Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

FintechZoom.com Bitcoin ETF analysis explores ROI, risks, and data reliability, helping investors assess if FintechZoom insights make Bitcoin ETFs a smart choice.

FintechZoom.com Bitcoin ETF has become a focal point for investors seeking data-driven insights into cryptocurrency-linked funds. As Bitcoin ETFs gain mainstream traction, FintechZoom provides timely analysis on performance, risk exposure, and market sentiment. This article explores how its reports guide investors in understanding opportunities and challenges in today’s Bitcoin ETF landscape.

A Bitcoin ETF, or exchange-traded fund, allows investors to gain exposure to Bitcoin’s price movements without directly owning the cryptocurrency. Traded on traditional exchanges, it mirrors the performance of Bitcoin while offering the convenience of regulated market access. FintechZoom.com Bitcoin ETF coverage explains this mechanism in depth, helping readers understand how institutional and retail investors participate.

Unlike direct crypto ownership, a Bitcoin ETF simplifies investing by removing wallet management and security challenges. FintechZoom.com investments often highlight how this structure appeals to investors who want diversification with reduced operational complexity. It bridges the gap between traditional finance and the growing fintechzoom.com cryptocurrency ecosystem.

Platforms such as fintechzoom.com bitcoin provide insights into how ETFs differ from direct holdings or fintechzoom.com bitcoin mining, emphasizing transparency, liquidity, and accessibility. As fintechzoom.com bitcoin stock coverage expands, investors are increasingly using ETF data to compare traditional assets with emerging digital markets like fintechzoom.com bitcoin price trends.

Bitcoin ETFs have gained momentum as investors seek exposure to the crypto market without the operational complexity of direct ownership. FintechZoom.com Bitcoin ETF analysis highlights consistent capital inflows and the growing role of institutional participation. These products often mirror fintechzoom.com bitcoin price movements, allowing traders to benefit from market rallies while enjoying regulatory transparency.

Data featured on fintechzoom.com investments suggests that Bitcoin ETFs performed strongly during major bull cycles, aligning with rising fintechzoom.com bitcoin stock interest among diversified portfolios. However, profitability depends heavily on entry timing and market cycles. FintechZoom.com cryptocurrency reports show that ETFs can also outperform direct holdings when fees and custodial risks are considered.

| Year | Bitcoin ETF Avg. Return | Spot Bitcoin Return |

|---|---|---|

| 2023 | +42% | +38% |

| 2024 | +31% | +29% |

Compared to fintechzoom.com bitcoin mining or direct token holding, ETFs simplify exposure while maintaining profit potential. Yet, investors should remember that gains are still driven by Bitcoin’s volatility and broader market demand.

Despite the accessibility benefits, the risks of a Bitcoin ETF remain significant. FintechZoom.com Bitcoin ETF reviews frequently cite high price swings linked to spot market fluctuations. The same volatility that creates opportunity can also result in short-term losses.

Fintechzoom.com bitcoin insights emphasize that investors should assess each fund’s management fee and tracking method. In periods of uncertainty, fintechzoom.com bitcoin and fintechzoom.com bitcoin stock often move together, intensifying market pressure. Understanding these elements is key to managing portfolio exposure effectively within fintechzoom.com cryptocurrency investments.

FintechZoom.com has become a recognized source for cryptocurrency and investment insights, especially regarding the fintechzoom.com bitcoin etf. The platform offers updates on market trends, expert commentary, and ETF fund performance, helping readers interpret market data through a financial journalism lens. Its reports combine fundamental and technical views, often referencing fintechzoom.com bitcoin stock behavior and institutional sentiment.

Investors evaluating fintechzoom.com investments often appreciate its accessibility and timely analysis. The site compiles information from multiple exchanges and asset managers, presenting a wide perspective on digital asset performance. However, users should still cross-reference data with official ETF filings and other credible sources to ensure accuracy.

Transparency and data reliability are essential for investor confidence. While fintechzoom.com bitcoin etf reports often highlight new opportunities, investors should remember that opinions expressed by analysts do not eliminate the inherent risks of a Bitcoin ETF. The best approach is to use FintechZoom as one data point among many in constructing a broader investment strategy.

