Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Major brokerages expect 25-basis-point Fed rate cut in December; Silver, palladium headed for weekly gain; PCE inflation data for September due at 10 a.m. ET.

Gold prices rose on Friday as expectations that the Federal Reserve will cut interest rates next week gained traction, with investors awaiting U.S. inflation data that could clarify the central bank's next move.

Spot goldrose 0.7% to $4,235.59 per ounce, as of 1416 GMT, and was on track for a 0.1% weekly gain.

U.S. gold futuresfor February delivery edged 0.6% higher to $4,266.50 per ounce.

"The odds are there for a rate cut... gold is retesting and reaffirming the $4,200/oz level. Although it has been volatile, the trajectory and momentum has been positive this week," said Alex Ebkarian, COO at Allegiance Gold.

Lower interest rates generally support gold, which is a non-yielding asset.

CME's FedWatch tool now shows an 87.2% chance that the U.S. central bank will cut rates next week.

Traders are waiting for September's Personal Consumption Expenditures (PCE) data later today after it was delayed due to the government shutdown. The release is expected to show a 0.2% monthly rise and 2.9% annual growth.

This follows Wednesday's labor market data, which showed private payrolls fell in November by the sharpest margin in over 2-1/2 years.

Several Fed policymakers have adopted a dovish tone recently.

Morgan Stanley projected a 25-basis-point rate cut by the Fed at its December 9-10 meeting, in line with estimates from J.P. Morgan, Bank of America, and a majority of Reuters-polled economists.

Meanwhile, physical gold demand in India and China eased this week as buyers wait for a correction in spot prices.

Silverrose 2.2% to $58.34 an ounce, up 3.5% for the week, after touching a record $58.98 on Wednesday.

The white metal has rallied 101% this year, fueled by supply deficits and its designation on the U.S. critical minerals list.

Platinumfell 0.4% to $1,640.23 and was set for a weekly loss, while palladiumgained 1.2% to $1,465.29 and was poised to end the week higher.

Vice President JD Vance is a master of dramatic soundbites. Rumors are swirling that the European Commission will fine X hundreds of millions of dollars for "not engaging in censorship," he tweeted on Thursday. Europe, in other words, was trying to force X's owner Elon Musk to smother the free speech of his users.

Vance was wrong on both counts. Europe's regulatory fine against Elon Musk's X has turned out to be a more modest €120 million ($140 million). It also has nothing to do with censorship. X isn't being told what content to remove. It's simply required to be transparent about verification, advertising and provide access to third-party researchers, none of which the company has done.

X's descent into a racist, politically radical hellscape fueled by porn in recent years is the predictable outcome of chronic opacity and deliberate obfuscation. X misled users by monetizing its blue checkmarks so anyone could become "verified." It blocked independent researchers from accessing public data and charged prohibitive fees for limited Application Programming Interface access, making it nearly impossible to study misinformation patterns, according to the Commission's findings. And the company declined to maintain a searchable, reliable advertising database too, obscuring who was paying what to influence public discourse.

The fine represents 6% of X's $2.3 billion in projected advertising revenue for 2025. That's perfectly manageable for the world's richest person and X has 90 days to implement changes that fix the issue or it could face additional fines, Bloomberg News reported. But the penalty could have been much bigger. The Commission had originally considered calculating a fine based on Musk's entire private company portfolio, or what the Commission called the Musk Group. That would have included SpaceX's projected income of $15.5 billion for this year, along with money from xAI, Boring Co. and X. To have abandoned a higher number after a two-year investigationsuggests the EU is pulling its punches.

The reason is almost certainly geopolitical pressure and the threat of trade retaliation. US Commerce Secretary Howard Lutnick recently told Brussels it must loosen digital laws in exchange for lower steel tariffs. The quid pro quo was explicit.

The Commission would deny it's going soft on Big Tech. After all, it's mulling a probe into Meta Platforms Inc. over WhatsApp's artificial intelligence features, and is rolling out the world's most sweeping legislation on AI.

But the latter legislation has been delayed, and the Commission has been similarly timid with antitrust fines this year against against Apple Inc. of €500 million and Meta of €200 million, which were tiny fractions of their revenue and well below the 10% permitted under the region's new antitrust legislation.

