israeli Generals Met On Friday At The Pentagon Amid Iran Tensions, Two USA Officials Tell Reuters

[Bitcoin Briefly Dips Below $77,000, Ethereum Briefly Dips Below $2,300] February 1st, According To Htx Market Data, Bitcoin Briefly Dropped Below $77,000, Now Trading At $77,011, With A 24-Hour Decrease Of 5.32%.Ethereum Briefly Dropped Below $2,300, Now Trading At $2,301.07, With A 24-Hour Decrease Of 9.28%

Qatar Prime Minister: Qatar To Introduce 10 Year Residency For Entrepreneurs And Senior Executives

[Speaker Of The U.S. House Of Representatives: Confident Of Sufficient Votes To End Partial Government Shutdown By Tuesday] February 1st, According To Nbc News, U.S. House Speaker Johnson Said He Is Confident That There Will Be Enough Votes By At Least Tuesday To End The Partial Government Shutdown

Iranian Official Tells Reuters: Media Reports Of Plans For Revolutionary Guards To Hold Military Exercise In Strait Of Hormuz Are Wrong

Ukraine's Defence Minister Says Kyiv And Spacex Working On System To Ensure Only Authorized Starlink Terminals Work In Ukraine

Russian Security Committee's Vice Chairman Medvedev: Europe Has Failed To Defeat Russia In Ukraine

Russian Security Committee's Vice Chairman Medvedev: We Never Found The Two Nuclear Submarines Trump Spoke Of Deploying Closer To Russia

Russian Security Committee's Vice Chairman Medvedev: Victory Will Come 'Soon' In Ukraine But Equally Important To Think Of How To Prevent New Conflicts

Russian Security Committee's Vice Chairman Medvedev: Trump Is An Effective Leader Who Seeks Peace

Russian Defence Ministry: Russia Gains Control Over Two Villages In Ukraine's Kharkiv And Donetsk Regions

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)A:--

F: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)A:--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)A:--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)A:--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)A:--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)A:--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)A:--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)A:--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)A:--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)A:--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)A:--

F: --

P: --

U.S. Core PPI YoY (Dec)

U.S. Core PPI YoY (Dec)A:--

F: --

U.S. Core PPI MoM (SA) (Dec)

U.S. Core PPI MoM (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Dec)

U.S. PPI YoY (Dec)A:--

F: --

P: --

U.S. PPI MoM (SA) (Dec)

U.S. PPI MoM (SA) (Dec)A:--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)A:--

F: --

P: --

Canada GDP YoY (Nov)

Canada GDP YoY (Nov)A:--

F: --

P: --

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)

U.S. PPI MoM Final (Excl. Food, Energy and Trade) (SA) (Dec)A:--

F: --

P: --

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)

U.S. PPI YoY (Excl. Food, Energy & Trade) (Dec)A:--

F: --

P: --

U.S. Chicago PMI (Jan)

U.S. Chicago PMI (Jan)A:--

F: --

Canada Federal Government Budget Balance (Nov)

Canada Federal Government Budget Balance (Nov)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Jan)

China, Mainland NBS Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Composite PMI (Jan)

China, Mainland Composite PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold hit a record high just below $4,000 an ounce as the US government shutdown, a wobble in technology stocks, and political shake-ups in Japan and France buoyed demand.

Gold hit a record high just below $4,000 an ounce as the US government shutdown, a wobble in technology stocks, and political shake-ups in Japan and France buoyed demand.

Bullion rose as high as $3,999.41 an ounce, before paring some gains. December futures in New York — the most active contract — surpassed $4,000 for the first time on Tuesday.

The US shutdown, now into its second week, has delayed key data, muddying the outlook for the Federal Reserve’s rate-cutting path. Investors are also monitoring signs the ebullience driven by artificial intelligence may have reached excessive levels, after a report on Oracle Corp.’s cloud margins, while a political crisis in France and a change of leadership in Japan are adding to the uncertainty.

Gold has soared more than 50% this year as President Donald Trump shook up trade and geopolitics, helping to spur a move away from the dollar. Central banks have been enthusiastic buyers, while the Fed’s rate cut last month drove investors into gold-backed exchange-traded funds. Goldman Sachs Group Inc. sees room for the rally to continue, raising its forecast for December 2026 to $4,900 an ounce, up from $4,300.