Overall, fintechzoom.com cryptocurrency analysis provides valuable context for market participants but should be complemented with independent research and professional advice before making major portfolio decisions. For long-term investors, the key is distinguishing between short-term sentiment and enduring structural trends within fintechzoom.com bitcoin markets.

The leading Bitcoin ETFs often mentioned on fintechzoom.com bitcoin etf updates include BlackRock’s IBIT and Fidelity’s FBTC. These funds attract strong inflows and offer low fees, but performance still depends on overall bitcoin market trends.

FintechZoom.com is a widely used platform for fintech and cryptocurrency coverage. While its data is timely, investors should cross-check fintechzoom.com investments information with official ETF disclosures before acting.

Bitcoin ETFs provide a regulated entry point into digital assets, removing wallet and custody issues. However, investors should understand the volatility and other risks of a bitcoin ETF before committing capital.

Several spot Bitcoin ETFs have already received approval in major markets, and fintechzoom.com bitcoin coverage tracks future proposals closely. Further approvals depend on regulatory reviews and evolving market maturity.

FintechZoom.com Bitcoin ETF analysis offers investors valuable insight into returns, volatility, and market behavior. While the platform delivers timely updates, decisions should rely on diversified research. Overall, fintechzoom.com bitcoin etf coverage helps bridge traditional investing with the fast-evolving cryptocurrency landscape, providing informed guidance for market participants.

Key points:

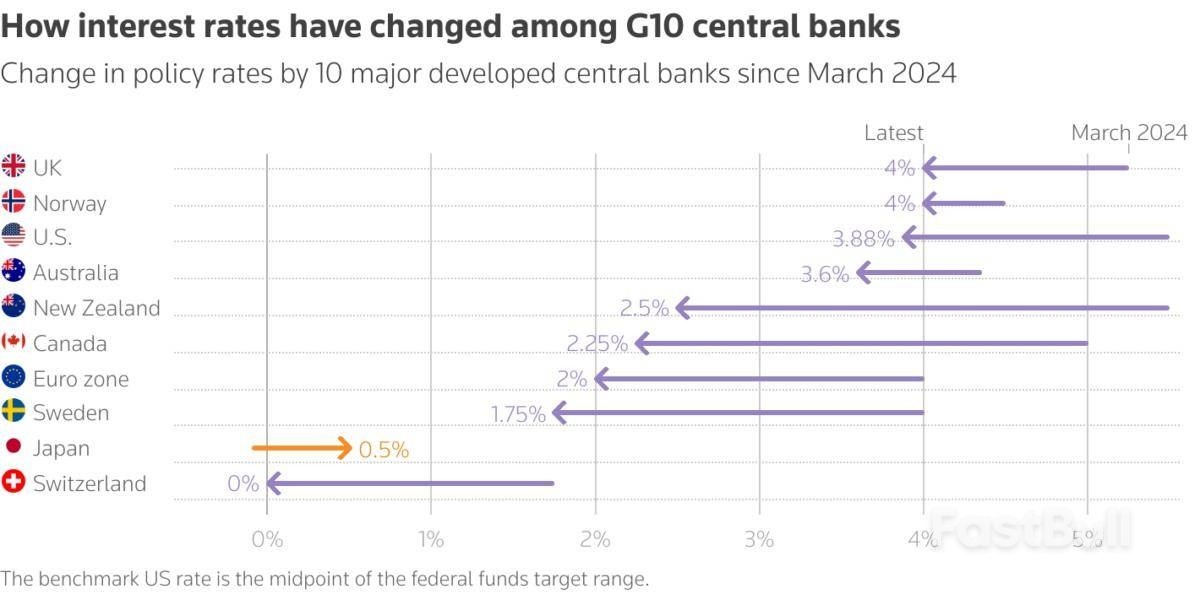

The U.S. Federal Reserve has moved back into line with other major rate setters after it cut rates by a quarter point on Wednesday but pushed back against market bets that it would keep going as the Washington shutdown fogs up its forecasting lens.

The Bank of Japan and European Central Bank left rates unchanged on Thursday.

