Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

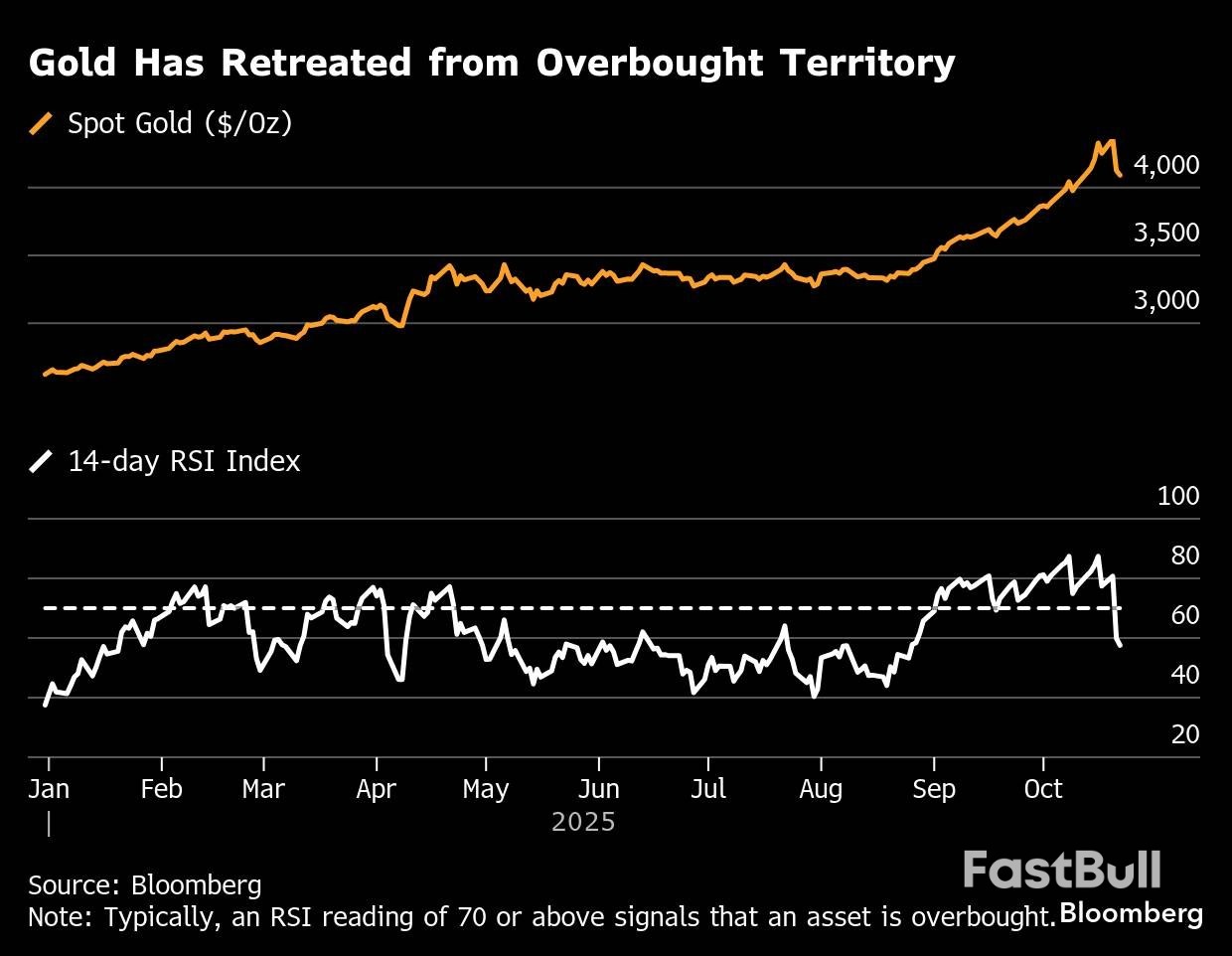

Gold declined for a third day, edging back in the direction of $4,000 an ounce on concerns a prolonged rally has become overheated.

Gold declined for a third day, edging back in the direction of $4,000 an ounce on concerns a prolonged rally has become overheated.

Spot gold slipped to around $4,090 an ounce in early Asian trading on Thursday, reinforcing a technical reset, while investors also weighed the prospects for a US-China trade deal to relieve some of the geopolitical tensions that have bolstered demand for haven assets. The metal has dropped nearly 6% in the last two sessions from a record high.

Technical indicators have shown that the rally was likely overstretched, with this week's pullback taking some heat out of the market. The so-called debasement trade, in which investors avoid sovereign debt and currencies to protect themselves from runaway budget deficits, has been a driver of gold's growth since mid-August.

