Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Loretta Mester, Cleveland Fed President, emphasized cautious monetary policy amid persistent inflation, October 2023.

Loretta Mester, Cleveland Fed President, emphasized cautious monetary policy amid persistent inflation, October 2023.

Her stance influences financial markets, particularly Bitcoin and Ethereum, vigilantly watching U.S. monetary policy changes.

Cleveland Fed President Loretta Mester urged caution in easing monetary policy due to persistent inflation above the 2% target. Mester, known for her hawkish stance, mentioned the close proximity to the neutral rate, expressing worries about potential economic overheating if constraints are lifted prematurely.

Market reactions have been mixed, with key figures like Raoul Pal and Arthur Hayes commenting on potential volatility. Pal noted the complex dynamics in play, while Hayes suggested preparing for eventual market movements when policy shifts occur.

Market reactions have been mixed, with key figures like Raoul Pal and Arthur Hayes commenting on potential volatility. Pal noted the complex dynamics in play, while Hayes suggested preparing for eventual market movements when policy shifts occur.

The U.S. dollar faced continued pressure in early trading in Asia on Tuesday as traders parsed comments by members of the Federal Reserve for clues on the path of interest rates.The greenback edged lower, extending declines after snapping a three-day winning streak on Monday, with the U.S. dollar index last at 97.28."It’s a slightly hawkish tone from Fed speakers that has given people a little bit of pause for thought," said Tony Sycamore, market analyst at IG in Sydney.

Investors are assessing the impact of U.S. President Donald Trump’s economic policies on the health of the global economy and the implications for Federal Reserve policy ahead of the release of core personal consumption expenditures (PCE) data later this week.Congressional funding talks this week to avert a government shutdown on September 30 have added to market jitters.Traders have reined in bets of interest rate cuts at the Federal Open Market Committee’s October meeting, with Fed funds futures implying a 10.2% chance of a hold, compared to a probability of 8.1% on Friday, according to the CME Group’s FedWatch tool.

Against the yen, the dollar was flat at 147.74 yen, remaining firmly in the trading range it has sat in since the start of August. Japanese markets were closed for a public holiday on Tuesday.The kiwi weakened 0.1% to $0.5867 after the New Zealand government said it would make an announcement related to the central bank on Wednesday at 1 p.m. (0100 GMT), as markets await the appointment of a new governor.

Gold hit a fresh record high of $3,749.03 per ounce.

The yield on benchmark 10-year Treasury notes extended its climb to 4.1467% after reaching a three-week high at the U.S. close of 4.145% on Monday. The two-year yield, which rises with traders’ expectations of higher Fed funds rates, edged up to 3.6051% compared with a U.S. close of 3.601%."Yields on Treasuries ticked slightly higher amid several Fed officials suggesting a more cautious approach to the cutting cycle and emphasising that there remain upside inflation risks," Westpac analysts wrote in a research note. "Investors pulled back the likelihood of a U.S. Fed rate cut in October following the comments."

St. Louis Fed President Alberto Musalem, who votes on Fed policy this year, said the central bank "should tread cautiously", as its policy rate accounting for inflation might already be close to neutral.Atlanta Fed President Raphael Bostic, in a Wall Street Journal interview, said the focus needed to remain on ensuring inflation returns to the Fed’s 2% target from a current level about a percentage point higher and that further rates cuts this year were not needed.Cleveland Fed President Beth Hammack also said the Fed "should be very cautious in removing monetary policy restriction". Neither Bostic nor Hammack votes on Fed policy this year.

Meanwhile, new Federal Reserve Governor Stephen Miran said on Monday that the Fed was misreading how tight it has set monetary policy and would put the job market at risk without aggressive rate cuts.Fed Chair Jerome Powell will speak on the economic outlook later on Tuesday.

The euro stood at $1.1798, little changed so far in Asia, paring gains after its best daily performance in a week from Monday.The dollar sank 4.5% against Argentina’s peso after U.S. Treasury Secretary Scott Bessent said on Monday that "all options" were on the table for stabilising Argentina, including swap lines and direct currency purchases.He added no steps would be taken until after he and Trump meet with Argentine President Javier Milei in New York on the sidelines of the United Nations General Assembly on Tuesday.The Australian dollar fetched $0.6599, weakening 0.1% in early trade, after hitting a two-week low on Monday.

The offshore yuan traded unchanged at 7.1158 yuan per dollar.

Sterling fluctuated between gains and losses, last trading flat at $1.35125.

Oil was little changed after a four-day decline as investors assess the potential impact of moves by western nations to curtail Russian energy exports.

West Texas Intermediate’s November contract traded near $62 a barrel after falling almost 3% over the previous four sessions, while Brent settled below $67. Canadian Prime Minister Mark Carney said he wants to see western allies impose secondary sanctions on Russia quickly in order to dramatically ramp up pressure on President Vladimir Putin.