Here's where 10 major central banks stand after the latest round of meetings:

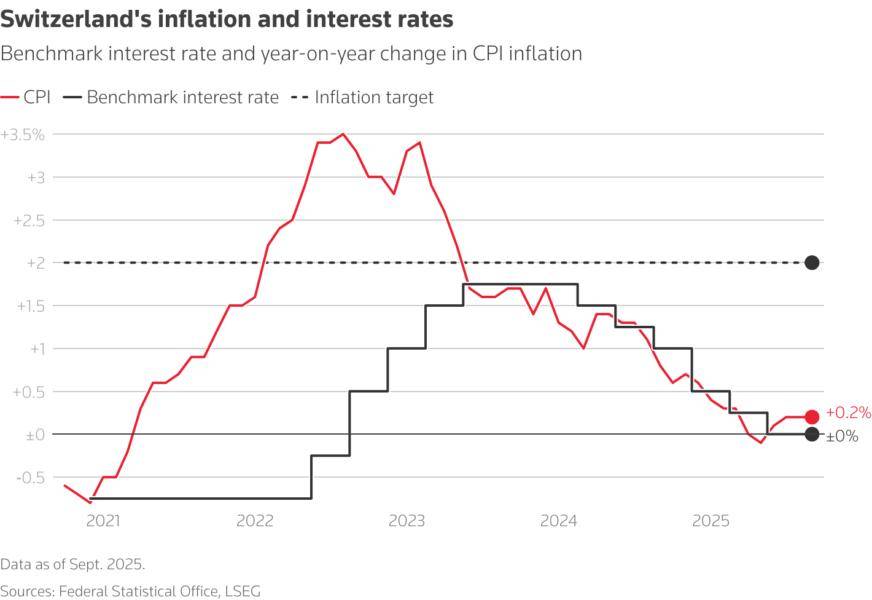

The Swiss National Bank cut its key rate to 0% in June and is widely expected to hold steady with markets pricing a long pause.

In its first set of minutes detailing its rate setting discussions, published last week, the SNB quashed market speculation that it would return to negative rates to stop the strong francpushing the sluggish economy into deflation.

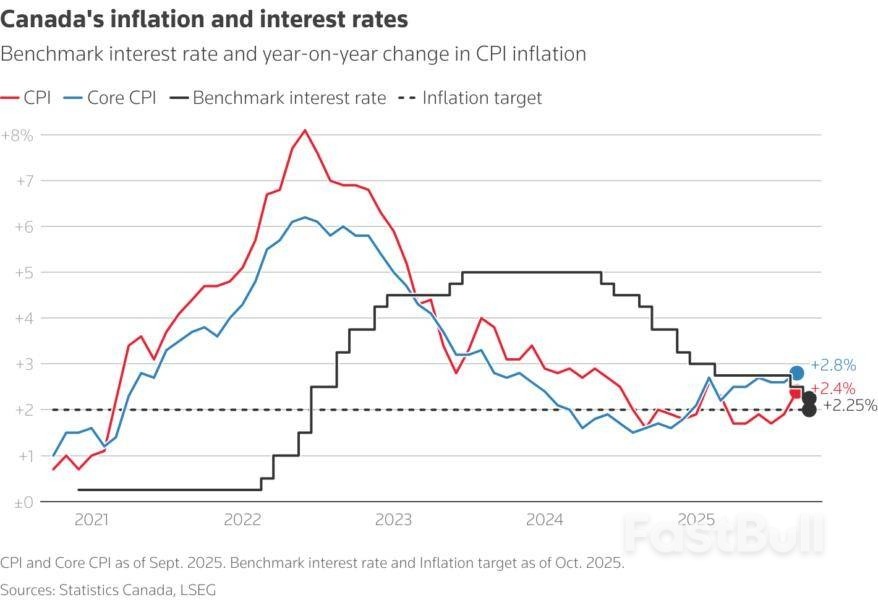

The Bank of Canada, battling an economic slowdown exacerbated by U.S. tariffs and the inflationary impact of the trade war, cut rates to a more than three-year low of 2.25% on Wednesday.

It also sent strong signals that easing ends here and traders see more than 60% odds on the BoC standing pat until December 2026.