Gold is still up about 55% this year, with prices also supported in recent weeks by bets the Federal Reserve will make at least one quarter-point cut by the end of the year.

"After an overstretched rally, gold is behaving like an elastic band that's been pulled too far and is now snapping back hard," said Hebe Chen, an analyst at brokerage Vantage Global Prime Pty Ltd. "Prices holding firm above the $4,000 mark point to a technical reset rather than a fundamental shift, with safe-haven demand and the 'debasement trade' still very much intact."

Traders are also watching potential progress in talks between the US and China following a recent resurgence in tensions between the world's two largest economies. US President Donald Trump on Tuesday predicted an upcoming meeting with Chinese President Xi Jinping would yield a "good deal" on trade – while also conceding that the talks may not happen.

"Markets are taking a balanced stance toward the trade and geopolitical noise — cautious, yet grounded in a realistic sense of optimism," said Chen.

Gold edged lower to $4,095 an ounce at 8:05 a.m. Singapore time. The Bloomberg Dollar Spot Index was steady. Silver extended a decline after dropping 7.6% in the past two sessions. Palladium gained, while platinum dropped.

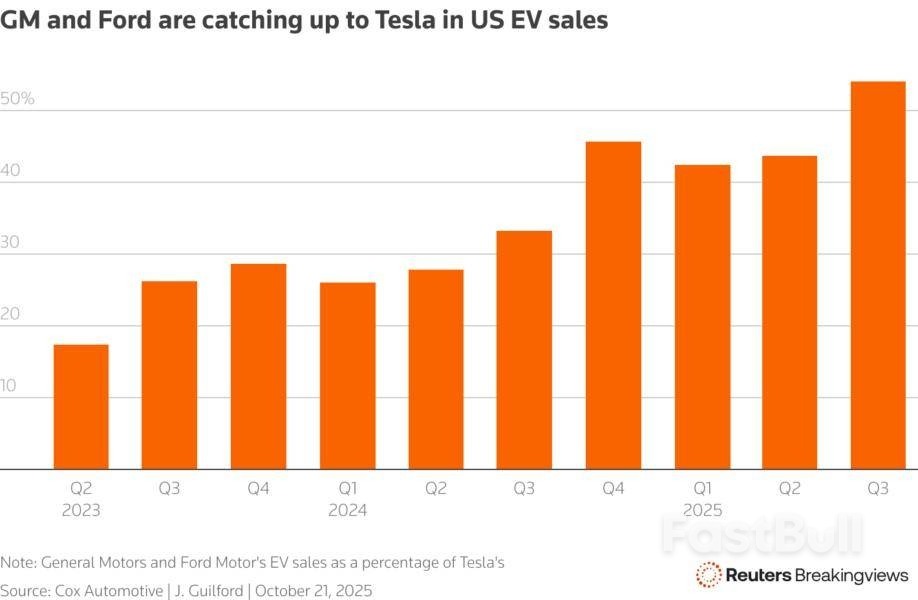

Teslahas blown past its last exit from a risky route. The electric-car maker posted better-than-expectedresultson Wednesday. Yet its best growth in years owes much to the impending expiry of customer subsidies in the United States, an industry-wide boon on which its rivals also capitalized. What remains is boss Elon Musk's all-or-nothing bet on autonomy.Third-quarter revenue of $28 billion came in 12% higher than last year and 6% above analysts' expectations, according to Visible Alpha data. Tesla's most important gauge - gross margin adjusted for sales of regulatory credits in its core automotive business - appears to have stabilized at 15.4% after a years-long slide. A 7% year-over-year bump in car deliveries represents the fastest growth since 2023.

The worst, then, might seem to be over. Save for one thing: Tesla did little to drive this bumper quarter. Overall U.S. electric vehicle sales soared 30% year-over-year in the third quarter, Cox Automotivereckons, as buyers rushed to nab tax credits for battery-powered purchases before the Trump administration axed them. Musk's rivals benefitted, too: Ford Motorand General Motorsfurther narrowed their gap to the market leader.

Moreover, profit tanked more than a third as operating expenses jumped 50%. Meanwhile, the long-awaited release of new, "affordable" cars was little more than a slight price cut on existing models that does little to expand the market.In that case, while Tesla's nadir may have passed, so too may its peak, at least as far as the humdrum business of "selling cars" is concerned. It's perhaps no surprise. The company once aimed to shift 20 million cars a year. A new proposed pay package for Musk has effectively ditched that, rewarding him with billions if he reaches that many sales since Tesla's founding.