The latest threat to the OPEC+ member’s supply comes after President Donald Trump urged European countries to stop buying Russian energy as he seeks to stem the biggest source of funds for the war in Ukraine. However, the US has so far spared China — the biggest buyer of Moscow’s barrels — from additional tariffs after slapping a 50% rate on India for its purchases last month.

The lack of concrete new measures has left oil in limbo — with prices stuck in a narrow $5 a barrel band since early August as traders also assess forecasts for a surplus later in the year. Breaking out of that range would likely require western nations to align on harsher measures against buyers of Russian oil, said Dennis Kissler, senior vice president for trading at BOK Financial.

Longtime readers might have noticed that I rarely spend much time writing about macroeconomic issues. One of my core beliefs is that it’s almost impossible to predict the future direction of interest rates, economic growth, currency movements, and inflation, not to mention how those factors might impact investment performance.As Peter Lynch famously said, “If you spend 13 minutes a year on economics, you’ve wasted 10 minutes.”

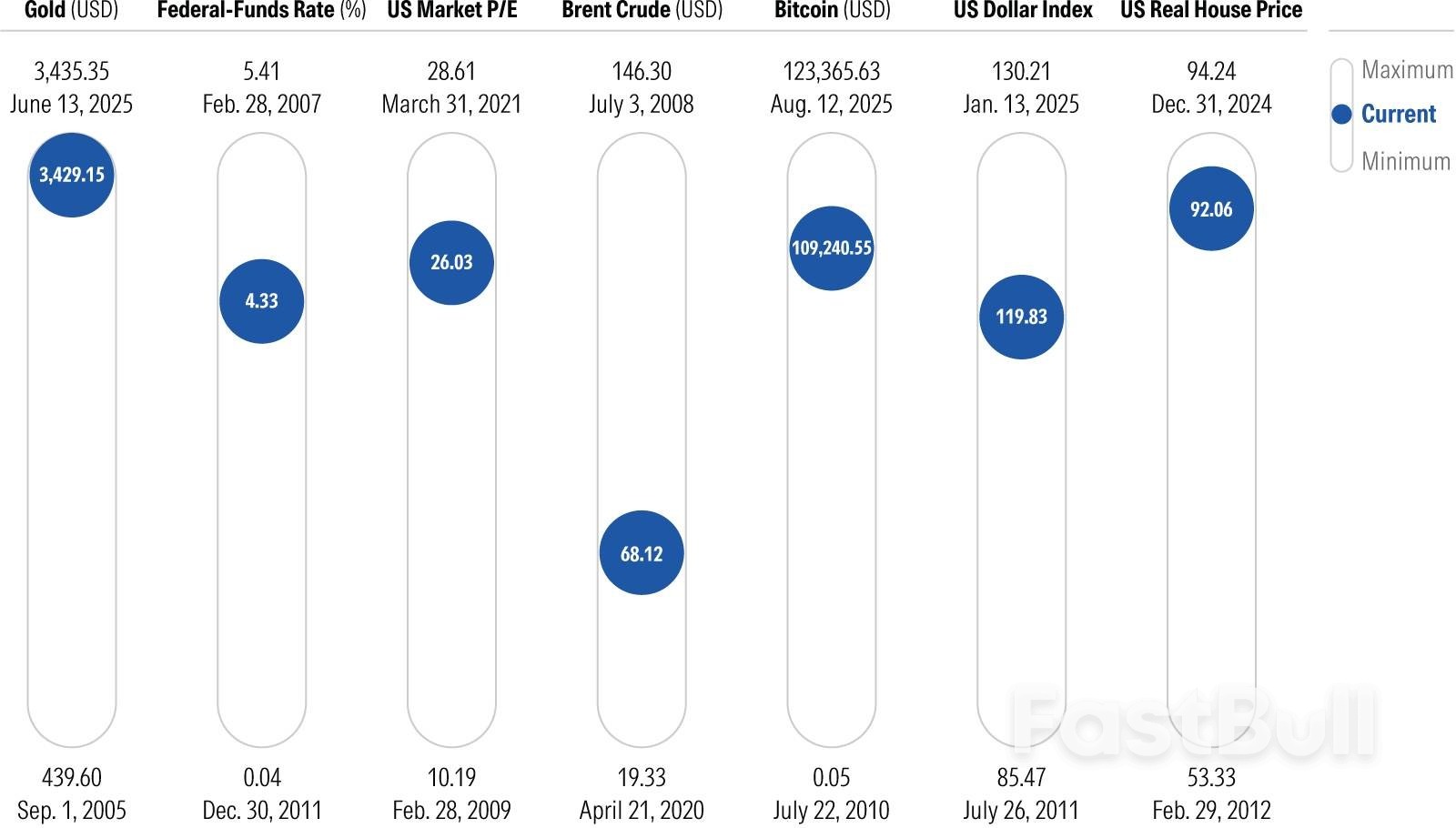

That said, it can be helpful to zoom out and take a big-picture view from time to time. To do so, I updated a chart included in Morningstar’s Markets Observer that depicts seven key metrics and where each one stands relative to its range over the past 20 years. I like this chart because it packs in so much information; even without reading all the details, you can glean that six of these seven metrics currently stand at pretty high levels relative to their historical ranges. Writ large, that suggests some caution may be warranted.