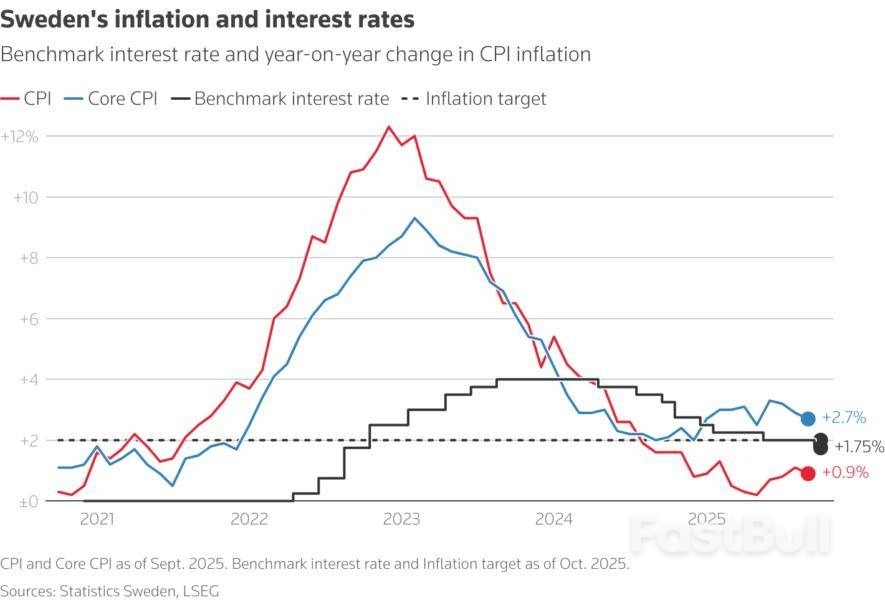

Money markets price in less than a one in five chance of further easing before 2026 as domestic inflation stays sticky, which has sent traders piling in to Sweden's crown. The currency has risen 15% against the dollar year-to-date. (0#SEKIRPR)

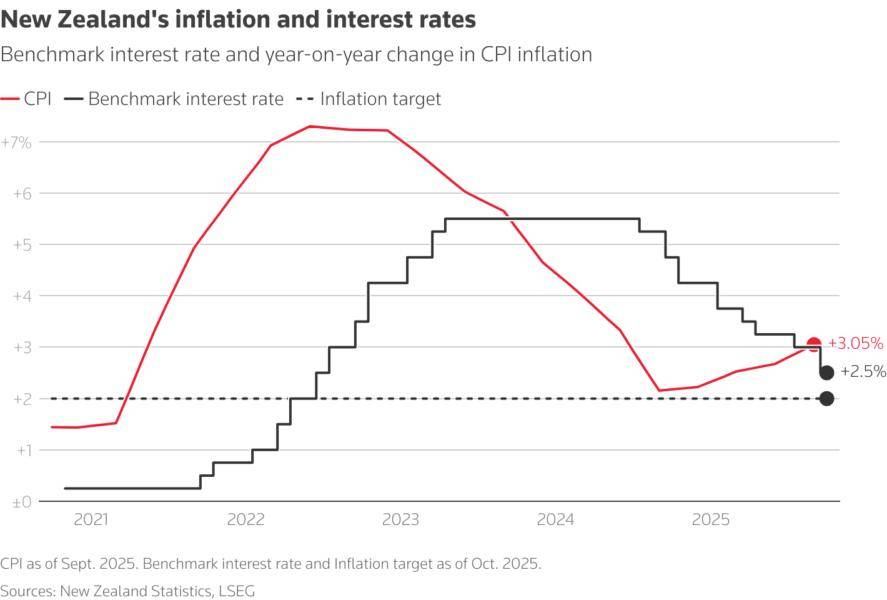

The Reserve Bank of New Zealand cut rates by a punchy 50 basis points (bps) to 2.5% this month in an attempt to prop up a frail economy.

Markets see a good chance of a further cut in late November, though inflation sitting at the top of the RBNZ's 1-3% target band could be a complication.