X was the European Union's first probe under its other new law addressing harmful online content, known as the Digital Services Act (DSA). The law is careful about threading the needle on free speech by pushing companies to conduct more transparent risk assessments on their recommendation algorithms, to ensure they're not promoting violence, hate speech or content about eating disorders and self-harm.

Now Europe's handling of this initial case sets the template for its enforcement against TikTok, Meta and others — and its weak response to Musk threatens to undermine the entire regulatory framework.

Critically, Musk's case shows why consolidated power in the hands of a few tech billionaires can be so perilous. He not only controls a major social platform but also critical infrastructure that could steer the war in Ukraine (Starlink), advanced artificial intelligence (xAI) and space technology (Space X), all while having served as an advisor to the US president, a tenure that was fleeting and explosive but still retains a legacy judging by Vance's latest comments.

Far from turning X into a town square for free speech, Musk has made it a vehicle for his personal political agenda while neglecting to build the necessary checks and balances to make such a platform safe and trustworthy. False, ideologically extreme posts go viral on X, poisoning public discourse and warping democratic decisions. It sets a precedent that could embolden other billionaire-owned platforms to prioritize ideology over the public interest. European regulators faced the exact scenario they've been striving to prevent, and they blinked.

Key points:

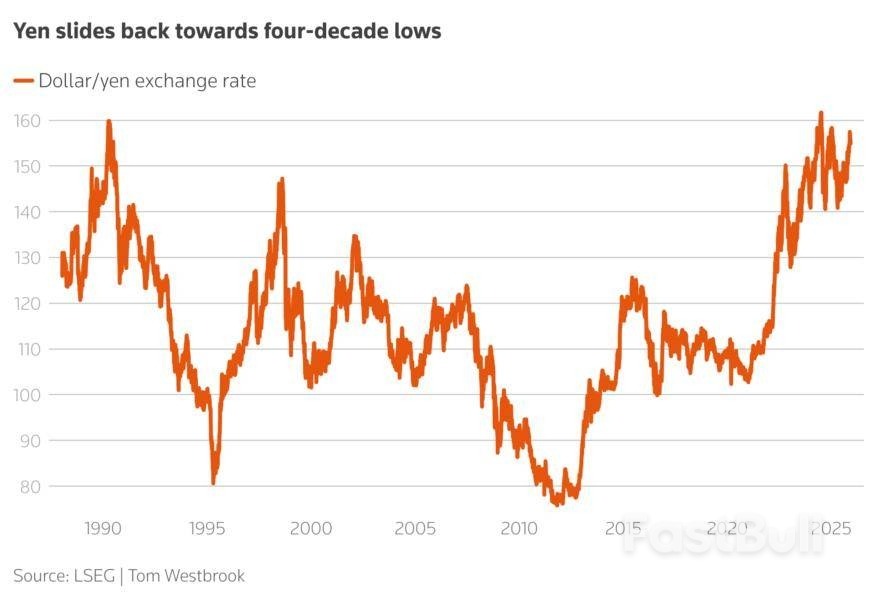

As Prime Minister Sanae Takaichi was finalising her $137 billion spending plan last month, which in recent weeks has put Japan into a standoff with investors over the outlook for government finances, a bond chart was brought to her attention.

Finance Minister Satsuki Katayama pulled up the chart on her tablet at a November 17 meeting in Takaichi's official residence. It showed selling, which drives up long-term borrowing rates.

The prime minister's expression turned serious, according to a person familiar with the encounter.

"The finance minister was becoming more vigilant," the person said. "The prime minister also seemed quite concerned about the weak yen and bond-price declines."

The person asked not to be identified because they were not authorised to speak with the media. But the concern they described was well-placed, because Takaichi is facing a challenge from the markets that she needs to fund her agenda.

At stake was not only her massive stimulus package, which will be paid for largely through borrowing, but the direction of the ailing yen- in real terms near record lows - and longer-term investor faith in Japanese assets.

Takaichi's meeting with Katayama and other top officials marked the beginning of a shift in rhetoric aimed at soothing investor concerns, though it is too early to say whether it can steady the market in a durable way and keep bond vigilantes out of Japan.