The chart shows where each indicator sits relative to its maximum and minimum over the past 20 years.

Current level: Very high

What it means: Gold has been on a tear but be wary of chasing performance.

As I wrote in a recent article, gold has been the top-performing major asset class over the past 20 years, and also gained more than 31% for the year to date through Aug. 31, 2025. This performance has partly been driven by central banks around the world buying up gold as they “de-dollarize” their reserve assets, as well as other investors seeking a safe haven amid macroeconomic turmoil and geopolitical uncertainty.

Those trends could continue, but there’s also additional risk now that gold is trading at such a pricey level. Academic researchers Campbell Harvey and Claude Erb have found that, over time, gold prices tend to revert to the mean. When gold is trading at elevated prices in inflation-adjusted terms, prices have often declined in subsequent periods. That happened in 1980, when steep prices were followed by a long period of sluggish returns during most of the following decade. The same pattern showed up when the real price of gold reached a peak in August 2011, which was followed by a sharp downturn from 2013 through 2015.

In short, the recent runup in gold means potential risk is even higher than usual. In my opinion, it’s prudent to limit any gold exposure to 5% of the total portfolio (or less). And it’s important to keep in mind that the current bull run probably won’t last forever.

Current level: Relatively high

What it means: Even after a rate cut, yields on cash are still higher than inflation, making fixed-income securities relatively attractive.

The midpoint of the target range for the federal-funds rate stood at 4.33% as of Aug. 31 (the date for all of the data above) but has since declined to about 4.15%. However, the fed-funds rate remains significantly higher than its low of 0.04% as of late 2011, when the Federal Reserve’s zero interest rate policy reached its nadir. In the wake of the global financial crisis, the Fed aggressively dropped short-term rates to near zero to stabilize the economy. It also purchased US Treasuries and agency mortgages as another way to keep bond yields low. ZIRP and successive rounds of quantitative easing led to a nearly 15-year period of low borrowing costs.

Fast forward to March 2022, and ZIRP became a distant memory as the Fed embarked on a series of aggressive interest-rate hikes to tamp down inflation. But even now that rates have once again been moving lower, yields on cash and short-term securities remain relatively attractive. For example, the three-month Treasury bill yield of about 3.98% as of Sept. 19, 2025, remained well above the most recent annual inflation rate of 2.90%. As a result, investors saving for short-term goals don’t need to worry about the value of their savings eroding over time, at least for the moment.

More broadly, yields on high-quality fixed-income securities remain significantly higher than they were a few years ago. When rates were extremely low, there was nowhere for yields to go but higher and nowhere for bond prices to go but lower. Now we’re clearly in a different environment, making bonds more attractive than they were a decade ago.

Current level: High

What it means: Domestic stocks are priced at steep levels, making international diversification even more important than usual.

US stocks have been the second-best-performing major asset class over the past 20 years (falling just slightly short of gold over that period). Aside from a couple of brief downturns in 2018, early 2020, and 2022, domestic equities have continued to power ahead, with price gains driven by growth in corporate earnings as well as multiple expansion. As a result, the overall price/earnings ratio for the Morningstar US Market Index has more than doubled from its low of 10.19 in the wake of the global financial crisis. The benchmark’s P/E as of Aug. 31 was down slightly from a peak of 28.61 but still on the high end of the range over the past 20 years.

Equity valuations could remain elevated if corporate earnings continue to deliver, but high prices also mean stocks have more room to fall if growth falls short of expectations. And now that valuations have already climbed higher, there’s not as much room for future multiple expansion as a driver of equity market returns.While the US market as a whole isn’t in the bargain bin, there are still some pockets of value available for price-conscious investors. Smaller-cap stocks, as well as sectors such as energy, healthcare, and real estate, look more attractive based on Morningstar’s estimates of their underlying fair value. And valuations on international stocks remain lower than those of their domestic counterparts, despite the strong gains in non-US stocks so far this year.

Current level: Relatively low

What it means: Consider adding a small position in a broad-based commodity fund that includes energy exposure for inflation protection.