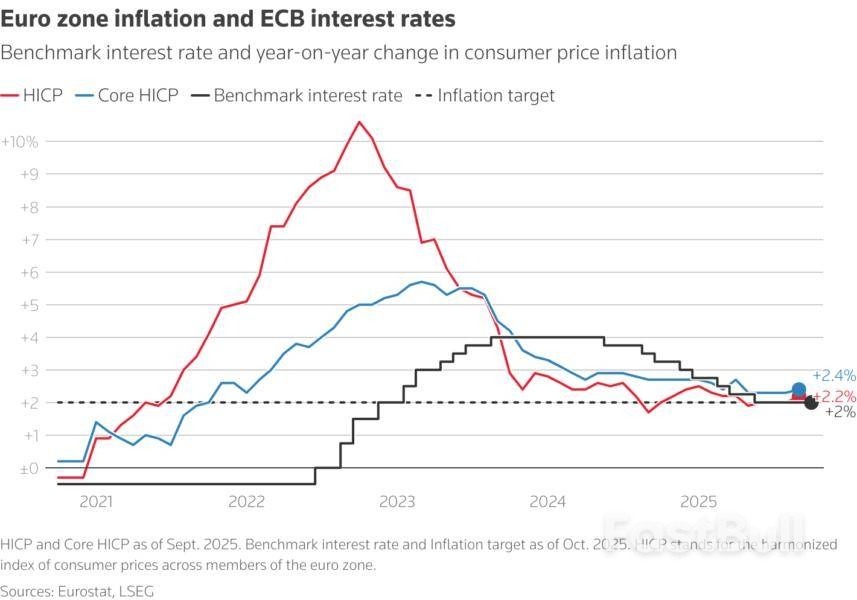

The ECB on Thursday matched traders' expectations and held the bloc's main deposit rate at 2% for a third straight meeting.

Traders viewed this ECB easing cycle as almost over, pricing in less than a 50% chance of further easing by July 2026.

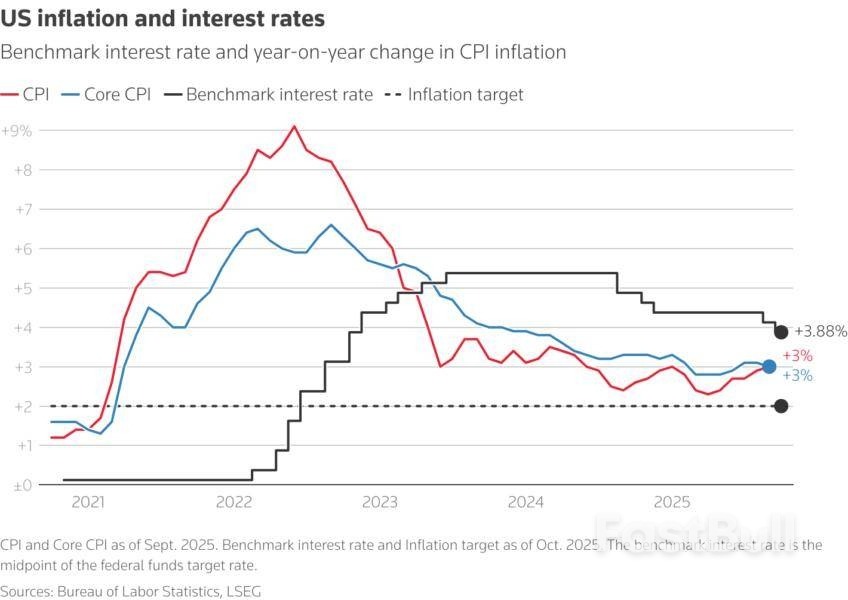

The Fed on Wednesday executed a widely flagged 25 bps cut but pushed back against market bets for more by warning that data gaps caused by the U.S. government shutdown were clouding its forecasting lens.

"If you're driving in the fog you slow down," Chair Jerome Powell said in his post-announcement press conference.

The rate cut drew dissent from two policymakers, with Stephen Miran again calling for a deeper reduction and Kansas City Fed President Jeffrey Schmid favoring no cut given above-target inflation.

Traders price a 70% probability of a 25 bps December cut, down from 84% ahead of Wednesday's decision.