Admittedly impressive growth in the company's other businesses, selling grid-scale batteries and services to drivers, isn't enough to support its $1.4 trillion valuation. The remainder is, as always, Musk's grandest plans: turning every car into an automated chauffeur, and deploying the humanoid Optimus into factories - though his talk on Wednesday of building a "robot army" over which he should exert influence will send some chills.Some of those visions are getting less outlandish, though. Alphabet'sWaymo has a robo-taxi business in operation right now. General Motors, earlier on Wednesday, said it would release its own "eyes-off" system in 2028. The difference is in approach. Rivals augment in-car cameras with LiDAR or radar, utilizing extra sensors - at extra cost - to navigate the road. Musk has stubbornly stuck to a cheaper, cameras-only approach.

This is a difficult technological nut to crack, though the CEO said in a call with investors that Tesla taxis should soon operate without any humans at the steering wheel. In fact, he boasts that production will ramp up in anticipation of an autonomous future. At this point, he needs to be right. All other options are disappearing in the rear-view mirror.

Automaker Tesla said on October 22 that it generated roughly $28.1 billion in revenue for the third quarter of 2025, roughly 6% above analysts' expectations, according to Visible Alpha data.Revenue from the company's core automotive business came in 7% above estimates, at $21.2 billion. Excluding sales of regulatory emissions credits, the unit's gross margin reached 15.4%, versus an anticipated 14.9% and continuing its climb from a low point at the beginning of the year.

Andrew Cuomo sought to cast Zohran Mamdani as a frontrunner unprepared to actually be mayor of the largest US city in the final debate before New York City's mayoral election.The former New York governor is seeking to overturn a double-digit polling deficit with just two weeks left in the campaign."The issue is you have no experience, you have accomplished nothing," Cuomo told Mamdani in the second and final debate before the Nov. 4 election. Early voting in the election begins Saturday.

Mamdani, the 34-year-old Queens state lawmaker and democratic socialist, shocked New York City's establishment when he won the Democratic primary for mayor in June, besting Cuomo by more than 12 points in a race where nearly every poll predicted Cuomo would win. Cuomo is running on an independent ballot line in the November election.Mamdani, leading in both polls and political betting markets, cast Cuomo as a failure in Albany who couldn't bring change to the city.

"The issue is we've experienced your experience," Mamdani told Cuomo, in one of many tense moments between the pair.A Quinnipiac University poll taken in early October showed Mamdani leading Cuomo 46-33, with Sliwa earning 15% of voters' support. Most polls taken since the June 24 Democratic primary have shown Mamdani with a comfortable, double-digit lead, which he has maintained even in the weeks after incumbent Mayor Eric Adams announced he would withdraw from the race late last month.

The debate comes as some Republicans and prominent donors are calling upon GOP candidate Curtis Sliwa, founder of the Guardian Angels, to exit the race, helping improve former governor Andrew Cuomo's odds against Mamdani. Sliwa has insisted he will not exit the race, despite the pressure he faces to step aside. Earlier this week the five chairs of New York City's county Republican organizations issued a letter supporting Sliwa and urging him to remain in the race.

Sliwa, the third candidate on stage, was often overshadowed as Cuomo and Mamdani launched barbs at one another. Yet he showed no signs of leaving the race.Instead, Sliwa cast himself as the only option for voters uncertain about a pair of flawed alternatives."Zohran, your resume could fit on a cocktail napkin," Sliwa said. "And Andrew, your failures could fill a public school library in New York City."

Canadian Prime Minister Mark Carney on Wednesday said his government's first budget will reduce economic and security reliance on the United States and cut wasteful spending.

Carney, who was elected in April, stressed that his government's maiden budget will be about both austerity and big investments as he seeks to protect the Canadian economy from what he has called a crisis brought on by a newly protectionist U.S.

"The decades-long process of an ever-closer economic relationship between the Canadian and U.S. economies is over," Carney said in a televised address to a group of university students.

"Many of our former strengths — based on close ties to America — have become our vulnerabilities," he said.

As U.S. tariffs batter Canada's steel, aluminum and auto sectors, Carney pledged to double the country's non-U.S. exports over the next decade. The diversification will bring in an additional C$300 billion, he claimed.

Carney, under pressure to spur growth and assert Canada's sovereignty, has promised a massive scale-up in defense spending and housing infrastructure.

But he has also lost revenue due to tax cuts, scrapped retaliatory tariffs to try to strike a deal with U.S. President Donald Trump, and spent on relief measures for tariff-hit industries, straining government coffers.

His government has asked all ministries to cut spending.

In his address, he said the budget will present a strategy to cut wasteful expenditures and drive efficiency.

"When we have to make difficult choices, we will be thoughtful, transparent, and fair," he said.