The price of oil has been subject to dramatic highs and lows over the past 20 years. At the beginning of the period, prices surged, driven by growing demand from China and other emerging markets, combined with limited supply. As a result, prices reached a peak of about $146 per barrel in July 2008. That was followed by a precipitous drop during the global financial crisis, when the price dropped by more than 50%. Prices partially recovered over the next few years, only to suffer sharp losses in 2014, and 2015 as the OPEC group of major oil-exporting countries kept production levels high, leading to a glut in supply. Fast forward to the pandemic, and oil prices reached a low of $19.33 per barrel in April 2020.

Since then, oil prices have partially recovered but have mostly been in a downtrend over the past few years. Concerns about economic weakness in China and the shift toward renewable energy have weighed on returns. Geopolitical issues such as ongoing wars in the Middle East and Ukraine have also added to uncertainty.Many of these headwinds could continue, and a potential economic slowdown in the United States would be another negative. But for investors who can tolerate risk, a small stake in a broad-based commodities fund that includes exposure to energy could help improve portfolio diversification and hedge against inflation.

Current level: High

What it means: If you don’t already hold bitcoin or other digital assets, beware of buying into the hype.Bitcoin is a newer entrant on the scene and didn’t exist until relatively recently. The pseudonymous Satoshi Nakamoto mined the initial genesis block on the bitcoin blockchain in early 2009, but most buyers couldn’t purchase bitcoin until later in the year. Initial purchases could be made for pennies on the dollar, with a low price of $0.05 per bitcoin in July 2010. Early buyers have racked up spectacular gains since then, and bitcoin’s annualized return of 86.2% over the trailing 10 years ended Aug. 31, 2025, made it by far the best-performing asset class over that period.

However, potential buyers should be aware of bitcoin’s extreme price volatility. In addition to its eye-popping gains, bitcoin has been subject to extreme drawdowns. The price dropped by about 75% between December 2017 and January 2019, and similar amounts during another “crypto winter” between October 2021 and December 2022.

Because bitcoin doesn’t generate cash flows, it’s tough to pin down what its value should be. And while the digital asset has started to gain more credibility among institutional investors, it remains a speculative asset with price swings often driven by fear of missing out. It’s now trading within about 10% of its peak of about $123,000 per bitcoin, making caution even more warranted.

Current level: Relatively high

What it means: The dollar could weaken further over the next several years.

For years, the US dollar seemed unstoppable. The Nominal Broad U.S. Dollar Index hit a low of 85.47 in July 2011 and mostly continued marching upward until the beginning of this year. Toward the start of the dollar’s long climb, it benefited from turmoil in other markets. As countries such as Greece, Italy, Portugal, and Spain grappled with unsustainable debt levels, investors fled euro-denominated assets and took refuge in the dollar instead.Generally strong economic growth and rising corporate earnings in the US also bolstered the dollar, as did the greenback’s undisputed position as the world’s leading reserve currency.

That narrative has started to change. For the year to date through Aug. 31, 2025, the Nominal Broad U.S. Dollar Index dropped about 7%. However, the current index value of 119.83 remains on the high end compared with the dollar’s range over the past 20 years. Central banks around the world have been “de-dollarizing” their reserves by purchasing both gold and other currencies. The rising federal debt, which is equivalent to 119% of gross domestic product, could also weaken investor confidence and further decrease demand for dollar-based assets. Additional rate cuts by the US Federal Reserve later this year would be another factor depressing demand for dollar-based assets.

All of this makes it especially important to make sure your portfolio has some exposure to non-dollar-denominated assets. In addition to domestic equity exposure, most portfolios should include an international-stock fund that doesn’t hedge its currency exposure.

Current level: Very high

What it means: Retirees may have an opportunity to tap into home equity to help cover spending needs, while younger people may be priced out of home buying.After dropping for a few years in the wake of the global financial crisis, US home prices have mostly climbed higher in inflation-adjusted terms. Our customized benchmark of real (inflation-adjusted) housing prices hit a low of 53.33 in early 2012 and is now close to its peak of 94.24.

While housing prices vary by location, many retirees may be sitting on hundreds of thousands of dollars in housing wealth. In the Chicago metropolitan area, for example, the average home is now priced at about $362,000, compared with as low as $160,000 in 2012. Retirees who don’t mind downsizing could sell an existing residence and move into a smaller condo, townhouse, or single-family home. Proceeds from selling a house could also be used to cover part of the costs for moving into a continuing-care retirement community.

Retirees who don’t want to relocate could also consider a home equity loan or home equity conversion mortgage, although both options can be pricey and complex.On the other end of the spectrum, younger people might find themselves priced out of buying a home. They might need to settle for a smaller fixer-upper or continue renting for a few more years while building up savings.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up