“The ever-louder narratives surrounding de-dollarization and de-globalization” have gavlanized demand for gold, Bart Melek, head of commodities strategy at TD Securities, said in a note. “Given the speed and magnitude of the rally since mid-August, there’s a risk that speculators may be tempted to take some profits.”

Billionaire Ray Dalio said Tuesday that gold is “certainly” more of a safe haven than the dollar and the record-setting rally echoes the 1970s, when it surged during a time of high inflation and economic instability. The remarks from the founder of hedge-fund firm Bridgewater Associates came after Citadel founder Ken Griffin said that bullion’s rise reflected anxiety about the US currency.

“The metal’s climb to the $4,000 milestone reflects not only surging safe-haven demand, but also a deepening distrust in paper assets as fiscal risks and geopolitical tensions intensify,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “In the short term, a consolidation phase looks likely after such a relentless advance.”

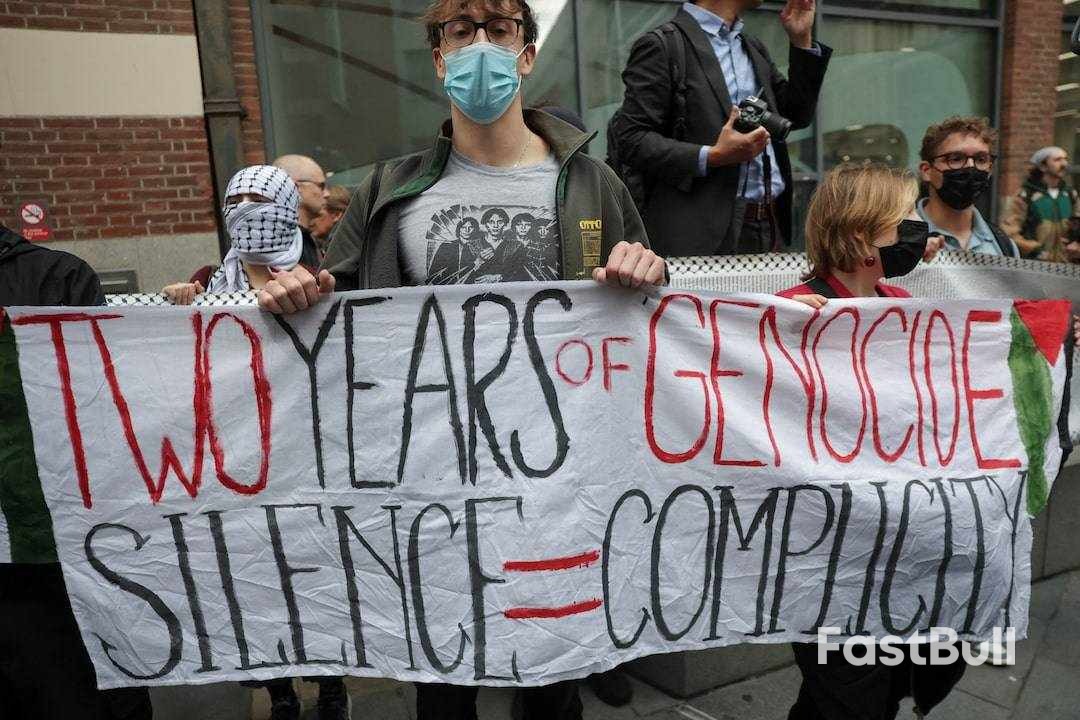

Pro-Palestinian protesters demonstrated around the world on Tuesday against Israel's assault on Gaza while vigils and other events commemorated Israeli victims on the second anniversary of the Hamas attack that sparked Israel's war in the enclave.As indirect negotiations took place in Egypt on a U.S. proposal to end the war, protests in support of Palestinians took place in Sydney, Istanbul, London and Washington as well as in New York City, Paris, Geneva, Athens and Stockholm.Demonstrators spoke out against the humanitarian crisis and bloodshed in Gaza while politicians urged pro-Palestinian protesters not to let their outrage turn into glorification of Hamas' violence.

Hamas' October 7, 2023, attack killed 1,200 people and the militants also took over 250 hostages, according to Israeli tallies.At the White House, President Donald Trump on Tuesday hosted Edan Alexander, believed to be the last surviving U.S. hostage held in Gaza when the dual Israeli-U.S. citizen was handed over by Hamas in May.Top U.S. officials, including Secretary of State Marco Rubio, joined a vigil for Israeli hostage families and survivors.

