Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold prices held steady in Asian trade on Wednesday after sharp gains in the past two sessions, supported by U.S....

Gold prices held steady in Asian trade on Wednesday after sharp gains in the past two sessions, supported by U.S. fiscal deficit concerns as the Senate passed President Donald Trump’s tax-and-spending megabill.

Bullion was also supported by uncertainty over U.S. trade deals ahead of Trump’s July 9 tariff deadline.

Spot Gold was largely unchanged at $3,337.25 an ounce, while Gold Futures for August edged 0.1% lower to $3,347.40/oz by 01:52 ET (05:52 GMT).

Gold has risen more than 2% this week so far, erasing losses from last week when Israel-Iran ceasefire reduced its safe-haven appeal.

Senate Republicans narrowly passed Trump’s sweeping tax-cut and spending bill on Tuesday.

The bill—aimed at cutting taxes, curbing social programs, and increasing military and immigration enforcement funding—is projected to add $3.3 trillion to the national debt.

It will now move to the House of Representatives for potential final approval, with Trump aiming to sign it into law by the July 4 Independence Day holiday.

Meanwhile, Federal Reserve Chair Jerome Powell repeated on Tuesday that the central bank will wait and learn about tariff impacts before cutting rates, defying Trump’s calls for swift, deep cuts.

Investors parsed Powell’s recent comments as slightly dovish as he did not rule out the chances of a rate cut next month.

Markets now await Thursday’s nonfarm payrolls report to gauge the chances of a July rate cut, while a reduction in September is largely priced in.

Expectations of lower interest rates and U.S. fiscal deficit concerns supported gold prices, while uncertainty over U.S. trade deals ahead of the looming July 9 deadline further aided sentiment.

Trump said he had no plans to extend the deadline and would instead notify countries of the tariff rates they will face through formal letters.

He said India may ease curbs on U.S. firms, opening the door to a deal, but added that he was doubtful about a deal with Japan.

The US Dollar Index remained subdued in Asian trading hours, wallowing near its lowest level since February 2022.

Still, metal markets were largely subdued as investors sought clarity on trade deals and sectoral tariffs.

Silver Futures were largely muted at $36.05 per ounce, while Platinum Futures edged up 0.2% to $1,369.05.

Meanwhile, benchmark Copper Futures on the London Metal Exchange rose 0.4% $9,968.65 a ton, while U.S. Copper Futures jumped 1.6% to $5.1165 a pound.

