Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Gold surged above \$3,550 as weak U.S. jobs data fueled Fed cut bets and dollar weakness. ETF inflows, central-bank diversification, deficits, and geopolitical risks keep demand strong despite overbought signals.

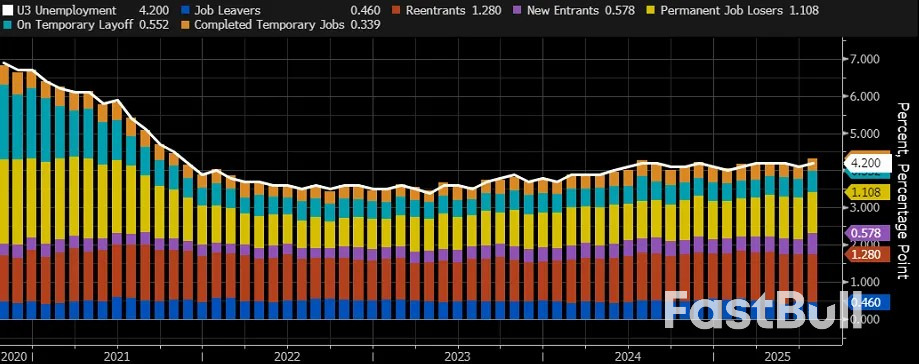

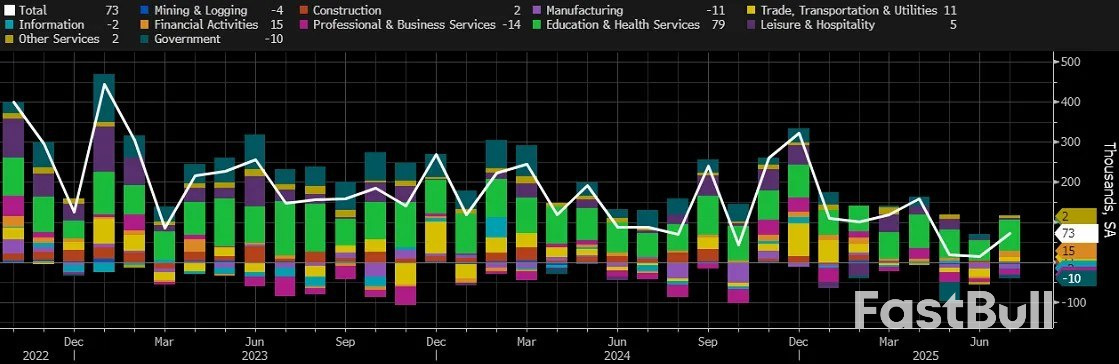

Several benchmark Treasury yields declined to the lowest levels in several months as additional evidence of labor-market cooling bolstered expectations for Federal Reserve interest-rate cuts beginning this month.

Yields across maturities declined only slightly, however the five-year note’s reached the lowest level since the early-April rally unleashed by the US administration’s tariff plans, and the 10-year note’s fell below 4.17% to a level last seen in early May.

Thursday’s US economic data included a gauge of private-sector hiring that fell short of estimates, while the Labor Department’s weekly tally of new jobless claims rose more than economists anticipated. The department’s comprehensive employment report for August to be released Friday is expected to confirm the hiring slowdown that became apparent in the July data and to show an increase in the unemployment rate to 4.3%, last exceeded in 2021.

“The Fed without doubt cuts rates in September,” with additional cuts likely by year-end and next year, said Tom di Galoma, managing director at Mischler Financial Group.

Contracts for predicting Fed moves continued to price in about 90% of a quarter-point rate cut this month and at least two cuts by year-end.

For the August employment report to be released Friday, options pricing shows that traders expect a large market reaction. A 10-basis-point move in either direction is the breakeven for contracts expiring at Friday’s close, compared with seven basis points ahead of last month’s report. The July data released Aug. 1 unleashed the Treasury market’s biggest rally this year as it showed weak job creation and downward revisions to the previous two months.

Pricing on short-term Treasury options that expire at Friday’s close indicate a break-even daily range on the 10-year yields of approximately 10 basis points, which compares to around 7 basis points break-even seen for the August jobs report.

The rally poses a challenge to investors who had recently turned bearish after losing confidence in the outlook for Fed rate cuts.

Fed officials remain divided on the need for rate cuts. Wednesday, Fed Governor Christopher Waller reiterated he favors “multiple cuts” in the coming months, while Atlanta Fed President Raphael Bostic said he thinks one will suffice this year.

And while most Wall Street bank economists predict a September rate cut and at least one more this year, Bank of America Corp.’s say rate cuts are premature based on inflation, which could worsen as a result.

“Some of these cuts that are priced into the market are more preemptive than something that is warranted,” Subadra Rajappa, head of US rates strategy at Societe Generale, said on Bloomberg TV.

Key points:

President Donald Trump said on Wednesday the U.S. might have to "unwind" trade deals it reached with the European Union, Japan and South Korea, among others, if it loses a Supreme Court tariffs case, and warned that a loss would cause the U.S. "to suffer so greatly."Trump, speaking to reporters at the White House, said his administration will ask the Supreme Court to reverse a U.S. appeals court ruling last week that found many of his tariffs were illegal. Trump, however, said he thought his administration would prevail in the case.

"We made a deal with the European Union where they're paying us almost a trillion dollars. And you know what? They're happy. It's done. These deals are all done," he said. "I guess we'd have to unwind them."The comments were Trump's first specifically suggesting the trade deals reached with major trading partners - which were negotiated separately, outside of the tariffs - could be invalidated if the Supreme Court lets Friday's ruling stand.Trump said rescinding the tariffs would be costly, although trade experts note that the duties are paid by importers in the United States, not companies in the countries of origin. Economists have warned that tariffs are likely to fuel inflation in the United States.

"Our country has a chance to be unbelievably rich again. It could also be unbelievably poor again. If we don't win that case, our country is going to suffer so greatly, so greatly," Trump said.The appeals court ruling addressed the legality of what Trump calls "reciprocal" tariffs first imposed as part of a trade war in April, as well as a separate set of tariffs imposed in February against China, Canada and Mexico. The decision does not impact tariffs issued under other legal authority, such as those on steel and aluminum imports.

Trade experts said his comments on the cost of rescinding the tariffs were intended to convince the Supreme Court that removing the tariffs would unleash major economic chaos.Ryan Majerus, a former senior U.S. trade official who is now a partner with law firm King & Spalding, said it had been clear from the start that the trade deals with the EU and other trading partners were framework agreements that were subject to change, not fully fledged trade agreements."The president’s announcement today that the deals could be unwound reflects an effort to maximize leverage on the U.S. side," he said.

Legal and trade experts say the Supreme Court's 6-3 majority of Republican-appointed justices may slightly improve Trump's odds of keeping in place at least some of the tariffs after the appeals court ruled 7-4 last week that they are illegal.But they say it is difficult to predict exactly what the court will do, given rulings in past cases and the unprecedented nature of the challenge.Senator Ron Wyden, the top Democrat on the Senate Finance Committee, said Trump's comments sowed more confusion.“The Trump administration can’t get its story straight about whether its trade deals will hold any water if the tariffs are struck down," he said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up