Israel's assault on Gaza has killed over 67,000 people, with thousands more feared buried under rubble, Gaza authorities say.New York City protesters carried banners that read "Gaza is bleeding" and "U.S. and Israel - your hands are red."A crowd of Muslim demonstrators prayed in front of the Trump Hotel in New York City, pro-Palestinian group "Within Our Lifetime" said on X.

Local media said thousands of people gathered in Central Park for a Jewish circle of unity. Participants chanted, "Bring them home" in reference to the hostages, the reports said.In London, several hundred protesters waved Palestinian flags and shouted, "Israel is a terrorist state" outside King's College London. A small group of people waving Israeli flags stood nearby.British Prime Minister Keir Starmer said it was "un-British" to hold protests "on the anniversary of the atrocities of October 7."

The wave of demonstrations reflected a shift in global sentiment over the two-year war from nearly universal initial sympathy for Israel to widespread outrage over its military assault, which has displaced nearly the entire population of Gaza, left the enclave in ruins and caused starvation.Mounting anger over the war and repeated ceasefire failures have driven major Western nations to recognize a Palestinian state, defying Israel and the United States and reviving Palestinians’ long-held hopes for statehood.Mark Etkind, a retiree in his early 60s from London, wore a sign around his neck saying he was the son of a Holocaust survivor. He said a call by Starmer not to protest was "outrageous".

"I have always opposed genocide," he told Reuters. "Of course, I support students here who are actively opposing genocide."Multiple rights experts, scholars and a U.N. inquiry say Israel's assault on Gaza amounts to genocide. Israel calls its actions self-defense after the 2023 Hamas attack, which marked the deadliest day for Jews since the Holocaust.Emily Schrader, a 34-year-old Israeli journalist who was visiting London, said: "There are much better ways to support Palestinians than engaging in an activity like this that is so hurtful, so deeply offensive, and that emboldens radicalism and terrorism."

Events were held across Israel to mark the anniversary of the Hamas attack while in Germany mourners gathered at Berlin's Brandenburg Gate, placing stones and photos of victims in a vigil echoing Jewish remembrance traditions.

In the Netherlands, pro-Palestinian activists splashed red paint on Amsterdam's Royal Palace, protesting a ban by the mayor on a pro-Palestinian rally while permitting a pro-Israeli event.In New York City, police raised security at religious and cultural sites but said there were no credible threats.New York media said security was tightened at the Israeli consulate in Manhattan where a protest was reported. Synagogues, schools and religious sites got extra protection as well, according to the reports.

Rights advocates have noted a rise in antisemitism and Islamophobia globally during the war.Noteworthy incidents included a fatal synagogue attack in Manchester last week in which two were killed and a fatal shooting of two Israeli embassy staff in Washington in May.There was also a deadly stabbing of a 6-year-old Palestinian child in Illinois in October 2023 while last week a Texas woman was sentenced for attempting to drown a 3-year-old Palestinian girl.

Mergers-and-acquisitions activity globally is roaring back to life, with several megadeals in the third quarter building on momentum from earlier this year. When Donald Trump returned to the White House, markets expected a deregulatory wave and tax-friendly environment to spark a dealmaking surge. However, recession fears, geopolitical flashpoints and tariffs concerns kept boardrooms a bit cautious. Now, they appear to have put aside those worries for good, leading to a sharp surge in M & As, buoyed by rate-cut expectations and elevated levels of private-equity "dry powder."

According to data provided by financial markets platform Dealogic, the third-quarter saw a surge in M & A activity this year with collective deal value at $1.29 trillion, compared to $1.06 trillion in the second quarter and $1.1 trillion in the first quarter. The first six months witnessed smaller, mid-market deals, while the third quarter saw the return of big-ticket transactions. "After a turbulent spring, a surge in megadeals and a growing appetite for strategic repositioning boosted M & A activity in the third quarter, giving dealmakers hope of a strong finish to 2025," M & A intelligence firm Mergermarket said in a recent report. The nine-month global deal value stood at over $3.4 trillion — a 32% year-on-year jump and the strongest showing since 2021, according to Mergermarket.