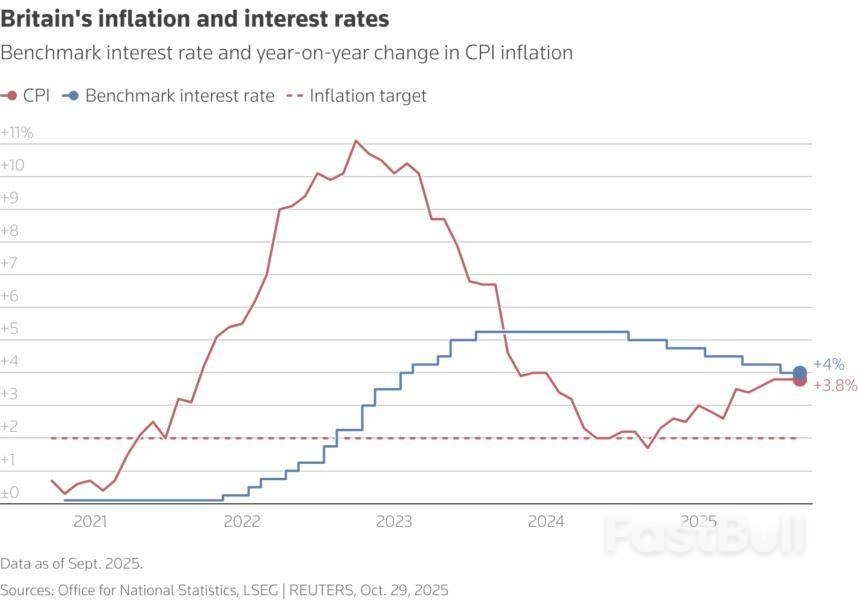

The Bank of England is another major rate setter that is signalling cautious moves from here as it kept rates unchanged at its last meeting and said inflation risks remained high.

Traders expect another hold on November 6 but markets price a 60% chance of a December cut after above-target UK inflation at least held steady in September.

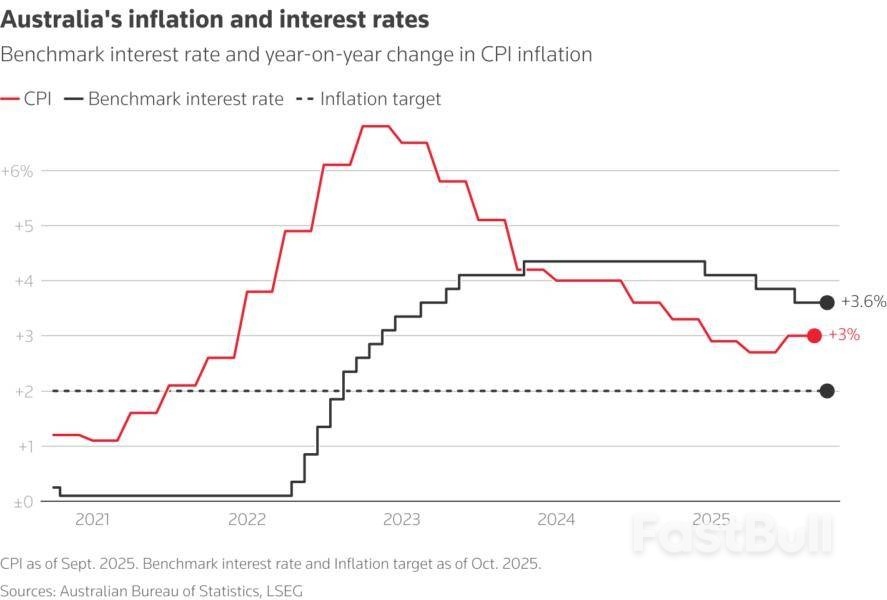

The Reserve Bank of Australia has cut rates by 75 bps since February but hotter-than-expected inflation encouraged it to hold rates steady and turn more hawkish in September.

That trend has continued, pushing expectations for the next cut forward to at least February 2026. (0#AUDIRPR).