Economists forecast the government's fiscal deficit for the year 2025/26 will be between C$70 billion and C$100 billion, one of the largest in decades and a massive jump from the projected C$43 billion for the fiscal year that ended March 2025.

The budget, which will be presented on November 4, will help to catalyze "unprecedented" investments in Canada over the next five years, Carney said. He plans to balance the operating budget in three years and said he will include a climate strategy.

But the budget, a major test for Carney, cannot be passed unless his minority government gathers support from some opposition members.

In an outreach effort, Carney met with leaders from other political parties on Wednesday including the main opposition leader Pierre Poilievre, who has urged restraint on the deficit.

"We won't play games. We won't waste time. And we won't hold back. We will do what it takes," Carney said in his remarks.

BHP Groupsaid on Thursday it would be forced to take "difficult decisions" for its metallurgical coal business in Australia if there were no regulatory changes to support it, its CEO said at its annual general meeting on Thursday.BHP last month said it would suspend operations and cut 750 jobs at a Queensland coking coal mine it shares with a unit of Mitsubishi, blaming low prices and high state government royalties that have dented its returns."Without change, there's without doubt going to be more difficult decisions that are going to be made," CEO Mike Henry said at the miner's annual general meeting.

Incoming chair Ross McEwan of the world's top miner and Australia's biggest company said that the critical minerals deal between the U.S. and Australia this week was a "good start".U.S. President Donald Trump and Australian Prime Minister Anthony Albanese signed a critical minerals agreement aimed at countering China on Monday."I think, it's a little bit early to actually see the outcomes of what we see as a good meeting between the prime minister of Australia and the president of the United States. But I think it was a very good meeting to start those conversations," McEwan said.

BHP is a large producer of copper, iron ore and steelmaking coal, rather than in niche critical minerals markets, he added, although copper is increasingly regarded as a strategic metal given its outsize role in the energy transition.Australia is quite well positioned to support the U.S. as it tries to derisk its critical mineral supply chain, Henry said, after he and two top Rio Tintoexecutives met with Donald Trump and Interior Secretary Doug Burgum in the Oval Office on August 19."I was impressed on just how fierce the focus is in the U.S. on getting more ... mines and processing facilities up and going," Henry said. BHP is looking with partner Rio Tinto to build the Resolution copper mine in Arizona, which could account for a quarter of U.S. demand for the metal.

"I think we should see (the agreement) as symbolically significant, in that it goes to just how seriously this issue has been put down and the position that Australia can play in supporting the U.S.," Henry said.

The Australian and New Zealand dollars held still on Thursday as the threat of a new round of U.S.-China trade restrictions curbed risk sentiment ahead of a key reading on U.S. inflation.

Investors assume the U.S. consumer price report on Friday is unlikely to deter the Federal Reserve from cutting rates next week, but could decide whether it moves in December as well.

Australia's third-quarter CPI is due on October 29 and again will likely decide whether the Reserve Bank of Australia cuts its 3.60% cash rate in November.

Analysts at CBA see headline CPI picking up to an annual 3.0%, the very top of the RBA's 2% to 3% target band, while the core measure should stay at 2.7%.

"Given the cautious and gradual pace of easing so far, we expect the RBA will want to see clear evidence that inflation is continuing to move towards the mid-point of the target band before easing further," said Trent Saunders, a senior economist at CBA.

"With trimmed-mean inflation expected to remain steady on an annual basis, we do not expect the hurdle for another rate cut to be met by the November meeting."

With so much at stake the Aussie was stuck at $0.6487, having hardly moved overnight. Support comes in at $0.6471 and $0.6438, with resistance around $0.6525 and $0.6628.

The kiwi dollar idled at $0.5736after crawling as high as $0.5759 overnight. Support lies at $0.5710, with resistance at $0.5769 and $0.5884.

Yields on kiwi 10-year bonds (NZ10YT=RR) have fallen 22 basis points so far this month to trade 12 basis points under Australian yields, near levels not seen since 2020.

New Zealand cash rates at 2.5% are far below the Australian 3.60%, helping lift the Aussie as high as NZ$1.1445earlier this month from around NZ$1.0800 mid-year. It was last trading at NZ$1.1302.

"This does suggest a good chance the cross can test levels above NZ$1.1500, but we don't envisage such moves as likely to prove sustainable," said Rodrigo Catril, a senior FX strategist at NAB.

In particular, there was a good chance the New Zealand economy would pick up speed in the coming quarter given the full impulse from past rate cuts is yet to be felt.

"If we are right about NZ potential growth rebound, then next year the cross is at risk of facing a more pronounced downturn," he added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up