Megadeals valued at $10 billion or more drove the surge, with 49 such transactions announced thus far this year, the highest on record for nine months, according to the firm's data. The third quarter featured two marquee moments for the global M & A landscape: Union Pacific's $85 billion acquisition of Norfolk Southern announced in July, and the more recent Electronic Arts' $55 billion take-private deal by Public Investment Fund of Saudi Arabia, Silver Lake and Affinity Partners — the largest leveraged buyout in history. "The key difference now is that leaders have shifted from a 'wait-and-see mode' to 'action mode,'" said EY-Parthenon Americas' Vice Chair Mitch Berlin. "They've accepted high geopolitical and trade uncertainty is the new normal, and they're looking [at] their next cycle of growth," he told CNBC. There definitely is pent up demand for mergers and acquisitions as well as divestitures.

Mercer Jeff Black According to EY-Parthenon , 48% of the CEOs it surveyed in August are planning more deals, showing sustained commitment to further acquisitions. Initial public offerings saw volumes climb about 12% year on year as of the start of September, according to JPMorgan's mid-year M & A outlook report, driven by strength in fintech and industrials sectors as well as renewed appetite for marquee tech listings. Jefferies Financial Group posted its third best quarterly advisory fees recently, signaling that Wall Street's investment banking engines are running hot again. Investment banking behemoths such as JPMorgan have not posted their third-quarter results, but JPM co-CEO of commercial and investment bank Doug Petno expects investment banking revenue to grow a low double-digit percentage .

"There definitely is pent up demand for mergers and acquisitions as well as divestitures," said Jeff Black, who leads Mercer's global M & A advisory practice. "We are also seeing more stakeholder pressure on public companies to grow. This is triggering more divestitures," he added. Lucinda Guthrie, head of Mergermarket, pointed to structural tailwinds such as lighter-touch regulation, record private-equity uninvested capital or dry powder, and a backlog of exits. According to management consulting firm Bain, the global PE industry is currently sitting on $1.2 trillion in uninvested funds. "There's been a rush for AI-linked assets — data, infrastructure and talent — while traditional industries divest non-core assets to pivot to the new environment," she said. Not a 2021 easy-money rerun Market watchers told CNBC that the U.S. Federal Reserve's September cut gave companies the confidence that financing costs may have peaked.

Last month, the Fed approved a widely anticipated rate cut and signaled that two more were on the way before the end of the year Lower financing costs make it cheaper for companies to borrow money to fund acquisitions or leveraged buyouts. When the Federal Reserve signals that rates have likely peaked, that clarity makes it easier to price deals, plan financing structures and move forward with M & A transactions. The dealmaking boom that's unfolding, however, is not a rerun of 2021's easy-money frenzy: Guthrie noted that small- and mid-cap M & A activity remains sluggish, hampered by valuation gaps and an exit environment that is especially tougher for the smaller players more exposed to policy volatility under the Trump administration While financing expenses are expected to come down, for now sponsors are still grappling with elevated costs, while seller expectations are anchored in 2021 valuations, Mergermarket's insights team said.

To navigate these headwinds, sponsors and corporates are employing more creative deal structures including joint ventures with buyout options and continuation vehicles amongst other methods, Mergermarket said. A continuation vehicle is an investment fund that a PE firm creates to buy one or more portfolio companies from a fund nearing the end of its lifecycle, allowing it to hold those assets for longer. "Top-tier private equity funds are active and raising capital, but mid-market funds face exit and fundraising challenges," said Mercer's Black.

Japan’s wages rose at the slowest pace in three months with real pay extending its falling streak, highlighting a challenge for newly elected ruling party leader Sanae Takaichi who has pledged to address the increase in living costs.

Nominal wages increased 1.5% in August from a year earlier, down from 3.4% in the previous month, according to a report by the Ministry of Health, Labour and Welfare on Wednesday, coming in below economist expectations. Real cash earnings dropped 1.4%, marking an eighth month of declines and also coming in weaker than expected.

Economists had forecast nominal gains of 2.7%, expecting a slowdown in bonuses after the previous month’s jump. Bonuses fell 10.5% as fewer companies distributed additional pay in August, according to the labor ministry. A more stable measure of pay, which avoids sampling issues and excludes bonuses and overtime, climbed 2.4% for a second month for regular workers.

