Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

In just one week, the highly anticipated FastBull Finance Summit Dubai 2025 will grandly open at the Coca-Cola Arena in Dubai from April 16th to 17th! This premier financial event will bring together top global industry leaders and seasoned experts to jointly discuss the cutting-edge developments in the foreign exchange market and blockchain financial technology, and conduct in-depth analysis of global market dynamics.

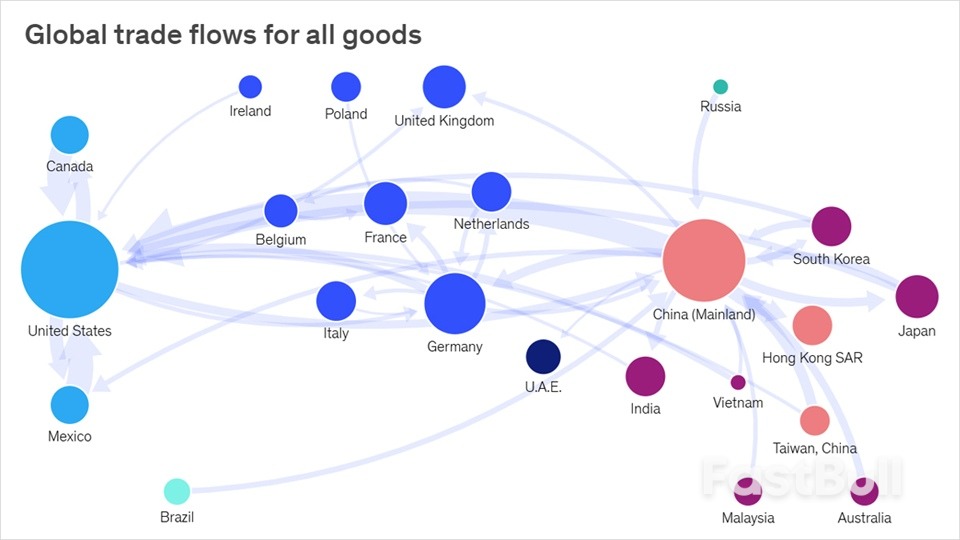

Analysts at Morgan Stanley have slashed their prediction for U.S. economic growth this year and projected a sharp firming in inflation, citing possible disruptions from President Donald Trump’s tariff agenda.

In a note to clients, the strategists led by Michael Gapen said they now expect real U.S. gross domestic product to come in at 0.8% in 2025 and 0.7% in 2026, down from their earlier forecasts of 1.5% and 1.2%.

Headline and core personal consumption expenditures -- a key gauge of inflation closely watched by the Federal Reserve -- are also tipped to stand at 3.4% and 3.9%, respectively, by the end of the year. These would be about a full percentage point higher than previous expectations, the analysts flagged.

The unemployment is seen increasing to 4.9%, as higher uncertainty around the trajectory of Trump’s tariffs weighs on business confidence and hiring.

Although they are not anticipating a recession for the U.S. economy, "the gap between a sluggish growth outlook and a downturn has narrowed," the analysts said.

"Our narrative entering the year was ’slower growth, stickier inflation.’ In our March revisions our narrative shifted to ’slower growth, firmer inflation’ since an earlier implementation of tariffs was halting disinflation at a higher pace of inflation. Now our narrative is squarely in the realm of ’even slower growth and sharply firming inflation.’"

The analysts noted that the scope of some of Trump’s tariffs could be "negotiated lower," although they acknowledged that previously "underestimated both the speed of tariff implementation and the level of tariffs put in place."

Markets are still attempting to understand if the Trump administration plans to permanently impose the tariffs, which include a minimum 10% levy for all U.S. imports and targeted rates of up to 50%, or use them as a cudgle during negotiations with trading partners. On Monday, Trump said "both can be true."

U.S. Trade Representative Jamieson Greer is due to tell the Senate Finance Committee on Tuesday that he has been approached by almost 50 countries asking to discuss Trump’s sweeping tariffs, according to media reports.

Greer will say in written testimony that several of these countries, like Argentina, Vietnam, and Israel, have suggested they will bring down their tariffs and non-tariff barriers, Reuters reported.

Feeling boxed into a corner by the United States' intensifying tariff assault on China and any country that buys or assembles Chinese goods, is bracing for an economic war of attrition.

Washington last week imposed import tariffs of at least 10% on almost the entire world, and much higher levies on countries such as Vietnam, where Chinese factories have been shifting production. This drew retaliation from China, followed by new threats of escalation from U.S. President Donald Trump.

"Whoever surrenders first becomes the victim," said a Chinese policy adviser, asking for anonymity due to the topic's sensitivity. "It’s a matter of who can hold out longer."

China has no great options, though. It will court other markets in Asia, Europe and the rest of the world, but this may not be much of an escape valve.

Other countries have much smaller markets than the U.S., and local economies are also taking a hit from the tariffs. Many are also wary of allowing more cheap Chinese products in.

Domestically, a currency devaluation would be the simplest way to cushion the tariffs' impact but that could trigger capital outflows, while also alienating trade partners China may try to court. China has so far allowed very limited yuan depreciation.

More subsidies, export tax rebates or other forms of stimulus could be on the cards, but this also risks exacerbating industrial overcapacity and fuelling more deflationary pressures.

Analysts have advocated for years for policies that would boost domestic demand.

But despite Beijing's declarations, little has been done to meaningfully increase household consumption, given that the bold policy shifts that would be required could prove disruptive to the manufacturing sector in the short term.

Hitting back with its own tariffs and export controls may not be very effective, given China ships to the U.S. about three times as much in goods than around $160 billion it imports. But it may be the only option if Beijing believes it has a higher pain threshold than Washington has.

So far China has responded to last week's additional 34% U.S. tariffs with a similar blanket counter-levy. As Trump threatened escalation with an extra 50% hike, Beijing vowed to "fight to the end".

"China cannot inflict as much pain on the U.S. as it receives, since it runs the big trade surplus and, rare earths aside, still has more to lose from export controls," said Arthur Kroeber, head of research at Gavekal.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up