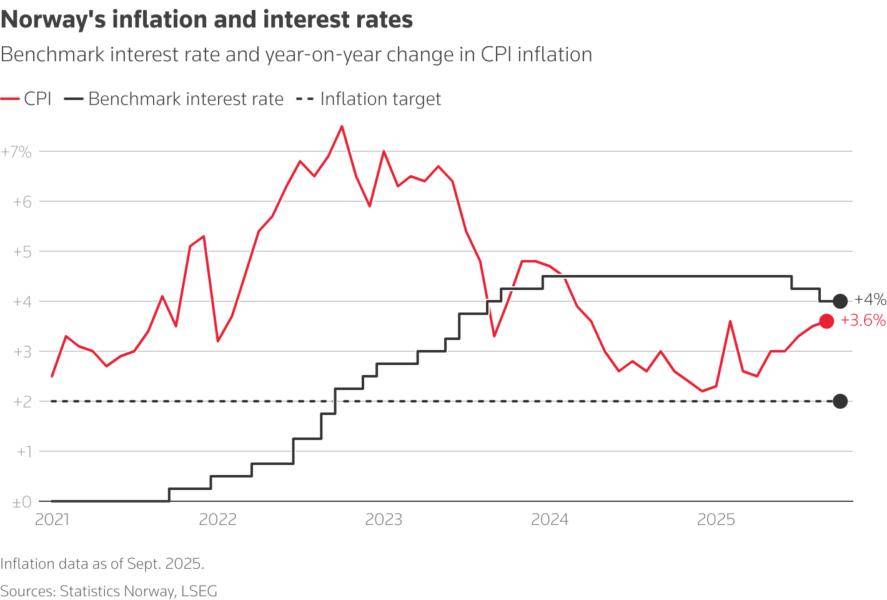

Norway's central bank eased borrowing costs by 25 bps to 4.0% in September but signalled further cuts were less likely because underlying inflation was rising. That has helped the crown keep powering higher against the dollar, with a 12% gain for the year so far (0#NOKIRPR).

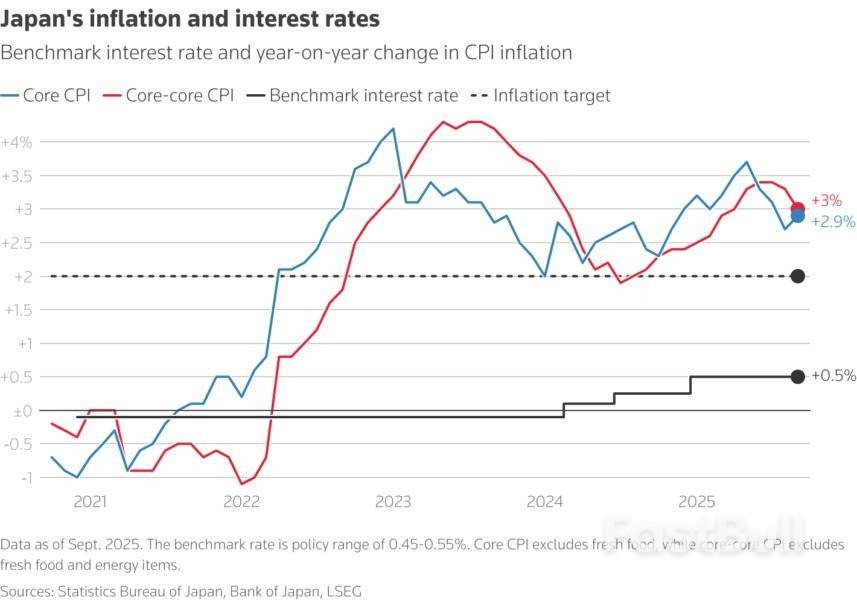

The Bank of Japan, the sole central bank in hiking mode, kept rates steady on Thursday but repeated its pledge to keep increasing borrowing costs if the economy moves as it projects, shifting investor focus to December's meeting.

The yenweakened after the announcement.

U.S. Treasury Secretary Scott Bessent this week called for speedier BOJ rate hikes to avoid weakening the currency too much.

Debate over XRP’s identity keeps resurfacing: is xrp a meme coin or a payments-focused utility token? This article gives a clear answer first, then tests the claim with evidence—technology, use cases, market positioning, and adoption. You’ll see how XRP differs from meme coins, why perceptions persist, and what it means for research-driven investors. We also outline risks, limits, and context.

Meme coins are cryptocurrencies born from internet jokes or community trends rather than clear technical or financial objectives. Their value usually depends on viral exposure, celebrity mentions, or social sentiment instead of utility. Classic examples include Dogecoin, Shiba Inu, and PEPE. Unlike assets such as XRP, which have defined use cases, most meme coins rely on community-driven enthusiasm.

No, XRP is not a meme coin. XRP is not a meme coin but a blockchain-based asset built for payment efficiency. Yet, the ongoing debate continues as investors and analysts explore its nature. To determine whether XRP belongs in the same category as DOGE or SHIB, it helps to analyze its architecture, market fundamentals, and ecosystem performance against typical meme projects.

When people ask “is xrp a meme coin today,” they often refer to its online popularity and price volatility. However, an evidence-based comparison shows XRP’s foundation differs completely. While meme tokens exist purely for cultural engagement or speculation, XRP’s value links to real-world usage within financial systems. Even if it sometimes trends as an xrp meme coin across social media, its operational framework places it closer to a utility asset than to hype-driven cryptos.