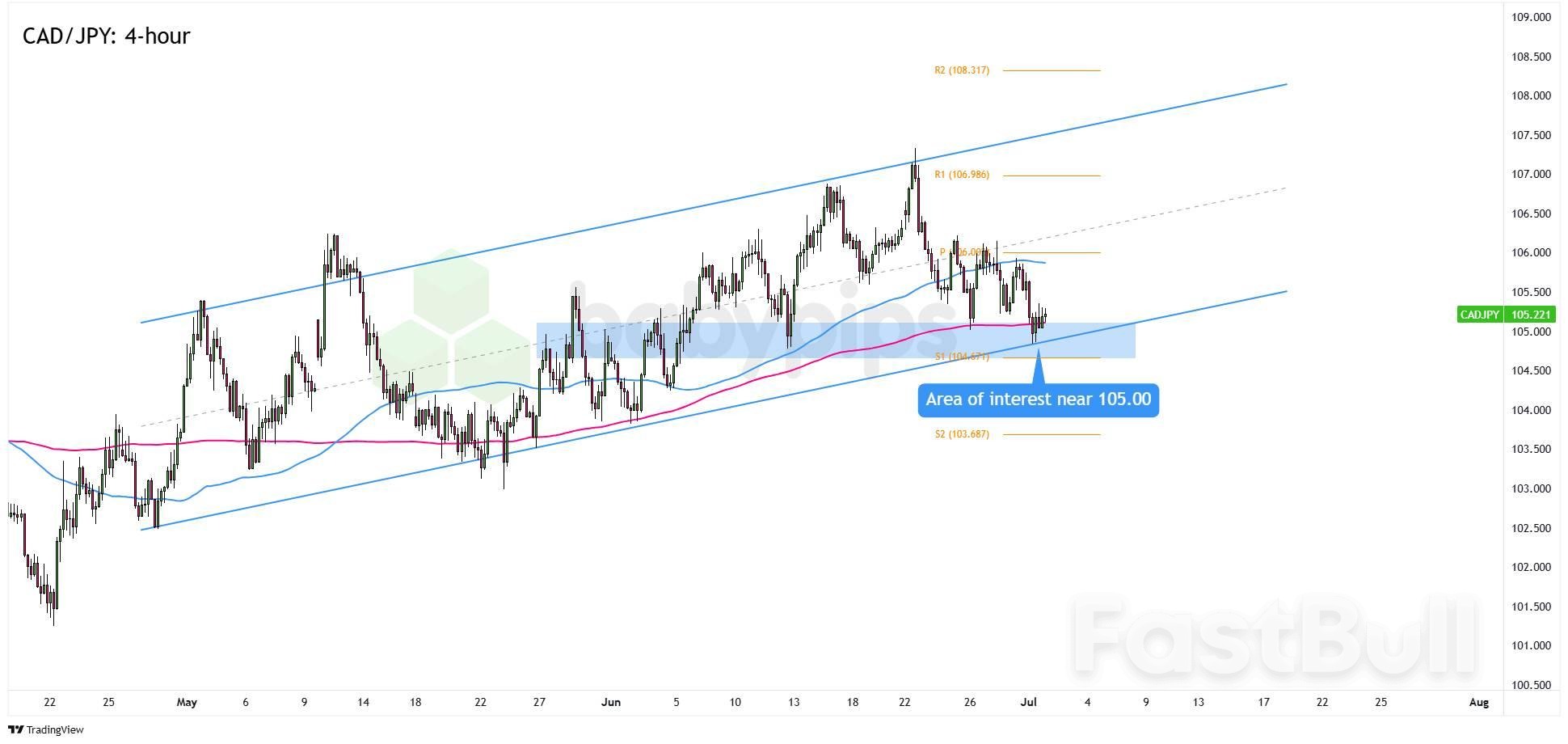

The Loonie is having trouble extending its downswings near a key support zone!

Think it means CAD/JPY is ready to extend a longer-term uptrend?

Let’s take a closer look at the 4-hour time frame!

Japanese yen traders found some support from slightly better-than-expected manufacturing surveys and comments from BOJ Governor Ueda at the ECB Forum, where he noted that underlying inflation remains below the central bank’s 2% target. Still, the yen gave back some of its weekly gains on Tuesday as geopolitical tensions and trade war concerns began to ease.

Over in Canada, a modest rebound in crude oil prices and signs of progress on a potential U.S.-Canada trade deal helped limit the Loonie’s losses, even though it remains one of the less favored major currencies when risk appetite returns.

Remember that directional biases and volatility conditions in market price are typically driven by fundamentals. If you haven’t yet done your homework on the Canadian dollar and the Japanese yen, then it’s time to check out the economic calendar and stay updated on daily fundamental news!

CAD/JPY has been slipping since hitting resistance at 107.00 last week, and is now trading near the 105.00 psychological level.

As you can see, this area lines up with the 100 SMA on the 4-hour chart, the S1(104.67) Pivot Point, and the ascending channel support that has held since May.

If the pair holds above 105.00 and prints bullish candlesticks, it could resume its longer-term uptrend. A move toward the 106.00 Pivot Point or even a retest of the 107.00 highs would be on the table.

But if downside momentum picks up and CAD/JPY breaks below the channel support, the uptrend could be in trouble. In that case, watch for a possible drop toward the 104.00 handle or the S2 Pivot Point near 103.69.

Whichever bias you end up trading, don’t forget to practice proper risk management and stay aware of top-tier catalysts that could influence overall market sentiment.

A seasonal lift for Asian equities in July may be hard to come by this year, as tariff and macroeconomic concerns dampen sentiment.