While the August data were weaker than expected, the overall trend of moderate wage increases suggests that the Bank of Japan is still on track to keep slowly raising rates. Expectations for a rate hike later this month have cooled sharply after Takaichi was elected leader of the ruling party. She is expected to be voted in as prime minister next week, and she has indicated she prefers a more cautious approach from the bank.

Traders see about a 20% chance for the central bank to hike rates when it delivers its next policy decision on Oct. 30, plunging from about 68% early last week. Known as a strong advocate of monetary easing, Takaichi surprised market participants by winning Saturday’s leadership election for the ruling Liberal Democratic Party.

The LDP has lost elections primarily by failing to address households’ struggles with the elevated cost of living, as wage growth has failed to catch up while the price of key products like rice soared. Since April 2022, real wages have only registered a monthly gain on four occasions.

Americans are increasingly concerned about their financial situation amid expectations that inflation could pick up, according to a New York Federal Reserve survey released Tuesday.

The central bank's monthly Survey of Consumer Expectations found that consumers expect inflation to be higher in the year ahead, and fewer expect their households' financial situations to be better off a year from now.

Household spending growth expectations also declined, the New York Fed's survey found.

While many Americans have expressed worries about rising prices and the effect of President Donald Trump's tariff policies, few have changed their spending habits yet. Up until now, experts say, that is what has helped the U.S. avoid a significant economic slowdown.

But Americans are having a harder time keeping up, other research shows. High food costs, in particular, make it more difficult to cover expenses in a typical month. Grocery prices rose by 2.7% in August from a year earlier, the fastest annual pace since August 2023, according to the latest consumer price index.

"Few things drive Americans' perception of the economy more than grocery prices," said Matt Schulz, chief credit analyst at LendingTree. "If people are convinced that those are just going to keep rising, it stands to reason that fewer people would think that their own household's financial situation would be better off a year from now."

'A complex set of uncertainties'

Despite the cautious Fed outlook, a separate report by KPMG shows consumer spending is set to increase heading into the peak shopping season at the end of the year.

"The consumer is spending like a poker player with a small chip stack," Duleep Rodrigo, KPMG's U.S. consumer and retail leader, said in a statement.

"They know they can't play every hand but are willing to go 'all in' on a promising hand with a high emotional payoff," he said of projections that holiday spending will increase compared to last year.

"There's also a psychological element where the consumer is managing a complex set of uncertainties," Rodrigo said.

At the same time, credit card balances are edging higher, according to other research on household debt by the Federal Reserve Bank of New York, indicating that more consumers are are struggling to manage their expenses.

Balances reached a collective $1.21 trillion in the second quarter of 2025 — up 2.3% from the previous quarter and in line with last year's all-time high.

Kemi Badenoch will vow to cut the UK deficit if the Conservatives win the next general election, as she seeks to recover her party’s claim to sound stewardship of the economy.In a speech to her party’s annual conference in Manchester on Wednesday, Badenoch will say that half of all savings identified by a future Tory administration will be used to reduce Britain’s deficit, after the national debt soared to almost 100% of the size of the UK economy in recent years. Under her new “golden rule,” the other half will be directed toward tax cuts or spending.

“We have to get the deficit down — and we must also show how every tax cut or spending increase is paid for,” Badenoch will say, according to lines pre-briefed by her party. “Every pound we save will be put to work.”The Tories are trying to restore their reputation for economic competence after the damage wrought by Liz Truss during her brief tenure as prime minister. Truss proposed an unfunded package of tax cuts that sent the pound to a record low against the dollar and forced the Bank of England to prop up the gilts market.

Budget surpluses are rare in Britain, with the last one logged in 2000-01. As a result, the national debt has crept upwards, reaching 96.4% of economic output in August, up from 64.7% in 2009-10, the fiscal period before the Tories took office for what would be 14 years.The Conservatives managed to reduce the deficit to £44 billion ($59 billion) in 2018-19 from almost £160 billion in 2009-10. But it later soared to more than £300 billion in 2020-21, as Boris Johnson’s administration supported workers and businesses during successive coronavirus lockdowns. Under Labour Chancellor Rachel Reeves, the Office for Budget Responsibility forecasts a deficit of £118 billion this fiscal year.

“It is stealing from our children and grandchildren,” Badenoch will say. “And Conservatives will put a stop to it.”

