Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

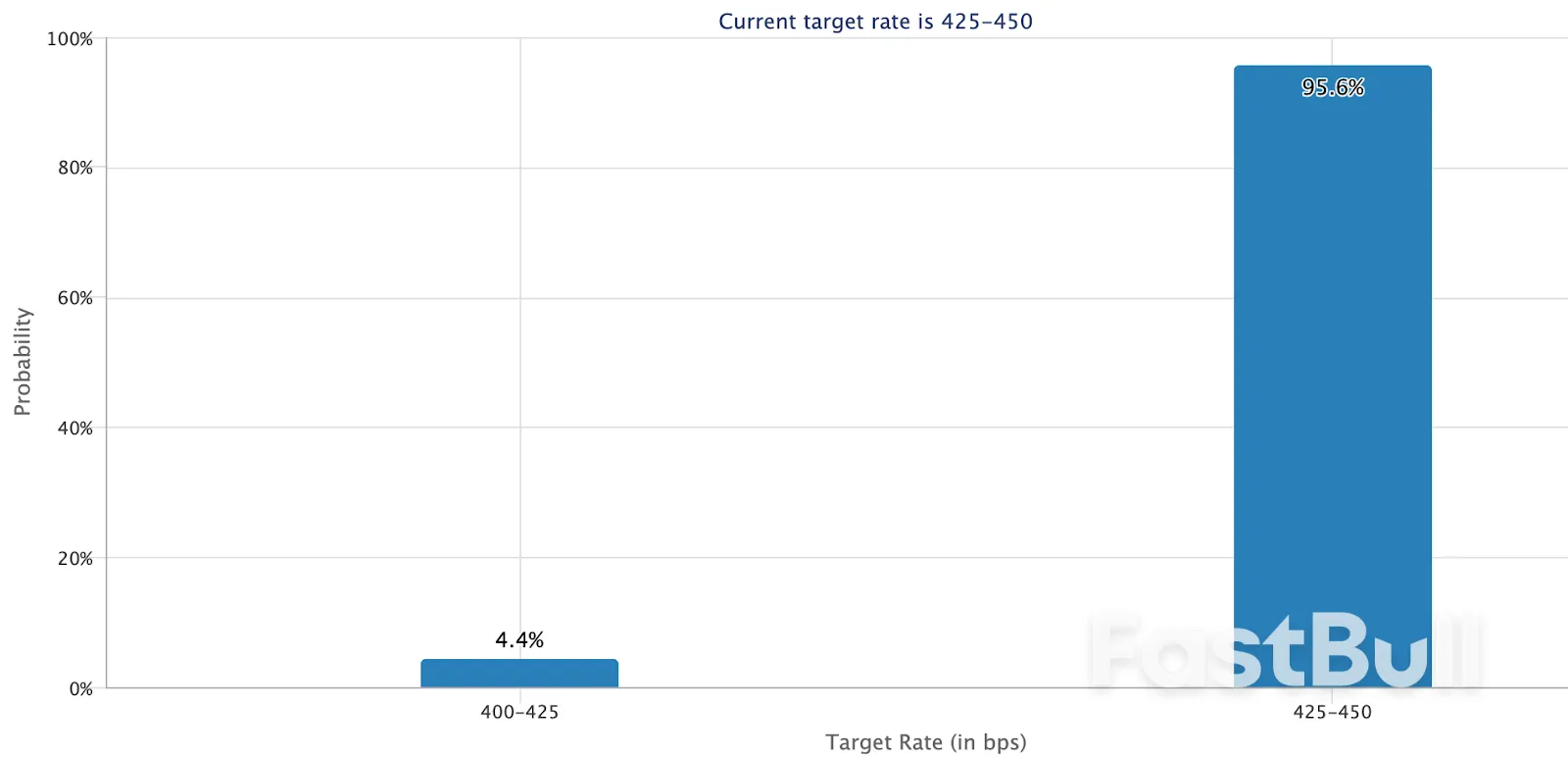

The Fed is expected to hold rates steady as it assesses the inflationary impact of Trump’s tariffs. Political pressure mounts, but uncertainty keeps policymakers cautious.

The Energy Information Administration (EIA) released its weekly report on Crude Oil Inventories, showing a decline in the number of barrels of commercial crude oil held by US firms. The data revealed that inventories decreased by 2.032 million barrels, a figure that surpasses the forecasted decline of 1.700 million barrels.

In comparison to the previous week’s data, the current figure is less than the 2.696 million barrel decrease. However, it still indicates a greater-than-expected reduction, which is a bullish indicator for crude prices. The level of inventories can significantly influence the price of petroleum products, and in turn, can have a substantial impact on inflation.

