Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold prices jumped over $60 amid safe-haven demand following a U.S. credit rating downgrade and trade tensions. Global stocks weakened, silver rose moderately, and risk aversion dominated early-week trading.

Hey crypto enthusiasts! While your focus might be on Bitcoin charts and altcoin movements, a significant shift just happened in the traditional finance world that could send ripples into the digital asset space. The US 30-year Treasury yield just climbed to a level not seen since November 2023, hitting 5.02%. What does this seemingly distant financial metric have to do with your crypto portfolio? Potentially, a lot. This surge didn’t happen in a vacuum; it closely followed a major announcement from credit rating agency Moody’s.

Let’s break it down. The US 30-year Treasury yield represents the return an investor receives for holding a U.S. government bond for 30 years. Think of it as the interest rate the U.S. government pays to borrow money over the long term. It’s a crucial benchmark for long-term interest rates across the entire economy, influencing everything from mortgage rates to corporate borrowing costs.

When the yield goes up, it means investors are demanding a higher return to lend money to the government for such a long period. A jump to 5.02%, the highest point since November 2023, signals a significant shift in the bond market. This could be driven by several factors:

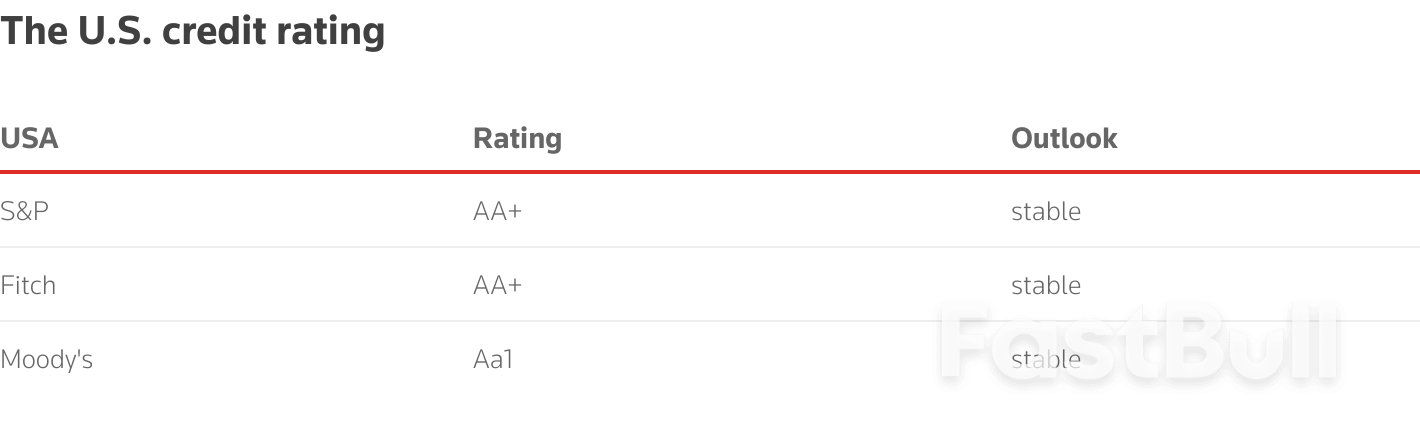

Adding fuel to the fire, this yield surge occurred shortly after Moody’s announced on the evening of May 16 that it had downgraded the U.S. government’s credit rating. The rating moved from the top-tier Aaa to Aa1. This Moody’s US downgrade is a big deal because credit ratings are essentially grades given by agencies like Moody’s, S&P, and Fitch, assessing a borrower’s ability to repay debt. A downgrade suggests a slightly increased risk, even for a borrower as historically safe as the U.S. government.

While still a high rating (Aa1 is the second-highest tier), a downgrade from Aaa can rattle investor confidence and potentially increase the perceived risk of holding U.S. debt, contributing to the demand for higher yields.

The Treasury yield impact extends far beyond just government bonds. As a benchmark, the 30-year yield influences a wide range of long-term interest rates. Higher Treasury yields generally lead to:

The recent move to 5.02% is part of broader bond market trends that have seen yields fluctuate based on economic data, inflation reports, Federal Reserve policy expectations, and now, credit rating assessments. The bond market is often seen as a forward-looking indicator. The current trends suggest that investors are factoring in persistent inflation, potential future rate hikes (or fewer cuts than previously expected), and increased fiscal risk.

These trends indicate a market environment where the cost of capital is rising. This can pose challenges for businesses relying on borrowing and can influence investment decisions across all asset classes.

Now, for the question many of you are asking: What does this mean for crypto? The crypto market reaction to traditional finance shifts isn’t always direct or immediate, but macro factors play a significant role, especially in times of uncertainty.