Badenoch secured her party’s leadership almost a year ago, in the wake of an electoral wipeout in which it lost two thirds of its seats in the House of Commons. With her party struggling for relevance amid stagnant poll ratings and a surge in support for Nigel Farage’s populist Reform UK — which announced the defections of 20 former Tory councilors on Tuesday — Badenoch’s leadership has been questioned in some quarters of her Party.

At the conference this week there were words of support from Shadow Justice Secretary Robert Jenrick, who she defeated in the contest for party leader last year and who’s seen as a potential challenger. A series of announcements on the economy, energy, immigration and justice appear to have shored up Badenoch’s position in the party, after she faced criticism for being slow to announce policies.

These proposals “are the route” back into government, Shadow Business Minister Harriett Baldwin said in an interview, identifying a promise to eliminate business rates for shops and pubs, and plans to slash energy bills. “They really are good retail policies.”Badenoch’s pledge comes two days after Tory Shadow Chancellor Mel Stride announced plans to save £47 billion ($63 billion) by cutting a quarter of civil service employees, halving international development aid and finding £23 billion of savings from the welfare bill.

A measure of how difficult that could be is that Stride was himself head of the Department for Work and Pensions from 2022 to 2024 under the previous Conservative administration, when its spending rose by tens of billions, according to official figures.In an indication of how they intend to fight the governing Labour Party and Nigel Farage’s insurgent Reform UK Party, the slogan of this year’s Tory conference is “stronger economy, stronger borders.” Achieving the former is the key to meeting promises on the latter and in other policy areas, Badenoch will say.“Securing our borders, getting people into work, policing our streets, defending the nation: None of it is possible without the money to pay for it,” she’s due to say. We are going to get our economy growing again. And bring down the taxes stifling our economy.”

Tuesday marks the grim two-year anniversary of the Oct.7 terror attack by Hamas which targeted southern Israel, including the Nova music festival and several Kibbutzim, as well as Israeli military border outposts.Coinciding with the anniversary and memorials being held across the country, Yemen's Houthis have been launching drones throughout the day on the southernmost Israeli city of Eliat, on the Red Sea.

"Yet another drone launched by the Houthis in Yemen at Israel’s southernmost city of Eilat was shot down by air defenses, the military says," reports Times of Israel.The drone was intercepted outside Israeli airspace while it was still inbound, and so there were no public alert sirens activated. "It marks the fourth Houthi drone shot down in the Eilat area within an hour," the report indicates.The Houthis have vowed to continue such attacks so long as IDF forces continue their operations in the Gaza Strip, even though urgent peace talks are currently underway in nearby Egypt, based on President Trump's 20-point peace plan.

Trump envoy Steve Witkoff is expected to join the talks Wednesday, which are happening 'indirectly' between the Israeli and Hamas sides. Hamas has said it is ready to release all remaining 48 hostages (dead and alive) - but significant hurdles remain over an array of conditions.Meanwhile, at a moment of national mourning in Israel, hostage victims' family members are still looking for answers as to why police and military intervention took so long during the attack of Oct.7"Where were the rescue forces? Where was the state? How come you were here for hours and no one saved," the families said in a statement, Kan public broadcaster reported.

"And yet two years later, we still have no answers. All the investigations they have presented to us are rubbing salt in the wounds and sand in the eyes of the families," they said.Various political leaders in the West offered their condolences marking the day, including US Vice President JD Vance, who stated on X, "On this second anniversary of the terrible terrorist attacks of October 7, we remember all of the innocent people brutally murdered by Hamas."

"And we continue to work towards President [Donald] Trump’s plan to bring the remaining hostages home and build a lasting peace for all," he wrote further.Hamas and Palestinian Islamic Jihad (PIJ) had killed about 1,200 people and took 251 hostages on that day two years ago. The brazen and well-planned attack even featured paragliders flying into the Nova festival grounds, where a massacre ensued in what some eyewitnesses said felt "apocalyptic". Later analysis indicated that some Israelis may have been killed by 'friendly fire' during the chaotic Israeli military response, which included deployment of helicopters and tanks.

Israel's military response in Gaza has itself been brutal and overwhelming. Well over 60,000 people have died, including many tens of thousands of civilian men, women, and children. But Israel says a significant bulk of this figure is Hamas militants. Wars on other fronts have since raged - including in Lebanon, Iran, Syria, and Yemen - with the whole geopolitical landscape having shifted dramatically since Oct.7.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up