A decrease in crude inventories that is more than expected implies a stronger demand for crude oil, which can push prices higher. Conversely, an increase in inventories that surpasses expectations implies weaker demand and can put downward pressure on crude prices.

In this instance, the reported decrease in inventories, although less than the previous week, was still more than what was forecasted. This indicates a robust demand for crude oil, which is a positive sign for crude prices.

The EIA’s Crude Oil Inventories report is one of the key indicators watched by traders and investors, given its potential impact on the energy market and broader economy. Its importance is underscored by the fact that changes in crude oil prices can affect inflation, consumer spending, and the overall economic outlook.

This week’s data suggests that demand for crude oil remains strong, which could provide support for crude prices in the coming days. However, market participants will continue to closely monitor future inventory reports, as well as other factors such as global oil supply and demand dynamics, geopolitical developments, and economic indicators, in order to gauge the direction of crude prices.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

“We now live in a world that is losing faith in the US dollar,” Co-Founder Brad Dunkley said in a letter to investors seen by Bloomberg News. “Central banks and ordinary citizens, particularly in India, China and developing markets, have increasingly turned to gold to preserve their purchasing power.”

Dunkley said he expects gold will “do much of the heavy lifting” for the firm’s funds in 2025. Still, its two flagship funds, Waratah One and Waratah One X, lost 3.3% and 5% in the first quarter, respectively. The firm’s long-biased fund gained about 2% and its thematic fund climbed 4.5%.

Gold has surged to new records this year as investors and traders take a dimmer view of the US dollar amid President Donald Trump’s shifting trade and economic policies. The price of gold touched $3,500 for the first time last month, and the metal’s value is up by more than 45% over the past year.

Toronto-based Waratah expects the prices of copper, natural gas, and electricity to continue rising as the use of artificial intelligence proliferates, but remains skeptical that AI processing will ever be a good business. “There are just too many competitors lacking meaningful differentiation,” Dunkley wrote.

“The trillions of dollars being spent on quickly depreciating capital reminds me of the rollout of high-speed fiber optics: consumers and businesses are going to be the beneficiaries, not the capital spenders,” he said.

Waratah’s long-short equity fund, which has C$247 million ($179 million) in assets as of the end of February, increased its exposure to Canadian stocks — particularly engineering and construction companies — ahead of the country’s April 28 election. The firm expects higher infrastructure spending — a promise made by Prime Minister Mark Carney — as Canada responds to tariff threats, portfolio manager Jason Landau wrote in the same letter.

Other stock holdings include Nexgen Energy Ltd., a Canadian company with assets in Saskatchewan that has the potential to become a large uranium producer. The company is awaiting its final federal permit, which Landau said may be expedited after the election.

Waratah, founded by Dunkley and Blair Levinsky, managed about C$3.8 billion as of Feb. 28 for wealthy individuals, family offices, foundations and pension funds.

Gold prices fell more than 1% on Wednesday as hopes around trade talks between the United States and China weighed on the safe-haven metal ahead of a Federal Reserve rates decision later in the day.

Spot gold was down 1.2% at $3,388.49 an ounce as of 1141 GMT, after a sharp rise in the previous session.U.S. gold futures lost 0.8% to $3,396.70."Late yesterday, reports emerged of a potential meeting between U.S. and Chinese officials this week, which could bolster sentiment if confirmed by Chinese and U.S. authorities," said Zain Vawda, analyst at MarketPulse by OANDA.U.S. Treasury Secretary Scott Bessent and chief trade negotiator Jamieson Greer will meet top Chinese economic official He Lifeng in Switzerland this weekend to discuss tariffs.

The U.S. and China imposed tit-for-tat tariffs last month, triggering a trade war that stoked global recessionary fears and prompting investors to take refuge in safe-haven assets such as gold.

Market focus now shifts to the Fed policy announcement at 1800 GMT. The central bank is widely expected to keep rates steady but investors will look for signals on future cuts.

Markets now imply only a 30% chance of a Fed rate cut in June, according to the CME FedWatch Tool.

Gold, traditionally seen as a hedge against economic and political uncertainties, tends to thrive in a low interest rate environment.

On the geopolitical front, India attacked Pakistan and Pakistani Kashmir on Wednesday and Pakistan said it had shot down five Indian fighter jets in the worst fighting in more than two decades between the two nuclear-armed enemies.

"If the current friction between India and Pakistan escalates into a more serious conflict, gold is likely to attract increased safe-haven demand, which could support prices further," Vawda said.

Elsewhere, spot silver slipped 1% to $32.91 an ounce, platinum eased 0.3% to $988 and palladium edged 0.7% higher to $981.25.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up