When safe-haven assets like U.S. Treasuries offer increasingly attractive returns (like 5.02% on a 30-year bond), the relative appeal of volatile, risk-on assets like cryptocurrencies can diminish. Investors who prioritize capital preservation might opt for the higher yield on government bonds rather than the potential high returns (and high risks) of crypto.

However, it’s important to remember that the crypto market has its own unique drivers, including technological developments, regulatory news, and adoption rates. While macro headwinds can create pressure, they don’t solely dictate crypto’s trajectory.

The current environment presents challenges but also offers opportunities for informed investors.

Challenges:

Insights:

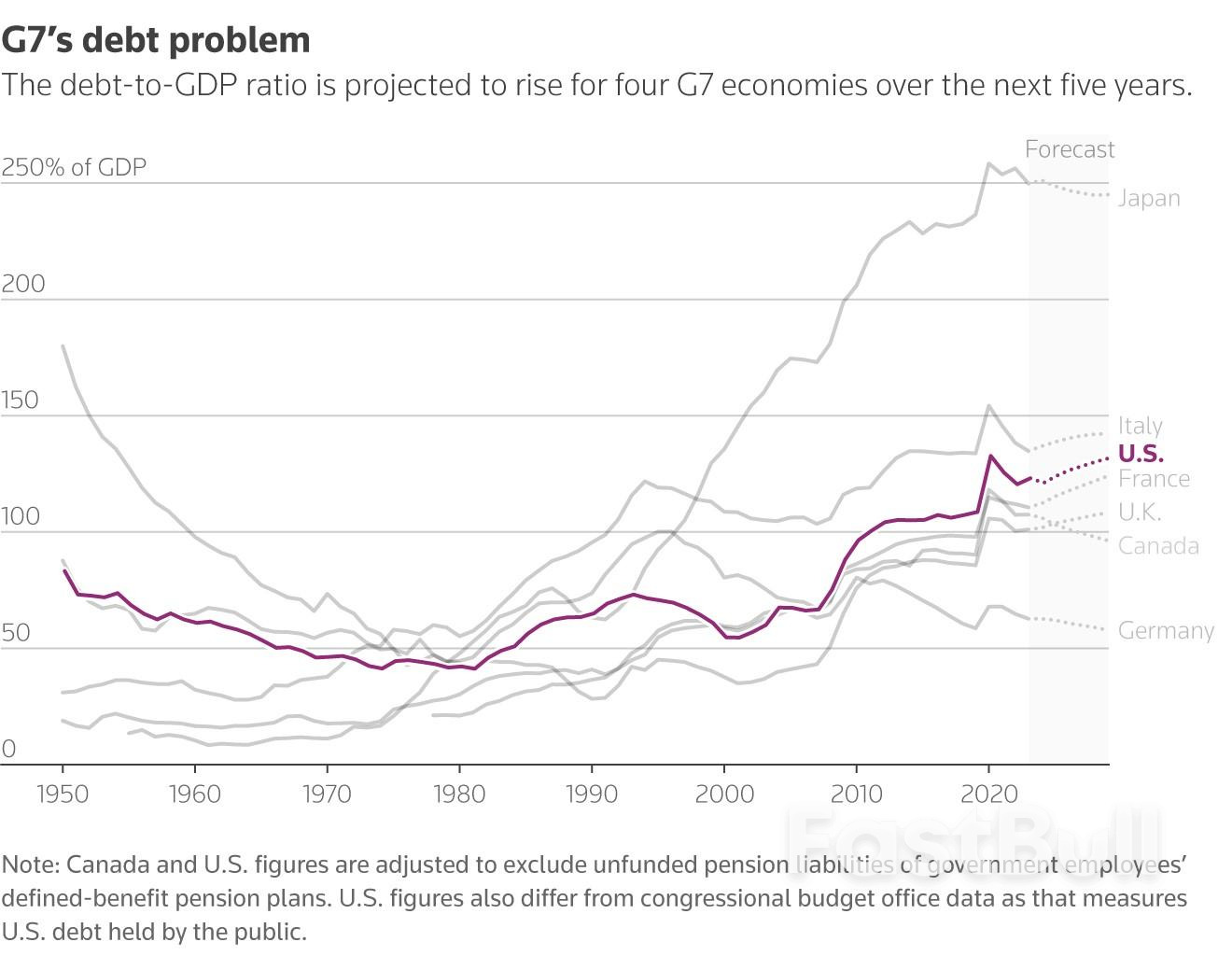

The surge in the US 30-year Treasury yield to 5.02% and the preceding Moody’s US downgrade are significant developments in the traditional financial world. They highlight ongoing fiscal challenges and political risks facing the U.S. economy. These factors contribute to rising borrowing costs and can influence global investment flows.