The XRP Ledger underpins Ripple’s payment ecosystem and processes thousands of transactions per second with minimal energy use. In contrast, most meme coins are secondary tokens that depend on host chains like Ethereum or Solana. They lack independent consensus mechanisms or scaling innovations. This technical distinction clarifies why XRP cannot be grouped with meme assets, even though some meme coins on xrp ledger exist as side projects for community fun.

| Feature | XRP | Meme Coins |

|---|---|---|

| Blockchain Type | Native ledger (XRP Ledger) | Built on existing networks (ERC-20/Solana) |

| Transaction Speed | 3–5 seconds per transaction | Dependent on host chain traffic |

| Energy Efficiency | Low (Consensus Protocol) | Varies; often higher cost |

| Core Objective | Global payments and liquidity | Community engagement and speculation |

Many traders ask “is xrp considered a meme coin” because its price often moves with retail sentiment. Yet XRP’s valuation model is utility-based. Ripple’s partnerships with banks and fintech firms give it a role as a bridge currency, while meme coins thrive on momentary excitement. Unlike coins that depend on influencer promotion, XRP gains relevance from institutional adoption and transactional throughput.

Comparing XRP with hype-driven assets clarifies that it functions as a structured digital payment instrument rather than an xrp memecoin or short-lived social phenomenon.

Within the ripple ecosystem meme coins sometimes emerge, but they are secondary experiments rather than the system’s foundation. XRP’s role is to provide liquidity for On-Demand Liquidity transactions and cross-border settlements. The network’s partnerships with entities like Santander, Tranglo, and SBI highlight its professional-grade use. Even if speculative tokens appear as meme coins on xrp ledger, they do not define XRP’s utility.

For users evaluating “is xrp a meme coin or altcoin,” the clearer classification is that XRP is a utility altcoin designed for real payments. It occupies a hybrid space: technically an altcoin but functionally a financial settlement asset.

The popularity of meme tokens rests on their viral culture. They spread through Twitter, Reddit, and TikTok via trends like xrp memes, celebrity endorsements, and online humor. Such momentum may attract attention but rarely builds sustainable value. XRP, on the other hand, gains legitimacy from measurable adoption and compliance frameworks.

Meme tokens depend on attention cycles; XRP depends on utility cycles. Understanding this difference explains why XRP’s identity has substance beyond internet hype, reaffirming that despite the debates, it remains a legitimate utility-driven digital asset.

Despite its strong fundamentals, some traders and online communities label XRP a meme coin. The confusion stems from overlapping market behavior, social hype, and the rise of smaller tokens inspired by xrp memes. In times of market volatility, XRP’s sharp rallies can mimic those of meme-based projects, leading newcomers to question its identity.

Another reason lies within the broader ripple ecosystem meme coins narrative. While meme coins on xrp ledger exist, they serve different purposes than XRP itself. These tokens borrow visibility from XRP’s ecosystem but lack the institutional adoption or payment network backing that define XRP’s true role.

Critics who still ask “is xrp considered a meme coin” or “is xrp a meme coin or altcoin” overlook its integration in cross-border liquidity systems and regulated financial corridors. The overlap of retail excitement with institutional adoption blurs perceptions, yet evidence continually points to XRP being a practical utility token, not a speculative fad.

XRP is a digital asset built for payments, not a meme-based token. It supports real-world transactions and liquidity management within Ripple’s global network. While small meme coins on xrp ledger exist, XRP itself functions as a utility token with institutional adoption.

Most analysts consider a $100 price target highly unrealistic under current supply and market capitalization levels. For XRP to reach such valuation, it would require trillions in capital inflow—beyond the total crypto market size. The focus should remain on XRP’s adoption rather than speculation.

XRP is viewed as a solid crypto for utility-driven investors due to its speed, cost efficiency, and partnerships. Whether it is a “good” investment depends on individual risk appetite, but its underlying purpose and use cases set it apart from speculative meme coins.

In summary, despite community hype and social comparisons, XRP’s fundamentals prove it is not a meme coin. The question is xrp a meme coin underscores how perception can blur reality, but evidence shows it operates as a real-world utility token focused on payments, liquidity, and enterprise adoption.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up