Markets are bracing for heightened volatility ahead of the July 9 deadline for countries to cut trade deals with the US. Uncertainty over the outcome of these negotiations poses a hurdle for regional shares to maintain an average return of 1.36% for July — the second-best performing month of the year — over the past decade.

Investors are “somewhat holding back on fresh allocations to emerging Asia,” said Christian Nolting, global chief investment officer at Deutsche Bank’s Private Bank. “While recent comments from high-level negotiators suggest constructive progress in ongoing talks with major Asian trading partners,” uncertainties remain high, given that trade disputes during US President Donald Trump’s first term lasted one and a half years, he added.

While the MSCI Asia Pacific Index has gained for three consecutive months through June, a potential return of “Liberation Day” tariff rates could send shares plunging in a similar way they did in early April.

Trump ruled out delaying the July 9 deadline for imposing higher levies on trading partners and renewed threats to hike tariffs on Japan. That saw Japanese shares leading losses in Asia early on Wednesday, with the Nikkei 225 down about 1%.

Even if trade deals materialise, some levels of tariffs are likely to stay. That would be a drag on the region’s export-led economies. A number of central banks in Asia have lowered their growth outlooks for the year. Meanwhile, elevated US interest rates may curb the scope for Asian central banks to further lower borrowing costs.

“The third quarter looks to have lots of dangerous potholes, with higher inflation and the prospect of slower growth,” said Gary Dugan, chief executive officer of the Global CIO Office. “We are not so convinced [that] the US Federal Reserve (Fed) will have sufficient reasons to cut rates at the pace the market prices.”

To be sure, a milder-than-expected tariff outcome and more dovish signalling from the Fed may encourage flows into the region. Current positioning in Asian assets leaves room for upside, said Gary Tan, a portfolio manager at Allspring Global Investments.

The US central bank has refrained from cutting interest rates this year, as it assesses the impact of Trump’s tariffs on inflation. The Trump administration though, has been applying pressure to lower borrowing costs, and two Fed governors in recent days have said a cut could be appropriate as soon as July.

The MSCI Asia Pacific gauge has risen 12% so far this year, outperforming the US, with shares in South Korea and Hong Kong seeing renewed interest. Still, some markets in Southeast Asia, where countries were hit with among the highest tariff rates, remain under pressure.

“We continue to expect choppy markets over the summer,” Nomura Holdings Inc strategists, including Chetan Seth, wrote in a recent note. “We recommend [that] investors focus on stock selection and on idiosyncratic themes that provide insulation from policy uncertainty and ones that offer better visibility.”

Bitcoin prices faced a correction on July 2, 2025, fueled by announced tariff measures from President Donald Trump, influencing market sentiments and trading activity on Indonesian exchange Tokocrypto.

This event highlights the enduring impact of geopolitical factors on cryptocurrency markets, with immediate market reactions suggesting increased volatility and strategic adaptability from exchanges like Tokocrypto.

On July 2, 2025, Bitcoin's price experienced a notable correction driven by tariffs announced by Donald Trump. Tokocrypto, Indonesia's prominent exchange, remains pivotal in managing the dynamics caused by such macroeconomic influences.

Tokocrypto's market leadership, underscored by its acquisition by Binance, highlights its role in the cryptocurrency exchange ecosystem in Indonesia. It now serves over 1.5 million users, holding a significant national market share.

Bitcoin's correction has sparked discussions about the exchange's strategic positioning to handle such market fluctuations. Traders and analysts watch for changes across other cryptocurrencies affected by broader market sentiments.

Historically, geopolitical changes like tariffs influence Bitcoin and Ethereum significantly. Such events might increase volatility on platforms aligned with asset diversification, as evidenced by Tokocrypto's recent expansion efforts in trading pairs.

Similar historical events, such as trade tensions, often lead to corrections in Bitcoin prices, affecting the wider crypto market landscape. Layer 1 assets like BTC and ETH historically react to these catalysts.

Expert analysis from Kanalcoin suggests potential outcomes influenced by historical trends. Tokocrypto's resilience is noted, supported by its comprehensive asset offerings designed to offset short-term disturbances.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up