While the direct Treasury yield impact on daily crypto prices can be hard to isolate, these macro bond market trends create a backdrop of tighter financial conditions. The potential crypto market reaction is one of increased sensitivity to risk-off sentiment and potentially reduced liquidity compared to periods of ultra-low interest rates.

For crypto investors, staying aware of these broader economic shifts is vital. It’s a reminder that the crypto market doesn’t exist in a vacuum and is increasingly influenced by global macroeconomic forces. As markets continue to digest these developments, vigilance and a well-thought-out strategy remain your best tools.

The European Commission has cut its growth forecasts for the eurozone this year and next as a result of uncertainty caused by Donald Trump’s tariff wars.

The commission said the impact of tariffs demanded a “considerable downgrade” to the expected growth this year of the 20-member eurozone to 0.9% from the previous forecast, made in November, of 1.3%.

The commission’s spring forecast also reduced the extent of the eurozone recovery in 2026 to 1.4% from the November forecast of 1.6%.

Trump’s threat in April to impose a 20% tariff on imported goods from the EU, followed by its suspension for 90 days has given rise to a level of uncertainty “not seen since the darkest days of the Covid-19 pandemic”, said the economy commissioner, Valdis Dombrovskis.

He said the European economy remained resilient and that the jobs market was robust, with the commission predicting a fall in unemployment to a record low 5.7% next year.

Germany is expected to be the biggest drag on growth in 2025, although the commission said zero growth in 2025 and 1.1% in 2026 would mean the EU’s largest economy would avoid a third consecutive year of contraction.

Germany’s economy has suffered from a lack of public investment and high energy costs after the Russian invasion of Ukraine. A sharp slowdown in exports to China has hit exports. Hopes of a recovery this year have been dashed by the prospect of German car and industrial goods losing sales after the increase in US tariffs.

Dombrovskis said risks of a further deterioration in Europe were “tilted to the downside”, although Trump is under pressure to reduce the impact of higher tariffs after the rating agency Moody’s stripped the US of its much-coveted triple-A credit rating last week.

The rating agencies S&P and Fitch had already downgraded the US, citing the hit to economic growth from higher tariffs and White House plans to cut taxes and increase defence spending expected in the autumn.

Hauke Siemssen, an interest rate strategist at Commerzbank, said: “While Moody’s is catching up with other rating agencies, the downgrade serves as a reminder of the mounting fiscal challenges [in the US].”

The impact of US tariffs is expected to be discussed at the G7 meeting of finance ministers and central bank governors in Banff, Canada, later this week, although there is not expected to be an agreement on the next steps.

The Belgian central bank governor, Pierre Wunsch, told the Financial Times that the extra stress on the eurozone economy from tariffs could force the European Central Bank to cut interest rates to “slightly below” 2%.

The 10-year US Treasury bond rose to 4.54% on Monday. The equivalent bond sold by the German government attracts a yield of 2.60% and 3.63% for 10-year Italian bonds.

Underscoring the EU’s safe haven status, despite the downgrade to growth, the European Commission sold three-year bonds on Monday at an average yield, or interest rate, of 2.31%. A UK five-year bond on Monday was trading at a yield of 4.17%.

S&P Global said its survey of UK consumers found them to be nervous about spending because of “limited cash availability”. Its regular consumer sentiment survey of 1,500 households, which tracks their financial wellbeing, job prospects, savings and debt, rose from 44.5 in April to 45.2 in May, when a figure below 50 indicates contraction.

New York Federal Reserve president John Williams acknowledged on Monday that investors are taking a look at how they invest in US assets while noting he's seen no large-scale move away, and added that the US central bank can take its time before deciding its next interest rate move.

Flagging signs of "rumors or concerns" about the state of US dollar assets amid big government policy changes and large levels of uncertainty, Williams told a Mortgage Bankers Association conference in New York that "we're not seeing major changes" in how foreign money flows into the Treasury bond market, although there have been some price effects related to those shifting preferences.

Williams said even with rising yields related to this situation, government bond yields have been mostly range-bound. He also said when it comes to "core" fixed income markets like the Treasury market, the sector has been "functioning very well."

The New York Fed chief also said "the economy is doing very well" at the moment amid lots of uncertainty and some signs in recent data that there could be trouble ahead. Fed interest rate policy is slightly restrictive of growth and is "well positioned" for what lies ahead, he said.