Japan's benchmark 10-year yield rose to its highest point since 2007 on Friday and has climbed 25.5 basis points in four weeks, the sharpest rise in nearly three years and one that has begun to send ripples through global markets.

The situation is all the more delicate because of Japan's heavy debt - its debt-to-GDP ratio is by far the highest of any developed country - and how its bond market is in transition as buying from both the central bank and insurers dries up.

Addressing the risks, Takaichi told Parliament last week that there was no possibility of a "Truss shock," downplaying parallels with the 2022 selloff in gilts and the pound that sank British Prime Minister Liz Truss' plan for unfunded tax cuts.

She has also softened her previous resistance to monetary policy tightening and promised to limit extra borrowing. In addition, she has unveiled other initiatives including what some analysts have called the Japanese version of DOGE to cut wasteful government spending.

On Friday, Katayama said the government was monitoring markets and would ensure the sustainability of Japan's public finances and maintain investor confidence.

Takaichi's office did not respond to a Reuters request for comment on her November 17 meeting.

"Takaichi's plan is to expand the growth potential of Japan ... but if that growth doesn't materialise, then the only thing remaining is the huge amount of government debt," said Toshinobu Chiba, a Tokyo-based fund manager at Simplex Asset Management.

"And that's the problem."

Takaichi, who came to power after her predecessor quit, has a reputation as a disciple of Shinzo Abe's "Abenomics," the massive monetary and fiscal stimulus programme aimed at rescuing Japan from stagflation that kicked off more than a decade ago.

What surprised investors was how little of that was jettisoned when she took office, despite inflation running at 3% and the national debt exceeding 1.3 quadrillion yen ($8.5 trillion).

Takaichi appointed a dovish coterie of economic advisors and told Parliament last month she would water down Japan's fiscal target to allow for multi-year spending on key growth areas.

And when an early draft of the stimulus plan was crafted by the finance ministry, she quickly turned it down because it was too modest in size, according to the Nikkei newspaper.

"What you have is, I would say, a very loose policy mix overall and basically a monetary boom," said Ian Samson, a multi-asset portfolio manager at Fidelity International.

"I'm personally short yen because I think that's the path of least resistance."

Extra bond sales will also test an already fragile market, where demand - especially for long-dated paper - has traditionally been uneven from foreign investors and has been drying up for years from domestic banks and insurers.

After accounting for redemptions and decreased purchases by the Bank of Japan, net supply in the market will jump by nearly 11 trillion yen in 2026 from 58 trillion in 2025, according to Bank of America estimates.

"The problem is ... who's going to buy these bonds?" said Sally Greig, head of global bonds at Scottish long-only manager Baillie Gifford. "We've still got more supply to absorb and Japan's not the only one spending money."

Some dealers said there had even been a small increase in short interest in bonds, particularly over the past week, though positions were small.

"The dynamics in the JGB market are more indicative of a lack of buying interest, rather than outright selling," said Daiki Hayashi, head of Japan market sales and marketing at J.P. Morgan in Tokyo.

Bets against the yen, however, may start to pick up, despite Takaichi's preference for a stronger currency and a recent escalation of intervention warnings, traders say.

"There would definitely be interest to look at shorting the yen if we can move to between 153 and 154 (per dollar)," said Patrick Law, head of APAC fixed-income, currencies and commodities trading at Bank of America in Hong Kong.

The yentraded at 155 per dollar on Friday and has slid some 5% versus the dollar since Takaichi was appointed as leader of Japan's ruling party in early October.

To be sure, positioning in the market is not clear because data has been delayed by the U.S. government shutdown, and there remain a number of forecasts for a stronger yen.

Morgan Stanley, for example, expects the yen to hit 140 per dollar in the first half of 2026 and chief Asia and emerging-market equity strategist Jonathan Garner said yields were rising as part of a healthy reflation of the economy.

And that still makes for a difficult moment to step into the bond market.

"Investors, including pensions and banks, still have a big capacity to buy more JGBs," said J.P. Morgan's Hayashi, particularly around the details of the government's bond-issuance plan. "What they need is greater transparency."

"Until this is clarified, I think it will likely remain difficult for investors to buy JGBs aggressively."

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price ChartWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up