"It's going to take some time to get a clear view" on how the economy is faring given all the government policy shifts and "we can take our time" to figure out where interest rate policy stands. He said clarity on the impact of things like the surge in import tariffs implemented by the Trump administration will not come quickly.

BTC/USDT 4-hour chart with RSI data. Source: Michaël van de Poppe/X

BTC/USDT 4-hour chart with RSI data. Source: Michaël van de Poppe/X

US dollar Index (DXY) 1-day chart. Source: Cointelegraph/TradingView

US dollar Index (DXY) 1-day chart. Source: Cointelegraph/TradingView

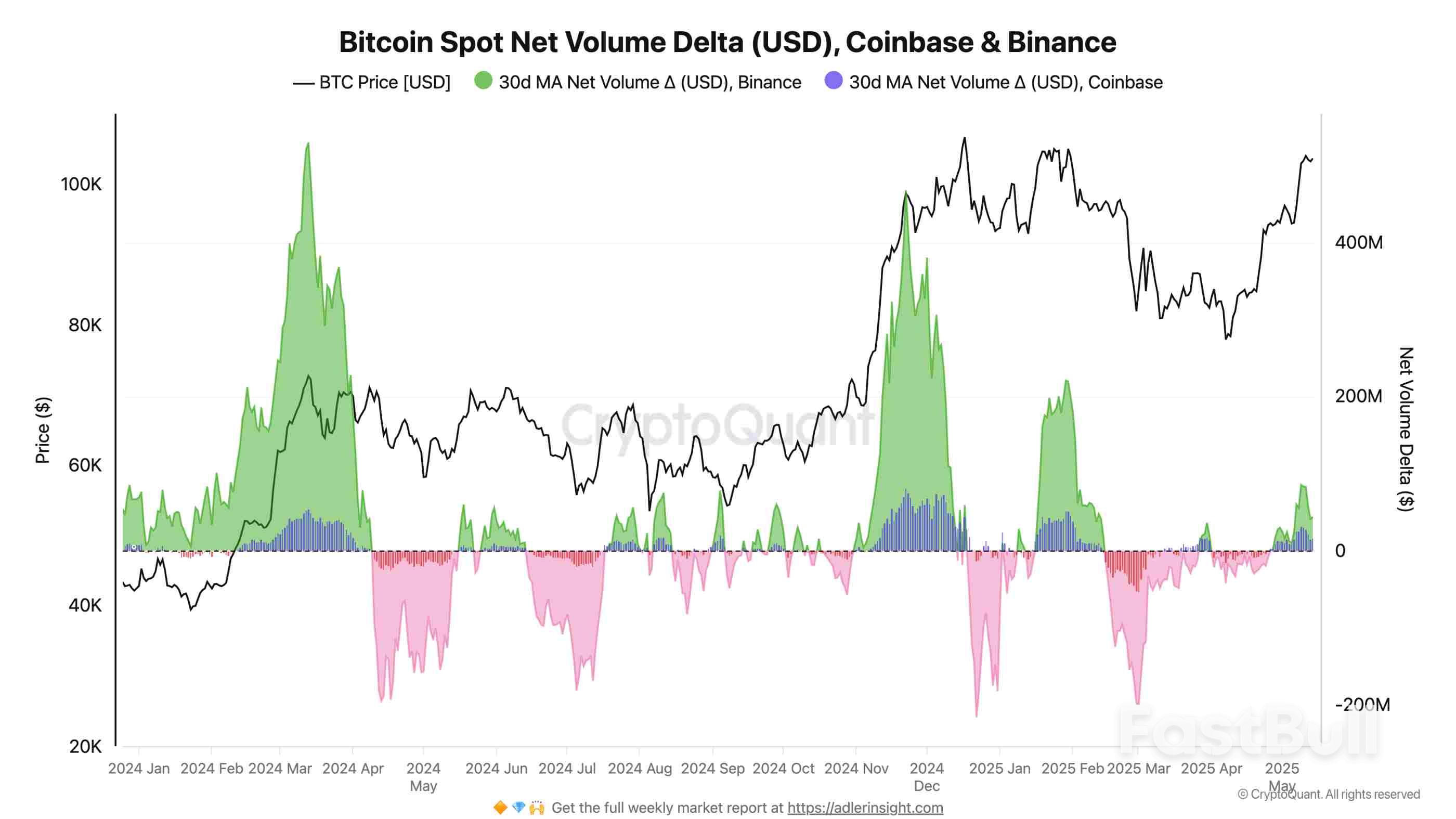

Bitcoin spot net volume delta. Source: CryptoQuant

Bitcoin spot net volume delta. Source: CryptoQuantWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up